Check Annual Filing Status on the MCA Portal (Step-by-Step Guide for Companies & LLPs)

Annual compliance is one of the most critical responsibilities for companies and Limited Liability Partnerships (LLPs) operating in India. Every registered entity is required to submit specific financial and statutory documents each year to maintain its legal standing. While many businesses focus on filing forms before deadlines, they often overlook an equally important task verifying whether those filings are properly recorded and reflected in government records.

The Ministry of Corporate Affairs (MCA) is the regulatory authority responsible for administering corporate laws in India. Through its online portal, it maintains a centralized database of company and LLP records. This database is publicly accessible and allows stakeholders to review filing history, company status, and compliance records.

In this detailed guide, we will explore what annual filing means, how to check annual filing status on the MCA portal, what different compliance indicators signify, common issues users face, and how tools like SignalX can simplify compliance monitoring for businesses and professionals.

What Is Annual Filing Under MCA?

Annual filing refers to the mandatory submission of financial statements and annual returns by companies and LLPs to the MCA at the end of every financial year. These filings ensure transparency, accountability, and regulatory oversight.

For companies registered under the Companies Act, 2013, annual filing primarily involves submitting Form AOC-4, which contains the financial statements, and Form MGT-7 or MGT-7A, which contains the annual return. These documents disclose essential information such as the company’s financial performance, shareholding pattern, directors’ details, and registered office address. The due dates for these forms are generally linked to the date of the Annual General Meeting (AGM), and delays can attract additional fees.

For LLPs, annual compliance includes filing Form 8, which is the Statement of Account and Solvency, and Form 11, which is the Annual Return. These forms disclose financial health and partner information.

Non-compliance with annual filing requirements can result in significant consequences. The MCA imposes additional fees for each day of delay. In cases of prolonged default, directors may face disqualification, and the company itself may be at risk of being struck off from the register. Therefore, checking filing status is not just administrative it is a risk management necessity.

Stay Compliant. Avoid Penalties.

Regularly check your annual filing status to ensure your company or LLP remains legally secure and financially credible.

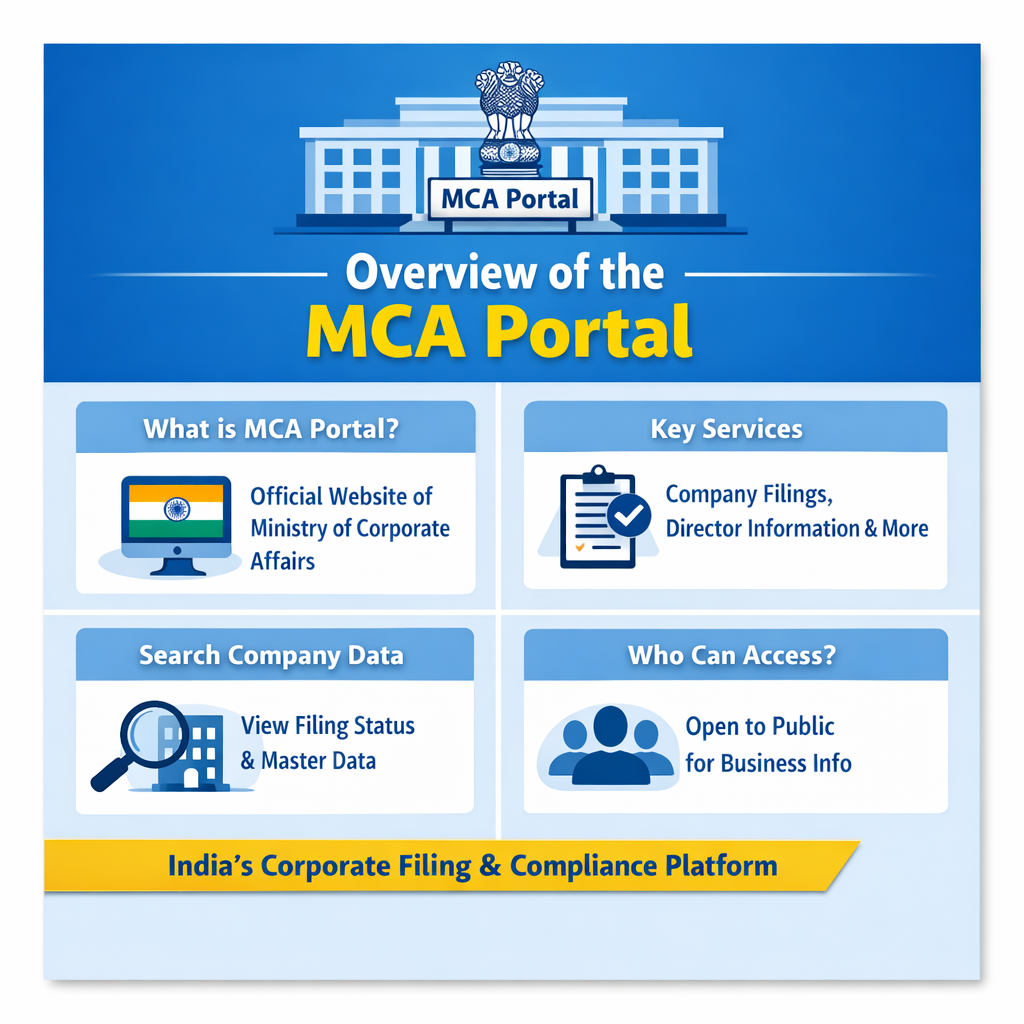

Overview of the MCA Portal

The official portal of the Ministry of Corporate Affairs serves as the digital backbone of corporate compliance in India. It enables companies and LLPs to complete statutory filings online and provides public access to corporate records.

One of the most valuable features of the MCA portal is the “Master Data” section. This section allows users to search for a company or LLP using its Corporate Identification Number (CIN), LLP Identification Number (LLPIN), or name. Once accessed, the master data page displays key information such as company status, date of incorporation, registered office address, directors’ details, and filing history.

This transparency promotes trust in the corporate ecosystem. Investors, vendors, lenders, and regulators can independently verify whether an entity is compliant with annual filing requirements.

Why Checking Annual Filing Status Is Important

Many businesses assume that once a form is uploaded, compliance is complete. However, filings may sometimes be rejected, marked for resubmission, or remain under processing. If these issues are not tracked, they can turn into compliance defaults.

Regularly checking annual filing status helps avoid unexpected additional fees. The MCA imposes per-day penalties for late filings, and these amounts can accumulate quickly. Early detection of pending filings allows companies to act before penalties escalate.

Another major risk is director disqualification. If a company fails to file annual returns for consecutive financial years, its directors may be disqualified from holding positions in other companies. This can severely impact professional credibility.

Beyond internal compliance, checking filing status is also a key due diligence step. Businesses often review the compliance records of vendors, partners, or investment targets before entering into agreements. A history of non-filing may indicate poor governance practices or financial instability.

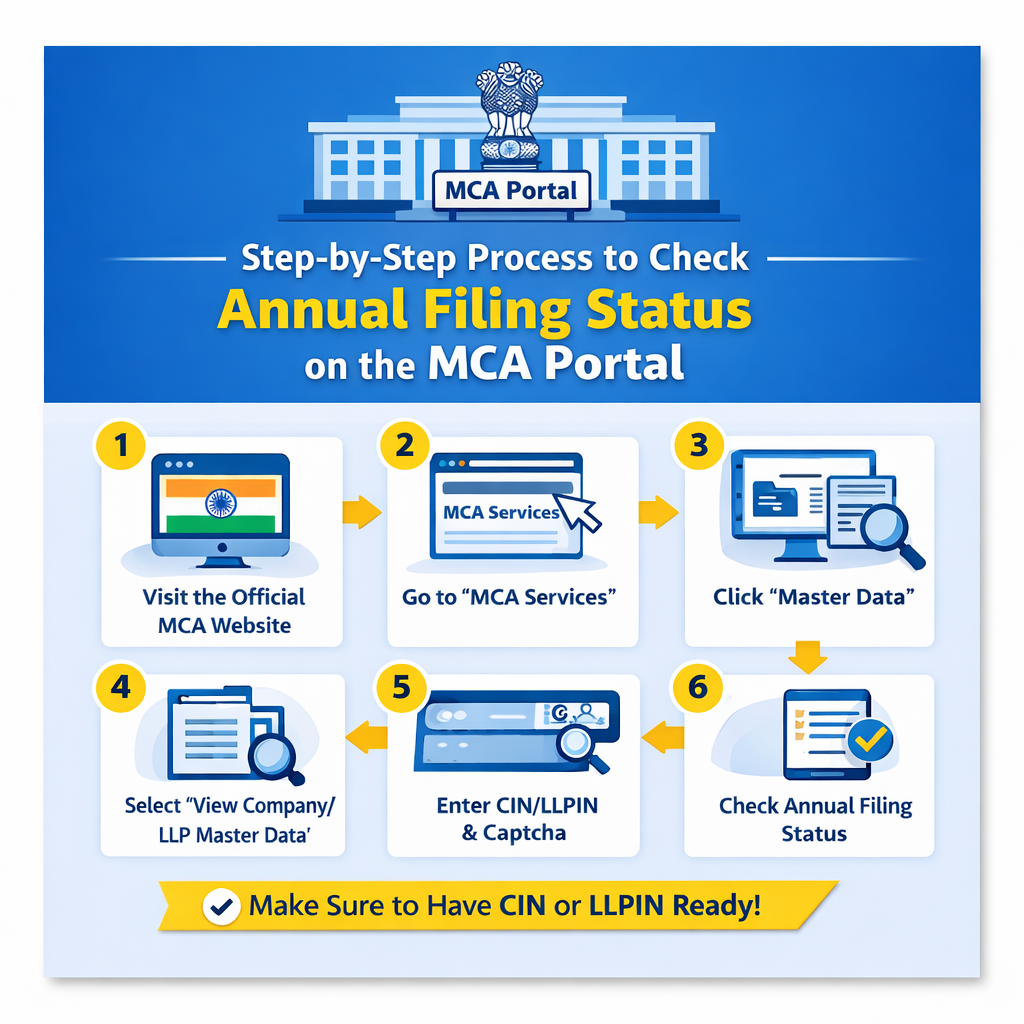

Step-by-Step Process to Check Annual Filing Status on the MCA Portal

Checking annual filing status on the MCA portal is a straightforward process, though it requires careful navigation.

First, visit the official website of the Ministry of Corporate Affairs. On the homepage, locate the “MCA Services” tab. Under this section, you will find an option called “Master Data.”

After clicking on “Master Data,” select the option to view company or LLP master data. You will then be prompted to enter the Corporate Identification Number (CIN) for a company or the LLP Identification Number (LLPIN) for an LLP. After entering the required details and completing the captcha verification, submit the request.

The portal will display the master data page of the selected entity. Scroll down to review the filing history section. Here, you can see financial year-wise records of forms filed, including AOC-4, MGT-7, Form 8, or Form 11, depending on the entity type.

Each filed form is associated with a Service Request Number (SRN). The SRN helps track the processing status of the filing. If a form is missing for a particular financial year, it may indicate non-filing or delayed filing. In some cases, recently submitted forms may appear as “Under Process” until approval is completed.

Users also have the option to download certain public documents for a prescribed fee. This is particularly useful for conducting deeper due diligence.

Checking Filing Status for a Private Limited Company

When reviewing a Private Limited Company, particular attention should be given to financial statements and annual returns. The presence of Form AOC-4 and Form MGT-7 (or MGT-7A for small companies) for the latest financial year is essential.

In addition to reviewing filed forms, observe the company’s status. If it is marked “Active,” it indicates that the company is currently operational and compliant in basic terms. However, if the status shows “Inactive,” “Strike Off,” or similar remarks, further investigation is necessary.

Repeated delays in filing may also result in additional fees, which can reflect patterns of compliance weakness. Such trends are important for stakeholders assessing long-term reliability.

Checking Filing Status for an LLP

For LLPs, compliance verification focuses primarily on Form 8 and Form 11. These forms must be filed annually, even if the LLP has minimal operations.

While the process of checking LLP filing status is similar to that of companies, users must ensure they are entering the correct LLPIN. A common mistake is confusing CIN with LLPIN, which results in search errors.

LLPs do not have share capital in the same way companies do, so their filings emphasize solvency declarations and partner information. Ensuring that both Form 8 and Form 11 are filed for each financial year is critical to confirming compliance.

Understanding Filing Status Indicators

The master data page provides several indicators that help interpret compliance status. The company status field shows whether the entity is active, dormant, under liquidation, or struck off. This gives a quick snapshot of its legal standing.

The financial year-wise filing section shows whether annual forms were submitted on time. Missing entries can signal non-compliance. If forms were filed late, additional fees may have been levied.

In some cases, the system may indicate a defaulting status. This is a warning sign and should be addressed immediately.

Understanding these details helps users move beyond surface-level verification and conduct a meaningful compliance assessment.

Common Issues While Checking Filing Status

Users may occasionally face technical challenges while using the MCA portal. Incorrect CIN or LLPIN entries are among the most common issues. Even minor typographical errors can prevent search results from appearing.

At times, the website may experience downtime due to maintenance or heavy traffic. In such cases, retrying after some time usually resolves the issue.

Another common concern is when a recently filed form does not immediately reflect in the master data. This may occur if the filing is still under processing. If the delay persists, consulting a company secretary or contacting MCA support may be necessary.

How SignalX Enhances Filing Status Monitoring

While the MCA portal is reliable for individual searches, it requires manual effort for each entity. For organizations that need to monitor multiple companies or LLPs, this process can become time-consuming.

SignalX addresses this challenge by aggregating MCA data and presenting it in a structured, searchable format. Instead of conducting repeated manual searches, users can monitor multiple entities from a single dashboard.

The platform provides automated alerts for compliance changes, highlights risk flags for non-compliant companies, and supports bulk tracking. This makes it particularly useful for vendor due diligence, compliance risk assessments, corporate investigations, and investment screening.

By combining official data with intelligent monitoring tools, businesses can transition from reactive compliance checks to proactive risk management

Monitor Compliance Smarter

Track multiple companies, receive real-time alerts, and identify compliance risks instantly with automated monitoring.

What to Do If Annual Filing Is Pending

If you discover that annual filing is pending, immediate action is essential. Identify the missing financial year and prepare the required financial statements or returns. Submit the appropriate form through the MCA portal and pay the applicable additional fees.

Delays increase financial penalties and may escalate legal consequences. Seeking professional assistance from a Chartered Accountant or Company Secretary can ensure accurate and timely filing.

FAQs

1. Is MCA filing status public?

Yes. Basic filing status is publicly available on the website of the Ministry of Corporate Affairs.

2. Can anyone check company compliance?

Yes. Anyone can check a company’s filing history using its CIN or LLPIN on the MCA Portal.

3. Is there a fee to check filing status?

No. Basic filing status is free. However, downloading detailed documents requires a government fee.

4. How often should businesses monitor compliance?

At least quarterly and before major business transactions to avoid compliance risks.

5. Can SignalX monitor multiple companies at once?

Yes. SignalX allows bulk company monitoring with automated alerts and compliance tracking.

Conclusion

Checking annual filing status is a fundamental aspect of corporate governance in India. Whether you are managing your own company, evaluating a vendor, or screening an investment opportunity, verifying compliance records protects you from avoidable risks.

The Ministry of Corporate Affairs portal provides a transparent and accessible platform for manual verification. However, as compliance ecosystems grow more complex, automated monitoring solutions like SignalX offer significant advantages for businesses handling multiple entities.

Proactive compliance tracking strengthens credibility, reduces financial exposure, and ensures that companies and LLPs remain in good legal standing. Regular monitoring is not merely a best practice it is a strategic necessity.