MSME Declaration Format: Detailed Explanation, Uses, and Legal Significance

In the Indian business environment, compliance and transparency are no longer optional they are essential. One such compliance-related document that has gained significant importance in recent years is the MSME declaration format. Although this document does not come directly from the government, it plays a vital role in audits, statutory disclosures, delayed payment compliance, and corporate reporting.

The MSME declaration format is used by businesses registered under the MSMED Act, 2006, to formally declare their MSME status to buyers, auditors, banks, and regulatory authorities. This declaration helps stakeholders understand whether the enterprise falls under the Micro, Small, or Medium category and whether special legal provisions apply.

With stricter audit checks and MCA reporting requirements, submitting an accurate MSME declaration has become a practical necessity for businesses across India.

What Is an MSME Declaration?

An MSME declaration is a self-written confirmation issued by a business entity stating whether it is registered as a Micro, Small, or Medium Enterprise under the MSMED Act.

It is not automatically generated and must be prepared by the enterprise itself whenever requested.

Why MSME Declaration Is Required in Business Transactions

MSME declaration is required because it helps establish legal clarity between buyers and suppliers. It ensures that both parties are aware of the supplier’s MSME status and the legal consequences that may arise from delayed payments.

Key reasons include:

- To identify whether a supplier qualifies for MSME protections

- To determine applicability of delayed payment provisions

- To enable correct disclosure in financial statements

- To support audit verification

Without an MSME declaration, buyers may unknowingly violate disclosure norms.

Who Usually Asks for MSME Declaration?

MSME declarations are commonly requested by:

- Buyers and corporates, to meet statutory disclosure requirements

- Statutory auditors, to verify MSME-related balances

- Banks and lenders, to assess eligibility for MSME benefits

- Government authorities, during tenders or inspections

What Is MSME (Micro, Small and Medium Enterprises)?

Definition Under MSMED Act

MSME stands for Micro, Small and Medium Enterprises, defined under the MSMED Act, 2006. These enterprises are classified based on their financial capacity rather than ownership structure.

Classification Based on Investment and Turnover

MSME classification depends on two combined criteria:

Investment Criteria

This refers to the amount invested in:

- Plant and machinery (for manufacturing enterprises)

- Equipment (for service enterprises)

Lower investment generally indicates a smaller enterprise.

Turnover Criteria

Turnover refers to the annual sales revenue of the business. This helps ensure that enterprises with high revenue are not misclassified as smaller entities.

Applicability to Manufacturers vs Service Providers

The MSME framework applies equally to:

- Manufacturing businesses

- Service providers

There is no separate declaration or registration process for either category.

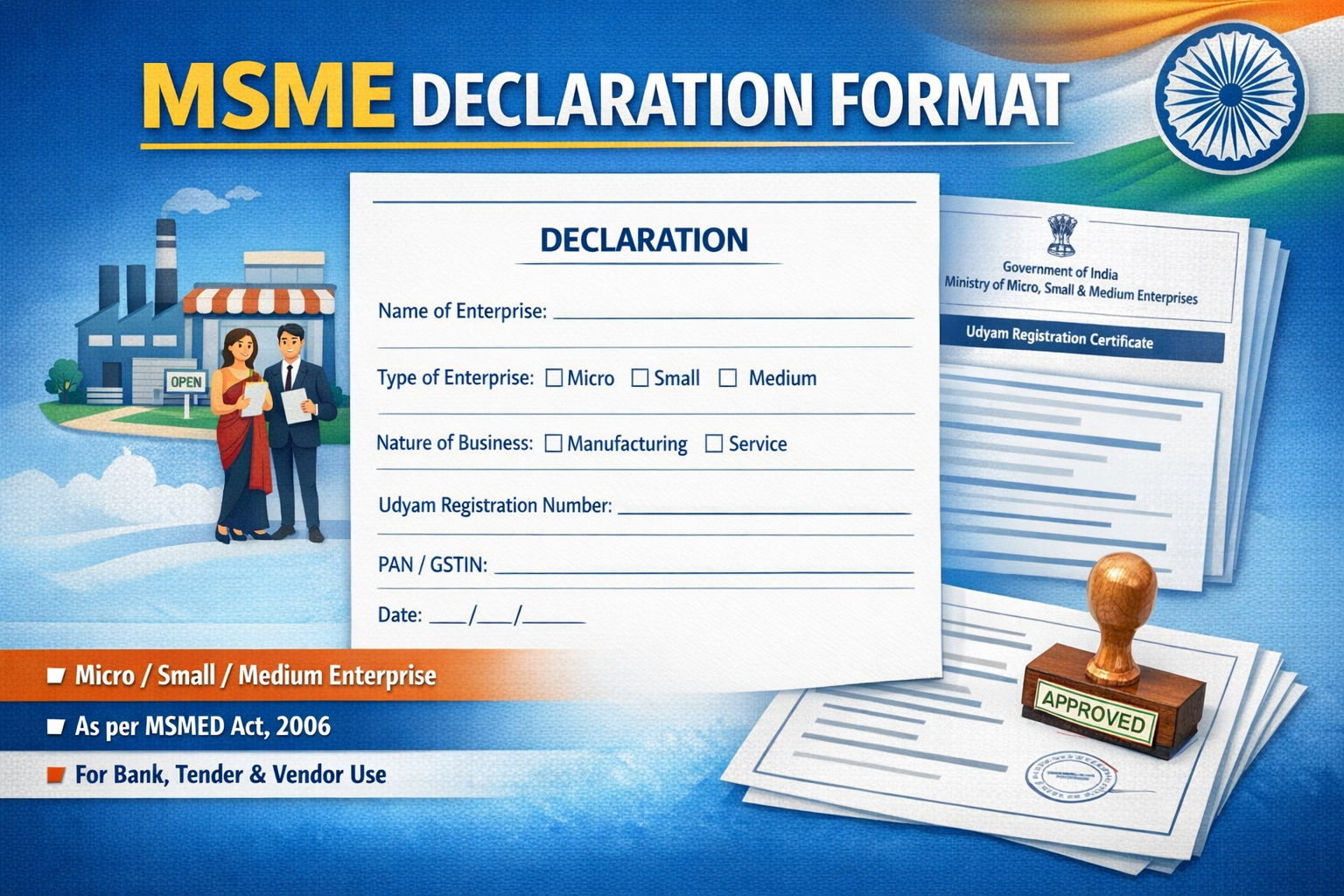

What Is MSME Declaration Format?

Meaning of MSME Declaration Format

The MSME declaration format refers to the structure and content of the declaration letter submitted by an enterprise. It clearly states the MSME status of the business for a specific financial year.

This format ensures uniformity and clarity when the declaration is reviewed by auditors, buyers, or authorities.

Difference Between MSME Registration Certificate and MSME Declaration Letter

| Aspect | MSME Registration Certificate | MSME Declaration Format |

|---|---|---|

| Nature | Government-issued document | Self-declared document |

| Issued By | Ministry of MSME | Business entity |

| Purpose | Proof of MSME registration | Compliance & disclosure |

| Usage | Loans, subsidies, tenders | Audit & statutory reporting |

Is There a Government-Prescribed MSME Declaration Format?

No.

There is no official format prescribed by the government. However, businesses are expected to include specific details to make the declaration legally and practically acceptable.

When Is MSME Declaration Required?

MSME Declaration for Vendors Supplying Goods or Services

Vendors are usually asked to submit MSME declarations when they start supplying goods or services to a buyer. This helps buyers identify whether MSME provisions apply to them.

MSME Declaration for Disclosure Under Section 22 of MSMED Act

Section 22 requires buyers to disclose:

- Outstanding MSME dues

- Interest payable on delayed payments

These disclosures are based entirely on MSME declarations received from vendors.

MSME Declaration for Statutory Audit and MCA Reporting

Auditors rely on MSME declarations to:

- Verify MSME creditor balances

- Ensure compliance with accounting standards

- Report correct information in audit reports

MSME Declaration for Delayed Payment Compliance

If a vendor is declared as MSME:

- Payments must be made within 45 days

- Interest becomes mandatory on delay

MSME Declaration Format – Key Components Explained

A valid MSME declaration format must contain the following details, each serving a specific purpose:

- Business name and address :This identifies the legal entity issuing the declaration.

- Udyam Registration Number : Confirms that the business is officially registered as an MSME.

- MSME category (Micro / Small / Medium) : Determines applicability of legal protections and disclosures.

- Type of enterprise (Manufacturing / Service): Helps auditors classify the nature of operations.

- Financial year : MSME status may change, so year-specific declaration is required.

- Declaration statement :A clear confirmation of MSME status under the MSMED Act.

- Date and authorized signatory : Establishes authenticity and accountability.

MSME Declaration Format for Different Use Cases

MSME Declaration Format for Buyers

Buyers use MSME declarations to:

- Identify MSME suppliers

- Comply with statutory disclosures

- Avoid penalties under MSMED Act

MSME Declaration Format for Statutory Auditors

Auditors depend on these declarations to:

- Verify MSME classification

- Report outstanding dues accurately

- Assess compliance risk

MSME Declaration Format for Annual Compliance

Many organizations collect MSME declarations:

- At the beginning of every financial year

- During year-end audit processes

MSME Declaration Format for Bank, Loan, or Tender Purposes

Banks and authorities may request MSME declarations to:

- Confirm MSME eligibility

- Grant financial benefits

- Approve tenders

Sample MSME Declaration Format (Reference Only)

MSME declarations are usually submitted in:

- Word format

- PDF format

- Email-based confirmations

- Letterhead vs Plain Paper

- Letterhead is preferred for credibility

- Plain paper is acceptable for email submissions

Who Needs to Submit MSME Declaration?

The MSME declaration applies to all forms of business entities, including:

- Proprietorship firms

- Partnership firms

- LLPs

- Private Limited Companies

- One Person Companies

Any MSME supplying goods or services may be asked to submit a declaration.

MSME Declaration Format vs Udyam Registration Certificate

| Basis | MSME Declaration Format | Udyam Registration Certificate |

|---|---|---|

| Purpose | Compliance disclosure | Registration proof |

| Issuing Authority | Self-declared | Government |

| Audit Usage | Mandatory | Supporting |

| Legal Standing | Informative | Authoritative |

Legal Importance of MSME Declaration Format

Protection Under MSMED Act

MSME declarations enable enterprises to:

- Claim legal protection

- Access dispute resolution mechanisms

Interest on Delayed Payments

Delayed payments attract:

- Mandatory compound interest

- Higher-than-market interest rates

Buyer’s Disclosure Obligation

Buyers must disclose MSME dues in:

- Financial statements

- MCA filings

Penalties for Incorrect Declaration

Incorrect declarations may result in:

- Legal action

- Audit qualifications

- Loss of MSME benefits

Common Mistakes While Preparing MSME Declaration Format

Common errors include:

- Declaring incorrect MSME category

- Using old EM-II registration numbers

- Not updating turnover figures

- Declaring MSME status without registration

- Missing signature or date

Frequently Asked Questions on MSME Declaration Format

Is MSME declaration mandatory?

Not legally mandatory, but practically essential for compliance.

Can MSME declaration be self-attested?

Yes, it is a self-attested document.

Is MSME declaration valid without Udyam registration?

No, Udyam registration is mandatory.

How often should MSME declaration be updated?

At least once every financial year.

How SignalX.ai Helps in MSME Declaration Compliance

Managing MSME declarations manually becomes complex as vendor numbers increase. SignalX.ai plays an important role by helping organizations organize, monitor, and analyze MSME-related compliance data.

Role of SignalX.ai in MSME Declaration Management

SignalX.ai supports MSME compliance by:

- Centralizing vendor MSME status information

- Tracking MSME declarations received from suppliers

- Flagging missing or outdated MSME declarations

- Assisting compliance and finance teams during audits

How SignalX.ai Supports Buyers and Corporates

For buyers and corporates, SignalX.ai helps:

- Identify MSME vendors across large datasets

- Support Section 22 disclosures

- Reduce compliance risk related to delayed payment

How SignalX.ai Assists Audits and Reporting

During audits, SignalX.ai can:

- Provide structured MSME vendor data

- Support audit documentation

- Improve accuracy in financial disclosures

By using intelligent compliance insights, SignalX.ai helps organizations move from manual tracking to data-driven MSME compliance management.

Simplify MSME Declaration Compliance with SignalX.ai

Managing MSME declarations manually becomes complex as vendor numbers increase.

SignalX.ai helps buyers, corporates, and finance teams centralize MSME vendor data,

track declarations, support Section 22 disclosures, and remain audit-ready at all times.

Move from spreadsheets to data-driven MSME compliance management.

Conclusion

The MSME declaration format is a critical compliance document that connects MSME registration with audit reporting, statutory disclosures, and legal protection. Although it is self-declared, its importance cannot be overstated.

A properly drafted and updated MSME declaration format helps businesses avoid penalties, ensures transparency, and strengthens compliance with the MSMED Act.