Check Company Financials

Check Company Financial Health Instantly with MCA Filings

Reviewing company financials early helps understand whether growth is sustainable, obligations are manageable, and risk is visible before it turns into exposure.

Access Company Financials Instantly to Reduce Risk, Avoid Surprises, and Validate Credibility.

Assess Financial Health

Analyze a company’s balance sheet, capital structure, and solvency.

2. Evaluate Profitability & Cash Flow

Review revenue trends, operating margins, and liquidity.

3. Verify Governance & Risk Signals

Examine auditor reports and director notes.

Why MCA Financials Are Critical for Your Decisions

Statutory & Reliable

Legally enforceable filings provide standardized financial snapshots

Risk Detection

Identifies solvency, liquidity, and governance issues

Decision Support

Crucial for lending, investing, or vendor management

Why Review Company Financials Before You Engage?

Reviewing company financials is essential to assess solvency, profitability, liquidity, and governance risk before lending, investing, or onboarding a vendor. Statutory MCA filings provide a standardized and legally enforceable view of a company’s true financial position, helping you make informed and risk-aware decisions.

1. Evaluate Solvency & Financial Health

Analyze balance sheets, net worth, and leverage to ensure the company can meet obligations and maintain stability.

2. Assess Profitability

Review revenue trends, operating margins, and recurring expenses to understand the company’s growth potential and risk of losses.

3. Detect Cash Flow & Liquidity Risks

Compare operating cash flows with reported profits to spot working capital stress or dependency on financing.

4. Ensure Credit & Lending Readiness

Identify secured/unsecured borrowings, guarantees, and repayment capacity to make informed lending or investment decisions.

5. Identify Fraud, Misrepresentation & Governance Red Flags

Cross-verify MCA financials with GST and bank records; detect auditor qualifications, related-party transactions, or sudden anomalies.

6. Support M&A, Investment & Vendor Decisions

Validate historical performance, normalize earnings, and assess counterparty stability to reduce operational and financial risk.

From MCA Filings to Company Financial Insights. Here’s What You’ll Get

Balance Sheet

Profit & Loss Statement

Cash Flow Statement

Notes to Accounts

Auditor’s Report

Director’s Report

Financial Health Assessment

Profitability

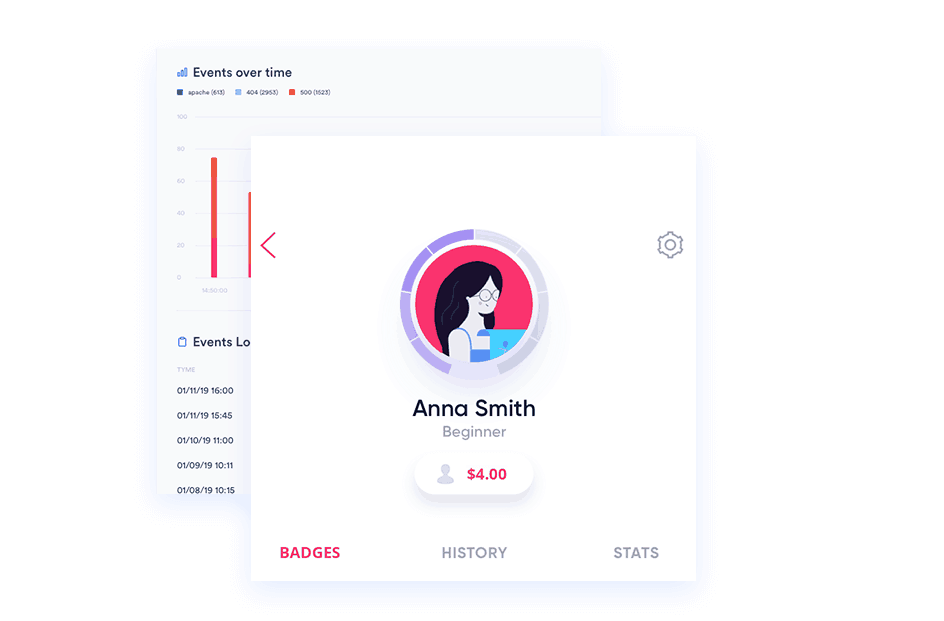

How SignalX can help you?

Analyze Financial Health

SignalX extracts MCA financial filings to provide a clear view of a company’s solvency, leverage, and overall financial stability.

Assess Profitability & Liquidity

Evaluate revenue trends, profit margins, cash flow patterns, and operational sustainability to identify business viability.

Make Informed Decisions

Use actionable insights from audited financials for lending, investment, vendor risk assessment, or M&A evaluation.

FAQs

MCA financial data consists of statutory documents that Indian companies file annually under the Companies Act. These include the Balance Sheet, Profit & Loss Statement, Cash Flow Statement, Notes to Accounts, Auditor’s Report, and Director’s Report. Accessing this data provides insights into a company’s financial health, transparency, and ability to meet obligations, making it crucial for investors, lenders, and partners.

A typical filing includes:

Balance Sheet: Shows assets, liabilities, and net worth.

Profit & Loss Statement: Reports revenues, expenses, and profits.

Cash Flow Statement: Tracks cash inflows and outflows.

Notes to Accounts: Offers detailed explanations of financial figures.

Auditor’s Report: Provides independent verification of financials.

Director’s Report: Summarizes company performance and key developments.

All registered Indian companies, whether private, public, or one-person companies (OPC), are legally required to submit annual financial statements. Compliance ensures transparency and accountability.

Companies are required to file financial statements once every financial year, usually within a specified timeline after their Annual General Meeting (AGM). Delays can lead to penalties.

You can download financial statements using the Company Identification Number (CIN) on the official MCA portal. Certain third-party platforms also provide aggregated and searchable access to filings.

Yes. Businesses, investors, and banks use this data to:

Assess solvency and liquidity

Evaluate profitability trends

Review debt obligations and governance practices

Make informed investment or lending decisions

Most companies are required to have their statements audited by a certified auditor. The Auditor’s Report indicates the reliability of the financial information and highlights any discrepancies or exceptions.

It signals the accuracy of financial records, highlights risks or qualifications, and may reveal governance or compliance issues that could affect credit, investment, or partnerships.

Late filings can attract monetary penalties and, in extreme cases, legal action against company directors. Prompt compliance ensures the company avoids fines and reputational risks.

Companies and investors analyze MCA filings to evaluate financial health, cash flow stability, debt levels, profitability, and hidden liabilities. It forms a key part of lending, investment, M&A, and vendor risk assessment processes.

Verify the Financial Health of Your Vendors & Partners

Request Financial Report