How Legal Vendor Due Diligence Protects Your Company from Third-Party Risks

How Legal Vendor Due Diligence Protects Your Company from Third-Party Risks

In today’s globalized and interconnected business environment, companies rely heavily on third-party vendors to provide essential services, products, and technology solutions. While these partnerships create efficiencies and competitive advantages, they also introduce various types of risks that can adversely affect the company’s legal standing, financial stability, cybersecurity, and reputation. These risks can arise unexpectedly and cause serious consequences if vendor relationships are not carefully managed. Legal vendor due diligence is a crucial process through which companies investigate and assess their vendors comprehensively before and during the partnership to minimize these risks

What is Legal Vendor Due Diligence?

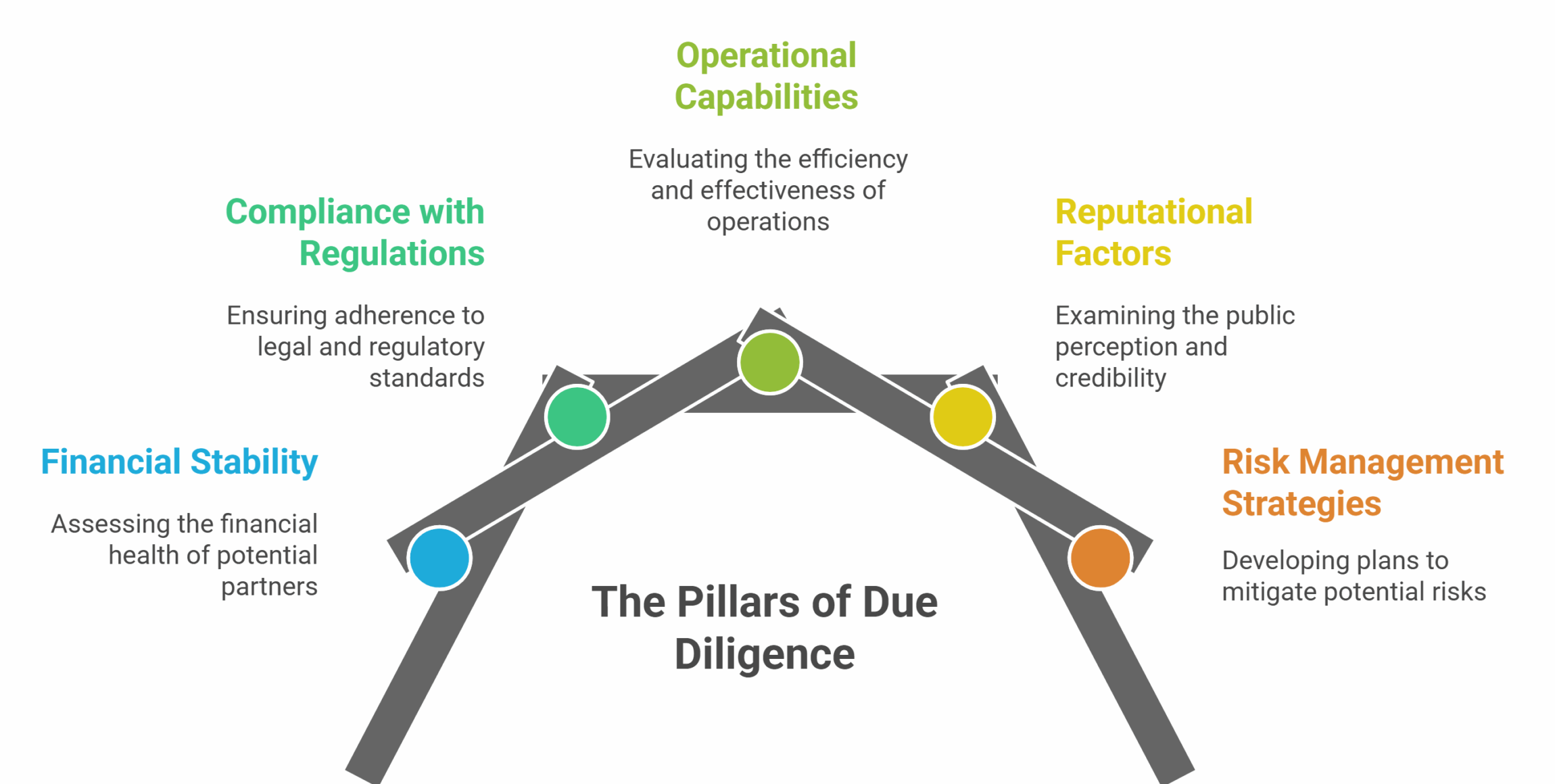

Legal vendor due diligence is a structured process used to assess whether a current or prospective vendor meets legal, financial, and operational expectations before entering or continuing a business relationship. It involves reviewing the vendor’s corporate structure and regulatory authorizations, examining any past or ongoing legal disputes, and confirming compliance with relevant laws, regulations, and industry requirements. The process also evaluates ownership and protection of intellectual property, the strength of contractual terms and liability provisions, and the effectiveness of cybersecurity and data protection controls. In addition, a vendor’s financial stability and credit profile are analyzed to gauge long-term reliability. By conducting this comprehensive review, organizations can uncover potential risks early, improve transparency, and put contractual safeguards in place to better manage and reduce overall exposure.

Why Legal Vendor Due Diligence is Crucial for Protecting Your Business

Engaging with third-party vendors without performing proper legal due diligence can expose your company to various risks, including:

Legal Risks: Vendors may fail to comply with relevant regulations, such as anti-corruption laws, data privacy acts (GDPR, CCPA), or industry-specific standards, potentially leading to regulatory fines, sanctions, or lawsuits.

Financial Risks: Vendors facing financial instability or bankruptcy may disrupt supply chains or service delivery, leading to operational losses.

Operational Risks: Inadequate performance or breaches of service level agreements (SLAs) can impact your business continuity.

Cybersecurity Risks: Vendors with poor data security protocols can become the source of data breaches, putting sensitive customer or corporate information at risk.

Reputational Risks: Vendor misconduct or unethical practices may reflect poorly on your company’s brand and stakeholder trust.

By conducting legal vendor due diligence, companies can proactively identify these risks and implement mitigation strategies that protect their legal and business interests.

Key Steps in Legal Vendor Due Diligence

- Review Corporate Documentation: Validate the vendor’s legal existence, licenses, registrations, and compliance certifications.

- Check Regulatory Compliance: Ensure vendors comply with industry regulations, environmental standards, and data protection laws.

- Assess Litigation History: Investigate past or ongoing lawsuits, regulatory investigations, sanctions, or negative press.

- Evaluate Contractual Terms: Confirm contracts include key protections such as indemnity clauses, limitations of liability, confidentiality agreements, data breach notification requirements, audit rights, and termination rights.

- Perform Cybersecurity Assessment: Review security protocols, data encryption methods, breach response plans, and access controls.

- Analyze Financial Stability: Review audited financial reports, credit ratings, and payment histories to assess vendor viability.

- Conduct Background Checks: Screen owners and key personnel for reputational, ethical, or legal concerns.

- Implement Continuous Monitoring: Set up processes to regularly assess vendor risk throughout the relationship lifecycle.

How Due Diligence Mitigates Third-Party Risks

- Risk Identification: By examining legal compliance, financials, and public records, companies identify warning signs and assess the true risk profile of vendors.

- Contractual Safeguards: Robust contracts legally bind vendors to your company’s standards of conduct, data security, and performance expectations.

- Regulatory Assurance: Compliance checks ensure vendors meet regulatory requirements, reducing the risk of penalties affecting your company.

- Financial Reassurance: Financial due diligence ensures vendors are stable enough to deliver services without interruption.

- Cybersecurity Protection: Evaluations of IT controls reduce vulnerabilities that third parties can introduce to your infrastructure.

- Ongoing Risk Management: Continuous monitoring allows timely intervention, renegotiation, or termination of risky vendor relationships.

Benefits of Legal Vendor Due Diligence for Risk Protection

Third-party risk management plays a critical role in helping organizations stay aligned with applicable laws and industry regulations, reducing the likelihood of fines, enforcement actions, or legal disputes. By identifying adverse litigation, sanctions exposure, or negative media at an early stage, businesses can address potential risks before they escalate. Strong risk assessments also reinforce contractual safeguards, particularly around liability, data protection, and breach notification requirements. Evaluating a vendor’s financial stability helps prevent unexpected service interruptions or operational failures, while cybersecurity risk controls reduce exposure from external systems that handle sensitive information. Ongoing monitoring enables organizations to identify changes in risk profiles in real time, rather than relying on static assessments. Together, these practices build trust among customers, regulators, and partners by demonstrating a mature, proactive approach to risk management.

Practical Considerations and Best Practices

- Use a Risk-Based Approach: Tailor due diligence depth depending on the vendor’s criticality, data access, and risk exposure.

- Leverage Technology: Use vendor management and risk assessment software to automate information gathering and ongoing monitoring.

- Collaborate Across Departments: Involve legal, compliance, IT security, procurement, and finance teams to cover all risk angles.

- Maintain Documentation: Keep detailed records of due diligence activities to demonstrate compliance and decision rationale.

- Update Regularly: Reassess vendors periodically or upon any material changes in service scope, regulatory environment, or incident reports.

How SignalX Helps with Legal Vendor Due Diligence

To strengthen and accelerate the due diligence process, companies increasingly rely on advanced technology platforms. SignalX is designed to streamline and enhance legal vendor due diligence by providing automated, data-driven insights that reduce manual effort and improve accuracy.

Here’s how SignalX supports organizations in managing third-party risks:

1. Automated Vendor Background and Compliance Checks

SignalX conducts deep compliance screening across global corporate registries, sanctions lists, regulatory filings, and legal databases. This helps organizations quickly detect red flags such as:

- Past litigation and disputes

- Regulatory violations

- Blacklisting or sanctions

- Director/ownership history and adverse media

2. Comprehensive Financial Health Assessment

The platform aggregates data from financial reports, credit scores, payment histories, and market insights, giving companies a clear picture of a vendor’s financial stability and long-term viability.

3. Real-Time Risk Monitoring

Instead of relying on one-time checks, SignalX provides continuous monitoring of vendors with alerts triggered by:

- New lawsuits

- Regulatory updates

- Financial deterioration

- Negative news or reputation events

This ensures proactive risk management throughout the vendor lifecycle.

4. Centralized Due Diligence Workflows

SignalX consolidates all vendor documents, screening results, and risk reports into a single dashboard. This helps legal, compliance, procurement, and finance teams collaborate efficiently and maintain complete audit trails.

5. Customizable Risk Scoring

The platform uses AI-driven scoring models to rate vendors based on legal, financial, cyber, and reputational risk factors. Companies can customize these scores based on:

- Industry

- Vendor criticality

- Compliance requirements

This makes decision-making faster and more consistent.

6. Enhanced Reporting and Documentation

SignalX automatically generates structured due diligence reports that help organisations:

Meet internal compliance requirements

Prepare for external audits

Maintain regulatory documentation

Demonstrate risk management practices to stakeholders

7. Scalable for Small and Large Enterprises

Whether managing 10 vendors or 10,000, SignalX offers scalable automation, reducing the heavy manual workload involved in vendor risk assessments.

Conclusion

Legal vendor due diligence is an indispensable part of third-party risk management. It empowers companies to uncover and address potential legal, financial, operational, and cybersecurity risks before entering into contracts, thus protecting business continuity, reducing liabilities, and enhancing brand reputation. Organizations that embed thorough due diligence into their vendor management programs can confidently build stronger, more resilient partnerships in today’s complex business ecosystem.

Frequently Asked Questions

1. What is legal vendor due diligence?

Legal vendor due diligence is a process where a seller conducts a legal assessment of its own business before entering a transaction. It helps identify risks, prepare documents, and address issues in advance to make the deal smoother.

2. Why is legal vendor due diligence important?

It allows sellers to detect legal risks early, resolve compliance gaps, avoid surprises during buyer due diligence, speed up negotiations, and increase deal value.

3. What does a typical legal vendor due diligence cover?

It usually covers contracts, corporate records, compliance, litigation history, intellectual property, labor laws, regulatory approvals, licenses, and financial or tax exposure.

4. How does vendor due diligence differ from buyer due diligence?

Vendor due diligence is done by the seller before the sale, while buyer due diligence is conducted by the buyer during the transaction. Vendor due diligence makes the process faster and more transparent.

5. Who conducts legal vendor due diligence?

It is typically carried out by external legal advisors, law firms, or compliance consultants with expertise in mergers, acquisitions, and corporate law.

6. When should a company perform vendor due diligence?

Ideally, a company should perform vendor due diligence before initiating the sale process or when preparing for fundraising, mergers, or restructuring.

7. What are the benefits of legal vendor due diligence for sellers?

- Faster deal execution

- Increased buyer confidence

- Better valuation

- Reduced negotiation friction

- Early identification of red flags

8. What documents are reviewed during legal vendor due diligence?

Corporate documents, contracts, shareholder agreements, IP registrations, employment contracts, compliance records, tax filings, litigation documents, and licenses.

9. How long does legal vendor due diligence take?

Depending on the size and complexity of the business, it can take anywhere from two weeks to several months.

10. Can vendor due diligence help avoid deal failures?

Yes. By proactively addressing legal and compliance issues, vendor due diligence significantly reduces the risk of deal delays or failures.