How to Protect Your Business with Strong Financial and Risk Management

Uncertainty is part of every business journey. Unexpected expenses, delayed income, and market shifts can weaken even well-performing companies. The key to staying prepared lies in building a strong Financial and Risk Management approach that helps businesses control financial exposure and make informed decisions before challenges escalate.

Rather than relying on reactive fixes, businesses that prioritise development clarity, stability, and long-term confidence.

Building Business Resilience Through Sound Financial Risk Management

At its core, focus on identifying financial pressure points and creating systems that protect business operations. It enables organizations to maintain control over their finances while preparing for possible disruptions.

Businesses that adopt structured Financial and Risk Management benefit from:

- Clear visibility into financial health

- Early identification of potential threats

- Stronger planning accuracy

- Reduced financial surprises

Financial Planning as a Core Element of Financial and Risk Management

Planning is essential for management. Businesses that outline future income, expenses, and capital needs are better positioned to manage uncertainty.

Sound planning supports:

- Realistic budgeting

- Improved cost discipline

- Better alignment between goals and resources

When planning is integrated, financial decisions become more consistent and reliable

Maintaining Control Over Cash Movement

Cash flow challenges often develop gradually. financial and risk emphasise consistent tracking of incoming and outgoing funds to maintain balance.

Effective methods include:

- Reviewing cash positions frequently

- Scheduling payments strategically

- Keeping short-term financial reserves

Handling Financial Commitments Responsibly

Debt, leases, and recurring costs require careful oversight. Financial and Risk Management ensures obligations remain manageable and aligned with cash availability.

Smart practices include:

- Structuring repayments around revenue cycles

- Limiting unnecessary financial commitments

- Periodic review of liabilities

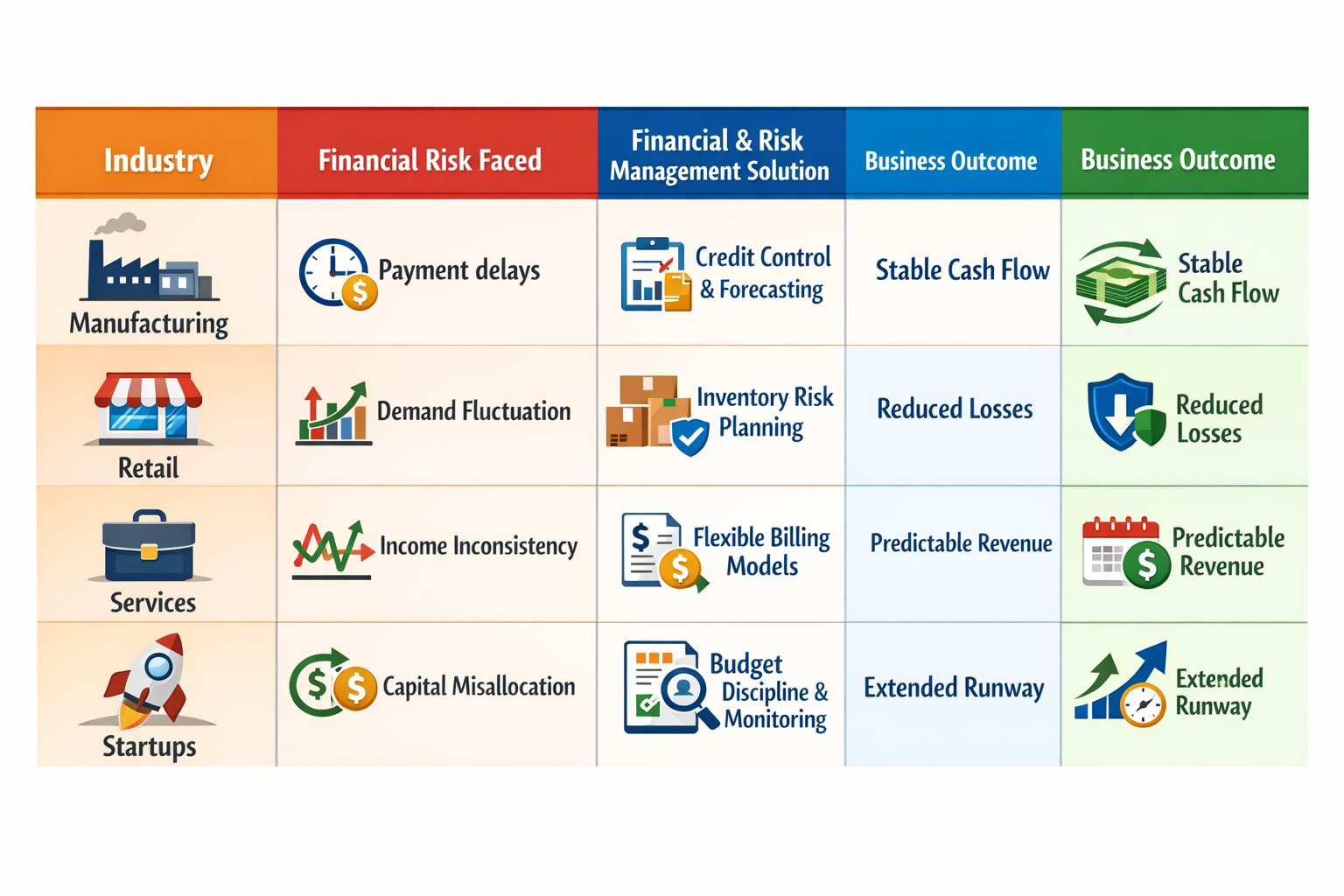

Real-Life Applications of Financial and Risk Management

Businesses across industries apply financial and risk management to address everyday financial challenges.

- A production firm improved liquidity by forecasting expenses in advance

- A retail operation reduced losses by aligning purchases with demand trends

- A service-based business stabilised its income through flexible billing models

These examples demonstrate how Financial and Risk Management supports practical, real-world decisions.

Making Smarter Decisions with Financial and Risk Management

Businesses that rely on financial and risk management make decisions based on financial insight rather than assumptions.

This approach helps:

- Reduce costly errors

- Improve resource allocation

- Support sustainable growth initiatives

When leaders integrate Financial and Risk Management into decision-making, financial outcomes become more predictable.

Designing an Optimal Financial Risk Management System

Strategies for Proactive Financial Risk Management

To develop reliable Financial and Risk Management processes, businesses should:

1. Define financial limits and priorities

2. Track key financial indicators

3. Review financial performance regularly

4. Adjust strategies as conditions change

Consistency is critical to making Financial and Risk Management effective.

Common Gaps That Weaken Financial and Risk Management

Even profitable businesses can face challenges is neglected.

Frequent issues include:

- Ignoring early warning signs

- Overlooking cash flow planning

- Making decisions without financial data

Addressing these gaps improves financial resilience.

Strategic Advantages of Proactive Financial and Risk Management

A disciplined approach delivers lasting value by:

- Strengthening financial stability

- Improving confidence among stakeholders

- Enhancing crisis preparedness

- Supporting controlled business expansion

Real-World Examples of Financial and Risk Management in Action

Case Study 1: Small Manufacturing Business Prevents Cash Flow Crisis

A mid-sized manufacturing company faced recurring cash shortages despite steady sales. The issue was not revenue, but delayed customer payments and poor expense forecasting.

By implementing Financial and Risk Management practices, the company:

Introduced rolling cash flow forecasts

Set credit limits for customers

Built a three-month emergency reserve

Result:

Within six months, the business eliminated cash shortfalls and stabilised operations. Strong Financial and Risk Management helped transform unpredictable cash flow into a controlled financial process.

Case Study 2: Retail Business Reduces Market Risk Through Financial Planning

A retail business operating in a competitive market struggled with seasonal demand fluctuations. Over-ordering inventory led to losses during off-peak periods.

Through structured Financial and Risk Management, the business:

Analyzed historical sales data

Aligned inventory purchasing with demand forecasts

Diversified suppliers to manage price volatility

Result:

The business reduced excess inventory costs by 30% and improved profit margins. This shows how Financial and Risk Management supports smarter operational decisions.

Case Study 3: Service-Based Company Strengthens Financial Stability

A professional services firm experienced revenue inconsistency due to project-based income. Fixed operating expenses created financial stress during low-demand periods.

By applying Financial and Risk Management, the company:

Shifted to milestone-based billing

Controlled fixed costs through flexible contracts

Created financial risk thresholds for new projects

Result:

Revenue predictability improved, and the company maintained positive cash flow year-round. Effective Financial and Risk Management reduced financial vulnerability.

Industry-Wise Impact of Financial and Risk Management

How SignalX Strengthens Financial and Risk Management

While sound Financial and Risk Management principles provide the foundation, having the right technology in place makes these practices more consistent, data-driven, and scalable. SignalX plays a critical role in helping businesses operationalize Financial and Risk Management across daily decision-making.

Turning Financial Data into Actionable Insights

SignalX helps organizations gain real-time visibility into financial risks and performance indicators. By centralizing financial data, risk metrics, and operational inputs, businesses can identify potential pressure points before they escalate into serious challenges.

With SignalX, businesses can:

- Monitor financial health through structured dashboards

- Track key risk indicators tied to cash flow, obligations, and exposure

- Detect early warning signals for financial stress

Supporting Proactive Financial Planning

SignalX enables businesses to move beyond static spreadsheets by supporting **dynamic planning and forecasting**. This helps organizations align budgets, cash flow projections, and financial goals more accurately.

Key benefits include:

- Improved forecasting accuracy

- Better alignment between revenue expectations and expenses

- Faster scenario analysis for changing market conditions

Enhancing Cash Flow and Commitment Control

Managing cash movement and financial commitments is a core part of Financial and Risk Management. SignalX helps businesses maintain control by providing structured oversight of inflows, outflows, and liabilities.

Using SignalX, organizations can:

- Track cash flow trends consistently

- Assess the impact of payment delays or recurring obligations

- Maintain financial discipline through clear visibility

Enabling Smarter, Risk-Aware Decisions

SignalX empowers leadership teams to make decisions based on data-backed financial insight rather than assumptions. By integrating risk awareness into financial planning, businesses can allocate resources more effectively and reduce costly missteps.

This results in:

- More confident decision-making

- Reduced financial surprises

- Stronger support for sustainable growth

Building Long-Term Financial Resilience

By embedding Financial and Risk Management into everyday workflows, SignalX helps businesses transition from reactive responses to proactive financial control. The platform supports consistency, accountability, and transparency, key elements of long-term financial stability.

Financial and Risk Management is most effective when supported by the right systems. SignalX bridges the gap between strategy and execution, helping businesses anticipate uncertainty, protect financial health, and make informed decisions with confidence.

Build Financial Resilience Today

Conclusion

The real-world examples clearly demonstrate that strong Financial and Risk Management enables businesses to anticipate challenges, control uncertainty, and protect profitability. From managing cash flow to reducing market exposure, these practices empower leaders to make informed financial decisions.

Businesses that embed into daily operations are better prepared to adapt, grow, and succeed in an unpredictable financial environment.

Frequently Asked Questions (FAQ): Financial and Risk Management

1. What is Financial Management?

Financial management is the process of planning, organizing, controlling, and monitoring financial resources to achieve goals efficiently. It involves budgeting, saving, investing, and managing expenses.

2. What is Risk Management?

Risk management is the process of identifying, analyzing, and reducing potential risks that could cause financial loss or harm to an organization or individual.

3. Why is Financial and Risk Management important?

It helps individuals and organizations:

Avoid unnecessary losses

Make informed financial decisions

Ensure long-term stability

Prepare for unexpected events

4. What are common financial risks?

Common financial risks include:

Market risk (changes in prices or interest rates)

Credit risk (borrowers failing to repay loans)

Liquidity risk (not having enough cash when needed)

Operational risk (system or human errors)

5. How are financial risks identified?

Financial risks are identified by:

Reviewing financial statements

Analyzing market trends

Evaluating past data

Assessing internal processes

6. What are some ways to manage financial risk?

Financial risks can be managed by:

Diversifying investments

Buying insurance

Creating emergency funds

Setting budgets and financial controls

7. What is the role of budgeting in financial management?

Budgeting helps plan income and expenses, control spending, save money, and reduce financial uncertainty.

8. What is diversification and why is it important?

Diversification means spreading investments across different assets to reduce risk. If one investment performs poorly, others may balance the loss.

9. How does insurance help in risk management?

Insurance transfers risk to an insurance company by providing financial protection against losses such as accidents, illness, or property damage.

10. Who is responsible for financial and risk management in an organization?

Typically, financial managers, risk managers, and senior leadership share responsibility, but all employees play a role by following policies and procedures.