Difference Between CDD and VDD in Due Diligence

In the world of mergers, acquisitions, and private investments, confidence is currency. Before capital changes hands or ownership shifts, stakeholders must understand exactly what they are buying or selling. This is where due diligence becomes indispensable. At its core, due diligence is a structured investigation designed to validate assumptions, uncover risks, and confirm value. It transforms uncertainty into informed decision-making.

Two critical forms of diligence dominate high-stakes transactions: Vendor Due Diligence (VDD) and Commercial Due Diligence (CDD). While both serve the broader purpose of reducing risk and strengthening deal outcomes, they approach the process from different vantage points. Vendor Due Diligence is typically initiated by the seller to prepare the business for market scrutiny. Commercial Due Diligence, on the other hand, is led by buyers seeking to validate growth potential and long-term viability.

In increasingly competitive markets, instinct is no longer enough. Structured intelligence, robust analysis, and data-backed insight have become non-negotiable components of successful deal-making. Organizations that invest in thorough diligence position themselves not only to close transactions faster, but also to protect enterprise value long after the deal is complete.

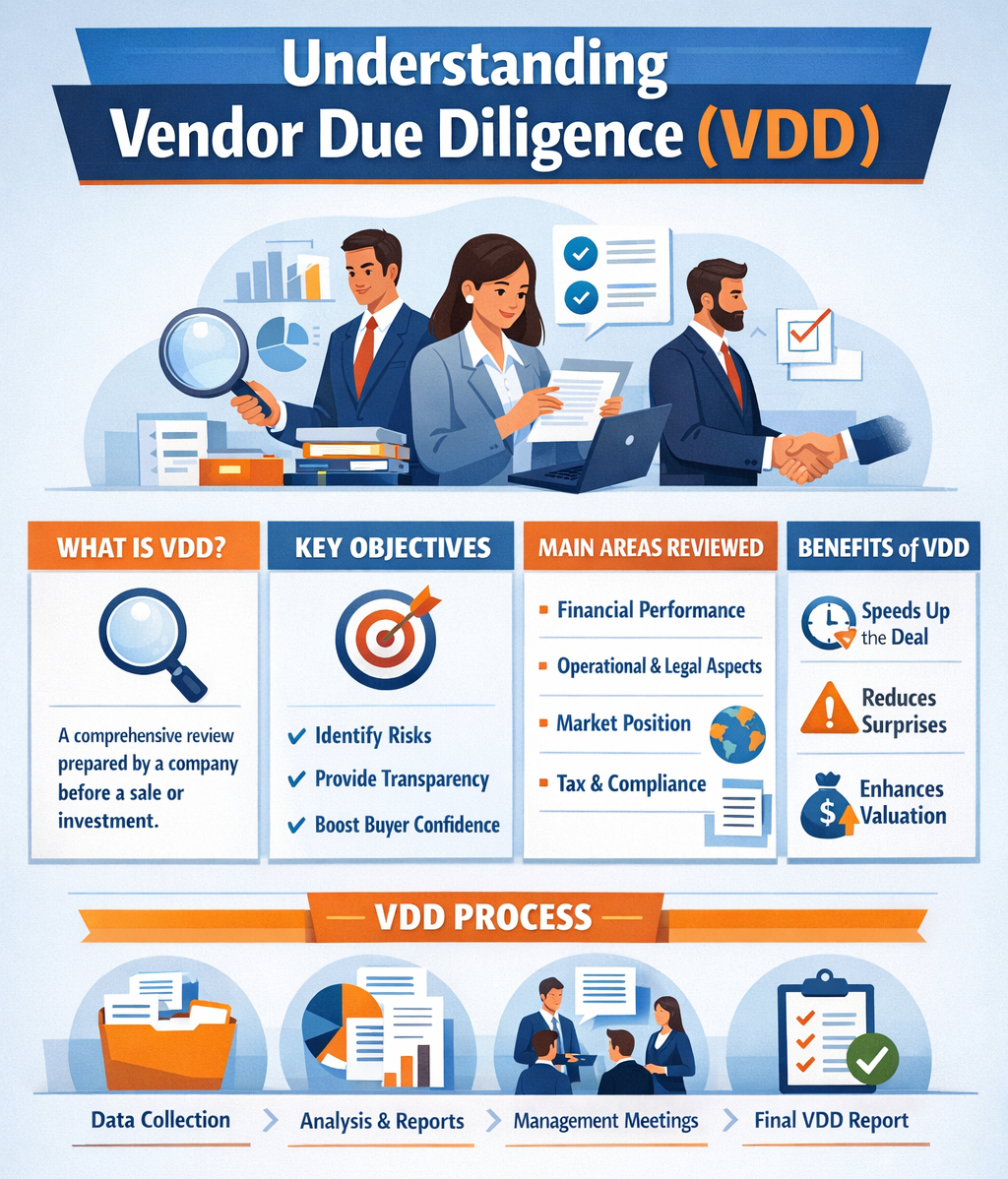

Understanding Vendor Due Diligence (VDD)

Vendor Due Diligence is a proactive review conducted by or on behalf of a seller before entering negotiations with potential buyers. Rather than waiting for acquirers to uncover weaknesses, sellers commission an independent assessment of their financial, legal, operational, and strategic standing. The goal is simple: identify risks early, strengthen transparency, and control the narrative of the transaction.

The core objective of VDD is preparation. Sellers aim to present a clear, credible, and thoroughly vetted view of their organization. By doing so, they reduce surprises during buyer review, streamline negotiations, and minimize the likelihood of price adjustments late in the deal process.

A comprehensive VDD typically examines multiple dimensions of the business. Financial review validates revenue quality, profitability drivers, working capital stability, and historical performance trends. Legal checks assess contractual obligations, compliance exposure, intellectual property protections, and regulatory standing. Operational assessments explore supply chain efficiency, technology infrastructure, and scalability. Risk exposure analysis identifies contingent liabilities, reputational vulnerabilities, and operational dependencies that could affect valuation.

For sellers, the advantages are substantial. First, VDD accelerates deal cycles by reducing back-and-forth information requests. Buyers receive organized, independently validated data, which builds trust from the outset. Second, it strengthens credibility. When a seller transparently addresses potential concerns, it signals confidence and maturity. Third, VDD reduces negotiation friction. Issues uncovered in advance can be contextualized or resolved, preventing last-minute price renegotiations.

However, Vendor Due Diligence is not without pitfalls. One common mistake is treating it as a checkbox exercise rather than a strategic tool. Superficial analysis may fail to uncover deeper structural risks. Another risk lies in incomplete disclosure; if buyers later discover omitted issues, trust erodes quickly. To avoid these challenges, VDD must be thorough, objective, and supported by credible advisors or technology platforms capable of comprehensive risk assessment.

Ultimately, effective Vendor Due Diligence shifts the seller’s role from reactive to proactive. It empowers businesses to enter negotiations with clarity, preparedness, and a stronger negotiating position.

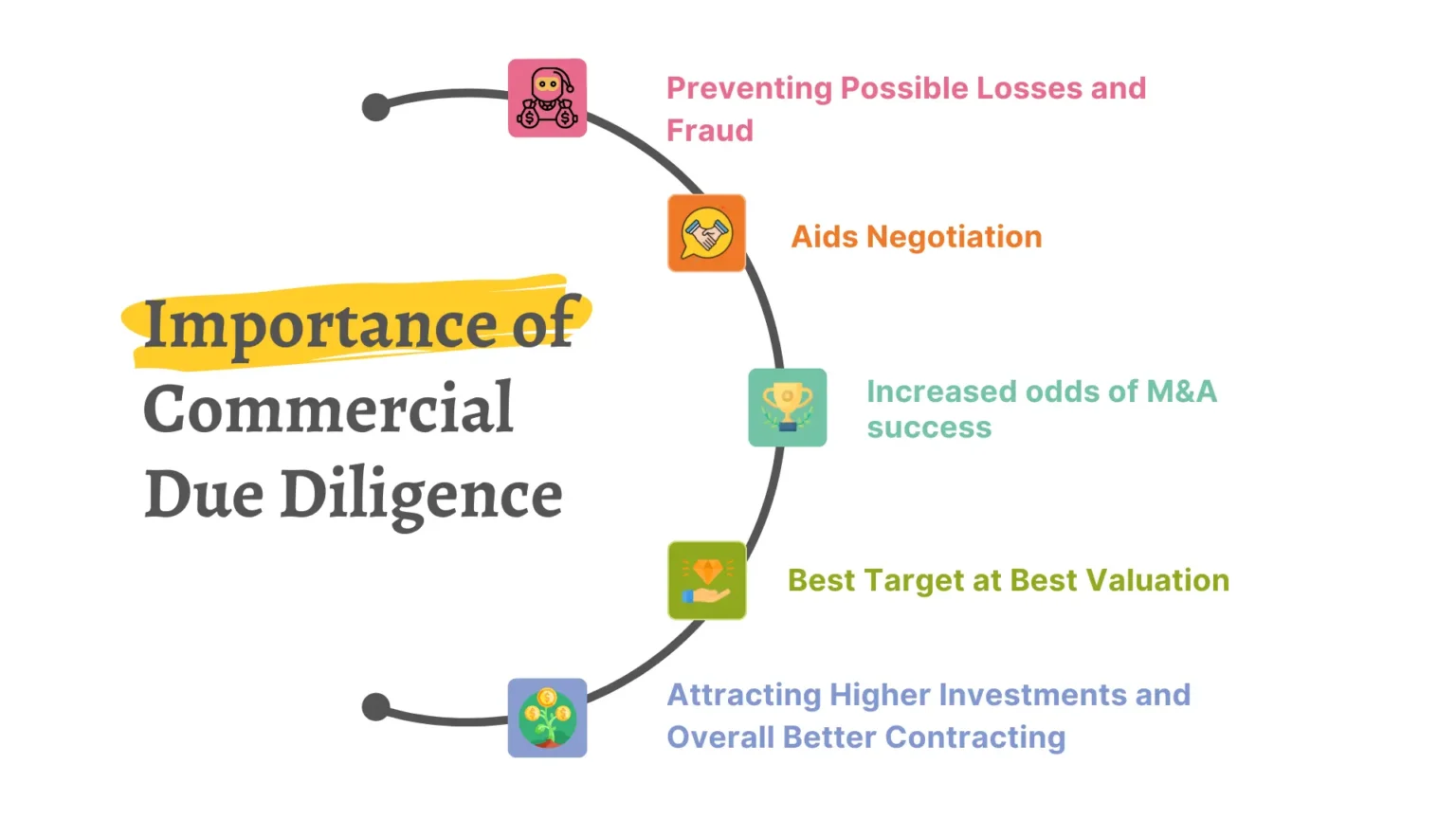

Exploring Commercial Due Diligence (CDD)

While VDD focuses on preparing the business for scrutiny, Commercial Due Diligence examines whether the business is truly worth acquiring. Conducted by buyers or investors, CDD evaluates the market realities that underpin revenue forecasts and growth expectations.

The primary goal of Commercial Due Diligence is validation. Buyers want to confirm that projected revenue streams are sustainable, that the market opportunity is genuine, and that competitive positioning is defensible. In other words, CDD answers the strategic question: Will this investment generate the returns we expect?

Market sizing is a foundational component. Investors assess total addressable market size, growth rates, customer segmentation, and demand drivers. Growth potential is scrutinized through industry trends, regulatory shifts, technological disruption, and macroeconomic factors. The competitive landscape is analyzed to understand barriers to entry, market concentration, pricing power, and differentiation strategies.

Customer behavior analysis is equally critical. Are revenues concentrated among a small number of clients? What is the churn rate? How strong is brand loyalty? These insights determine the stability of future cash flows. Revenue sustainability also requires evaluating contract structures, recurring revenue models, and pipeline visibility.

Buyers rely heavily on Commercial Due Diligence because financial statements alone cannot reveal forward-looking risks. A company may appear profitable today but operate in a shrinking market. Conversely, modest current performance might mask significant expansion opportunities. CDD distinguishes between temporary success and structural advantage.

Despite its importance, CDD presents challenges. Reliable market data can be fragmented or outdated. Competitive intelligence may require deep investigative effort. Forecast assumptions can be overly optimistic if not stress-tested rigorously. In addition, biases whether internal enthusiasm or deal pressure can cloud objective judgment.

To overcome these obstacles, leading investors integrate multiple data sources, conduct independent customer interviews, and leverage technology-driven intelligence platforms. A disciplined approach ensures that enthusiasm does not outpace evidence.

Ready to Strengthen Your Due Diligence Process?

Discover how AI-driven intelligence can reduce risk and accelerate smarter deal decisions.

Vendor vs. Commercial Due Diligence: Key Differences

Although both VDD and CDD aim to reduce uncertainty, they differ significantly in orientation, leadership, and objectives.

Vendor Due Diligence is seller-led. It focuses on internal validation ensuring that financial records, compliance frameworks, and operational processes withstand scrutiny. Commercial Due Diligence, in contrast, is buyer-led and externally focused. It evaluates market realities, competitive forces, and long-term growth prospects.

Another distinction lies in emphasis. VDD is primarily concerned with risk identification and mitigation. It aims to uncover weaknesses before they disrupt negotiations. CDD emphasizes growth validation. Buyers seek assurance that projected returns are realistic and sustainable.

Timelines also differ. VDD is conducted before or during the marketing phase of a sale process, often months in advance. CDD typically occurs during the exclusivity period or structured bidding phase, when buyers have access to detailed information.

Despite these differences, the two processes are complementary. A robust Vendor Due Diligence report provides a foundation of trust, enabling buyers to focus more effectively on commercial analysis. Similarly, insights from Commercial Due Diligence may validate the strengths highlighted in VDD, reinforcing confidence on both sides. When executed together, they create a comprehensive picture internal health combined with external opportunity.

In high-value transactions, synergy between these diligence streams reduces information asymmetry, shortens deal cycles, and enhances valuation accuracy.

The Role of Technology in Modern Due Diligence

Due diligence has evolved dramatically in recent years. What once depended heavily on manual data collection, spreadsheets, and static reports now leverages advanced analytics and artificial intelligence.

The shift toward AI-powered intelligence has transformed speed and precision. Automated data aggregation from news sources, regulatory filings, social signals, and market databases enables real-time monitoring. Instead of relying solely on historical documentation, stakeholders gain dynamic insight into emerging risks and trends.

Automation enhances accuracy by reducing human error in data compilation. It also enables scalability, allowing analysts to process vast volumes of information across geographies and industries. Real-time alerts notify decision-makers of reputational issues, regulatory changes, or competitor moves that could impact valuation.

Another significant advancement is the integration of alternative data. Beyond traditional financial metrics, investors now analyze digital footprints, customer sentiment, hiring patterns, and ecosystem activity. These non-traditional signals provide early indicators of performance shifts that may not yet appear in financial statements.

Technology does not replace expert judgment; rather, it augments it. By delivering structured intelligence quickly, digital platforms empower teams to focus on interpretation and strategy rather than data gathering.

How SignalX Supports Vendor and Commercial Due Diligence

In this data-driven landscape, platforms like SignalX are redefining how organizations conduct diligence. As an AI-powered market intelligence platform, SignalX aggregates structured and unstructured data to provide actionable insights for risk management, competitive tracking, and strategic evaluation.

In the context of Vendor Due Diligence, SignalX enhances transparency and preparedness. Reputation and risk monitoring capabilities allow sellers to detect negative signals before they escalate. Whether it involves regulatory scrutiny, adverse media coverage, or stakeholder disputes, early detection enables timely mitigation. Competitive benchmarking tools help organizations understand how they compare within their industry, strengthening positioning during negotiations. Executive and stakeholder intelligence further ensures that leadership backgrounds and affiliations are thoroughly vetted, minimizing reputational surprises.

For Commercial Due Diligence, SignalX supports buyer-led analysis by delivering continuous market visibility. Market and competitor tracking features enable investors to monitor industry shifts and competitor activity in real time. Deal and investment signal discovery highlights emerging partnerships, funding rounds, and strategic moves that could reshape competitive dynamics. Industry trend analysis uncovers macro patterns influencing demand and profitability. Customer and ecosystem insights provide deeper understanding of market sentiment and relationship networks.

The key advantage lies in immediacy. Real-time intelligence reduces reliance on static reports. Customizable alerts ensure that decision-makers remain informed throughout negotiation phases. Investigative capabilities allow deeper exploration into corporate structures, affiliations, and risk indicators. Together, these features accelerate decision-making while reducing blind spots.

By integrating AI-driven monitoring into diligence workflows, organizations transform reactive investigation into continuous intelligence.

Don’t Leave Deal Outcomes to Chance

Get real-time alerts, competitive insights, and risk intelligence in one unified platform.

Conclusion

In today’s complex transaction environment, relying on fragmented information is a costly risk. Vendor Due Diligence and Commercial Due Diligence serve distinct yet complementary purposes. One prepares the business for scrutiny by strengthening transparency and minimizing surprises. The other validates market opportunity and growth potential before capital is committed.

When combined, these approaches create a holistic evaluation framework internal resilience paired with external viability. Deals supported by both VDD and CDD are not only more likely to close smoothly, but also more likely to deliver long-term value.

As technology continues to reshape corporate strategy, intelligence platforms are becoming central to diligence processes. AI-driven tools enable faster analysis, deeper risk detection, and broader market awareness. They provide clarity in environments where uncertainty can undermine even the most promising opportunities.

For investors and acquirers, the message is clear: structured, technology-enabled diligence is no longer optional. It is a strategic imperative. Leveraging the right tools and methodologies empowers organizations to pursue transactions with confidence, reduce unforeseen risks, and unlock sustainable growth.