Free GST Number Verification

-

Name of the business

-

Address of the Business

-

Additional Place of Business

-

State Jurisdiction

-

Center Jurisdiction

-

Date of registration

-

Type of business

-

HSN Codes associated

-

GSTIN status - Active / Canceled

-

Date of Cancellation (if applicable)

-

Compliance Status

-

Last 12 month Compliance Status

Leading Enterprises Trust SignalX to Check MSME Status of their Vendors

What is a GST Identification Number (GSTIN)/GST Number?

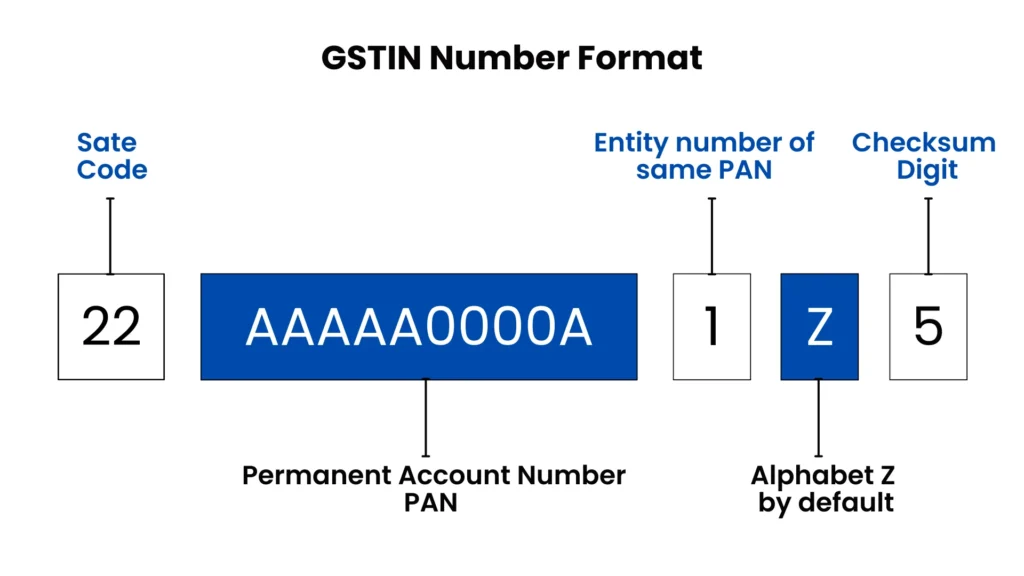

GSTIN or Goods and Services Tax Identification Number is a unique 15 digits alpha-numeric PAN-based code allotted to every registered person under Goods and Service Tax. This number is provided to the GST taxpayer along with the GST registration certificate, and the number also allows tracking of a registered Taxpayer. The GSTIN search Check feature helps to perform GST verification and Know your GST in India with the help of the HSN code.

Why GSTIN Verification with SignalX Matters

-

Unique 15-digit GSTIN helps identify and track registered businesses

-

Confirms authenticity of suppliers, vendors, and partners

-

Prevents fraud, fake GST numbers, and tax evasion

-

Enables accurate GST return filing and valid ITC claims

-

Reduces risk of penalties and financial losses

-

Helps businesses stay compliant with GST laws

-

Quick and reliable GST number validation via SignalX

-

Builds trust and transparency in business transactions

Run Struck Off Companies Checks in Bulk. Try Bulk Upload.

GSTIN Format – Understanding the 15 Digits

1st–2nd digits: State code

3rd–12th digits: PAN number of the entity

13th digit: Number of registrations under the same PAN in a state

14th digit: Default value “Z”

15th digit: Check code (used for error detection)

Search Smarter: Validate Businesses Before They Enter Your Vendor List

-

Name of the business

-

Address of the Business

-

Additional Place of Business

-

State Jurisdiction

-

Center Jurisdiction

-

Date of registration

-

Type of business

-

HSN Codes associated

-

GSTIN status - Active / Canceled

-

Date of Cancellation (if applicable)

-

Compliance Status

-

Last 12-month Compliance Status

How to Use SignalX GST Verification Tool

Validate any GST Number in Seconds

Follow these simple steps:

-

Visit the SignalX GSTIN Search Page

-

Enter the GSTIN you wish to verify in the search bar

-

Click ‘Search’ and get instant verification results

✅ GSTIN Verification in 3 Easy Steps

- Go to the SignalX GST search page

- Type in the GSTIN number

- Click on the search button

🚨 Report Fake GST Bill or Invoice

- Online: Visit cbec-gst.gov.in → CBEC MITRA Helpdesk → “Raise Web Ticket”

- Email: cbecmitra.helpdesk@icegate.gov.in

- Twitter: @askGST_GoI and @FinMinIndia

One-time checks are great. But your Business needs more.

FAQs

Enter the 15-digit GSTIN into an online checker either through the official GST portal or a trusted tool like GST Search to instantly see the business details and confirm its status.

You’ll typically get the business’s legal name, state of registration, registration status (active/inactive), type of taxpayer (e.g., regular or composition), and registration date.

Yes. GSTINs may get cancelled due to non-compliance, business closure, or voluntarily surrendered, which is why periodic re-verification is important.

Don’t proceed with the transaction. Reach out to the vendor for clarification, correct any mistakes, or wait until they restore a valid GSTIN. This ensures safe input tax credit claims and compliance.

Absolutely. SignalX GST Verification tool lets you upload multiple GSTINs in one batch and get verification results instantly saving time and minimizing manual errors.

It’s smart to verify during vendor onboarding and then refresh GSTIN statuses quarterly or before major filings. This keeps your records accurate and compliance-ready.

Basic validation is free on government portals. Advanced features like bulk checks, exportable reports, or analytics may require paid tools or subscriptions.

Most searches are completed in under a minute, even in bulk making it easy for teams to verify hundreds of GSTINs quickly.

If you transact with a GSTIN that’s not valid, your ITC claim may be rejected. Verifying in advance helps ensure your tax credits are valid and recoverable.

Automating GST search during onboarding safeguards against fraudulent GSTINs, helps avoid future disputes, and establishes a reliable audit trail boosting your compliance posture from day one.

Get Ahead of Hidden Risks

Before signing a deal, onboarding a vendor, or renewing a contract do you really know the risks involved?

Risk360 Reports give you a 360° view of financial, legal, compliance, and reputational red flags delivered in 48 hours.

Trusted by compliance, procurement, and corporate development teams to make smarter, safer decisions.

📑 Get a Free Sample Report