Free GST Number Verification

Run GST Verification Checks in Bulk. Try Bulk Upload.

GSTIN or Goods and Services Tax Identification Number is a unique 15 digits alpha-numeric PAN-based code allotted to every registered person under Goods and Service Tax. This number is provided to the GST taxpayer along with the GST registration certificate, and the number also allows tracking of a registered Taxpayer. The GSTIN search Check feature helps to perform GST verification and Know your GST in India with the help of the HSN code.

A Goods and Service Tax Identification Number (GSTIN) is essential as it helps in verifying the authenticity of a taxpayer registered under GST. There are many cases where individuals manipulate GSTIN numbers to evade taxes.

The GST verification tool by SignalX will help you attain transparency in all the business information and will help to ensure that you are filing correct GST Returns for a particular tax period. The GST verification and number search will also help to claim the Input Tax Credit (ITC) that you might lose in case of a fake/incorrect GSTIN.

GST verification is necessary to ensure that the Goods and Service Tax taxes land up in the right pockets. It is also an opportunity to contribute towards nation-building and attaining a transparent tax mechanism.

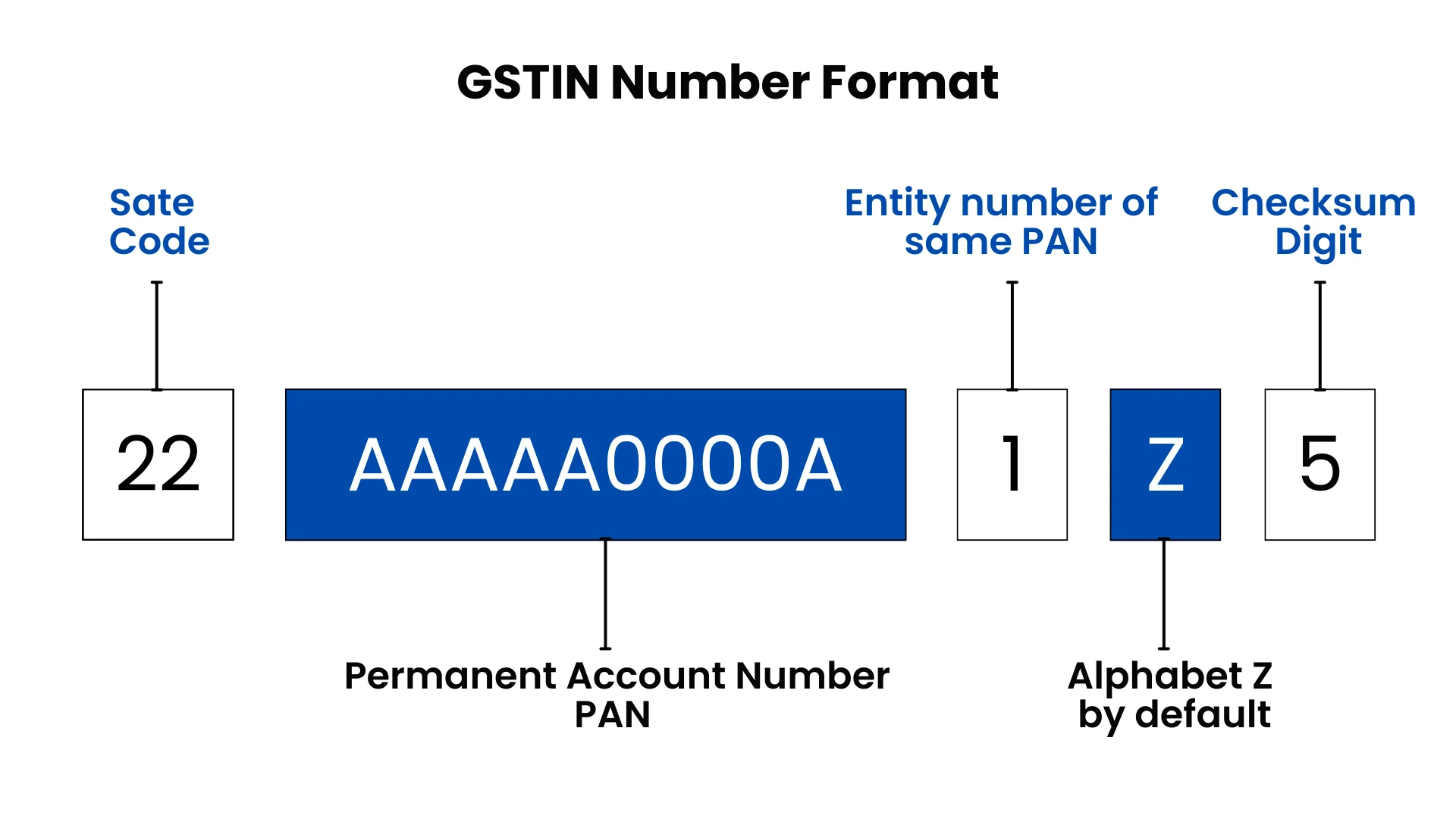

Every GST number provided to a holder has a 15-unique digit format. A person can easily identify a GST number by looking at the same.

- The first 2 numbers of the format represent the state or province to which the GST number is registered.

[#Note: Every state in India has a different identification number which is positioned as the first two digits of the complete GST number]

- Digits from the 3rd position to the 12th position in the number represent the PAN number of the holder to which the GST number is linked.

- The number in the 13th position indicates the number of GSTINs the holder has issued with a single PAN under that particular state.

- The 14th character is set to the alphabet Z by default.

- The next character(on the 15th position) represents a check code. This character can be an alphabet or a digit and is mainly used to detect errors.

Follow the easy steps to validate any GSTIN number using the SignalX GST verification/number search tool –

Step 1: Go to the SignalX GST search page.

Step 2: Type in the GSTIN number you want to verify in the dialogue box

Step 3: Click on the search button to get started.

Get your GSTIN number verified within a jiffy with just one click!

If a person comes across a fake GST bill or invoice he/she can directly issue a complaint against the holder.

Via online portal –

One way to file a GST number fraud complaint is, to visit cbec-gst.gov.in, click on CBEC MITRA Helpdesk, and select “Raise Web Ticket”.

Via Email –

The complaint can also be emailed to cbecmitra.helpdesk@icegate.gov.in.

Via Social Media handle –

Complaints can also be flagged on Twitter via the official GST and Finance Ministry handles (@askGST_GoI and @FinMinIndia).

Request a quote today. Let's talk.

Every entity registered under GST is provided with a unique 15-digit identification number from the concerned tax authorities. This number is provided with the purpose of collecting tax on behalf of the government and accessing input tax credits.

A GSTIN number can also be used to perform GST verification in order to validate the authenticity of a registered company or business.

A person can easily fetch details about a company from their GST number. Following the steps to get started.

- Go to the page: signalx.ai/gst-verification/

- Enter the whole GSTIN number and click on the search

- Get the details pertaining to the GST holder instantly.

All the goods-providing businesses whose annual turnover exceeds Rs. 40 Lakhs in a financial year are subjected to getting registered under the GST as a normal taxable entity. States such as Jammu and Kashmir, Himachal Pradesh, Uttarakhand, and North Eastern States of India are subjected to get registered with the threshold of Rs 20 lakh annual turnover.

All the services-providing businesses whose annual turnover exceeds Rs. 20 Lakh in a financial year are to be registered under GST as normal taxpayers. Except for Jammu and Kashmir, Himachal Pradesh, Uttarakhand, and the North Eastern States of India, the annual turnover threshold is Rs. 10 Lakhs.

HSN stands for Harmonised System of Nomenclature. The HSN Code was introduced in the year 1988 by WCO for the systematic classification of goods all over the world.

HSN is a 6-digit code that classifies each individual good. HSN codes are applicable to Customs and GST. The HSN code is used all over the world, every commodity has different HSN codes. Filing GST returns is simplified when HSN codes are used, since no details about the goods need to be uploaded separately.

Form GSTR 3B is a simplified summary return. In this return, the taxpayers are required to declare their summary GST liabilities for a particular period and discharge these liabilities.

For every taxpayer, it is mandatory to fill the Form GSTR 3B returns for every tax period. Form GSTR 3B can be filled out from the returns section of the GST portal.

- Log in with your credentials in the Online GST Portal,

- Go to Services > Returns > Returns Dashboard.

- Select the financial year and tax period, Form GSTR-3B, (if applicable), in the given period, will be displayed.

In case of no business, taxpayers are required to file for Form GSTR 3B as nil return (as no outgoing and incoming transactions are performed within that tax period)

The due date for filing Form GSTR-3B by monthly filers is the 20th day of the month following the month to which the return pertains.

Quarterly filers should submit Form GSTR-3B by the 22nd or 24th of the month following the quarter for which the return is filed, as notified by different states/UTs.

However, the due date for filing Form GSTR-3B can be extended by Government through notification.