MSME Verification in India – How to verify udyam registration of MSMEs

In Budget 2025, the classification limits for MSMEs were revised, considering both investment and annual turnover to determine an entity’s MSME status. Under the updated criteria, micro-enterprises must have an investment of up to ₹2.5 crore and a turnover of less than ₹10 crore. Small enterprises can have an investment of up to ₹25 crore, with a turnover limit of ₹100 crore. Medium enterprises, meanwhile, must have an investment of less than ₹125 crore and a turnover below ₹500 crore.

The revised MSME Verification framework expands eligibility to include a broader range of businesses and companies, improving access to government benefits and compliance recognition.

- The classification of MSMEs will be revised to include a broader range of businesses and companies.

- Micro-enterprises registered on the Udyam portal will receive credit cards with a ₹5 lakh limit, with 10 lakh cards to be issued in the first year (FY 2025-26).

- A new Fund of Funds worth ₹10,000 crore will be introduced with an expanded scope.

- A dedicated scheme will provide term loans of up to ₹2 crore over five years for 5 lakh women and SC/ST first-time entrepreneurs, along with online capacity-building support.

What is an MSME?

Micro, Small, and Medium Enterprises is referred to by the acronym MSME. An MSME is defined as a business with an investment in plant and machinery up to Rs. 10 crores for manufacturing enterprises and Rs. 2 crores for service enterprises.

Understanding MSME according to Indian Law

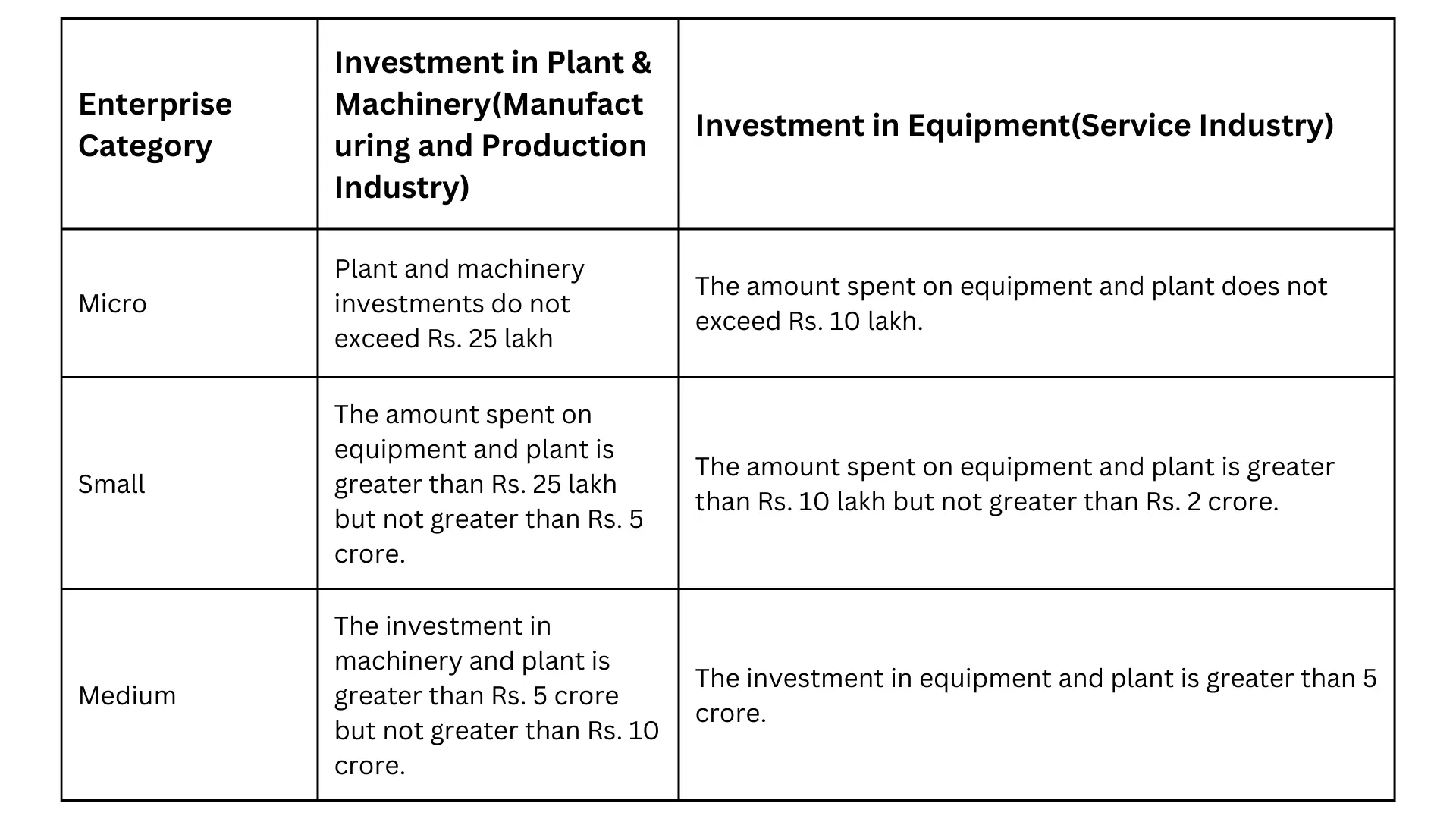

The Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, was created by the Indian government. The best way to understand what is meant by “micro, small, and medium enterprises” legally is the table below:

MSMEs currently contribute 6.11% of India’s manufacturing GDP and 33.4% of its manufacturing output, respectively. Additionally, they support 120 million jobs in India and account for about 45% of all exports from that country.

For a business or a company, MSME registration is necessary in order to participate in the MSME sector in India. Regardless of whether a business is in the manufacturing or service sectors, it must register as an MSME according to the MSME act, 2006.

MSME verification – what is it?

The procedure of confirming the validity and authenticity of an MSME (Micro, Small, and Medium Enterprise) registration in India is referred to as MSME verification. In order to ensure compliance with the relevant requirements and regulations, it entails verifying the information that the enterprise provided during the registration process.

In order to determine whether an MSME is eligible for the benefits and programmes the government offers to MSMEs, the verification process typically entails reviewing the documentation and information that has been provided by the MSME.

The benefits and support aimed at MSMEs are only given to legitimate businesses thanks to this verification, which also helps to prevent fraudulent registrations.

The main goals of MSME verification are to maintain the ecosystem’s integrity, ensure transparency, and make it possible for the government to implement policies and programmes that will effectively support these businesses.

However, before you verify your MSME, you need to register it.

MSME registration – what is it?

Micro, small and medium enterprises play a critical role in contributing to the economic growth of India, according to the Ministry of MSMEs under the Government of India. In order to achieve this, a variety of subsidies and benefits are provided. To obtain these benefits, and to establish a smooth authorization procedure, MSME registration is required.

Companies need to get the MSME registration done online using the portal Udyam registration.gov.in. This process is also known as Udyam Registration.

Is MSME Registration Compulsory?

No, registration for MSMEs is not mandatory for every business in India. Only new businesses, individuals, and business owners who wish to take advantage of subsidies, concessions, and other programmes may voluntarily register for MSME/Udyam Certificate. Since the government greatly supports MSMEs both directly and indirectly, doing so is always advisable if your company satisfies the requirements for classification.

What are the documents required for MSME registration?

- Address verification for the company

- A replica of the purchase and sales invoice book

- receipts and invoices for the purchase of machinery or equipment

- a copy of the PAN card, industrial license, and Aadhaar number

- IFSC code, bank account number, and NIC code

- employee information, if any

- Employee count and the date the business started

- In the case of a partnership firm, partnership details

- GSTIN document

- Partnership deed for an unregistered partnership

- Licenced partnership company: Certificate of Registration

- Articles of Association (ADA) and Memorandum of Association (MoA)

- Declaration of Incorporation

- Copy of the board resolution adopted at the company’s annual general meeting, along with a director’s permission to sign and submit the MSME application.

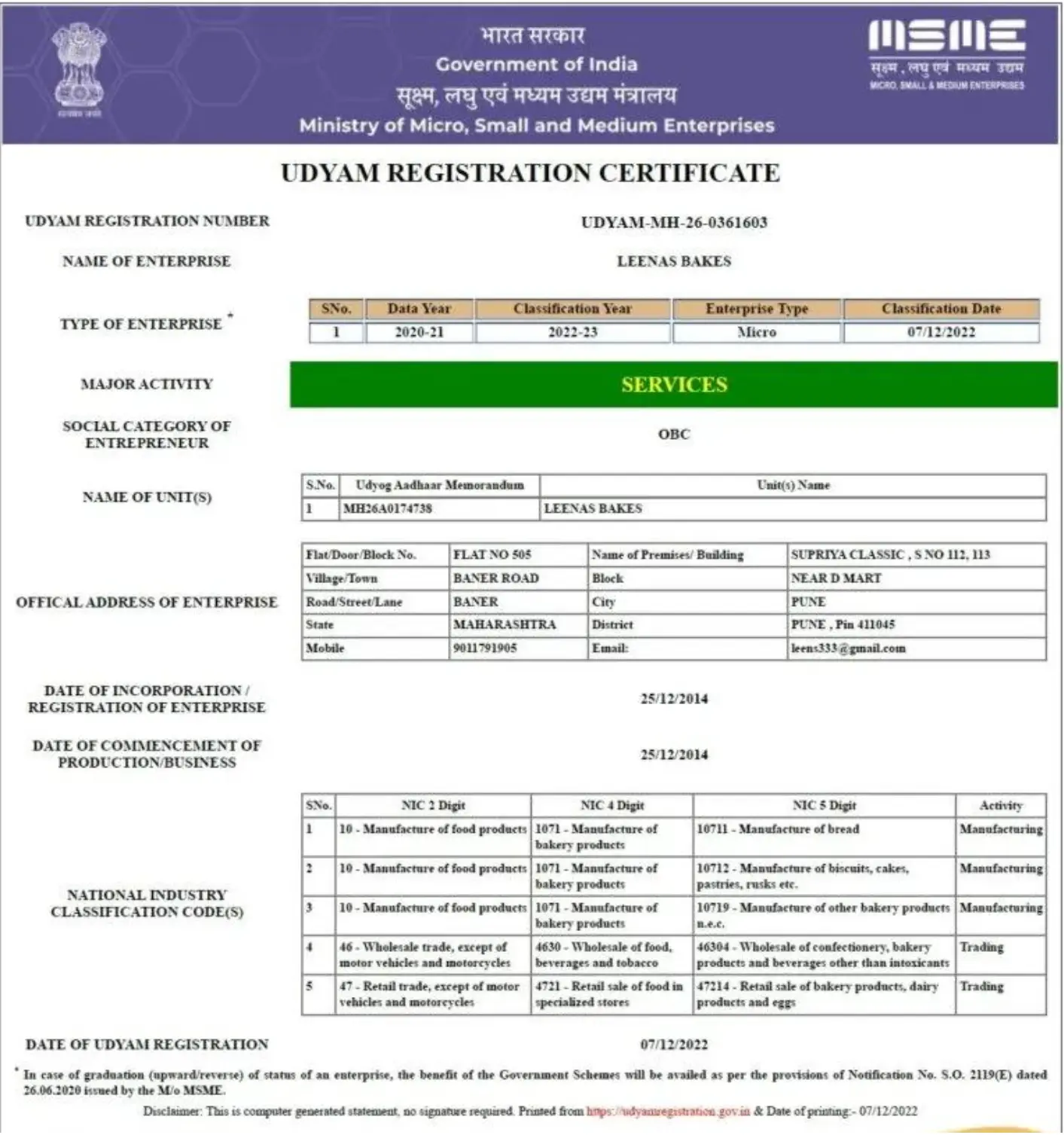

What is an MSME/ Udyam Certificate?

An MSM certificate or Udyam certificate is given to applicants after their successful MSME registration. This serves as registration proof. And is a legitimate document that is accepted to receive any authorizations, concessions, or schemes. Any applicant attempting to register multiple MSMEs must complete a separate registration process for each business. And a unique MSME certificate is issued for each of these.

How to verify the MSME registration in India?

-

- Visit the Udyam Registration Portal

- Go to the official MSME verification website: udyamregistration.gov.in.

- Select “Udyam Registration”

- On the homepage, locate and click on the “Udyam Registration” tab.

- Enter Your Udyam Registration Number (URN)

- Type the unique Udyam Registration Number (URN) assigned to your business during registration.

- Click on “Validate and Generate Certificate”

- After entering the URN, click on the “Validate and Generate Certificate” button to proceed.

- Verification and Certificate Generation

- If the URN is valid, the system will authenticate your MSME registration and generate your Udyam Registration Certificate instantly.

- Download and Save the MSME Certificate

- Visit the Udyam Registration Portal

Once generated, you can download and print your certificate for future reference. It’s recommended to keep both digital and physical copies for documentation.

Verifying your MSME registration is crucial to ensure your business is officially recognized and eligible for government benefits. Follow these simple steps to check your Udyam Registration Certificate online:

Steps to Verify MSME/Udyam Registration in India

Make sure to verify all the information on the Udyam Registration Certificate, such as the name of the enterprise, the registration date, the Udyam Registration Number, and other relevant details. Check that all details are accurate and match what was provided during registration.

Benefits of MSME verification

MSME verification plays a crucial role in supporting both registered businesses and the government. It ensures access to benefits, enhances credibility, and promotes business growth. Here are the key advantages of verifying your MSME/Udyam registration:

1. Access to Government Schemes & Incentives

- Verified MSMEs qualify for government subsidies, financial aid, tax exemptions, credit support, and technology upgrades.

- Gain priority in government contracts and access to marketing assistance programs designed to fuel MSME expansion.

2. Enhanced Credibility & Market Trust

- Official MSME verification boosts your business reputation among customers, investors, and financial institutions.

- Increases confidence in your business, making it easier to secure partnerships and collaborations.

3. Easier Access to Loans & Financial Assistance

- Banks and financial institutions prioritize verified MSMEs, offering better loan terms and working capital support.

- Reduces risk perception, increasing the chances of quick loan approvals at lower interest rates.

4. Priority in Government Tenders

- Verified MSMEs get preferential treatment in public procurement processes.

- Ensures fair competition against larger corporations while securing valuable government contracts.

5. Increased Business Exposure & Networking Opportunities

- Listing in official MSME directories increases visibility and credibility.

- Opportunities to participate in trade fairs, business expos, and networking events, helping businesses expand into new markets.

6. Data-Driven Policy Making & MSME Growth

- The government relies on verified MSME data to assess policies, identify challenges, and enhance support programs.

- Helps shape better policies, ensuring sustainable MSME development.

Why must organizations conduct MSME verification before onboarding any third party vendor or supplier?

An MSME verification check is crucial for any business trying to onboard a third party or partner into their supply chain operations. Here are some reasons why running an MSME/Udyam Verification Check is important.

1. Risk Mitigation:

Verification MSME registration of an entity at the time of onboarding to reduce the risk of fraudulent or financially unstable suppliers. It ensures that the MSME is operational, financially healthy, and has a proven track record.

2. Compliance:

MSME verification helps in ensuring regulatory compliance. When onboarding new suppliers, there are several regulatory mandates to adhere to in order to avoid legal complications and penalties. Performing a comprehensive MSME verification process ensures a company that the suppliers they engage with meet all necessary legal and regulatory requirements to avoid issues like fraud, money laundering, or violation of labor laws.

3. Supply Chain Stability:

Companies can ensure greater stability in their supply chain by verifying that an MSME is reliable and capable of delivering as promised. This can help prevent disruptions in the supply chain that might occur if an unverified supplier fails to deliver as per expectations.

4. Quality Assurance:

MSME Verification can help companies determine if the supplier meets their quality standards. This is especially important in industries where the quality of inputs can significantly impact the final product.

5. Sustainability and Ethical Sourcing:

Many companies today are committed to ethical sourcing and sustainability that leads to better compliance with ESG standards. MSME verification helps to confirm whether suppliers align with these values, such as by checking whether they adhere to environmental regulations, fair labor practices, and other related issues.

6. Building Trust:

Finally, onboarding a MSME verified entity can help build trust between the company and the supplier. By ensuring that the supplier is reputable and reliable, the company can enter into a business relationship with greater confidence.

Latest Government Initiatives for MSMEs

To further bolster the MSME sector, the Indian government is planning amendments to the MSME Development Act, 2006. One of the key changes is the implementation of a more effective 45-day payment rule, designed to ensure that payments owed to MSMEs are made promptly. Additionally, the government plans to introduce online dispute resolution mechanisms to address delays in payments. These reforms are set to improve cash flow for MSMEs, reducing financial strain and enabling smoother operations. By streamlining payment processes and providing a platform for quicker dispute resolution, the government aims to enhance the stability and growth potential of MSMEs across India.

Verify MSME Status Instantly with AI-Powered Risk Intelligence

Avoid compliance risks, detect false MSME claims, and validate Udyam registration details in seconds with SignalX’s MSME Verification solution.

Conclusion

Thus, in conclusion, MSME verification, defined by the MSME Act of 2006 in India, is a key driver in the creation of a sustainable and credible business environment. This process of validation not only confirms the existence of an MSME and thus makes it eligible for government support, but also helps to build up the MSME’s credibility and reputation.

For organizations, checking for prior MSME verification of suppliers is a way to minimize risk, meet regulatory requirements and ensure supply chain continuity. Therefore, it is possible to create trustworthy and sustainable business relationships and equip organizations with the necessary tools to proactively address risks when onboarding new partners.

FAQs

1. How do I verify an MSME registration online?

To confirm an MSME’s registration, you can use the official Udyam portal. Enter the Udyam Registration Number, and the system will instantly show whether the certificate is active and valid.

2. What details are needed to apply for MSME (Udyam) registration?

A business typically requires Aadhaar and PAN details of the owner, bank account information, and basic business data such as activity type and NIC code. These details are used to issue the Udyam certificate.

3. Is it compulsory for every business to register as an MSME?

No. Registration is optional. But many small and medium businesses choose it because it unlocks government incentives, easier loan approvals, and vendor preference in procurement.

4. Does an MSME certificate need to be renewed?

Currently, once a business is registered on the Udyam portal, the certificate does not expire. The business must, however, keep its information updated if financials or ownership details change.

5. What are the current thresholds for MSME classification in India?

Classification depends on both investment and turnover:

Micro: Smallest businesses with limited turnover and investment.

Small: Moderate scale enterprises within mid-range thresholds.

Medium: Larger operations that still qualify under MSME rules.

These bands are periodically revised by the government.

6. Why should businesses verify MSME status?

Verification assures buyers and partners that the enterprise is genuine, eligible for government schemes, and in good standing. It also helps large companies stay compliant when reporting payments to MSME vendors.

7. What if the information on an MSME certificate is outdated?

If turnover, ownership, or other key details have changed, the certificate should be updated on the Udyam portal. Keeping records current avoids disputes when applying for benefits or participating in tenders.

8. How can companies confirm if a vendor’s MSME certificate is authentic?

Businesses can ask vendors for their Udyam Registration Number and cross-check it on the Udyam portal. This step ensures the certificate is real and still valid.

9. How often should MSME verification be done for vendors?

It’s best to check MSME status at onboarding and review it periodically, especially before major contracts or regulatory filings. This keeps supplier records accurate and compliant.

10. Can the Udyam certificate be downloaded after verification?

Yes. Once verified on the portal, the system allows you to download a digital copy of the Udyam certificate. This copy can be stored or shared as proof of MSME status.