Anti Money Laundering Process: A Complete Step-by-Step Guide

Financial crime is no longer confined to cash-heavy businesses or traditional banking channels. With the rise of digital payments, global trade, fintech platforms, and virtual assets, money laundering methods have become faster, more complex, and harder to detect. Criminal networks now exploit gaps in onboarding, weak transaction monitoring, and fragmented compliance systems.

As a result, regulators worldwide are enforcing stricter Anti Money Laundering (AML) requirements, with heavy penalties for failures. Businesses that once considered AML a “bank-only” issue are now legally and operationally exposed.

A strong anti money laundering process is no longer just about meeting regulatory expectations it is about protecting revenue, reputation, and long-term growth. This guide explains the AML process from start to finish, with practical insights, industry-specific applications, modern challenges, and strategic advantages that most competitor blogs overlook.

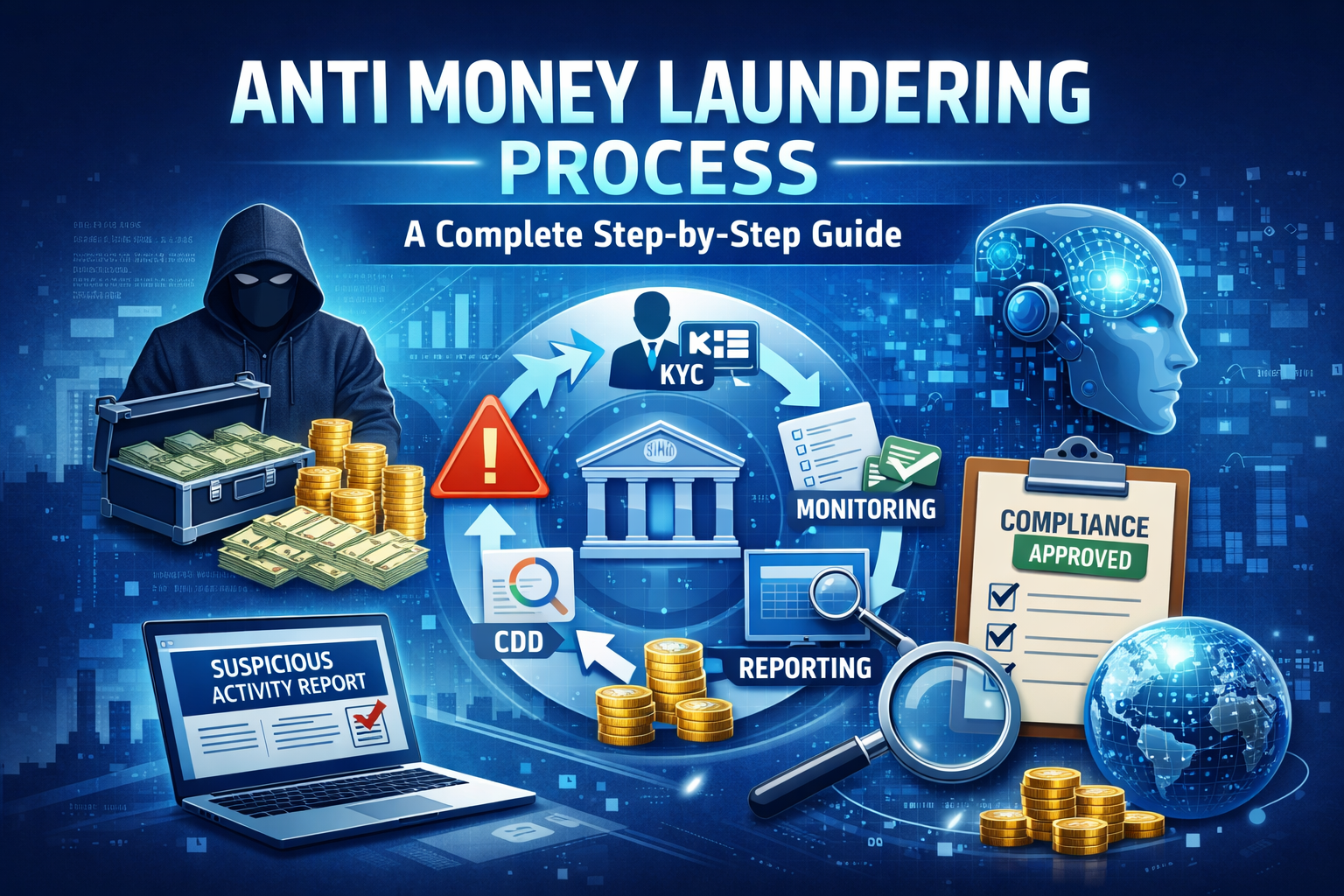

What Is the Anti Money Laundering (AML) Process?

The AML process refers to a structured, ongoing set of actions that organizations follow to identify customers, assess financial crime risk, monitor transactions, detect suspicious behavior, and report it to regulators.

Unlike static policies, the AML process is dynamic. It evolves with customer behavior, regulatory updates, and emerging crime patterns.

AML Process vs AML Policy vs AML Program

These terms are related but not interchangeable:

- AML Policy: A formal document defining rules, responsibilities, and regulatory commitments

- AML Process: The operational execution of those rules on a daily basis

- AML Program: The complete compliance ecosystem, including people, processes, policies, technology, and governance

In simple terms, the AML process is how AML works in real life.

Core Objectives of the AML Process

1. Prevent criminals from entering the financial system

2. Detect unusual or suspicious activity early

3. Report concerns to authorities accurately and on time

4. Maintain transparency and accountability

Why the AML Process Is Critical for Businesses Today

Financial crime continues to grow in volume and sophistication. Regulators are responding by expanding AML obligations beyond banks to fintechs, payment processors, crypto platforms, exporters, insurers, and even certain non-financial businesses.

Why AML Matters More Than Ever

- Regulatory penalties are increasing: Fines now run into millions and billions

- Reputational damage spreads instantly through media and investor networks

- Banking relationships can be terminated, disrupting operations

- Cross-border expansion becomes impossible without strong AML controls

Importantly, a well-designed AML process supports business continuity, investor confidence, and sustainable scaling, rather than slowing growth.

Key Regulations Governing the AML Process

Global AML Regulations

FATF (Financial Action Task Force): Sets international AML and CFT standards

FinCEN (USA): Oversees AML enforcement and suspicious activity reporting

EU AML Directives: Establish unified AML rules across European member states

AML Regulations in India

Prevention of Money Laundering Act (PMLA)

RBI AML Guidelines for banks, NBFCs, and payment institutions

SEBI and IRDAI AML norms for securities markets and insurance

Each regulator expects organizations to implement a risk-based AML process, not a one-size-fits-all approach.

The Anti Money Laundering Process Step-by-Step Breakdown

This section outlines the end-to-end AML workflow used by modern businesses.

Step 1: Customer Identification (KYC)

Customer identification, commonly known as Know Your Customer (KYC), is the first defense against financial crime.

Individual KYC Includes:

- Identity verification (PAN, Aadhaar, passport, voter ID)

- Address verification

- Biometric or video-based verification (where permitted)

Business KYC Includes:

Incorporation documents

Ownership and control structure

Identification of Ultimate Beneficial Owners (UBOs)

Digital KYC systems reduce onboarding time while improving accuracy, whereas manual processes often increase errors and fraud exposure.

Step 2: Customer Due Diligence (CDD)

CDD evaluates the risk profile of a customer after identification.

Types of Due Diligence

Simplified Due Diligence (SDD): Applied to low-risk customers

Standard Due Diligence: Used for most customers

Enhanced Due Diligence (EDD): Required for high-risk customers

EDD may involve source-of-funds verification, deeper background checks, and senior management approval.

Step 3: AML Risk Assessment

AML risk assessment determines how much scrutiny a customer or transaction requires.

Key Risk Dimensions

- Customer Risk: Nature of business, ownership complexity

- Geographic Risk: Exposure to high-risk or sanctioned jurisdictions

- Product Risk: Cash-intensive or anonymous services

Example of a Simple Risk Matrix

| Risk Area | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Geography | Domestic | Cross-border | Sanctioned country |

| Transactions | Predictable | Occasional spikes | Unusual patterns |

| Business Type | Transparent | Moderate risk | Cash-heavy |

Risk scores guide monitoring intensity and review frequency.

Step 4: Ongoing Transaction Monitoring

AML compliance does not end at onboarding. **Continuous transaction monitoring** is essential to detect suspicious activity over time.

What Is Monitored?

- Transaction size and frequency

- Sudden behavioral changes

- Cross-border movements

- Unusual use of products or accounts

Monitoring systems can be rule-based or behavior-driven, with advanced systems adapting dynamically.

Step 5: Suspicious Activity Detection & Red Flags

Certain behaviors often indicate potential money laundering.

Common Red Flags

- Structuring transactions to avoid reporting thresholds

- Rapid movement of funds with no economic justification

- Multiple accounts controlled by the same entity

- Activity inconsistent with stated business purpose

Red flags vary by industry, which is why generic AML controls are insufficient.

Step 6: Reporting Suspicious Transactions (STR / SAR)

When suspicion is confirmed, organizations must file Suspicious Transaction Reports (STRs) or Suspicious Activity Reports (SARs).

Key Reporting Principles

- Reports must be filed within regulatory timelines

- Customers must not be informed

- Supporting documentation must be retained

- Failure to report is itself a regulatory breach.

Step 7: Record Keeping & Audit Trail

Regulators expect organizations to maintain clear, accessible records.

- Customer data and transaction records must be retained for prescribed periods

- Audit trails support investigations and regulatory reviews

- Poor documentation often leads to penalties even without proven crime

AML Process Workflow (End-to-End View)

A modern AML workflow typically follows this sequence:

1. Digital or manual onboarding

2. Risk scoring and classification

3. Continuous transaction monitoring

4. Alert generation

5. Investigation and escalation

6. Regulatory reporting

7. Periodic review and audits

A seamless workflow ensures no compliance gaps.

AML Process by Industry

AML Process for Banks & NBFCs

- Large transaction volumes

- Strict supervisory oversight

- Advanced monitoring systems required

AML Process for Fintech & Payment Companies

- API-based KYC and screening

- Real-time monitoring

- Rapid scaling challenges

AML Process for Crypto & Virtual Assets

- Blockchain analytics

- Wallet monitoring

- High reliance on enhanced due diligence

AML Process for Importers & Exporters

- Trade-based money laundering risks

- Invoice manipulation detection

- Cross-border payment scrutiny

AML Process for Corporates & SMEs

- Vendor due diligence

- Internal fund flow monitoring

- Ownership transparency

Manual vs Automated AML Process

| Manual AML | Automated AML |

|---|---|

| Time-consuming | Real-time detection |

| High false positives | Smarter alerts |

| Difficult to scale | Easily scalable |

| High operational cost | Long-term efficiency |

Automation allows compliance to grow in parallel with business expansion.

Role of Technology & AI in the AML Process

Modern AML platforms use:

- AI-driven risk scoring

- Machine learning for anomaly detection

- Automated sanctions screening

- Alert prioritization tools

Technology improves accuracy, speed, and regulatory confidence.

Common AML Process Challenges Businesses Face

- Excessive false positives

- Poor data integration

- Managing multi-country regulations

- Rising compliance costs

- Talent shortages

Addressing these challenges requires a balanced mix of people, process, and technology.

Best Practices to Strengthen Your AML Process

- Adopt a risk-based AML framework

- Review customer profiles regularly

- Train employees continuously

- Conduct independent audits

- Update systems with regulatory changes

AML Process Checklist

✔ Customer identity verified

✔ Risk assessment completed

✔ Monitoring rules defined

✔ STR reporting mechanism active

✔ Records securely maintained

✔ Periodic reviews scheduled

How to Measure the Effectiveness of Your AML Process

Key AML KPIs include:

- False positive ratio

- Alert resolution time

- Detection accuracy

- Regulatory audit outcomes

Tracking these metrics ensures continuous improvement.

How AML Compliance Builds Trust & Business Growth

Strong AML processes lead to:

- Faster onboarding through digital compliance

- Increased partner and investor confidence

- Easier international expansion

- Reduced regulatory friction

Compliance done right becomes a competitive advantage.

Frequently Asked Questions (FAQ)

What are the main steps in the AML process?

KYC, CDD, risk assessment, monitoring, detection, reporting, and record keeping.

How often should AML reviews be conducted?

Based on customer risk and regulatory requirements.

Is AML mandatory for small businesses?

Yes, if they fall under regulated categories.

What happens if AML compliance fails?

Penalties, investigations, reputational damage, and possible license loss.

Final Thoughts on the Anti Money Laundering Process

The anti money laundering process is no longer optional or secondary. It is a strategic pillar of modern business operations. Organizations that invest in proactive, technology-driven AML frameworks are better equipped to manage risk, gain trust, and scale responsibly.

In an increasingly regulated world, strong AML is not a cost it is protection and opportunity combined.