Understanding the Stakeholder Model of Corporate Governance

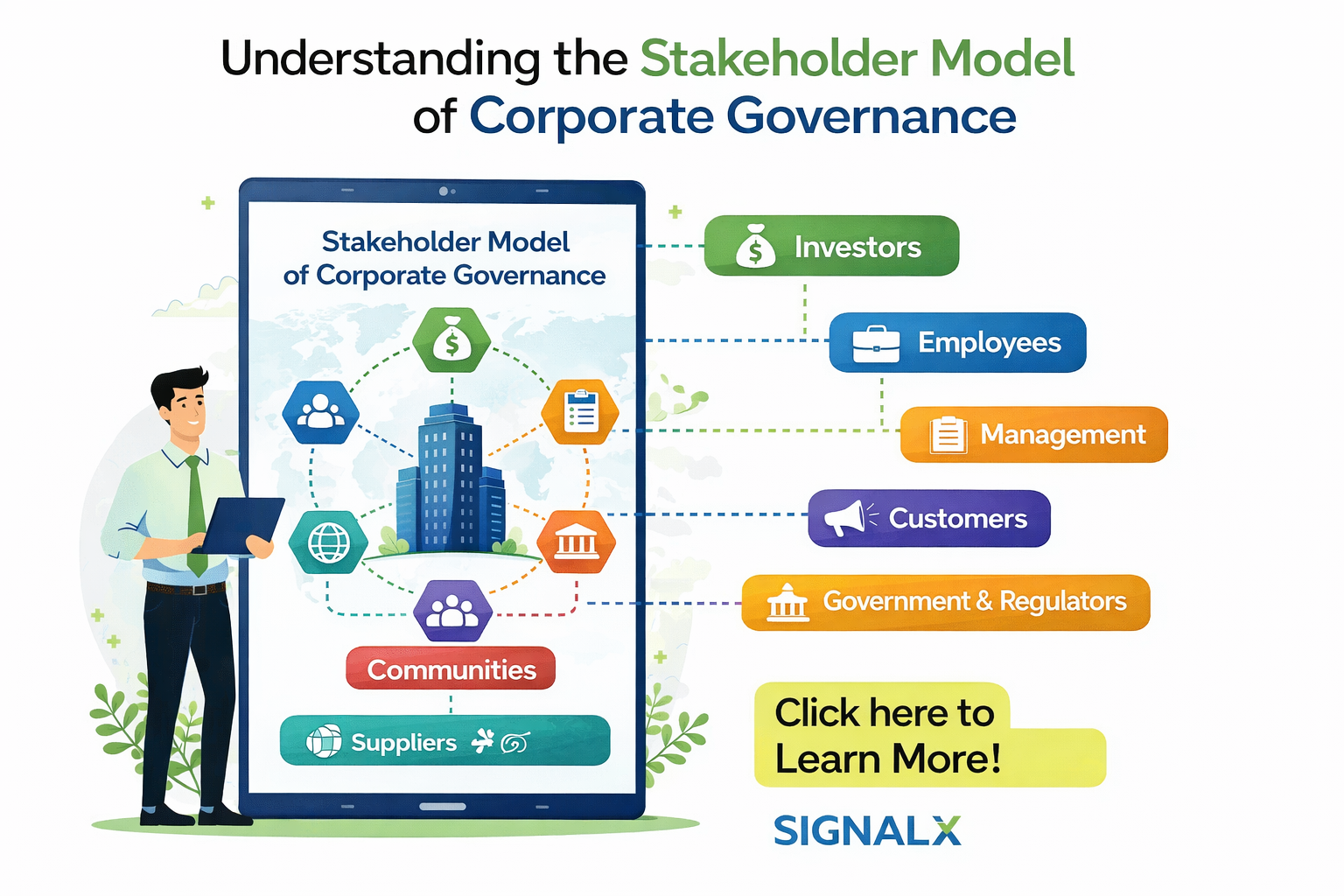

Good governance is no longer defined solely by financial returns or shareholder satisfaction. In the modern corporate landscape shaped by global regulation, social expectations, digital transparency, and rapid innovation, stakeholders have become central to how organisations operate, make decisions, and create long-term value. This shift has prompted leaders to re-examine traditional governance models and adopt more holistic approaches, such as the Stakeholder Model of Corporate Governance, which balances profitability with responsibility. Whether you’re a board member, executive, compliance officer, or governance enthusiast, understanding stakeholders is now essential.

This guide explores the fundamentals of corporate stakeholders, their growing importance in governance, and how companies can effectively engage them to foster sustainable success the Stakeholder Model of Corporate Governance .

Understanding Corporate Stakeholders

At its core, a stakeholder is any individual, group, or entity that affects or is affected by a company’s decisions, operations, or outcomes. Unlike shareholders, who primarily have a financial investment in a company, stakeholders have a broader, sometimes non-financial, relationship with the organization.

Stakeholders can influence:

- Company reputation

- Policy and regulatory compliance

- Operational continuity

- Talent acquisition and retention

- Market positioning

- Long-term financial performance

In the governance context, stakeholders introduce multiple dimensions of accountability, requiring companies to look beyond quarterly earnings and consider the broader societal and environmental impacts of their decisions. The Stakeholder Model of Corporate Governance reinforces this need, advocating for the consideration of all stakeholders in decision-making processes, not just shareholders.

Types of Stakeholders: Internal, External, and Indirect

Stakeholders can be grouped into three main categories based on their relationship to the organization: internal, external, and indirect stakeholders.

1. Internal Stakeholders

Internal stakeholders work within or are formally connected to the company.

They include:

- Employees

- Managers and executives

- Board members

- Owners (in private companies)

- Shareholders (in public companies)

These stakeholders are directly involved in decision-making and daily operations. Their interests often center on job security, compensation, growth opportunities, organizational stability, and financial performance

2. External Stakeholders

External stakeholders interact with the organization from the outside but are directly impacted by its operations.

They include:

- Customers

- Suppliers and vendors

- Regulators and policymakers

- Investors and creditors

- Communities and local governments

- Competitors (in certain contexts)

These groups shape a company’s operating environment through market demand, regulation, social expectations, and industry trends.

3. Indirect Stakeholders

Indirect stakeholders do not engage with the company directly but are affected by its presence or activities.

They include:

- Advocacy groups

- Nonprofit organizations

- Environmental groups

- Media organizations

- Future generations (in sustainability contexts)

Though their influence may be less immediate, indirect stakeholders play a key role in shaping public opinion, sustainability frameworks, and long-term corporate reputation.

Understanding these categories helps organisations map out their broader ecosystem and prepare for diverse expectations.

Why Stakeholders Matter in Modern Governance

Traditional governance frameworks largely focused on shareholders, financial oversight, and compliance. Today, stakeholders hold new relevance due to several forces:

1. Regulatory Shifts

Governments and global bodies increasingly mandate environmental, social, and governance (ESG) disclosures, supply-chain transparency, data protection, and labour practices, all stakeholder-centred issues.

2. Public Accountability

With online platforms amplifying voices, stakeholders now have direct channels to call out corporate missteps, affecting reputation instantly.

3. Sustainable Strategy

Companies realize long-term value is tied to stakeholder trust customer loyalty, employee engagement, and community support contribute to stronger business models. The Stakeholder Model of Corporate Governance facilitates this, ensuring long-term business success beyond immediate financial returns.

4. Risk Management

Ignoring stakeholders can lead to strikes, lawsuits, boycotts, regulatory penalties, or loss of market share.

5. Competitive Advantage

Organisations with strong stakeholder relationships often benefit from:

- Better talent retention

- Stronger brand loyalty

- More resilient supply chains

- Favourable regulatory environments

Stakeholders shape corporate success more directly today than ever before, especially within the Stakeholder Model of Corporate Governance, which seeks to integrate and balance the interests of all stakeholders.

Shareholder vs. Stakeholder Model

1. Shareholder Model

Goal: Maximise shareholder (owners/investors) wealth.

Focus: Profit, stock value, financial returns.

Decision-making: Business choices prioritise what benefits shareholders the most.

Viewpoint:

The company’s primary responsibility is to its owners .Often linked with traditional corporate governance. Short-term profits are sometimes prioritized.

Examples:

- Publicly traded companies are focused on quarterly earnings

- Businesses are guided heavily by investor expectations

2. Stakeholder Model

Goal: Create long-term value for all stakeholders.

Stakeholders include: Employees, customers, suppliers, investors, regulators, communities, environment.

Decision-making: Balances financial goals with ethical, social, and environmental interests.

Viewpoint:

Company success depends on satisfying all groups affected by business actions. Promotes sustainability and long-term growth.

Examples:

- Companies focusing on ESG, corporate social responsibility

- Businesses with employee and customer-centric policies

Key Differences

| Aspect | Shareholder Model | Stakeholder Model of Corporate Governance |

|---|---|---|

| Primary Focus | Shareholder wealth | Value for all stakeholders |

| Decision Priority | Profit maximization | Balanced interests (profit + people + planet) |

| Time Horizon | Often short-term | Mostly long-term |

| Responsibility | Owners | Employees, customers, society, investors |

| Corporate Governance Style | Traditional | ESG-driven |

How Stakeholder Theory Changes Board Responsibilities

When organisations embrace stakeholder governance, board members must adapt in several key areas:

1. Broader Fiduciary Duty

Boards must consider how decisions affect customers, employees, communities, and the environment not just investors.

2. Expanded Risk Oversight

Boards are increasingly accountable for:

- Cybersecurity

- Social and labour issues

- Environmental impact

- Supply chain resilience

- Reputation management

3. Ethical and Responsible Decision-Making

Directors must ensure the company acts responsibly, even when it may not directly translate to immediate profits.

4. Transparent Communication

Boards must communicate clearly with diverse stakeholders, including through ESG disclosures and sustainability reports.

5. Long-Term Strategic Planning

A multi-stakeholder approach encourages sustainable growth rather than short-term gains.

Examples of Stakeholder-Focused Governance in Action

1. Patagonia

The outdoor apparel company has long placed environmental stewardship at its core. It reinvests profits into conservation efforts, adopts sustainable supply chains, and advocates for climate action activities supporting indirect stakeholders like environmental groups and future generations.

2. Unilever

Under its Sustainable Living Plan, Unilever redesigned its operations to reduce waste, improve worker conditions, and source ethically. This strategy aligns with communities, suppliers, and customers.

3. Salesforce

Salesforce invests heavily in employee well-being, community development, and ethical technology policies. It integrates stakeholder principles into its governance, earning strong trust among customers and partners.

Benefits and Challenges of Stakeholder Governance

Benefits

1. Enhanced Trust and Reputation

Companies that engage stakeholders responsibly build stronger brand loyalty and public goodwill.

2. Better Risk Management

Considering diverse viewpoints helps management anticipate issues before they become crises.

3. Greater Employee Engagement

When employees feel valued and heard, retention and productivity improve.

4. Sustainable Growth

Multi-stakeholder decision-making encourages long-term thinking, stability, and resilience.

5. Improved Innovation

Stakeholders provide insights and feedback that fuel better product design and market fit.

Challenges

1. Balancing Competing Interests

Different stakeholders often have conflicting priorities. For example, higher employee wages might reduce short-term shareholder returns.

2. Increased Complexity

Decision-making becomes more nuanced and slower due to additional data, perspectives, and accountability.

3. Measurement Difficulties

Non-financial metrics such as social impact or environmental stewardship are harder to quantify.

4. Risk of Superficial Compliance

Some companies adopt stakeholder language without meaningful action (“greenwashing”).

5. Legal and Structural Limitations

Corporate bylaws, national regulations, or investor expectations may still favor shareholder primacy.

Understanding these challenges helps organizations build realistic, effective stakeholder strategies.

Technology and Tools for Stakeholder Management

As stakeholder expectations grow, technology plays a critical role in managing relationships, gathering insights, and ensuring transparency.

1. Stakeholder Mapping Software

Tools like Miro, Lucid chart, and Kumu help visualise stakeholder networks, influence levels, and engagement plans.

2. ESG and Sustainability Platforms

Platforms such as Sustainably, MSCI ESG Ratings, and Workiva streamline reporting and compliance with global standards.

3. Communication and Engagement Tools

CRM systems (Salesforce, HubSpot) for customer outreach

Employee engagement platforms (Culture Amp, Qualtrics)

Community engagement tools (Social platforms, town hall apps)

4. Data Analytics and AI Tools

AI-powered platforms analyze stakeholder sentiment, market trends, and ESG risks using real-time data from news, social media, and operational systems.

Technology allows companies to shift from reactive stakeholder management to proactive, strategic engagement

Conclusion

Stakeholders have become central to corporate governance, shaping how companies operate, innovate, and interact with the world. A stakeholder-focused approach is no longer optional it is a foundational part of long-term business success.

By understanding stakeholder categories, embracing stakeholder governance models, and leveraging modern tools, organizations can:

- Build stronger relationships

- Reduce risk

- Improve transparency

- Drive sustainable value

- Strengthen trust across their ecosystem

In a world where corporate actions are increasingly visible and accountable, the companies that succeed will be those that treat stakeholders not as an obligation but as strategic partners in building a resilient, responsible, and prosperous future.

FAQ: Corporate Governance and Stakeholder Engagement

1. What is a corporate stakeholder?

A corporate stakeholder is any individual, group, or entity that affects or is affected by a company’s decisions, operations, or outcomes. Unlike shareholders, who primarily have a financial interest, stakeholders can have non-financial relationships with a company, including employees, customers, suppliers, communities, and regulators.

2. What are the types of corporate stakeholders?

Stakeholders can be grouped into three categories:

- Internal Stakeholders: Employees, managers, executives, board members, and owners (private companies).

- External Stakeholders: Customers, suppliers, vendors, regulators, investors, and local communities.

- Indirect Stakeholders: Advocacy groups, environmental organizations, media, future generations, etc. These groups influence public opinion and corporate reputation, although they don’t engage directly with the company.

3. Why are stakeholders important in modern corporate governance?

Stakeholders play a significant role in shaping a company’s reputation, risk management, long-term financial performance, and sustainability. Modern governance requires businesses to balance shareholder wealth with broader societal, environmental, and ethical concerns. As a result, businesses need to engage with stakeholders to ensure long-term value creation, manage risks, and stay competitive.

4. What is the difference between the shareholder model and the stakeholder model?

- Shareholder Model: Focuses primarily on maximizing shareholder wealth and prioritizing short-term profits. Decisions are centered around financial returns to owners and investors.

- Stakeholder Model: Aims to create long-term value for all stakeholders, including employees, customers, investors, communities, and the environment. It balances financial goals with social, ethical, and environmental considerations.

5. How has stakeholder theory changed the responsibilities of board members?

Boards now have a broader fiduciary duty that goes beyond just considering the interests of investors. They must evaluate how decisions affect a wider range of stakeholders, including employees, customers, communities, and the environment. This includes expanding risk oversight, fostering ethical decision-making, ensuring transparency, and planning for long-term strategic goals.

6. Can you give examples of companies that practice stakeholder-focused governance?

- Patagonia: The company integrates environmental sustainability into its operations, reinvesting profits into conservation and advocating for climate action.

- Unilever: Under its Sustainable Living Plan, Unilever focuses on reducing waste, improving labor conditions, and sourcing ethically, aligning with the needs of employees, suppliers, and customers.

- Salesforce: Salesforce emphasizes employee well-being, community development, and ethical technology practices, building trust among stakeholders.

7. What are the benefits of stakeholder-focused governance?

- Enhanced Trust and Reputation: Companies that engage stakeholders responsibly tend to build stronger brand loyalty and goodwill.

- Better Risk Management: Anticipating issues from diverse perspectives helps companies manage risks more effectively.

- Greater Employee Engagement: Valuing employees’ input leads to higher retention and productivity.

- Sustainable Growth: Focusing on the long-term impact of decisions promotes stability and resilience.

- Improved Innovation: Stakeholders provide valuable feedback, enhancing product design and market fit.

8. What challenges come with adopting a stakeholder-focused approach?

- Balancing Competing Interests: Different stakeholders may have conflicting priorities, like higher wages versus maximizing profits for shareholders.

- Increased Complexity: Decision-making can become slower and more nuanced due to the need to consider various perspectives.

- Measurement Difficulties: Non-financial metrics such as social impact or environmental responsibility can be harder to quantify.

- Superficial Compliance: Some companies might engage in “greenwashing” or superficial stakeholder engagement without taking meaningful action.

- Legal and Structural Limitations: Corporate bylaws and national regulations may still prioritize shareholder interests, making the transition to stakeholder models challenging.

9. How can companies use technology to manage stakeholders effectively?

- Stakeholder Mapping Software: Tools like Miro or Lucidchart help visualize stakeholder networks and influence levels.

- ESG and Sustainability Platforms: Platforms like MSCI ESG Ratings and Workiva help with compliance and reporting on environmental and social impacts.

- Communication and Engagement Tools: CRMs (Salesforce, HubSpot) and employee engagement platforms (Culture Amp) facilitate transparent and consistent communication with stakeholders.

- Risk and Compliance Management Software: Solutions like Diligent and NAVEX Global assist with managing risks and ensuring compliance with stakeholder-related regulations.

- Data Analytics and AI Tools: AI-powered platforms can analyze stakeholder sentiment and market trends, helping businesses stay proactive in stakeholder management.

10. What is the long-term importance of stakeholder governance for companies?

By focusing on stakeholder interests and aligning with societal and environmental values, companies can build stronger, more resilient brands. This approach promotes sustainability, risk management, and innovation, ultimately leading to long-term business success and positive relationships with a broader ecosystem of stakeholders.