What Is Due Diligence in Banking: Guide, Process, Types & Best Practices

Due diligence in banking is no longer just a regulatory formality it is a core defense mechanism against financial crime, reputational damage, and operational risk. In an era of rising fraud, global transactions, and stricter regulations, banks must thoroughly assess who they do business with, how risks evolve, and whether controls remain effective.

A bank without strong due diligence practices is exposed to money laundering, sanctions violations, and costly regulatory penalties. More importantly, weak due diligence erodes trust the foundation of the banking industry. This is why modern banks treat due diligence not as a one-time task, but as a continuous, risk-based process embedded into daily operations.

This guide explains what due diligence in banking is, why it matters, its types, the full due diligence process, and best practices banks follow to stay compliant and competitive.

What Is Due Diligence in Banking?

Broad Definition of Due Diligence in Banking

Due diligence in banking refers to the structured process of collecting, verifying, and evaluating information about customers, businesses, vendors, or counterparties before and during a financial relationship. The goal is to identify risks related to fraud, money laundering, terrorist financing, regulatory breaches, or financial instability.

Unlike routine checks, banking due diligence involves deeper investigation, risk assessment, and ongoing monitoring. It ensures that banks understand who they are dealing with, where funds come from, and whether activities align with legal and ethical standards.

Importance of Due Diligence for Banks

The importance of due diligence in banking goes far beyond compliance:

- Financial crime prevention: Detects money laundering, fraud, and illicit transactions early.

- Regulatory compliance: Helps banks meet AML, KYC, and global regulatory obligations.

- Reputation protection: Avoids scandals, fines, and public trust erosion.

- Operational stability: Identifies risky relationships before they cause losses.

- Without proper due diligence, banks face severe penalties, license restrictions, and long-term brand damage.

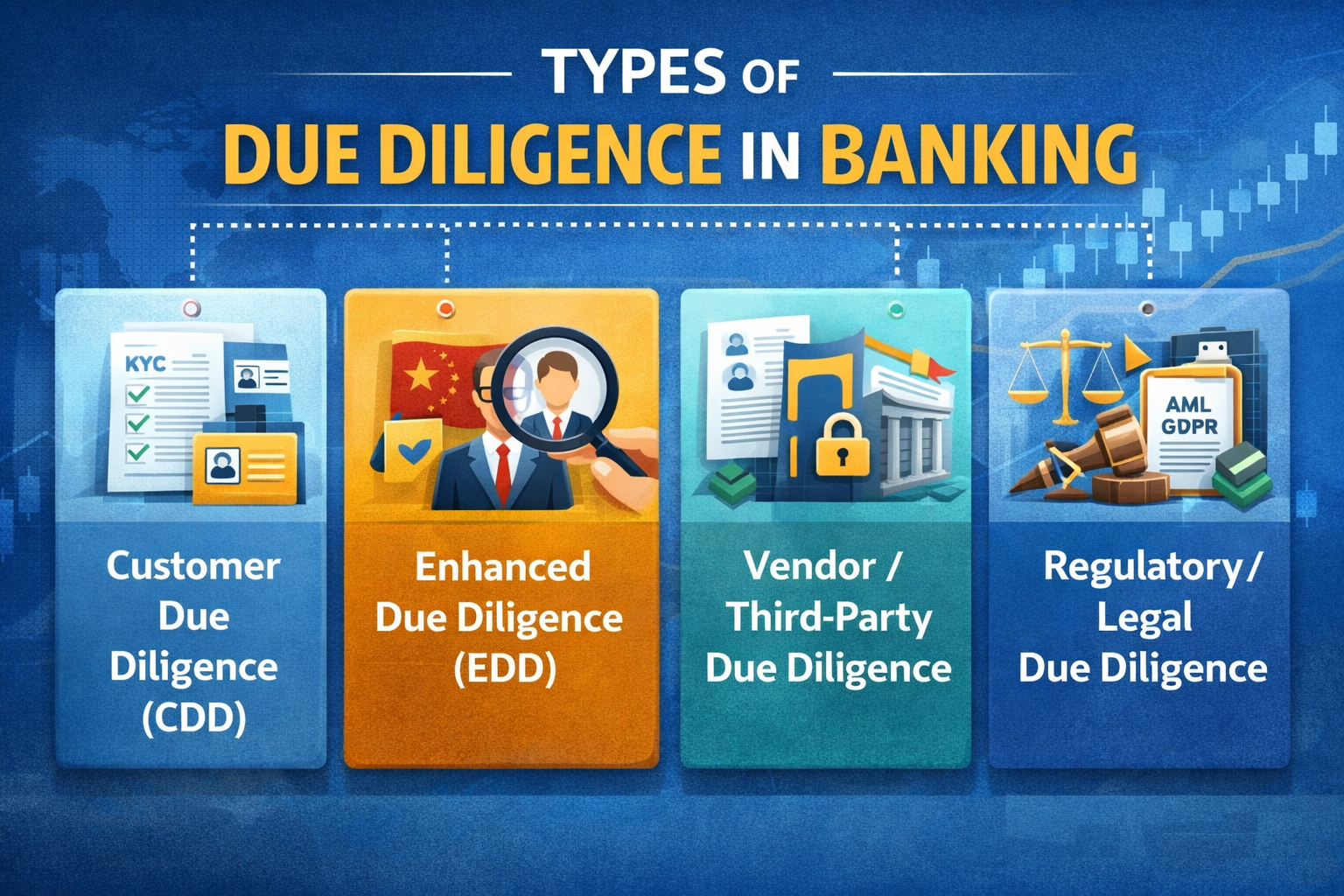

Types of Due Diligence in Banking

Customer Due Diligence (CDD) in Banking

Customer Due Diligence (CDD) is the foundational level of due diligence in banking. It applies to most customers during onboarding and throughout the relationship.

CDD typically includes:

- Verifying customer identity

- Understanding the nature of the business relationship

- Assessing basic risk levels

- Monitoring transactions for unusual behaviour

CDD ensures banks know their customers and can detect early warning signs of suspicious activity.

Enhanced Due Diligence (EDD) for High-Risk Customers

Enhanced Due Diligence (EDD) in banking applies when customers present higher-than-normal risk. This includes politically exposed persons (PEPs), customers from high-risk jurisdictions, or businesses with complex ownership structures.

EDD involves:

- Deeper background checks

- Source of funds and wealth verification

- More frequent transaction monitoring

- Senior management approval

The purpose of EDD is to mitigate elevated risks that standard CDD cannot sufficiently address.

Vendor and Third-Party Due Diligence in Banking

Banks increasingly rely on third-party vendors for technology, payments, and outsourced services. Vendor due diligence in banking ensures these partners do not introduce compliance, cybersecurity, or operational risks.

This process evaluates:

- Financial stability of vendors

- Regulatory compliance history

- Data protection and cybersecurity controls

- Ownership and governance structure

Poor third-party due diligence can expose banks to indirect regulatory violations.

Regulatory and Legal Due Diligence in Banking

Regulatory due diligence focuses on ensuring compliance with applicable laws and frameworks, such as AML, KYC, Basel norms, data protection regulations, and sanctions regimes.

Banks must confirm that:

- Customers and transactions comply with local and international laws

- Business operations align with regulatory expectations

- Internal policies reflect current legal requirements

This type of due diligence protects banks from legal exposure and enforcement actions.

Due Diligence Process in Banking

Step-by-Step Due Diligence Process in Banking

A structured due diligence process in banking typically follows these stages:

1. Information Collection

Banks gather personal, financial, and business information from customers or entities. This includes identification documents, business registrations, and ownership details.

2. Identity Verification (KYC Checks)

Documents are verified using manual review or digital verification tools to confirm authenticity and accuracy.

3. Risk Profiling and Assessment

Banks assess customer risk based on geography, business type, transaction behaviour, and ownership complexity.

4. Sanctions and Watchlist Screening

Customers are screened against sanctions lists, PEP databases, and adverse media sources.

5. Ongoing Monitoring and Reporting

Transactions are continuously monitored, and suspicious activities are flagged and reported when necessary.

This end-to-end approach ensures due diligence remains effective throughout the customer lifecycle.

Technology and Tools Supporting Due Diligence in Banking

Modern due diligence in banking increasingly relies on technology to improve accuracy and efficiency.

Key tools include:

- RegTech platforms for AML and KYC automation

- AI-powered transaction monitoring

- Digital identity verification solutions

- Centralized risk management dashboards

These technologies reduce manual errors, speed up onboarding, and enhance risk detection capabilities.

Due Diligence Checklist for Banks

A due diligence checklist helps banks standardize processes and avoid oversight.

Common checklist elements include:

- Regulatory and legal compliance status

- Verified identity documents

- Beneficial ownership information

- Credit and financial history

- AML and KYC compliance records

- Sanctions and watchlist screening results

- Transaction monitoring configuration

- Governance and management structure

Using a structured checklist improves consistency and audit readiness across banking operations.

Benefits of Effective Due Diligence in Banking

Stronger Regulatory Compliance

Robust due diligence reduces the risk of non-compliance, regulatory fines, and enforcement actions. It demonstrates proactive risk management to regulators.

Improved Risk Management and Decision-Making

By understanding customer and transaction risks, banks can make informed decisions about onboarding, limits, and monitoring intensity.

Enhanced Customer Trust and Reputation

Customers are more likely to trust banks that protect their assets and operate transparently. Strong due diligence reinforces credibility.

Protection Against Fraud and Financial Crime

Effective due diligence identifies suspicious behavior early, minimizing financial losses and operational disruptions.

Common Challenges in Due Diligence in Banking

Despite its importance, banks face several challenges when implementing due diligence programs.

Complex Regulatory Environment

Regulations vary across jurisdictions and evolve frequently, making compliance difficult.

Data Quality and Verification Issues

Incomplete or inaccurate customer data undermines risk assessments.

Balancing Compliance and Customer Experience

Lengthy due diligence processes can slow onboarding and frustrate customers.

Technology and Cost Constraints

Legacy systems and high implementation costs can limit automation efforts.

Addressing these challenges requires strategic investment and continuous process improvement.

Best Practices and Regulatory Requirements for Due Diligence in Banking

To strengthen due diligence frameworks, banks follow proven best practices:

- Adopt a risk-based approach: Focus resources on higher-risk customers and activities.

- Leverage automation and AI: Reduce manual workload and improve detection accuracy.

- Conduct regular reviews: Update risk assessments and customer profiles periodically.

- Train staff continuously: Ensure employees understand evolving risks and regulations.

- Align with global AML and KYC standards: Maintain consistency across regions.

Following these best practices ensures due diligence programs remain effective and future-proof.

Case Studies: Due Diligence in Banking in Action

Case 1: Consequences of Failed Due Diligence

A bank onboarded a corporate client without verifying beneficial ownership properly. The client later became involved in money laundering activities, leading to regulatory fines and reputational damage for the bank. This case highlights the importance of thorough due diligence at onboarding.

Case 2: Automation Improving Due Diligence Outcomes

Another bank implemented AI-driven transaction monitoring and automated KYC checks. As a result, suspicious activities were detected faster, false positives decreased, and compliance costs were reduced—demonstrating the value of technology-enabled due diligence.

Role of SignalX in Due Diligence in Banking

SignalX supports due diligence in banking by helping financial institutions identify, assess, and monitor risk more effectively through data-driven insights and automation. It strengthens both customer due diligence (CDD) and enhanced due diligence (EDD) by analyzing behavior patterns, transaction activity, and risk indicators.

By enabling continuous monitoring and real-time alerts, Signalx helps banks detect suspicious activities early, reduce manual workload, and improve compliance with AML and KYC requirements. This allows banks to adopt a more efficient, risk-based approach to due diligence while maintaining strong regulatory standards.

Ready to Strengthen Due Diligence in Banking?

Discover how SignalX helps banks detect risk faster, streamline compliance, and enable continuous due diligence with data-driven insights.

Frequently Asked Questions About Due Diligence in Banking

What is the main purpose of due diligence in banking?

The primary purpose is to identify, assess, and mitigate risks related to financial crime, regulatory non-compliance, and reputational damage.

How does customer due diligence differ from enhanced due diligence?

CDD applies to most customers, while EDD involves deeper scrutiny for high-risk individuals or entities.

When should banks perform due diligence?

Banks should conduct due diligence during onboarding, periodically throughout the relationship, and whenever risk profiles change.

What are the risks of poor due diligence in banking?

Poor due diligence can lead to fraud losses, regulatory penalties, reputational harm, and operational disruptions.

Conclusion: The Future of Due Diligence in Banking

Due diligence in banking is a critical pillar of financial integrity, risk management, and regulatory compliance. As financial crime becomes more sophisticated, banks must move beyond basic checks and adopt continuous, technology-driven due diligence frameworks.

By implementing structured processes, leveraging automation, and following best practices, banks can protect themselves, their customers, and the broader financial system. Strong due diligence is not just about compliance it is about building sustainable, trustworthy banking operations in an increasingly complex world.