Pre-Deal Due Diligence on Investment Targets & Promoters

Trusted by leading Law Firms, Transaction Advisory & Investment Teams

SignalX powers Investment, Credit and Legal Teams with data like never before

Fast-track Deal Cycles

Access data from 200+ regulatory sources & thousands of third-party sources to generate powerful and unbiased pre-investment due diligence risk intelligence on targets and promoters. Fast-track deal cycles by identifying issues early-on that could derail transactions at a later stage.

0+

Due Diligence Teams Enabled

0+

Entities and Promoters Analyzed

India’s most comprehensive Digital Due Diligence platform

Bringing Powerful Due Diligence Capabilities to Investment Teams at Pre-Deal Stage.

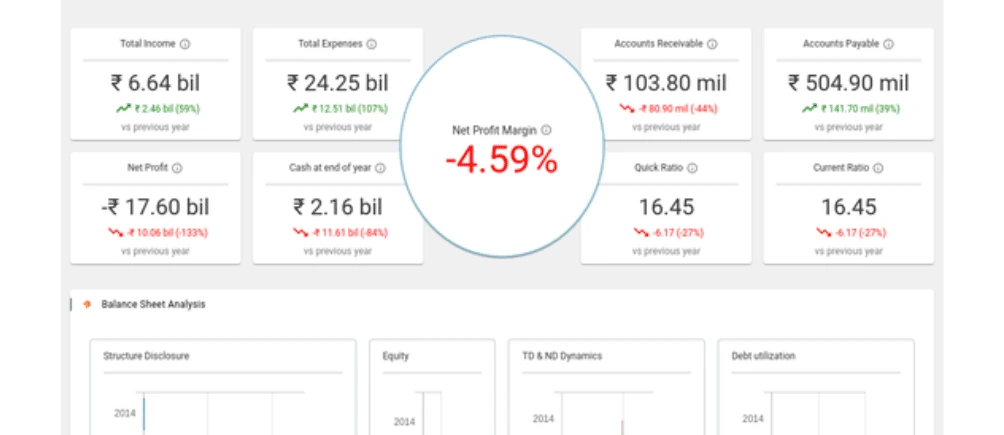

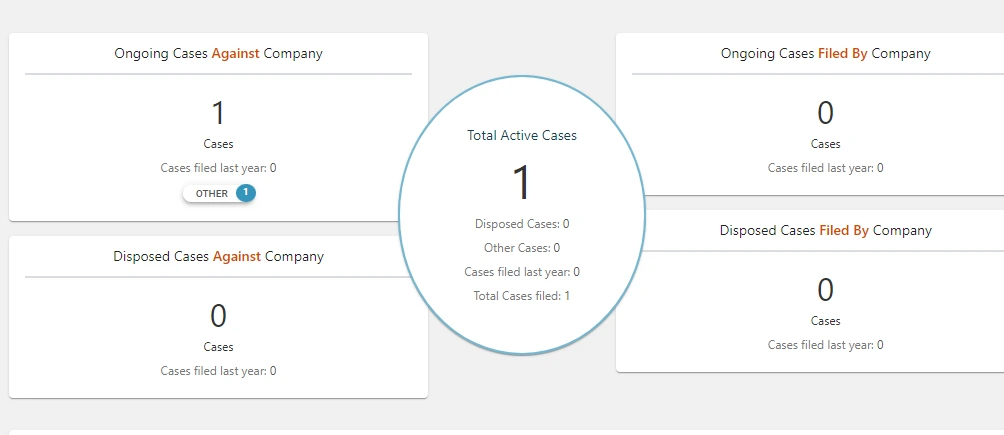

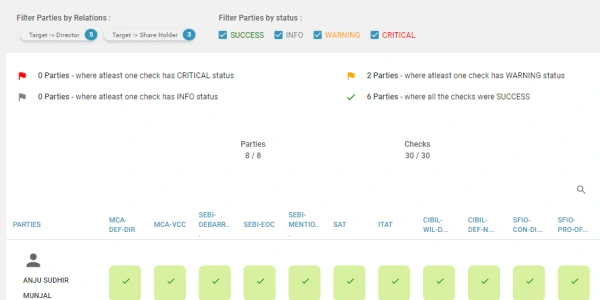

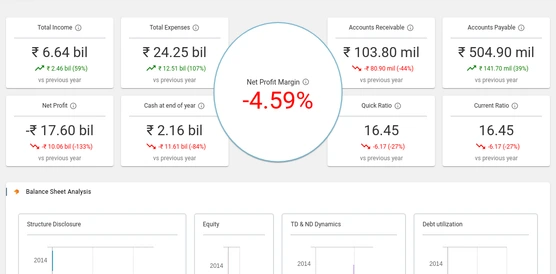

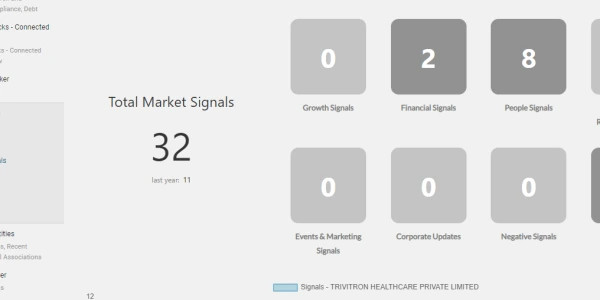

26 Parameter Risk Scorecard & Dashboard

SignalX’s proprietary 26 Parameter Risk Scorecard and Dashboard gives you a holistic picture of risk associated with the target. Visually identify red flags and share reports with your investment teams and counterparts for quicker decision making.

Fully Automated and Self Service

Conduct L1 pre-investment due diligence checks on targets and promoters like never before. Fully self-service and on-demand without having to engage lawyers and research teams at a pre-deal stage.

Comprehensive Checks

Data from 200+ regulatory sources and 1000s of third-party sources is used to run checks on given targets to help you generate unbiased intelligence on deals at a pre-investment due-diligence stage.

200+ Pre-Investment Due Diligence Checks Executed in 48 hours

Explore SignalX Pre-Deal Due Diligence Sample Reports

Built for Investment and Legal Teams

Mergers and acquisitions

Venture Capital

Angel Investors

Private Equity

Legal Teams

Investment Banking

Transaction Advisory

Strategy Teams

Corporate Development

Financial Institutions

Credit and Lending Teams

Pre-Investment due diligence is conducting due diligence checks using public information from regulators, courts, corporate registries and media on prospective intvement targets and promoters to help you identify red-flags early on and move deals faster. Pre-investment checks can include verifying financial claims, compliance defaults, identifying adverse litigations, registered IPs and more. SignalX enables investment teams conduct comprehensive pre-deal checks without having the need to contract a legal firm or expensive consultants at the pre-deal stage.

SignalX is the most comprehensive digital due diligence platform in India. SignalX Risk AI obtains its data from government agencies, regulators, publicly available media and a variety of other third-party datasets. We’re continually expanding our sources to enable us to generate new analyses such as fraud prediction, credit ratings, and compliance profiles. SignalX applies its proprietary machine learning algorithms to the collected data to reduce false positives and infer meaning. SignalX does not analyze any data points that have not been made public by the target company or other parties, either through media or in their regulatory filings.

Yes! Our analysts will assist you in customizing the reports to meet your organization’s reporting standards. You can also use the platform’s standard reporting format.

You can use SignalX’s Pre-deal Due Diligence solution on a pay-as-you-go model, only paying for the reports you consume. You can also avail subscription plans that are tailored to suit your specific needs. We transact with global clients and accept digital payments via credit/debit card.

Yes, SignalX uses information directly pulled from regulators and third-party sources to conduct L1 due diligence checks on investment targets. We do not interact with the target at all.

Yes! Monitoring services are included in the custom package. You will be notified when a specific signal is detected on your counterparties via email. You can request our analyst to set up custom signal alerts based on your specific requirements.

There are various signals of risk such as non compliance, integrity risks, reputational issues, issues in promoter background and more can be identified through pre-investment due diligence.

Following are a few red-flags that our users have identified using SignalX prior to their investments which has saved them valuable time and fast-track deals.

- Third partner / cofounder of the business who was never disclosed in the early stages

- Adverse litigation (NCLT, lower courts) disposed of in the past, not disclosed during deal stage

- Drastic change in headcount based on numbers from labor department, not aligned with provisional growth numbers being projected

- Claim of existing patent, however there was no records of the same

- Founding promoters have moved out of the firm, change in ownership occurred, but not disclosed

- Severe mismanagement of GST and EPF payments resulting in significant operational pressures, undisclosed during deal stage

- Loans taken from financial institutions, undisclosed in the early stages.

- Significant burn incurred in early years through loans from promoters in the balance sheet, undisclosed in the early deal stages