EPFO Compliance in India – Complete Guide for Employers

EPFO compliance is one of the most critical statutory responsibilities for employers in India. Whether you are running a startup, SME, or large enterprise, complying with the Employees’ Provident Fund (EPF) laws is not optional it is a legal obligation that directly impacts employee welfare and business credibility.

This comprehensive guide explains everything employers need to know about EPFO compliance, from registration and contribution rules to penalties and best practices for staying compliant.

What is EPFO Compliance?

The Employees’ Provident Fund Organisation (EPFO) is a statutory body established under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It manages retirement savings schemes for employees working in the organized sector in India.

EPFO compliance refers to the set of rules and procedures employers must follow to ensure timely deduction, contribution, reporting, and record maintenance of provident fund dues for eligible employees.

Purpose and Importance of EPF Compliance

EPF compliance ensures long-term financial security for employees by creating a retirement corpus. For employers, it establishes trust, legal safety, and corporate accountability. Non-compliance can lead to heavy penalties, legal proceedings, and reputational damage.

Applicability of EPF Act, 1952

The EPF Act applies to establishments employing 20 or more employees. Once an establishment comes under EPFO, compliance continues even if the employee count falls below the threshold later.

Who is Required to Register Under EPFO?

Mandatory Registration Criteria

Any establishment with 20 or more employees must register with EPFO within 30 days of reaching the threshold. Certain industries have lower thresholds as notified by the government.

Employee Threshold Rules

Employees include permanent, temporary, contractual, and even trainees (excluding apprentices under the Apprentices Act). The headcount is based on total employees, not only those eligible for EPF.

Voluntary EPF Registration Cases

Employers with fewer than 20 employees can opt for voluntary EPFO registration. Once registered voluntarily, all EPF compliance obligations apply fully and continuously.

EPFO Registration Process for Employers

Documents Required for EPFO Registration

Employers must keep the following documents ready:

- PAN of the establishment

- Certificate of incorporation or partnership deed

- Address proof of business

- Digital signature of the employer

- Details of directors, partners, or proprietors

- Bank account details and canceled cheque

Step-by-Step EPFO Employer Registration Process

The EPFO registration process is completed online through the EPFO portal:

- Create an employer account

- Fill in establishment and employee details

- Upload required documents

- Submit digital signature

- Receive EPFO establishment code

Timeline and Approval Workflow

Registration approval usually takes 7–15 working days, depending on document verification and portal processing.

Key EPFO Compliance Requirements for Employers

Monthly EPF Contribution Rules

Employers must deduct EPF contributions every month and deposit them with EPFO on or before the due date.

Employer vs Employee Contribution Percentage

- Employee contribution: 12% of basic wages + DA

- Employer contribution: 12%, split as:

8.33% to Employees’ Pension Scheme (EPS)

3.67% to EPF

For certain establishments, a reduced contribution rate of 10% may apply.

Wage Components Considered for EPF

EPF is calculated on:

- Basic salary

- Dearness allowance

- Retaining allowance (if any)

Allowances such as HRA, overtime, and bonuses are generally excluded unless structured to evade EPF.

UAN Generation and Management

Employers must generate and link Universal Account Numbers (UAN) for employees, ensure KYC verification, and update employment records accurately.

EPFO Monthly & Annual Compliance Checklist

Monthly EPF Return Filing (ECR)

Employers must file the Electronic Challan-cum-Return (ECR) every month, detailing employee-wise contributions.

Due Dates for EPF Payment

EPF contributions must be deposited on or before the 15th of the following month.

Annual EPF Returns and Records

Although most filings are now integrated into monthly ECR, employers must maintain:

- Contribution registers

- Wage registers

- Inspection-ready records

Compliance Calendar for Employers

A structured compliance calendar helps track:

- Monthly deductions

- Payment deadlines

- UAN updates

- Employee exits and transfers

EPFO Forms Every Employer Should Know

Form 5, Form 10, and Form 12A

- Form 5: New employee enrollment

- Form 10: Employee exit details

- Form 12A: Monthly payment summary

Form 3A and Form 6A

- Form 3A: Member-wise annual contribution

- Form 6A: Establishment-wise annual contribution summary

Purpose and Usage of Each Form

These forms ensure accurate tracking of contributions, service history, and benefits eligibility for employees.

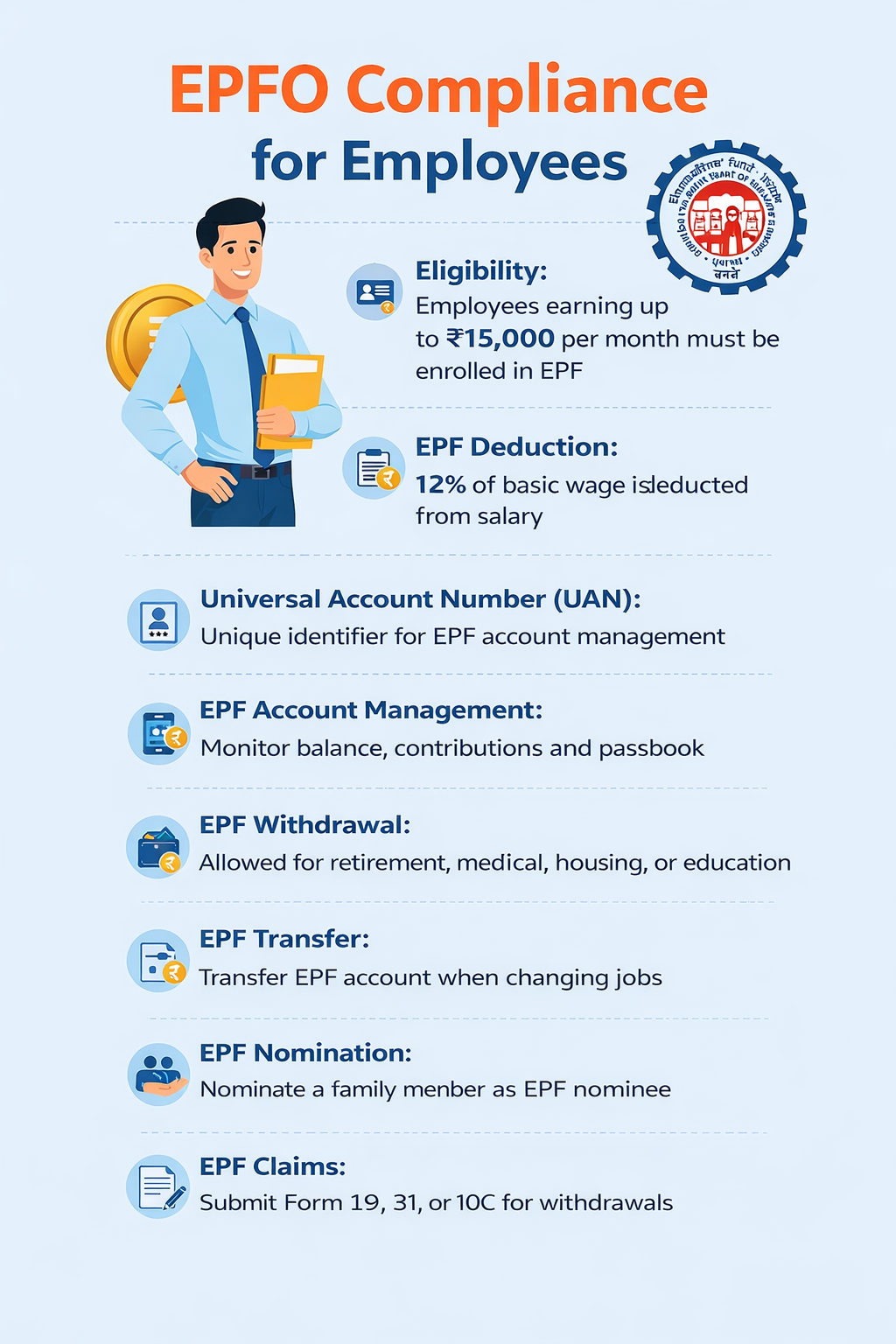

EPFO Compliance for Employees

Employee Eligibility and Enrollment

Employees earning up to ₹15,000 per month must be mandatorily enrolled. Employees earning above this limit can opt in with mutual consent.

EPF Deductions from Salary

EPF deductions appear clearly in salary slips and must be supported by contribution records.

EPF Withdrawal, Transfer, and Nomination Rules

Employees can:

- Transfer EPF when changing jobs

- Withdraw partially or fully under specified conditions

- Nominate beneficiaries through the UAN portal

Employers must facilitate these processes promptly.

Common EPFO Compliance Mistakes to Avoid

Late EPF Payments

Delayed payments attract interest and damages, even if the delay is unintentional.

Incorrect Wage Calculations

Misclassifying wages to reduce EPF liability can lead to inspections and penalties.

Non-Generation of UAN

Failure to generate or link UANs causes compliance gaps and employee grievances.

Errors in ECR Filing

Incorrect employee details, wage amounts, or contribution figures can result in notices from EPFO.

Penalties and Consequences of EPFO Non-Compliance

Interest on Delayed EPF Payments

Interest is charged at 12% per annum for delayed contributions.

EPF Penalties and Damages

Damages range from 5% to 25% of the arrears, depending on the delay duration.

Legal Consequences for Employers

Serious non-compliance can result in:

- Prosecution

- Imprisonment

- Attachment of bank accounts

- Business disruption

EPFO Compliance for Startups and Small Businesses

EPF Applicability for Startups

Startups must comply with EPFO once they reach the employee threshold, regardless of funding stage.

Exemptions and Relief Schemes

The government occasionally introduces schemes offering contribution relief or subsidies for eligible employers.

Cost-Saving Compliance Tips

- Use structured payroll systems

- Avoid artificial salary splits

- Maintain accurate records from day one

How to Ensure 100% EPFO Compliance

Internal Compliance Best Practices

- Assign a compliance owner

- Conduct monthly internal audits

- Maintain employee communication

Payroll Automation Tools

Automated payroll software reduces errors, ensures timely filings, and simplifies ECR generation.

Role of EPFO Consultants

Professional consultants help manage complex cases, inspections, and regulatory updates efficiently.

Frequently Asked Questions on EPFO Compliance

Is EPF mandatory for all employees?

EPF is mandatory for eligible employees earning up to ₹15,000 per month. Others may opt in voluntarily.

Can employers opt out of EPF?

No. Once applicable, employers cannot opt out of EPFO compliance.

What happens if EPF is not deducted?

Non-deduction is a violation of law and can lead to penalties, interest, and legal action.

How to check EPF compliance status?

Employers can track filings, payments, and notices through the EPFO employer portal.

Conclusion

EPFO compliance is not just a statutory requirement it is a long-term investment in employee welfare and organizational stability. Employers who stay compliant benefit from reduced legal risks, higher employee trust, and smoother business operations.

By understanding the rules, following a structured compliance process, and leveraging technology or professional support, businesses can ensure 100% EPFO compliance with confidence.