Comprehensive M&A Due Diligence Checklist for Successful Mergers and Acquisitions

Mergers and acquisitions (M&A) are high-stakes business transactions that often involve millions, if not billions, of dollars. In these deals, the importance of due diligence cannot be overstated. Due diligence serves as the backbone of any M&A deal, offering a systematic approach to assess risks, verify claims, and uncover potential pitfalls. It plays a crucial role in helping parties make informed decisions and protect their interests.

In this blog, we provide a comprehensive M&A Due Diligence Checklist to guide you through the key areas you need to assess before making a move.

Understanding Due Diligence: Purpose and Importance

The main objective of due diligence is to assess all aspects of the target company before a deal is finalized. This allows both buyers and sellers to make informed decisions based on a clear understanding of the risks and opportunities at hand. Here are the key purposes of due diligence:

Risk Assessment

One of the primary goals of due diligence is to identify and mitigate risks. Whether it’s financial instability, pending litigation, or regulatory non-compliance, due diligence uncovers red flags that could jeopardize the deal. Identifying these risks allows the parties involved to make informed decisions about whether to proceed with the acquisition, renegotiate the deal, or walk away altogether.

Valuation Accuracy

Due diligence also plays a critical role in accurately valuing the target company. By reviewing financial records, assets, liabilities, and business operations, due diligence helps ensure that the valuation aligns with the true worth of the business. Overvaluing a company can lead to paying more than it is worth, while undervaluing it could mean missing out on a valuable opportunity.

Compliance Verification

In addition to financial and operational assessments, due diligence ensures that the target company complies with all relevant laws, regulations, and industry standards. Legal due diligence focuses on uncovering potential compliance issues that may affect the deal, such as pending lawsuits, intellectual property disputes, or environmental violations.

Your Ultimate M&A Due Diligence Checklist for a Smooth Transaction

When it comes to mergers and acquisitions (M&A), the importance of due diligence cannot be overstated. This process helps you evaluate the risks, opportunities, and overall health of the company you’re considering acquiring (or selling). A well-organized M&A due diligence checklist can be the difference between a successful deal and a costly mistake.

Here’s a comprehensive, step-by-step guide for conducting M&A due diligence that covers all key areas from corporate structure to risk assessment.

1. Corporate Structure and Organizational Details

Before diving into financials, it’s important to understand the organizational makeup of the company in question. Focus on these elements:

- Articles of incorporation, bylaws, and shareholder agreements

- Subsidiaries, associated companies, and other legal entities

- Ownership structure and shareholding patterns

- Key personnel and their roles within the company

- Board meeting minutes and resolutions for the past few years

Assessing the company’s structure ensures there are no hidden governance issues or legal conflicts that could complicate the deal.

2. Financial Assessment and Verification

The financial health of a company is one of the primary concerns in any M&A deal. This stage helps ensure the financials align with expectations and reveals any potential red flags.

Key areas to review:

- Historical financial statements: balance sheet, income statement, and cash flow for the past 3-5 years

- Tax compliance: review tax filings, audits, and any existing disputes

- Debt obligations: outstanding loans, leases, credit facilities, and guarantees

- Accounts payable/receivable: aging reports and overdue items

- Working capital: analysis of current assets and liabilities

- Projections and budgets: future cash flow, expected revenue, and expense forecasts

This step helps verify the company’s true value and uncovers any financial risks or hidden liabilities.

3. Legal Compliance and Regulatory Review

To avoid future legal headaches, a deep dive into the company’s legal standing is essential. This includes:

- Material contracts: vendor agreements, customer contracts, intellectual property licensing

- Ongoing or past litigation: legal disputes, claims, and settlements

- Licensing and regulatory compliance: all necessary business licenses, permits, and regulatory filings

- Intellectual property (IP): verify ownership of patents, trademarks, copyrights, and any related disputes

- Environmental concerns: any potential liabilities or compliance issues in this area

A thorough legal review ensures the company is free from any unresolved legal issues that could impact the deal.

4. Operational Review and Efficiency Check

A detailed assessment of the company’s operations helps determine whether it has the systems and processes needed for continued growth and stability. This area includes:

- Operational contracts: service agreements, distribution contracts, and supplier arrangements

- Inventory and assets: value and condition of physical inventory, equipment, and property

- Insurance coverage: general liability, workers’ compensation, property, and other insurance policies

- Key operational systems: IT infrastructure, software licenses, and digital tools used for business operations

- Business continuity plans: disaster recovery and risk management strategies in place

This review allows you to identify any inefficiencies or gaps that could affect the smooth integration of operations after the acquisition.

5. Market and Commercial Due Diligence

Understanding the target’s market position and commercial viability is essential to determine if it fits your business strategy. Areas to evaluate include:

- Customer contracts: customer loyalty, renewal rates, and concentration risks

- Sales and revenue trends: historical sales data and market share

- Competitive positioning: how the company compares with its competitors in the market

- Product/service viability: performance of core products and services in the market

- Growth potential: long-term growth opportunities and expansion strategies

This step helps to understand how well the company is positioned in the marketplace and its potential for future success.

6. Human Resources and Management Evaluation

The strength of a company lies in its people. Ensure you’re acquiring a team that aligns with your goals and business culture. Focus on:

- Employee contracts: terms and conditions for all employees, including key personnel

- Management structure: profiles of executives, leadership stability, and key decision-makers

- Compensation packages: salaries, benefits, and incentive structures

- Employee retention: strategies in place to keep top talent

- HR policies: compliance with labor laws, employee satisfaction, and any active disputes

The human resources aspect plays a significant role in the long-term success of the acquisition, making it crucial to assess carefully.

7. Technology and Cybersecurity Assessment

As technology plays an increasingly vital role in business operations, it’s important to assess the company’s tech infrastructure and cybersecurity protocols. Key areas to focus on include:

- Technology stack: list of software, licenses, and hardware currently in use

- IT systems: overview of ERP, CRM, and other business-critical systems

- Cybersecurity measures: policies and protocols in place to protect data and customer information

- Data privacy compliance: adherence to data protection laws such as GDPR or CCPA

- Integration readiness: the ability of existing systems to integrate with your company’s infrastructure

A solid tech foundation ensures that the company can operate securely and efficiently, both during and after the acquisition.

8. Intellectual Property (IP) Review

Intellectual property can be one of the most valuable assets in an M&A transaction, so verifying the ownership and status of all IP is essential. Areas to evaluate:

- IP ownership: confirm patents, trademarks, copyrights, and trade secrets are owned outright

- Licensing agreements: ensure all IP licenses are current and legally sound

- Disputes or pending IP claims: review any IP litigation or disputes with third parties

- Renewal schedules: confirm the status and upcoming renewal dates for key IP assets

A robust IP portfolio can be a significant value driver, so ensure all IP assets are properly protected.

9. Environmental, Social, and Governance (ESG) Considerations

ESG is becoming an increasingly important factor in M&A deals. Here’s what to focus on:

- Environmental impact: environmental compliance audits and sustainability practices

- Social responsibility: diversity, equity, and inclusion policies, as well as community engagement

- Governance structures: transparency, ethical business practices, and leadership integrity

A strong ESG framework enhances the company’s reputation and minimizes risks related to social and environmental factors.

10. Risk Assessment and Closing Preparations

Once you’ve reviewed all key areas, it’s time to assess the overall risks and prepare for the final deal. This stage includes:

- SWOT analysis: identify strengths, weaknesses, opportunities, and threats of the target company

- Final risk assessment: highlight any critical issues or potential deal breakers

- Virtual Data Room (VDR): organize and store important documents in a secure online repository

- Integration planning: create a strategy for integrating the target company into your existing business

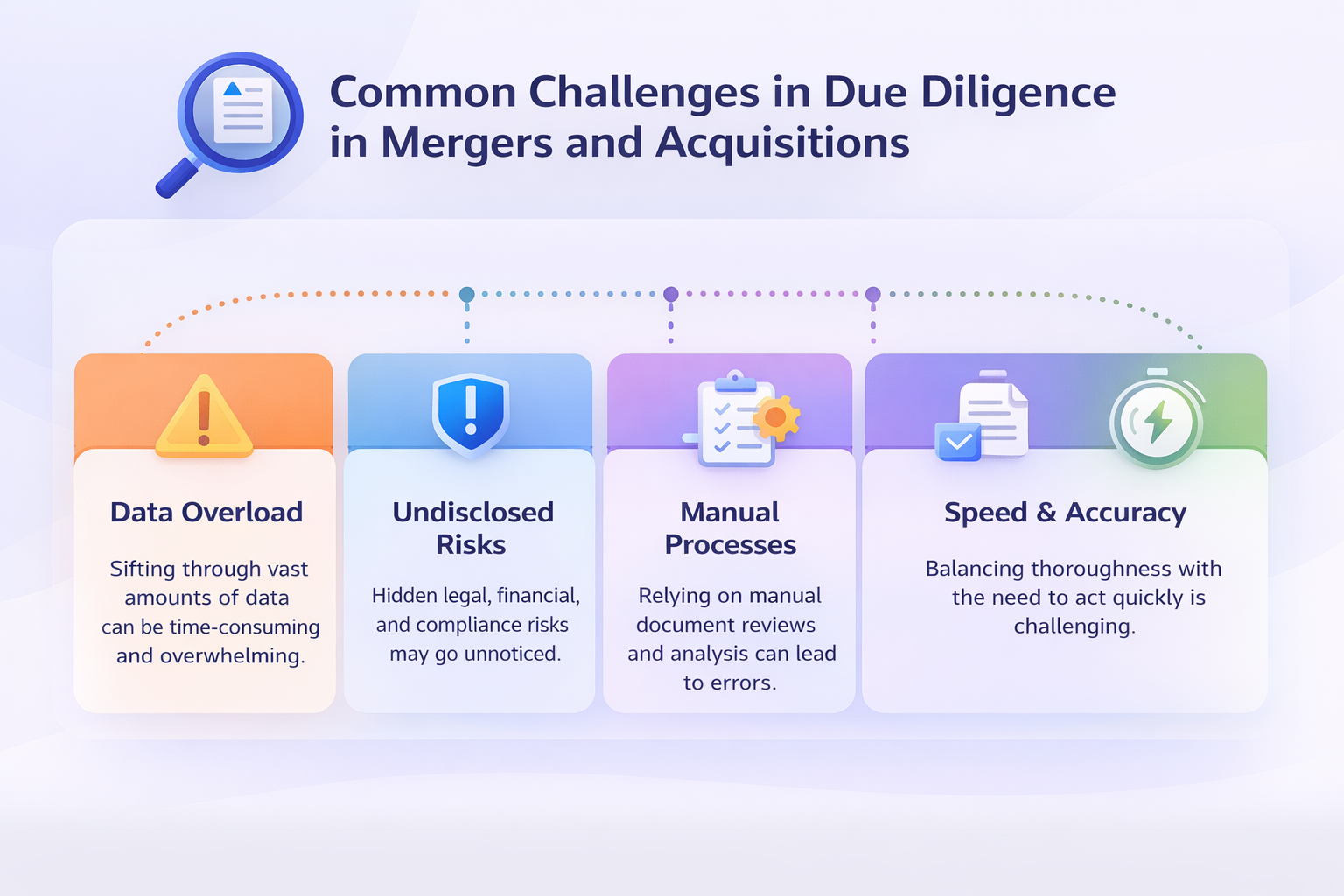

Common Challenges and How to Overcome Them

Despite the importance of due diligence, many companies face challenges throughout the process. Some of the common issues include:

Incomplete or Inaccurate Information

Often, the target company may not provide all the necessary information, or the information provided may be incomplete or inaccurate. To mitigate this risk, it’s essential to request all relevant documents upfront and conduct independent verification through third-party sources, such as auditors, consultants, or legal advisors.

Communication Gaps

Effective communication between stakeholders is crucial to ensure that the due diligence process runs smoothly. Miscommunication can lead to missed opportunities or overlooked risks. Establishing clear lines of communication and maintaining transparency throughout the process can help avoid misunderstandings.

Time Constraints

M&A deals are often time-sensitive, and the due diligence process can take longer than expected. To address this, the due diligence team should prioritize key areas of focus and be prepared to adapt to changing circumstances.

Leveraging Technology in Due Diligence

As the complexity of M&A transactions increases, so does the need for sophisticated tools to streamline the due diligence process. Technology, particularly artificial intelligence (AI) and data analytics, can enhance the efficiency and accuracy of due diligence.

AI and Data Analytics

AI-powered tools can help analyze large volumes of data more quickly and accurately than manual processes. These tools can detect patterns, identify risks, and even predict potential challenges that may arise in the future. AI also enables automated document reviews, speeding up the due diligence process and reducing human error.

Digital Platforms

There are several digital platforms available that help facilitate the due diligence process. These platforms allow teams to securely share and collaborate on documents, track progress, and centralize information. Some tools also offer built-in workflows and analytics to help manage large-scale due diligence projects more effectively.

How SignalX Enhances Due Diligence

SignalX is one such innovative technology that is transforming the way due diligence is conducted in M&A deals. SignalX leverages advanced data science, machine learning, and AI to provide deep insights into a target company’s operational and financial health. Here’s how SignalX takes part in due diligence:

Real-Time Risk Assessment: SignalX uses AI to identify and flag potential risks early in the process. By analysing historical data and cross-referencing multiple data sources, it can uncover hidden risks, such as compliance issues, financial inconsistencies, and regulatory red flags, that may not be apparent from traditional due diligence methods.

Automated Document Analysis: SignalX uses natural language processing (NLP) to automate the review of key documents, such as contracts, financial statements, and regulatory filings. This speeds up the process, reduces human error, and ensures no critical information is missed.

Data Visualization and Insights: SignalX turns

complex data into actionable insights by providing visualizations that highlight key trends, patterns, and risks. These visualizations help stakeholders understand the data more clearly and make more informed decisions.

Integration with Existing Workflows: SignalX integrates seamlessly with existing due diligence workflows, providing real-time updates and alerts on any new findings or developments. This helps due diligence teams stay on top of the process and make timely adjustments as needed.

Continuous Monitoring: SignalX doesn’t just stop at the due diligence phase; it continues to monitor the target company throughout the post-deal integration phase. This ensures that any new risks or opportunities are promptly identified, allowing the acquirer to take corrective action as needed.

to accelerate your due diligence process.

Case Studies: Lessons from Real M&A Deals

Case Study 1: The Yahoo–Alibaba Deal

In the case of Yahoo’s investment in Alibaba, due diligence played a pivotal role in uncovering critical business and financial information. Yahoo conducted extensive due diligence on Alibaba’s operations, financial statements, and market position, which allowed it to negotiate a favourable deal. However, the absence of thorough due diligence on cultural and management differences contributed to challenges post-acquisition.

Case Study 2: The Daimler-Chrysler Merger

The 1998 merger between Daimler-Benz and Chrysler is often cited as a cautionary tale. Despite extensive financial due diligence, the companies overlooked operational and cultural differences, leading to a failed merger. This example highlights the importance of non-financial due diligence, such as understanding corporate culture and operational synergies.

Conclusion

Proper due diligence is essential to a successful M&A transaction. By following this comprehensive M&A Due Diligence Checklist, you can confidently assess potential risks, verify the true value of the company, and ensure a smooth acquisition process.

Whether you’re buying or selling, having a clear and thorough due diligence process will help you make well-informed decisions and set your deal up for long-term success.

Frequently Asked Questions (FAQs)

1. What is due diligence in mergers and acquisitions?

Due diligence in M&A is a structured investigation conducted before finalizing a transaction. It involves examining financial records, legal obligations, operational processes, market positioning, technology, and ESG factors to verify information, uncover risks, and ensure the deal aligns with strategic objectives.

2. Why is due diligence critical to the success of an M&A deal?

Due diligence reduces uncertainty and prevents costly surprises after deal closure. It helps buyers avoid overvaluation, identify hidden liabilities, ensure regulatory compliance, and make informed negotiation decisions, ultimately increasing the likelihood of a successful acquisition.

3. What are the most important types of due diligence in M&A?

The key types include financial, legal, operational, commercial, technological, and ESG due diligence. Each focuses on a different aspect of the target business, ensuring a holistic understanding of risks, opportunities, and long-term sustainability.

4. How does technology improve the due diligence process?

Technology enhances due diligence by automating data collection, accelerating document reviews, and improving accuracy. AI and data analytics help identify patterns, anomalies, and red flags that may be missed in manual reviews, significantly reducing time and effort.

5. What role does SignalX play in M&A due diligence?

SignalX supports M&A due diligence by leveraging AI, machine learning, and data analytics to deliver real-time risk insights. It automates document analysis, highlights financial and compliance risks, visualizes complex data, and continuously monitors post-deal performance, enabling smarter and faster decision-making.

6. What are common challenges faced during due diligence, and how can they be addressed?

Common challenges include incomplete data, time constraints, and communication gaps between stakeholders. These can be addressed through early planning, clear scope definition, use of automated tools like SignalX, and maintaining transparent communication throughout the process.

7. Is due diligence relevant after the deal is completed?

Yes, due diligence extends beyond deal closure. Post-deal monitoring helps organizations track performance, manage newly identified risks, and ensure smooth integration. Platforms like SignalX enable continuous oversight, ensuring long-term value creation from the acquisition.