Startup Due Diligence Checklist: A Complete Guide for Founders and Investors

Startup due diligence is the structured process of investigating and verifying every critical aspect of a startup before making an investment, acquisition, or strategic partnership. It goes far beyond surface-level metrics and pitch decks, diving deep into financial health, legal standing, operational maturity, market potential, and team capability.

For investors, due diligence protects capital and reduces risk by uncovering weaknesses, inconsistencies, or deal-breaking issues early. For founders, it is equally important. A well-prepared startup builds credibility, accelerates fundraising timelines, and positions itself as a trustworthy, scalable business rather than a risky bet.

The due diligence process typically unfolds after initial investor interest but before final deal terms are signed. It involves document reviews, interviews, financial analysis, and technical assessments. While it can feel intense, due diligence is not an interrogation it is a validation exercise. Startups that understand this process and prepare proactively are far more likely to close deals successfully.

Financial Due Diligence

Financial due diligence is often the first and most heavily scrutinized area because it reveals how responsibly a startup has managed its resources and whether its growth story is financially realistic.

Key financial statements form the foundation of this review. Investors expect accurate income statements, balance sheets, and cash flow statements, typically covering the last two to three years or since inception. These documents should align with bank records and tax filings, as discrepancies quickly erode trust.

Burn rate and runway are central to evaluating a startup’s survival timeline. Burn rate reflects how quickly the company is spending cash, while runway shows how long it can operate before needing additional funding. A clear understanding of these metrics demonstrates financial discipline and strategic planning, especially when paired with assumptions about future revenue or cost changes.

A clean and transparent cap table is another critical element. It should clearly show ownership percentages, issued shares, option pools, convertible instruments, and any investor rights. Messy cap tables, undocumented side agreements, or unclear vesting schedules can delay or even derail funding rounds.

Common financial red flags include inconsistent revenue reporting, unexplained expenses, overly aggressive projections, and poor bookkeeping practices. While early-stage startups are not expected to be profitable, they are expected to be honest, organized, and realistic in their financial storytelling.

Legal Due Diligence

Legal due diligence ensures that the startup is properly formed, compliant, and protected against future disputes. It also verifies that investors are not inheriting hidden legal risks.

Essential legal documents include incorporation certificates, bylaws, shareholder agreements, board resolutions, and material contracts. These documents establish who controls the company, how decisions are made, and what obligations already exist.

Intellectual property is often a startup’s most valuable asset, making it a major focus during due diligence. Investors will examine whether the company truly owns its IP, including patents, trademarks, copyrights, and proprietary code. Founders must ensure that IP created by employees and contractors has been formally assigned to the company.

Regulatory compliance varies by industry but is especially important in sectors like fintech, healthtech, and edtech. Startups must demonstrate adherence to applicable laws, licenses, and data protection regulations. Non-compliance can result in fines, forced shutdowns, or reputational damage.

Pending or past legal issues are also reviewed closely. Lawsuits, threatened claims, or unresolved disputes should be disclosed transparently. Attempting to hide legal problems almost always causes more harm than addressing them upfront.

Operational Due Diligence

Operational due diligence evaluates how the startup functions on a day-to-day basis and whether its operations can support future growth.

The business model and revenue streams are analyzed to determine sustainability and scalability. Investors look for clarity around how the company makes money, pricing strategies, customer lifetime value, and dependency on any single client or partner.

Organizational structure and team dynamics reveal whether the startup has the leadership and internal alignment needed to execute its vision. Clear roles, decision-making authority, and accountability structures signal maturity, even in small teams.

Operational processes, including sales, customer support, and internal workflows, are reviewed to assess efficiency and scalability. Manual processes that work early on may become bottlenecks as the company grows, so investors often look for signs of systemization and automation.

Supply chain and vendor management are particularly important for startups that rely on manufacturing, logistics, or third-party platforms. Heavy reliance on a single vendor or fragile supply arrangements can increase operational risk.

Market and Competitive Analysis

Market due diligence validates whether the startup is solving a real problem in a large and growing market.

Total Addressable Market assessment helps investors understand the startup’s long-term potential. Founders must demonstrate not only that the market is big but that their target segment is reachable and willing to pay. Overinflated market size estimates without credible assumptions are a common concern.

The competitive landscape evaluation examines both direct and indirect competitors. Investors want to know how crowded the market is, what alternatives customers have, and how defensible the startup’s position truly is. Differentiation should be clear, measurable, and difficult to replicate.

Go-to-market strategy explains how the startup plans to acquire customers efficiently. This includes sales channels, partnerships, marketing tactics, and pricing strategies. A strong go-to-market plan shows that growth is intentional rather than accidental.

Customer acquisition and retention metrics provide evidence of traction. Metrics such as customer acquisition cost, churn rate, retention cohorts, and net revenue retention reveal whether customers find lasting value in the product.

Technical Due Diligence

Technical due diligence assesses whether the startup’s technology can support its business goals without excessive risk.

The technology stack overview gives insight into the tools, frameworks, and platforms powering the product. Investors look for modern, maintainable technologies rather than overly complex or outdated systems that may hinder future development.

The product development roadmap outlines upcoming features, technical milestones, and resource requirements. A realistic roadmap demonstrates strategic thinking and alignment between product vision and engineering capacity.

Data security and privacy measures are increasingly important as startups handle sensitive user data. Investors will assess how data is stored, protected, and accessed, as well as how the company responds to potential breaches.

Scalability and infrastructure readiness determine whether the product can handle growth in users, transactions, or data volume. Startups that have planned for scalability early are often more attractive investment opportunities.

Human Resources and Team Evaluation

People are often the deciding factor in early-stage investments, making team due diligence especially critical.

Founders’ background and experience provide context for execution capability. Investors look at domain expertise, past startup experience, and the ability to adapt and learn quickly rather than just impressive resumes.

Key team members and roles are reviewed to ensure the startup has the necessary skills across product, sales, operations, and finance. Skill gaps are not necessarily a problem if there is a clear plan to address them.

Hiring plans and talent retention strategies reveal whether the startup can attract and keep top talent in a competitive market. Compensation structures, equity incentives, and career growth opportunities all play a role here.

Company culture and values may seem intangible, but they strongly influence long-term success. Investors often assess how teams communicate, handle conflict, and stay aligned under pressure.

Preparing a Data Room

A data room is a centralized, secure repository where startups store documents for investor review during due diligence. It acts as the single source of truth throughout the fundraising process.

Documents to include typically span financials, legal agreements, product materials, customer metrics, and team information. Completeness and accuracy are far more important than volume.

Best practices for organization and access control include clear folder structures, consistent naming conventions, and role-based permissions. A well-organized data room signals professionalism and reduces back-and-forth with investors.

Make Smarter Investment Decisions Download Your Startup Due Diligence Checklist Today

Identify risks, validate opportunities, and invest with confidence using this comprehensive, investor-ready checklist.

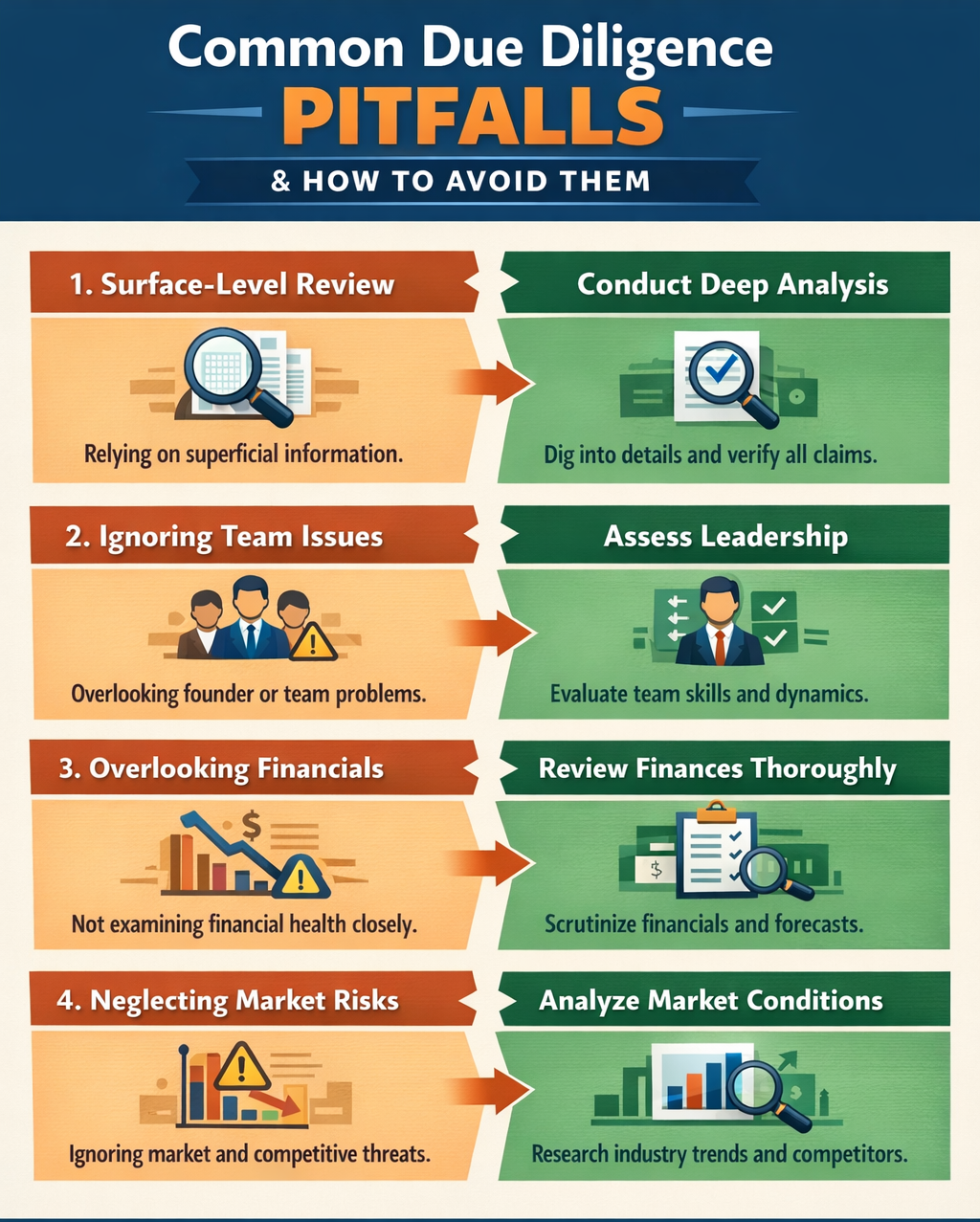

Common Due Diligence Pitfalls and How to Avoid Them

Incomplete or inaccurate information is one of the most common pitfalls. Missing documents or conflicting data slow down the process and raise concerns about management quality.

Lack of transparency damages trust quickly. Investors understand that no startup is perfect, but they expect honesty about challenges and risks.

Delayed responses to investor queries can signal disorganization or lack of urgency. Prompt, thoughtful communication keeps momentum alive during critical deal stages.

Ignoring red flags rather than addressing them proactively often leads to deal breakdowns. Founders who acknowledge issues and present mitigation plans are far more likely to retain investor confidence.

Conclusion

Startup due diligence is a comprehensive evaluation that touches every part of a business, from finances and legal structure to technology, market opportunity, and team strength. For investors, it provides clarity and risk reduction. For founders, it is an opportunity to showcase discipline, transparency, and readiness for growth.

Navigating due diligence successfully requires preparation, organization, and a willingness to engage openly. Startups that treat due diligence as a strategic process rather than a hurdle position themselves for stronger partnerships, better deal terms, and long-term success.

Frequently Asked Questions (FAQ)

1. How long does startup due diligence usually take?

The process typically takes between two to six weeks, depending on the stage of the startup, deal complexity, and how prepared the company is with documentation.

2. Do early-stage startups need full due diligence?

Yes, although the scope may be lighter. Even seed-stage startups are expected to provide basic financials, legal documents, and evidence of product and market validation.

3. What happens if issues are found during due diligence?

Issues do not automatically kill a deal. They may lead to revised valuations, additional terms, or requests for corrective actions before closing.

4. Can founders run due diligence on investors?

Absolutely. Founders should assess investors’ track records, portfolio support, reputation, and alignment with long-term goals.

5. What is the most common reason deals fall apart during due diligence?

Lack of transparency or discovery of undisclosed legal, financial, or ownership issues is a frequent deal-breaker.

6. How can startups prepare for due diligence in advance?

Maintaining clean financial records, updated legal documents, a clear cap table, and an organized data room significantly reduces friction.

7. Is due diligence only required for fundraising?

No. Due diligence is also critical for mergers, acquisitions, strategic partnerships, and even large customer contracts.