Risk360: Comprehensive

Due Diligence Report

Make every business decision smarter with Risk360 an advanced due diligence report that uncovers hidden risks across financial, legal, and reputational dimensions. Get 360° visibility into companies, vendors, and partners before you decide.

Comprehensive Due Diligence & Risk Assessment Report Globally

Get due diligence and risk reports for any vendor, counterparty, or business across the globe.

India

India United States

United States

China

China Australia

Australia United

Kingdom

United

Kingdom UAE

UAE Germany

Germany France

France Canada

Canada Japan

Japan Singapore

Singapore South Africa

South Africa

India

India United States

United States

China

China Australia

Australia United

Kingdom

United

Kingdom UAE

UAETrusted by Industry Leaders. Backed by Data.

Risk360 powers confident decision-making for enterprises across banking, fintech, consulting and compliance. Our customers rely on fast, structured insights to reduce risk and close deals faster.

Download Sample Report

What is Risk360?

Risk360 is SignalX's unified platform for due diligence, risk intelligence, and continuous vendor monitoring. It brings verified data sources, automated reporting and real-time alerts into a single workflow so teams can act with confidence.

- Run comprehensive entity checks across corporate registries, litigation databases, and adverse media.

- Understand ownership, connected parties, and financial signals at a glance.

- Generate exportable, audit-ready reports for governance and compliance reviews.

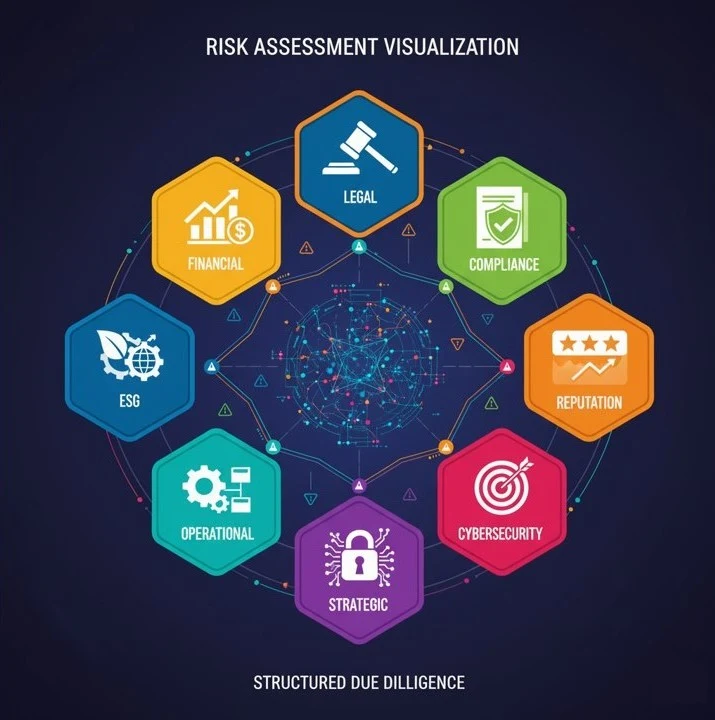

Why Risk360 Matters

Manual checks, multiple databases and slow turnarounds increase operational risk. Risk360 centralizes insights so you can make faster & safer decisions.

Centralized Due Diligence

Aggregate verified public & private data in one report for immediate clarity.

Faster Turnaround

Automate data collection and report generation reduce time-to-insight significantly.

Continuous Monitoring

Set alerts for litigation, sanctions, or regulatory changes impacting your counterparties.

Ownership & Structure

Visualize corporate hierarchies, beneficial owners, and connected parties.

Regulatory & ESG Checks

Inclusive checks for sanctions, PEPs, ESG signals and industry-specific compliance items.

Audit-ready Reports

Exportable PDFs and evidence trails to support governance and audit reviews.

Who Uses Risk360 and Why It Matters

Risk360 empowers different teams across your organization to work smarter, faster, and more transparently. Whether you're managing vendor risks, overseeing compliance, or conducting due diligence Risk360 is built to help you make confident decisions backed by intelligence.

For Chief Risk Officers & Risk Teams

Gain a complete view of entity and counterparty risks in real time. Risk360 helps you identify red flags early, track changes continuously, and make faster, data-backed risk assessments.

- Consolidated visibility across all vendors, clients, and partners.

- Early warnings for potential legal, regulatory, or financial issues.

- Helps reduce exposure through proactive monitoring and risk scoring.

For Compliance & Legal Teams

Risk360 simplifies compliance checks with automated workflows and centralized evidence trails. You can track policy adherence, perform AML/KYC reviews, and stay aligned with regulatory standards — effortlessly.

- Automated compliance validation with instant red-flag alerts.

- Single source of truth for all audit and KYC data.

- Improved reporting and documentation for regulatory reviews.

For Procurement & Vendor Management Teams

Onboard and monitor vendors with confidence. Risk360 helps procurement leaders evaluate supplier credibility, mitigate third-party risks, and maintain compliance across your entire vendor ecosystem.

- Instant due diligence checks for faster vendor onboarding.

- Continuous tracking of vendor performance and sanctions.

- Lower procurement risk while meeting governance goals.

For Audit & Governance Teams

Ensure every transaction and partnership stands up to scrutiny. Risk360 provides an audit-ready view of all diligence activities, helping governance teams enforce accountability and transparency.

- Clear audit trails for every check and report.

- Evidence-backed validation for internal and external audits.

- Enhances control mechanisms and compliance posture.

What's Inside a Risk360 Report

Each Risk360 report delivers a 360° intelligence view helping you assess financial, legal, operational, and compliance aspects of any company before you onboard, invest, or engage.

Financial Health

- Activity efficiency & profitability ratios

- Liquidity & solvency indicators

- Operational revenue performance

Corporate Structure & Capability

- Scale & business operations overview

- Management consistency & leadership history

- Employee strength

Credit & Payment History

- Credit defaults

- Bankruptcy, insolvency, and debt recovery checks

- Public financial liabilities overview

Compliance & Regulatory Health

- GST, EPFO & MCA compliance verification

- Regulatory reporting consistency

- Labour and indirect tax compliance

Litigation & Legal History

- Criminal & civil cases summary

- Tax litigations and insolvency filings

- Litigiousness rating and case status tracking

Defaulter & Blacklist Mentions

- MCA or SEBI defaulter records

- CBI, SFIO, and other market regulator checks

- Economic offense tracking

Sanctions & Political Exposure

- Global sanctions and trade restriction checks

- Politically Exposed Persons (PEP) mapping

- AML/KYC risk Indicators

Promoter & Related Parties

- Connected party litigation analysis

- Regulatory defaults by associates

- Political exposure of promoters

Market Sentiment & Reputation

- Adverse media coverage tracking

- Customer complaint records

- Reputation risk scoring

Certifications & Quality

- ISO, BIS, FSSAI and industry certifications

ESG & Indicators

- Environmental performance overview

- Social responsibility disclosures

- Governance & ethics assessment

Industry Benchmarking

- Peer comparison metrics

- Operational efficiency vs industry standards

- ESG and productivity benchmarking

Verification & Background Checks

- Entity verification (CIN, PAN, Address, etc.)

- IEC & LEI validation

Annexures & Financial Statements

- Balance Sheet and P&L extracts

- Cash Flow summary

- Tax and litigation annexures

Experience Risk360 in Action

See how Risk360 helps teams reduce risk, speed up onboarding, and stay audit-ready. Book a demo or request a custom walkthrough for your use-case.

Book a Demo Request WalkthroughFAQs

Risk360 is a self-assessment due diligence solution from SignalX that helps companies evaluate compliance, litigation, financial, and reputational risks in one consolidated report.

Most Signal360 reports are generated within 24 to 48 hours, making it faster than traditional due diligence processes.

Risk360 offers faster turnaround, transparent insights, lower cost compared to manual due diligence, and the ability to monitor risk on demand.

Yes. Risk360 is widely used by startups, SMEs, and large enterprises to establish credibility with investors, lenders, or tendering authorities.

Traditional due diligence is manual and resource-heavy. Risk360 automates checks, validates data with AI, and delivers standardized reports faster.

Yes. Many companies use Risk360 reports to demonstrate transparency and reduce investor concerns during fundraising or partnership discussions.

Yes. Risk360 cross-checks statutory filings, regulatory compliance, and litigation history from trusted data sources to provide a clear compliance status.

Yes. The platform allows reassessments and bulk GST checks, making it useful for companies who want to maintain updated risk profiles over time.

IT services, manufacturing, financial services, and supply-chain dependent businesses often rely on Risk360 to meet vendor and investor due diligence requirements.

SignalX ensures high-level data security with encryption and strict privacy protocols, ensuring all uploaded information remains confidential.

SignalX is an AI-powered risk intelligence suite that automates regulatory, financial, and operational due diligence, enabling faster, data-driven decision-making.

Cookie Consent

We use cookies to enhance your browsing experience and analyze site traffic. By continuing to use this site, you agree to our use of cookies.

Cookie Preferences

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

Pinterest Tag is a web analytics service that tracks and reports website traffic.

Service URL: policy.pinterest.com (opens in a new window)