How Litigation Data Strengthens Supplier Risk Evaluation and Compliance Programs

In today’s complex and interconnected supply chains, supplier risk is no longer limited to price, quality, or delivery timelines. Regulatory scrutiny is intensifying, reputational exposure spreads faster than ever, and financial contagion can move through vendor networks with alarming speed. As a result, leading procurement and compliance teams are rethinking how they evaluate third-party risk especially during supplier onboarding and ongoing monitoring.

One of the most underutilized yet powerful sources of insight in supplier due diligence is litigation data, often referred to as court-record data. When used correctly, litigation data offers a real-world view into how a potential or existing supplier conducts business, manages financial stress, responds to regulatory oversight, and resolves disputes. Unlike self-declared information or static documents, court records reflect actual behaviour under pressure.

Top-performing organizations now consider litigation screening a foundational element of their Third-Party Risk Management (TPRM) programs. This applies not only to large vendors but also to small businesses, proprietorships, and privately held companies that often operate with limited public disclosure.

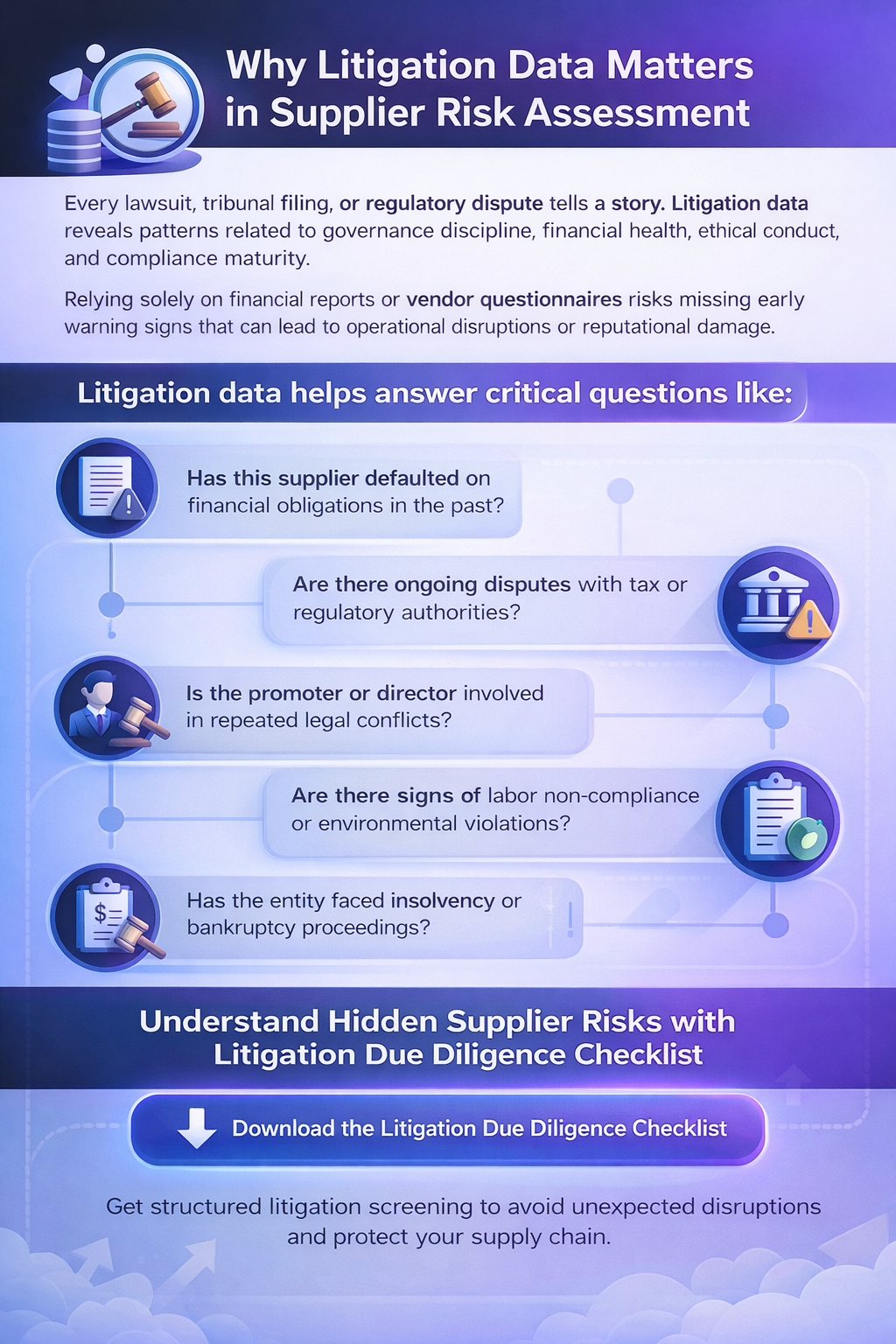

Why Litigation Data Matters in Supplier Risk Assessment

Every lawsuit, tribunal filing, or regulatory dispute tells a story. It reveals patterns related to governance discipline, financial health, ethical conduct, and compliance maturity. When procurement teams rely solely on financial statements or vendor questionnaires, they risk missing early warning signs that later translate into operational disruptions or reputational damage.

- Litigation data helps organizations answer critical questions such as:

- Has this supplier defaulted on financial obligations in the past?

- Are there ongoing disputes with tax or regulatory authorities?

- Is the promoter or director involved in repeated legal conflicts?

- Are there signs of labor non-compliance or environmental violations?

- Has the entity faced insolvency or bankruptcy proceedings?

In many real-world cases, supply chains have been disrupted because suppliers were unknowingly embroiled in economic offenses, insolvency proceedings, or criminal litigations. These risks often remain invisible without structured litigation screening.

The Complexity of Court Record Screening in India

India presents a unique challenge when it comes to accessing and analyzing litigation data. With more than 7,000 courts and tribunals across district courts, High Courts, consumer forums, labor courts, NCLT benches, and specialized tribunals, litigation information is deeply fragmented.

Manual court record checks are not only time-consuming but also impractical at scale. Searching by variations of company names, promoter names, or historical aliases introduces human error and inconsistency. Even when data is found, interpreting its relevance and severity requires legal and risk expertise that most procurement teams do not have in-house.

This complexity is the primary reason litigation data has historically been underused in supplier risk programs despite its immense value.

Automating Litigation Intelligence for Smarter Risk Decisions

Modern automation platforms such as SignalX have transformed how organizations consume litigation data. By aggregating court records from thousands of judicial sources and applying intelligent filtering, these platforms make it possible to identify high-risk litigations quickly and consistently.

Automation allows procurement and compliance teams to move beyond raw data and focus on actionable insights. Instead of reviewing hundreds of irrelevant cases, teams can surface litigations that materially impact supplier risk, assign risk weightages, and benchmark suppliers using litigation-driven scorecards.

More importantly, automation enables continuous monitoring. Supplier risk does not end at onboarding. New disputes, defaults, or regulatory actions can emerge months or years later, and without ongoing surveillance, organizations remain exposed.

Key Risk Signals Hidden Within Litigation Data

Litigation data covers a wide spectrum of legal and regulatory risks. When analyzed systematically, it provides early indicators of financial instability, governance weaknesses, and compliance failures.

One of the most common financial risk indicators is cheque bounce litigation. Repeated cases under negotiable instruments laws often signal liquidity stress or cash flow mismanagement. While a single instance may not be alarming, patterns across time or multiple counterparties raise serious concerns.

Disputes with tax authorities are another critical signal. Litigations involving GST authorities for tax evasion or defaults can indicate weak internal controls or deliberate non-compliance. Similarly, disputes with Income Tax departments often reflect aggressive tax positions that may expose downstream partners to scrutiny.

Customs-related disputes point toward risks in import-export compliance, valuation practices, or duty evasion. For organizations dependent on cross-border supply chains, these cases are especially relevant.

Debt recovery applications filed by banks or financial institutions reveal stress in credit obligations. Such cases often precede insolvency proceedings and can directly affect a supplier’s ability to fulfill contracts.

Insolvency and bankruptcy applications filed under the Insolvency and Bankruptcy Code are among the strongest red flags. Whether initiated by operational creditors or financial lenders, these proceedings signal systemic financial distress. Even if a case is resolved, its presence should significantly influence onboarding decisions and contract structuring.

Liquidation orders, whether against the company or other ventures linked to the promoter, provide insights into broader business conduct and financial discipline. Promoter-level analysis is essential, particularly in privately held entities where personal and corporate finances are closely intertwined.

Criminal litigations involving fraud, cheating, misrepresentation, or financial crimes represent severe risk signals. These cases carry reputational, legal, and ethical implications that extend far beyond commercial considerations.

Labor-related litigations shed light on workforce management practices. Repeated disputes involving unpaid wages, wrongful termination, or statutory non-compliance may indicate deeper operational and ethical issues that could disrupt supply continuity.

Civil disputes, including contract enforcement cases, customer disagreements, or property disputes, help assess how a supplier manages commercial relationships and conflict resolution.

Litigation Data as a Continuous Monitoring Tool

Supplier risk is dynamic, not static. A vendor that appeared stable during onboarding can deteriorate rapidly due to economic downturns, regulatory actions, or internal disputes among promoters. This is why leading organizations treat litigation monitoring as an ongoing activity rather than a one-time check.

New litigations such as promoter disputes, economic defaults, or creditor actions often surface long before financial statements reflect trouble. Early visibility into these developments allows procurement teams to plan contingencies, diversify suppliers, renegotiate terms, or activate exit strategies.

Continuous litigation monitoring also supports regulatory compliance, particularly in sectors subject to strict third-party oversight. Demonstrating that suppliers are actively screened and monitored strengthens audit readiness and governance maturity.

Building a Robust Third-Party Risk Management Program

A well-designed TPRM program integrates litigation intelligence into a broader risk-based framework. Effective programs do not apply the same level of due diligence to every supplier. Instead, suppliers are segmented based on criticality, spend, geographic exposure, and regulatory impact.

High-risk or strategic suppliers are subjected to deeper scrutiny, including detailed litigation analysis at both entity and promoter levels. Medium-risk suppliers may undergo periodic checks, while low-risk vendors receive baseline screening.

Risk-based due diligence ensures efficient allocation of resources while maintaining strong risk coverage. Litigation data plays a vital role in defining risk thresholds, escalation triggers, and approval workflows.

Importantly, litigation intelligence should not be viewed in isolation. It complements financial data, sanctions screening, adverse media, and ESG indicators to create a holistic supplier risk profile.

Turning Litigation Data into Actionable Risk Scores

One of the biggest challenges procurement teams face is translating legal information into business decisions. Raw court data is not inherently useful unless it is contextualized and quantified.

Advanced platforms like SignalX enable organizations to assign risk scores based on litigation severity, frequency, recency, and category. This allows teams to benchmark suppliers objectively and make consistent onboarding decisions.

Risk scorecards also support stakeholder communication. When procurement, legal, compliance, and leadership teams review the same standardized risk metrics, alignment improves and decision-making accelerates.

Strengthening Supply Chain Resilience Through Litigation Intelligence

Recent global disruptions have highlighted how fragile supply chains can be. Financial distress, regulatory crackdowns, and governance failures at the supplier level can ripple across entire industries.

Organizations that proactively monitor litigation data are better positioned to anticipate disruptions rather than react to crises. This proactive posture protects not only financial performance but also brand reputation and regulatory standing.

In an environment where regulators increasingly expect demonstrable third-party oversight, litigation-driven due diligence is no longer optional. It is fast becoming a benchmark of mature procurement and compliance functions.

Download the Supply Chain Due Diligence Checklist – SignalX

Why Enterprises Choose SignalX

Over 200 enterprises trust SignalX to streamline their supplier risk assessment processes. By automating access to litigation data across thousands of courts and tribunals, SignalX eliminates manual complexity and delivers high-quality risk insights at scale.

SignalX enables organizations to identify high-risk litigations, monitor changes in supplier risk profiles, and integrate litigation intelligence into their existing TPRM workflows. The result is faster onboarding, stronger compliance, and more resilient supply chains.

Final Thoughts

Litigation data offers one of the most realistic and unbiased views of supplier risk available today. When embedded into a structured, risk-based due diligence framework, it empowers procurement and compliance teams to make informed, defensible decisions.

As supply chains grow more interconnected and regulatory expectations rise, organizations that leverage litigation intelligence will have a clear advantage. They will onboard better partners, detect risks earlier, and build supply chains designed to withstand uncertainty.

If you are looking to elevate your supplier risk assessment program and move beyond surface-level due diligence, now is the time to integrate litigation data into your process.