GST Number in India – 11 Critical Q&As Explained

On July 1, 2017, India implemented a new tax structure intending to transform the entire country into a single market. This article will help you comprehend GST/GST number and GST verification online if you are new to GST and want to know how this new tax will benefit you and your business.

What is GST & How does it Work?

GST stands for goods and services tax. It is an indirect tax that was imposed to take the place of several other indirect taxes, including value-added tax, service tax, purchase tax, excise duty, and others. GST is an Indian tax levied on the provision of specific goods and services. GST is the only tax that is legal throughout India.

What GST is all about?

The Goods and Services Tax was enacted in India on July 1st, 2017. But the process of putting in place the new tax system started a long time ago. First, a committee was formed in 2000 by Atal Bihari Vajpayee, who was India’s prime minister at the time, to develop the GST law. Then, a task force determined in 2004 that the new tax structure should be imposed in order to improve the current tax system.

The Finance Minister recommended the implementation of the GST on April 1, 2010, and the Constitution Amendment Bill was passed in 2011 to make this possible.

The Standing Committee began debating GST in 2012 and presented its report on GST one year later. Arun Jaitley, the country’s then-new Finance Minister, reintroduced the GST bill in 2014, and the Lok Sabha approved it in 2015. However, because the law did not pass the Rajya Sabha, its implementation was postponed.

In 2016, the GST was implemented, and both houses of Congress approved the revised model GST statute. In addition, the Indian President approved. Four additional GST Bills were passed by the Lok Sabha in 2017 and were subsequently approved by the Cabinet. Following the passage of four additional GST Bills by the Rajya Sabha, the new tax system went into effect on July 1st, 2017.

What are the Tax Laws Before GST?

Both state and federal governments charged many indirect taxes under the previous tax regime. The states mostly collected taxes in the form of VAT (VAT). Each state had its own set of rules and regulations. The central government levied taxes on interstate sales of products. CST (Central State Tax) was imposed on interstate sales of goods.

Tax Laws Before the Implementation of GST

- The Centre and the State used to collect tax separately. Depending on the state, the tax regimes were different.

- Even when an import tax was levied on one individual, the burden was placed on another. In the event of direct tax, the taxpayer is required to pay the tax.

- There were direct and indirect taxes in India before implementing the GST.

These indirect taxes were imposed concurrently, including the entertainment, octroi, and local tax. The following are the indirect taxes that were in effect before the implementation of the GST regime:

- Central Excise Duty

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Cess

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entertainment Tax

- Entry Tax

- Taxes on advertisements

- Taxes on lotteries, betting, and gambling

Taxes like CGST, IGST, and SGST have replaced all the above taxes.

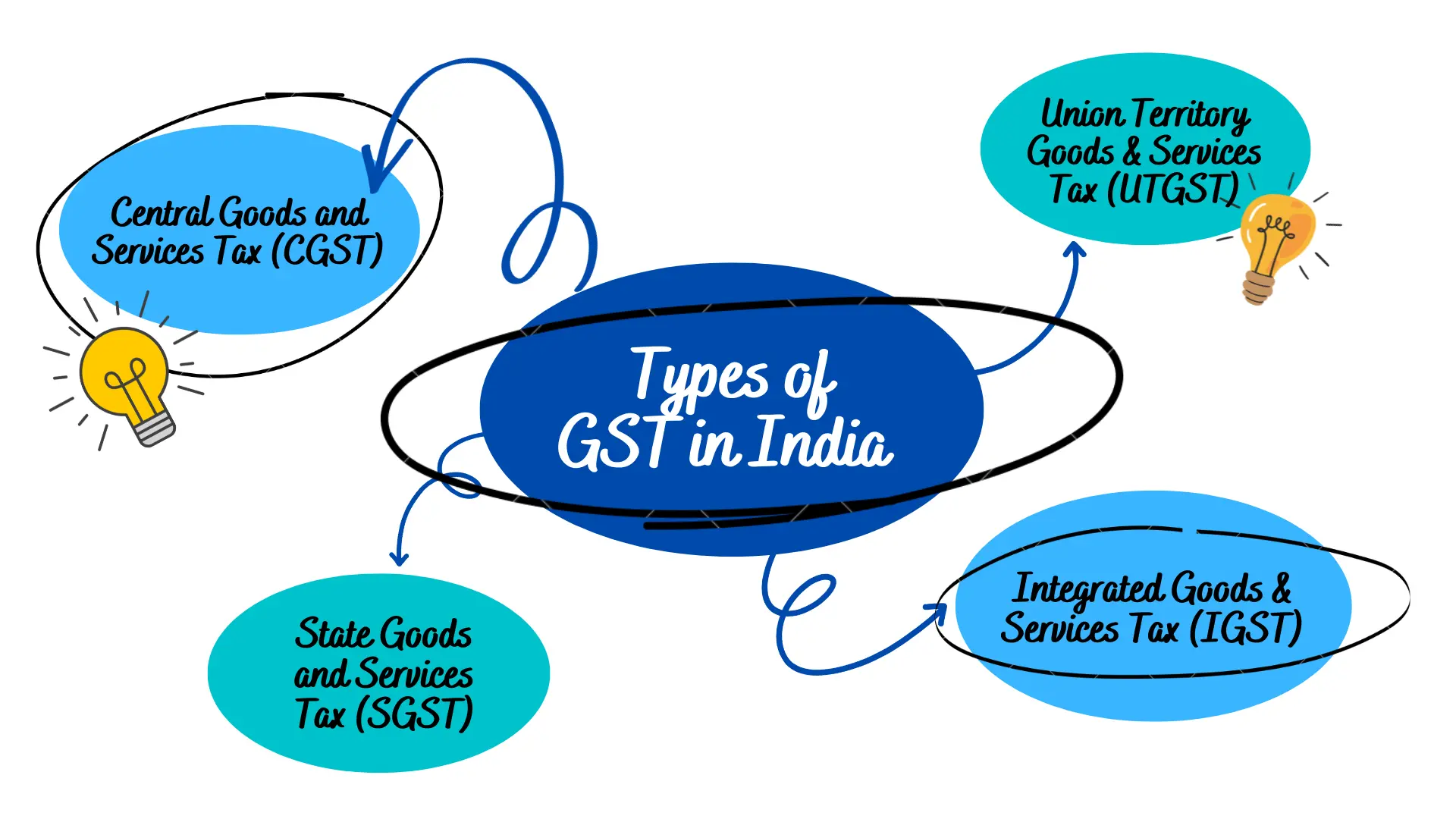

What are the types of GST in India?

The following are the four types of GST:

- Central Goods and Services Tax (CGST): This tax is levied on intrastate sales of goods and services.

- State Goods and Services Tax (SGST): Similar to CGST, SGST is levied on the sale of services and goods within a state.

- Integrated Goods & Services Tax (IGST): This tax levies on interstate goods and services sales.

- Union Territory Goods & Services Tax (UTGST): UTGST is a tax charged on the supply of goods and services in any of the country’s Union Territories, which include the Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh. UTGST is charged in addition to CGST.

What is GSTIN?

Every registered person under GST receives a 15-digit PAN-based GST identification number (GSTIN) or GST Number, which serves as their unique identifier. Before putting your GSTIN in your GST Returns, dealers who are registered for GST may want to double-check it.

The Goods and Service Tax Identification Number, which is shared by all taxpayers registered under for GSTverification, has been implemented, in accordance with the Goods and Services Tax (GST) regime.

This is in contrast to the former indirect tax regime, where several registration numbers were present for various laws, including excise, service tax, and value-added tax, because it was up to each legislation to decide whether or not its own registration method was applicable.

What is the GST Threshold?

At first, the GST Act mandated that businesses with a yearly revenue of more than 20 lakhs register as taxable companies. However, on April 1, 2019, this cap increased to Rs. 40 lakhs for suppliers of products. On the other hand, the service providers’ threshold amount is still 20 lakhs.

However, regardless of the threshold restriction, the following individuals and organizations are mandated to get a GSTIN in India:

- Businesses that operate across state borders and provide goods and services.

- Those who register for old taxes like VAT, excise, and service taxes.

- Input service providers.

- Online store aggregators.

- Supplier’s agents

- Businesses that offer someone or a company in India access to databases, online information, or retrieval services from outside India.

- Additionally, businesses that sell through an e-commerce aggregator.

- Other people and companies that the Central/State Governments have informed, as recommended by the GST Council.

What is the difference Between GSTIN and GSTN?

Do not get GSTIN and GSTN mixed up. GSTIN stands for Goods and Services Tax Identification Number. The Goods and Service Tax Network (or GSTN) is an organization that oversees the GST portal’s whole IT system.

The Government of India uses this portal to track every financial activity and give taxpayers all services, from registration to submitting taxes and preserving all tax records.

Why It’s necessary for GST Verification Online?

The GSTIN or GST number is open to the public. Therefore, GST verification by name is a critical job that every firm interacting with GST-registered taxpayers must complete to ensure the seller’s legitimacy and the GSTIN or GST number used in the invoice.

On the initial look, the GST verification of your GSTIN can partially be done by checking if the vendor’s PAN number matches the digits between 3 and 10 in the GSTIN.

To avoid creating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on tax credits to lawful customers, to name a few, it is also required to conduct a thorough examination of the GSTIN authenticity.

As a result, technology now allows you to validate GSTIN with the touch of a mouse from anywhere and at any time. Before entering into a commercial contract, look for the GST number. Then, use SignalX’s GST verification tool along with GSTIN verification to validate GSTIN or GST number quickly!

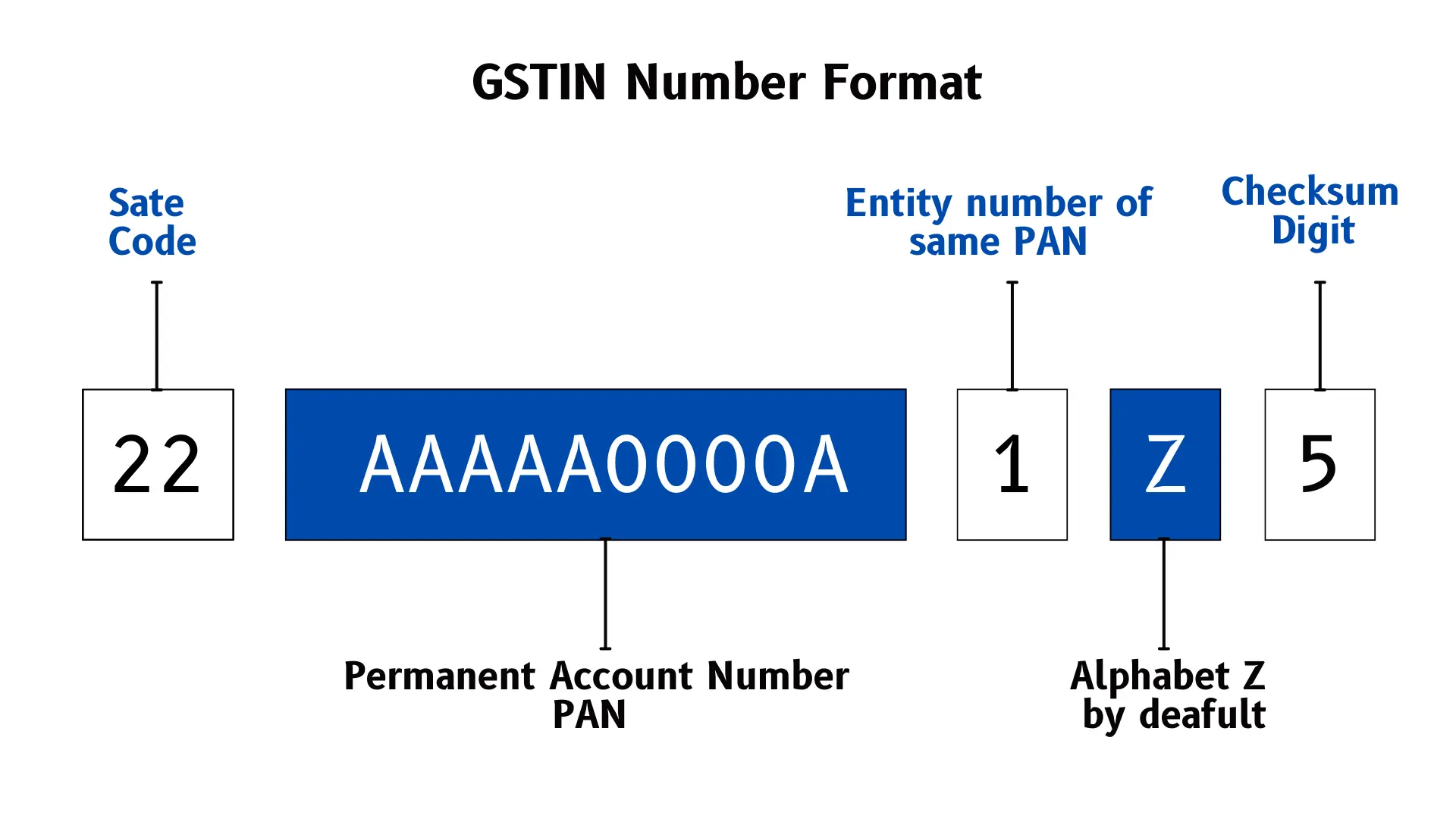

What is the GST Verification Number Format?

Check to see if the GSTIN is in the format shown below before performing the GST verification. If the GSTIN is not in the format shown below, it is not a legitimate GST number.

GSTIN structure comprises

- First two numbers → State code of the registered person

- Next ten characters → PAN of the registered person

- Next number→ Entity number of the same PAN

- Next character → Alphabet Z by default

- The Last number → Check code, which may be alpha or digit, used for detection of errors

What is GST Certificate?

A GST Certificate is an official document issued by the relevant authorities to a business that has registered for the GST system. Any business with an annual revenue of Rs.20 lakh or more and certain special companies must register under this system.

Form GST REG-06 is used to issue the GST registration certificate. You can obtain your GST Certificate via the GST Portal if you are a registered taxpayer under this system. The certificate is not physically issued. It is only available in digital form.

Items included in the GST Certificate are –

- GSTIN, Legal Name

- Trade Name

- Business Constitution

- Address

- Date of Liability

- Period of Validity

- Types of Registration

- Particulars of Approving Authority

- Signature

- Details of the Approving GST Officer

What are GST Returns?

A GST Return is a form that a taxpayer must submit to the government containing details about their income. The tax liability of the taxpayer is determined using this data. Registered dealers are required by the Goods and Services Tax to file their GST returns with information on their purchases, sales, input tax credit, and output GST. In addition, businesses must submit two monthly returns in addition to their annual return.

Frequently Asked Questions

When will a GSTIN be allocated?

The GST portal will assign the applicant a 15-digit GSTIN once the GST registration application has been processed correctly.

Is it required to include GSTIN on invoices?

Yes, it is required to include the GSTIN on every invoice submitted by a taxpayer. In addition, the GST-registered individual must also display their GST registration certificate at all of their company locations.

How can I obtain a GST Identification Number?

Using the GST portal, submit Form GST REG-01 together with the necessary supporting documentation to obtain a GSTIN. The applicant will be given a GSTIN followed by GST verification by an authority.

What are the uses of GSTIN?

One of the requirements for launching a business is having a GSTIN. In accordance with the GST rules, a registered person’s GSTIN must be visible at all locations where they conduct business. Additionally, it must be stated when creating e-way bills, raising invoices, filing GST returns, and submitting data to the tax authority.

Can I hold multiple GST or GSTINs numbers?

If a business operates in more than 1 state, the taxpayer may have separate GST registrations for each state. For example, if a textile company sells in both Telangana and Delhi, it must apply for separate GST registrations in both states. As a result, you may have numerous GST numbers. When you conduct a GST search, you will only get the details of that GSTIN.

Can we find the owner’s name by GST number?

You can enter the GST number or GSTIN into the search tool as input for GST verification. As a result, the owner’s name – Trade name and Legal name – will be revealed to you.

How do I find my GST number? / Where can I find my GST number online?

You may identify the GST number by performing GST verification and checking to see if it follows the format specified below-

- The first two characters are integers that represent the taxpayer’s state code, and the next ten characters are the PAN.

- Following that, the 13th letter is a digit denoting the entity number of the same PAN, followed by an alphabet Z character by default.

Finally, it concludes with a digit, a check code that can be alpha or numeric and is used to detect problems. To receive precise and immediate results, input your GST number into the SignalX GST number search tool.

Is it possible to find the GST number by name?

The GST number can be found by using the registered person’s trade or legal name. There are several tools available online that can help you to find a particular GST number by using the holder’s name.

Can we find the GST number using our PAN?

The GST number can be found by utilizing the PAN of the registered individual being sought.

How do I verify a GST number?

You can use the SignalX GST verification tool to see if a GST number is correct and valid (or if it has expired). Enter the GSTIN you have on hand to retrieve information about the taxpayer, customer, or supplier right now. After the GST verification, if the number is invalid, the GST verification tool will display it as such.

How to find the name from the GST number?

You can use the search function to enter the GST number or GSTIN. Following that, the taxpayer’s name, including trade and legal names, is displayed.

How can I obtain my company’s GST number?

Any GST number is public knowledge. This information, as well as the tax invoice or bill of supply, must be displayed at the taxpayer’s business premises (primary place of business).

Introducing the Free GST Check Tool from SignalX.

Visit our free GST verification page to get information about any businesses using their GSTIN number. All you have to do is:

Go to signalx.ai/gst-records-check/

Enter the GSTIN Number in the search box and click on “search”

Within seconds you will be able to fetch company information like –

- Name of the business

- Address of the Business

- Additional Place of Business

- State Jurisdiction

- Center Jurisdiction

- Date of registration

- Type of business

- HSN Codes associated

- GSTIN status – Active / Canceled

- Date of Cancellation (if applicable)

- Compliance Status

- Last 12-month Compliance Status

Book a Demo With SignalX For GST Checks

The GST verification tool from SignalX is a free tool that anyone can use to verify their GSTIN number. All the user has to do is enter the GST number they want to verify in the search box and click on the search button to get all information pertaining to the GST number.

With the SignalX GST verification tool, you are just one click away from verifying the authenticity of a GST number and company with no cost involved.