The Vendor Relationship Management Command Map

A practical, end-to-end guide to building high-impact vendor partnerships. Vendor ecosystems are no longer background infrastructure. They are core to speed, scale, compliance, and competitive advantage. Yet most organisations still manage vendors with fragmented ownership, static spreadsheets, and reactive risk reviews. This command map reframes Vendor Relationship Management (VRM) as an operational system one that SignalX was built to power through continuous intelligence, automation, and decision-grade visibility.

Vendor Relationship Management today is the discipline of governing third parties across their entire lifecycle from discovery to exit while balancing performance, risk, compliance, and cost. It is not procurement. It is not just third-party risk management. It is the connective tissue between business growth and operational resilience.

Most VRM programs fail because they are episodic. Vendors are reviewed annually, risks are assessed in isolation, and performance data lives in silos. High-performing teams operate differently. They treat vendors as dynamic entities, continuously monitored and contextually scored, with ownership clearly defined across business, risk, and operations.

In modern organizations, VRM ownership is shared. Procurement enables commercial structure, risk teams govern exposure, business owners drive outcomes, and leadership needs a unified, real-time view. SignalX exists to make that shared ownership executable through AI-driven insights instead of manual coordination.

DISCOVERY & CONTROL

Identify the Vendors That Actually Matter

Every vendor portfolio contains noise. Long-tail suppliers consume disproportionate oversight, while high-impact vendors often escape scrutiny because they are familiar or “strategic.”

Effective VRM begins with intelligent vendor segmentation. Vendors must be categorized by business criticality, data access, operational dependency, and financial exposure not just spend. A low-cost SaaS tool with privileged data access may represent more risk than a high-spend logistics partner.

SignalX automates this discovery phase by ingesting vendor data across systems and applying AI-driven classification models. Instead of relying on gut feel or static tiering exercises, teams gain a living map of which vendors truly matter, how their risk profile is evolving, and where ownership gaps exist between internal stakeholders.

Control starts with clarity. When vendor ownership is explicit and tiering is defensible, every downstream VRM decision becomes faster and more accurate.

SELECTION & DUE DILIGENCE

Choose Vendors You Won’t Regret

Vendor regret is expensive. It shows up as remediation costs, security incidents, compliance failures, and stalled initiatives. The root cause is almost always shallow evaluation.

Price-based selection ignores operational resilience, governance maturity, and long-term scalability. Modern due diligence must evaluate financial health, security posture, regulatory alignment, and delivery capability in parallel.

SignalX strengthens this mission by automating due diligence workflows and enriching vendor profiles with external intelligence. Instead of static questionnaires that vendors self-complete once a year, teams gain continuous signals financial stress indicators, security events, compliance gaps before contracts are signed and throughout the relationship.

The goal is not to eliminate risk, but to make informed tradeoffs with full visibility.

CONTRACT & EXPECTATION DESIGN

Lock in Performance, Not Just Terms

Contracts are often treated as legal artifacts rather than performance instruments. SLAs exist, but they are disconnected from business outcomes. KPIs are defined, but rarely enforced. Escalation paths exist on paper, but activate only when relationships are already strained.

High-impact VRM designs contracts as operating frameworks. Performance expectations are measurable, reviewable, and tied to incentives. Accountability is clear without being adversarial.

SignalX links contractual obligations to real-world performance data. AI-driven monitoring surfaces early deviations from agreed standards, enabling proactive intervention rather than reactive escalation. This transforms contracts from static documents into living benchmarks that guide vendor behavior and internal decision-making.

ONBOARDING & ALIGNMENT

Start Strong, Stay Aligned

Most vendor relationships fail quietly during onboarding. Assumptions go unchallenged, documentation is incomplete, and communication norms are undefined. Misalignment compounds until performance issues appear months later.

Effective onboarding is a structured alignment process. The first 90 days establish governance rhythms, data-sharing protocols, escalation norms, and mutual success criteria.

SignalX standardizes onboarding intelligence by ensuring every vendor relationship launches with a complete, validated profile spanning risk, compliance, performance expectations, and ownership. AI-driven reminders and gap detection prevent critical steps from being skipped, even as vendor volume scales.

Strong starts reduce long-term friction and accelerate value realization.

PERFORMANCE INTELLIGENCE

Measure What Matters

Vendor performance data is abundant but rarely useful. Scorecards are overengineered, inconsistently updated, and ignored by leadership because they lack context.

High-performing VRM programs focus on performance intelligence, not metrics volume. Quantitative indicators are paired with qualitative insights. Trends matter more than snapshots. Reviews are triggered by signals, not calendars.

SignalX turns vendor performance into decision-grade intelligence. AI synthesizes operational data, risk signals, and stakeholder feedback into clear performance narratives. Leadership sees which vendors are improving, degrading, or becoming concentration risks without manual reporting cycles.

Measurement becomes a strategic asset rather than a compliance exercise.

RISK, COMPLIANCE & CONTINUOUS MONITORING

Reduce Risk Without Slowing the Business

Traditional vendor risk management is episodic and intrusive. Assessments are long, reviews are infrequent, and remediation is slow. The result is either unchecked risk or business resistance.

Modern VRM shifts from point-in-time assessments to continuous monitoring. Risk is tracked as a dynamic condition, informed by real-world signals rather than self-attestation alone.

SignalX operationalizes this model through AI-driven risk monitoring across security, financial, operational, and compliance dimensions. Changes in vendor posture trigger alerts and workflows automatically, allowing teams to respond proportionately without halting operations.

Risk management becomes adaptive, not obstructive.

RELATIONSHIP OPTIMIZATION

Turn Vendors into Strategic Partners

Not all vendors should be partners, but the ones that matter most should be actively cultivated. Strategic vendors require governance models that go beyond issue resolution and contract enforcement.

Long-term value emerges through collaboration, shared roadmaps, and aligned incentives. Underperformance must be addressed constructively, with data-backed conversations rather than subjective frustration.

SignalX enables this shift by providing a shared source of truth. Performance trends, risk insights, and collaboration history inform relationship strategy. AI highlights where investment, renegotiation, or realignment will yield the greatest return.

Optimization replaces churn as the default response to friction.

RENEWAL, EXIT & TRANSITION

Know When to Double Down or Walk Away

Renewals are often automatic, and exits are often chaotic. Both outcomes reflect a lack of lifecycle intelligence.

Effective VRM treats renewal and exit decisions as strategic inflection points. Historical performance, evolving risk, and future business needs are evaluated together. Offboarding is planned, not reactive, ensuring continuity, knowledge transfer, and data integrity.

SignalX supports this mission by maintaining longitudinal vendor intelligence. Decision-makers see the full relationship arc, enabling confident renewals or disciplined exits. Transition risks are identified early, and dependencies are mapped before disruption occurs.

Endings become as controlled as beginnings.

INDUSTRY PLAYBOOKS

VRM by Industry

Vendor risk and value are highly contextual. Fintech organizations prioritize regulatory alignment and financial resilience. Healthcare organizations focus on data privacy and patient safety. SaaS and enterprise IT environments manage deep technical dependencies. Retail and e-commerce balance scale, logistics, and seasonal volatility.

SignalX adapts VRM intelligence by industry, applying AI models tuned to sector-specific risks and performance drivers. This ensures that vendor oversight reflects real-world exposure rather than generic frameworks.

Context-aware VRM outperforms one-size-fits-all governance.

COMMAND CENTER: TOOLS, TEMPLATES & STACK

Spreadsheets fail when vendor ecosystems scale, risks accelerate, and regulators demand evidence. Traditional vendor management systems capture data but rarely generate insight. TPRM tools focus narrowly on compliance, while VMS platforms prioritize workforce logistics.

SignalX functions as the VRM command center unifying vendor data, risk intelligence, and performance monitoring into a single AI-driven platform. It augments existing systems rather than replacing them, providing the connective intelligence layer modern organizations lack.

When visibility is real-time and insights are automated, teams spend less time managing tools and more time managing outcomes.

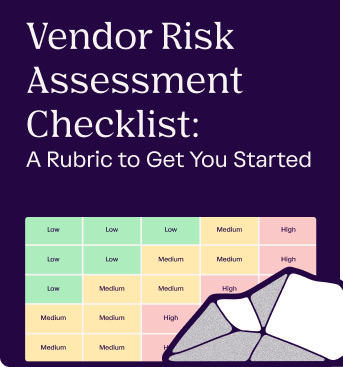

FIELD MANUAL: CHECKLISTS & TEMPLATES

Templates are only valuable when they are alive. Static documents decay quickly in dynamic vendor environments.

SignalX embeds lifecycle checklists, scorecards, questionnaires, and communication cadences directly into workflows. AI ensures they evolve as vendors, regulations, and business priorities change. This transforms best practices from shelfware into operational muscle memory.

Execution consistency becomes scalable.

FINAL BRIEF: EXECUTIVE TAKEAWAYS

Vendor Relationship Management maturity is defined by intelligence, not process volume. Organizations progress from reactive oversight to continuous, insight-driven governance. The most common failures stem from fragmented ownership, static assessments, and tool sprawl.

Scaling VRM requires a platform that sees vendors as dynamic systems constantly changing, interconnected, and consequential. SignalX delivers that perspective through AI, enabling leaders to balance growth, resilience, and trust across their entire vendor ecosystem.

In a world where third parties shape outcomes as much as internal teams, VRM is no longer optional infrastructure. It is a strategic command function.

Frequently Asked Questions (FAQ)

What is Vendor Relationship Management (VRM)?

Vendor Relationship Management is the end-to-end discipline of managing third-party vendors across their full lifecycle discovery, selection, contracting, onboarding, performance monitoring, risk management, optimization, and exit. Unlike traditional procurement or isolated risk assessments, VRM focuses on continuous visibility into vendor performance, risk, and business impact.

How is VRM different from procurement or third-party risk management (TPRM)?

Procurement focuses primarily on sourcing, pricing, and contracts, while TPRM concentrates on risk and compliance. VRM sits above both, connecting commercial decisions, operational performance, and risk intelligence into a single lifecycle view. SignalX enables this convergence by unifying data and insights across teams instead of keeping them siloed.

Why do most VRM programs fail?

Most programs fail because they are reactive and episodic. Vendors are reviewed annually, data is manually collected, ownership is unclear, and insights arrive too late to influence decisions. High-performing VRM programs use continuous monitoring, clear accountability, and AI-driven insights to act before issues escalate.

Who should own Vendor Relationship Management in an organization?

There is no single owner. Effective VRM is a shared responsibility across procurement, risk, compliance, IT, and business stakeholders. Executive leadership owns outcomes, while platforms like SignalX provide a shared source of truth that enables coordinated decision-making without constant manual alignment.

How does AI improve Vendor Relationship Management?

AI transforms VRM from a static process into a dynamic intelligence system. It automates vendor classification, detects changes in risk posture, surfaces performance trends, and prioritizes issues that require attention. SignalX uses AI to reduce manual effort while increasing the accuracy, speed, and relevance of vendor insights.

What types of risks should VRM cover?

VRM should address financial, operational, security, compliance, and strategic risks. This includes data privacy exposure, service disruption, regulatory non-compliance, vendor concentration risk, and long-term viability. Continuous monitoring is critical because vendor risk profiles change over time.

How often should vendors be reviewed?

Vendors should not be reviewed on a fixed calendar alone. Reviews should be triggered by signals such as performance degradation, changes in risk indicators, contract milestones, or business dependency shifts. SignalX enables this signal-based review model, reducing unnecessary effort while improving oversight.

When should a vendor be treated as a strategic partner?

Vendors should be considered strategic when they are critical to core operations, deeply integrated into systems, or directly impact revenue, compliance, or customer experience. Strategic vendors require stronger governance, shared roadmaps, and performance transparency all of which are supported through SignalX’s relationship intelligence.

How can organizations exit vendors without disrupting operations?

Successful vendor exits require early planning, clear transition ownership, and visibility into dependencies, data flows, and knowledge transfer. VRM platforms like SignalX maintain historical and operational context, allowing organizations to execute exits in a controlled, low-risk manner.

What industries benefit most from AI-driven VRM?

Any industry with complex vendor ecosystems benefits, but the impact is especially strong in fintech, healthcare, SaaS, enterprise IT, retail, and e-commerce. These sectors face high regulatory pressure, operational dependency, and rapid vendor change, making continuous intelligence essential.