AML & KYB Verification API

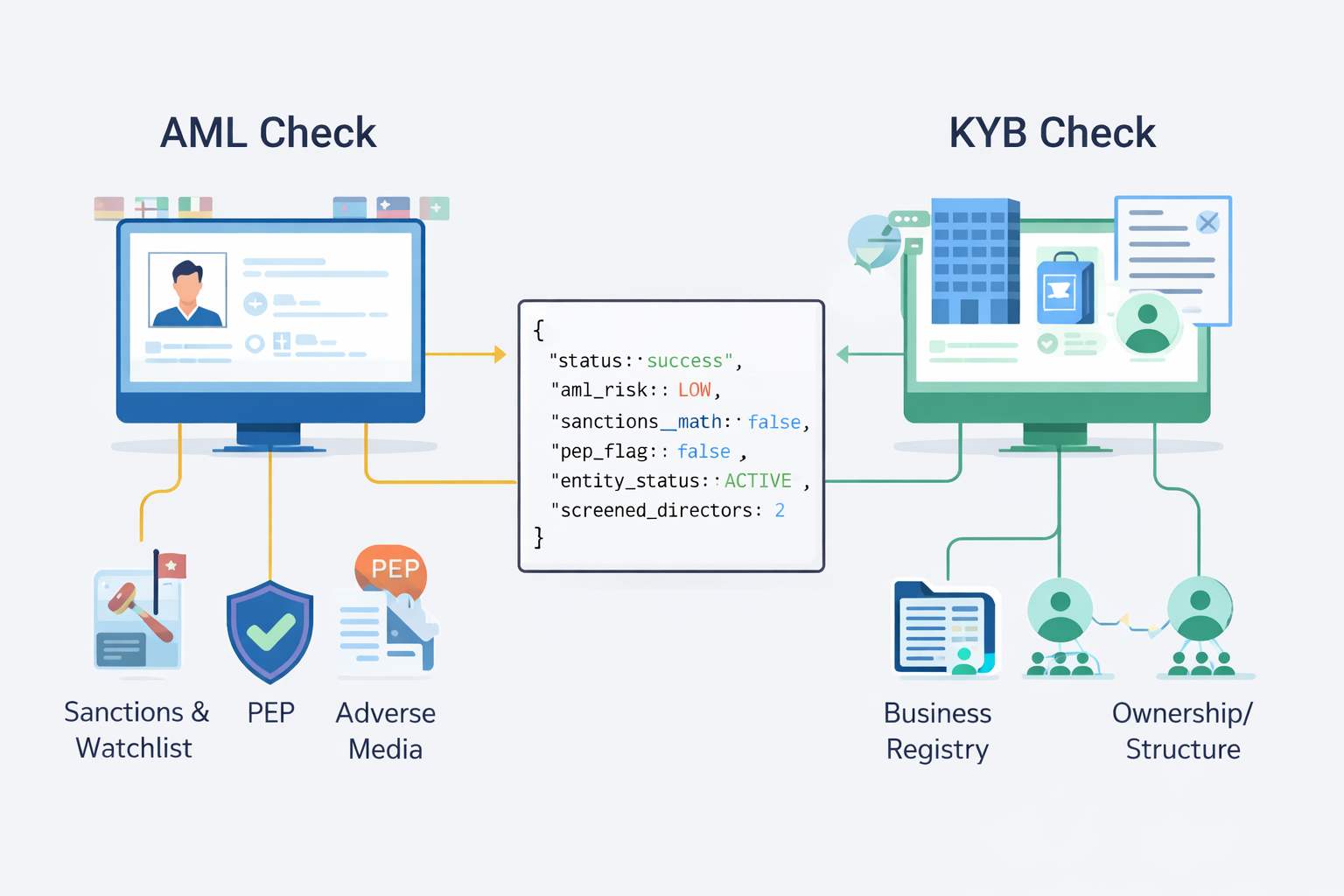

SignalX’s AML & KYB Verification APIs enable teams to automatically screen businesses and associated entities against regulatory, sanctions, and risk signals directly within onboarding, underwriting, or transaction workflows.

How does it work?

Submit Identifiers

Pass company identifiers such as CIN, PAN, Company Name, or director details via JSON.

SignalX Risk Engine

We correlate data from sanctions lists, adverse media sources, regulatory databases, and official business registries.

Receive Structured Output

The API returns real-time risk flags and verification status in JSON. Embed in Workflows Consume results to automate decisions in onboarding, payment logic, risk scoring, and compliance systems.

API Response Includes:

- ✓ entity_status – Active / Inactive / Deregistered

- ✓ aml_risk_level – Low / Medium / High

- ✓ sanctions_match – Yes / No

- ✓ pep_flag – Politically Exposed Person detected

- ✓ adverse_media_flag – Yes / No

- ✓ business_type – Private Ltd / LLP / Partnership / Proprietorship

Use Cases

For Customer & Business Onboarding Teams

Automatically screen individuals and businesses during onboarding against sanctions, PEP lists, and watchlists. Reduce manual reviews, false positives, and onboarding delays while meeting regulatory KYC / KYB requirements.

For Finance, Risk & Compliance Systems

Continuously assess AML and KYB risk by validating entities against global watchlists and adverse media sources. Supports risk-based decisioning, regulatory audits, and internal compliance controls with real-time API checks.

For Marketplaces, Platforms & Payment Systems

Ensure customers, merchants, and partners meet AML and KYB risk thresholds before activation or payouts. Embed automated screening into transaction monitoring, partner approval, and ongoing risk workflows.

Benefits of Using Our API

Plug and Play Integration

A REST-based AML screening API with a consistent request/response structure, designed for fast integration into KYC, onboarding, and transaction monitoring systems.

Real-time Sanctions & Watchlist Screening

Instantly screen individuals and entities against global sanctions lists, PEP databases, and enforcement watchlists in real time.

Early Financial Crime Risk Detection

Identify high-risk profiles before onboarding or transactions to reduce exposure to money laundering, terrorism financing, and regulatory breaches.

Trusted Compliance Data Sources

AML results are sourced from authoritative global and local regulatory datasets, ensuring accurate screening with minimal false positives.

Built for Continuous Monitoring

Supports both one-time screening and ongoing AML monitoring with scalable throughput and low-latency responses.

Seamless Compliance Automation

Easily embed AML checks into customer onboarding, periodic reviews, and transaction workflows to maintain audit-ready compliance.

FAQs

The AML API screens individuals and entities against global sanctions lists, PEP databases, adverse media sources, and regulatory enforcement lists to identify financial crime risk.

Yes. The API is built for scale and supports batch processing and high-throughput screening with consistent performance.

Yes. Where available, the API returns ownership and control details to help identify beneficial owners.

Yes. The API flags entities that are inactive, struck-off, or associated with high-risk indicators.

Yes. The API is designed for high-volume KYB workflows with enterprise-grade reliability.

Ready to automate AML & KYB checks?

Reduce manual reviews and meet regulatory expectations with real-time entity screening and risk signals.