How to find annual revenue for a private company in India: A Comprehensive Guide for Business Intelligence

Why knowing How to Find Annual Revenue for a Private Company is crucial?

The importance of understanding how to find annual revenue for a private company cannot be overstated. Revenue is a key indicator of a company’s financial health and operational success. It informs various stakeholders from investors to suppliers about the private company’s market presence and profitability. Knowing how to find private company financial statements can influence investment decisions, partnership terms, and even competitive strategies.Run exhaustive Due Diligence Checks on a target company

Download our Corporate Due Diligence Checklist to Get StartedConsequences of Non-Compliance

Failure to comply with these regulations can result in severe penalties. The Registrar of Companies can flag defaulting entities, putting them on a defaulters list that severely restricts their operational capabilities. In extreme cases, private companies can even be struck off the register, making it all the more crucial for entities to disclose their company financials, including how to find annual revenue for a private company.

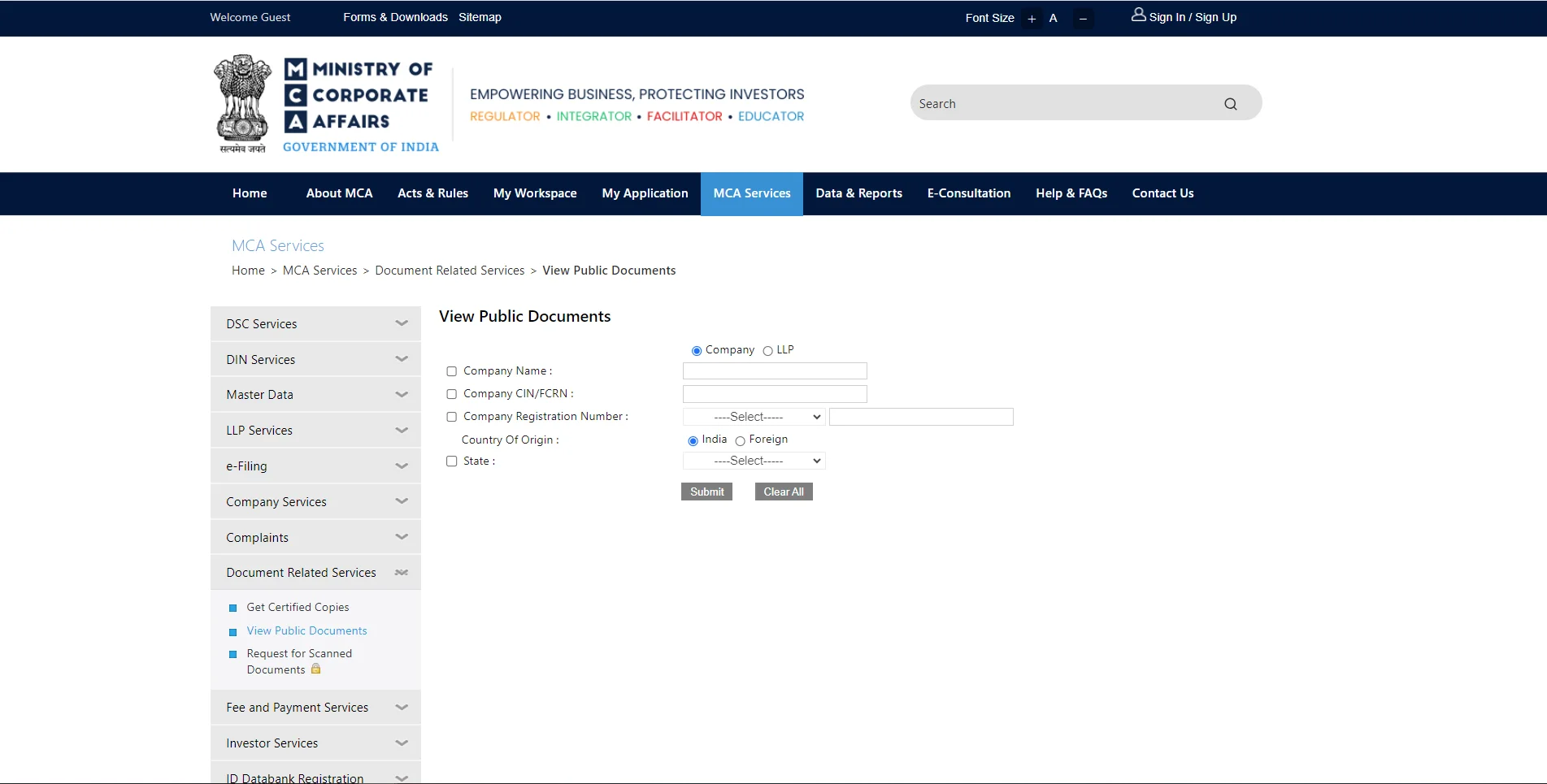

How to find private company financial statements online through MCA?

The MCA website is a treasure trove of financial information, including details on how to find private company financial statements. Data can be downloaded by making a small payment to the MCA via the web application. MCA provides historical information, that is, all the filings and disclosures made by the target private company since its incorporation in an organized format.Here’s a step-by-step guide:

- Visit the MCA Website: Create a user account by clicking ‘Register.’ Direct Link to the MCA Page

- Access Master Data: Hover over ‘MCA Services’ and click on ‘View Company/LLP Master Data.

- Company Search: If you don’t know the CIN, enter the company name and select the relevant entity from the list.

- Purchase and Download: Complete the purchase process to access the company’s financial documents, where you can find revenue of a company.

Challenges and Solutions

While the MCA website is a valuable resource, it’s not the most user-friendly. It’s often used by compliance professionals, and the documents can be in formats that require specialized software, for example XBRL files. However, this challenge is mitigated by third-party platforms like SignalX that simplifies how to find revenue for a company.Automating the Process: SignalX

SignalX is a robust platform that automates the process of finding revenue for a company. It offers deep due diligence, covering over 200+ regulators, including the MCA. Here’s how to use SignalX to find revenue of a company:- Create an Account: Log in to SignalX.

- Request a Report: Select ‘Standard Due Diligence Report.

- Enter Company Details: Type in the company name and select from the auto-suggest options.

- Submit: Your comprehensive due diligence report, including how to find revenue of a company, will be generated

Conclusion

Knowing how to find revenue for a company is an essential skill in today’s business world. With regulatory bodies like the MCA and platforms like SignalX, you’re well-equipped to make informed business decisions. So the next time you need to find revenue for a company, you know exactly where to look and what to do.FAQs

How can I check the annual revenue of a private company in India?

You can access a private company’s annual revenue through the Ministry of Corporate Affairs (MCA) portal by searching with the CIN or company name and downloading filed financial statements.

Is annual revenue of private companies public information?

In most cases, yes private companies must file financial statements with MCA. However, access may require payment and not all filings are immediately available.

What are the best tools to find private company revenue quickly?

Tools like SignalX aggregate official filings, financial disclosures, and market intelligence into easy-to-read reports, helping you avoid manual searches.

Can I calculate a private company’s revenue from balance sheet or P&L data?

Yes. The turnover or revenue line item is typically reported in the Profit & Loss statement filed with MCA. Balance sheets can also provide supporting indicators of business size.

Why is it difficult to find accurate revenue data for private companies?

Unlike public companies, private companies are not required to publish financials broadly. Their disclosures are limited, delayed, or sometimes incomplete, making it harder to verify numbers.

Can I use GST or tax filings to estimate private company revenue?

GST and tax filings can provide indicative ranges, but they are not fully public. For precise figures, MCA filings or third-party verified reports are more reliable.

How do investors usually estimate private company revenue?

Investors combine filed financials with market research, employee count, industry benchmarks, and sometimes credit reports to estimate private company revenue.

How often should I check a private company’s revenue?

It’s recommended to verify revenue annually, especially before making decisions like partnerships, investments, or extending credit, as turnover can change significantly.

What if a private company hasn’t filed its revenue data?

In such cases, you may rely on third-party databases, industry estimates, or request disclosures directly from the company during due diligence.

Are private company revenue figures reliable in third-party databases?

Reliability varies. Databases pulling directly from MCA or regulators are more trustworthy, while crowd-sourced or estimated figures should be treated cautiously.