EvaluateInvestment Targets & Promoters with Confidence

Investments come with risk but your due diligence process shouldn’t be one of them.

With SignalX, get a comprehensive view of your potential investment targets and promoters, backed by AI-driven checks across litigation, compliance, and financial signals. Delivered in just 48 hours, our reports are trusted by leading investors and deal teams to make credible, informed decisions under pressure.

Trusted by leading Insolvency, Bankruptcy & Liquidation teams across India

Built for India’s Complex Risk Landscape. Designed for You.

Built for Legal, Credit & Investment Teams Who Need Verified Intelligence.

Spot Red Flags Early

A complete range of checks covering financials, litigations, ownership structures, business history, tax compliance, market reputation, willful defaults, and more empowering investment professionals to detect potential risks at the prospecting stage before a deal progresses.

Accelerate Deal Cycles

Leverage data from 200+ regulatory sources and thousands of third-party databases to produce robust, unbiased pre-investment due diligence insights on targets and promoters. Speed up deal timelines by uncovering potential issues early, preventing disruptions later in the transaction process.

Bringing Powerful Due Diligence Capabilities to Investment Teams at Pre-Deal Stage.

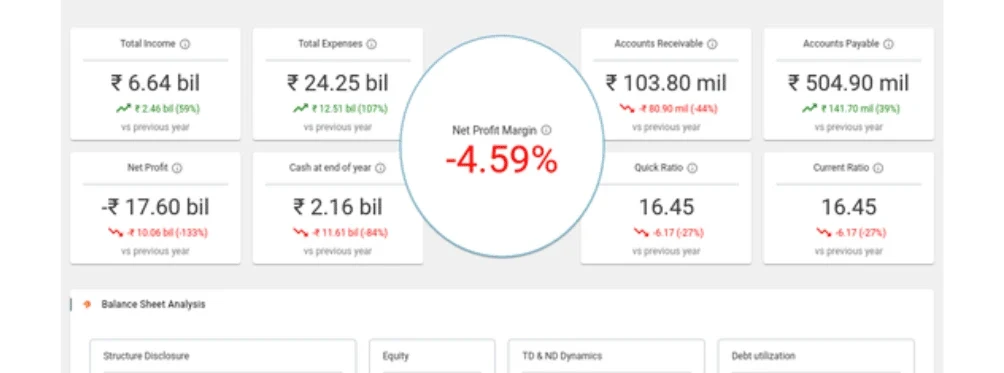

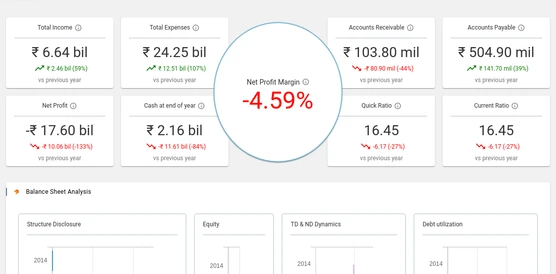

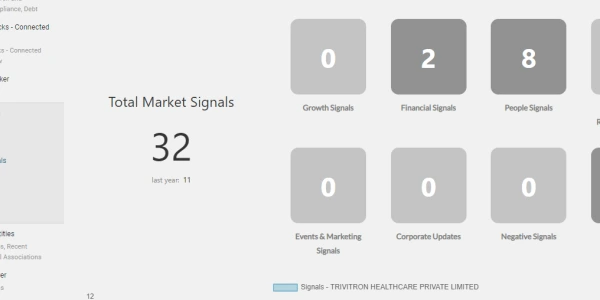

26 Parameter Risk Scorecard & Dashboard

Get a comprehensive view of potential risks with SignalX’s proprietary 26-parameter risk scorecard. Instantly spot red flags, visualize key insights, and share reports seamlessly with stakeholders to accelerate confident decision-making.

Instant, Self-Serve Pre-Investment Due Diligence

Run Level 1 due diligence on targets and promoters instantly and independently. No need to involve legal or research teams at the early stage. Fully automated, on-demand, and built for speed, SignalX empowers you to move forward with confidence.

Comprehensive Risk Intelligence

Leverage data from 200+ regulatory bodies and thousands of third-party sources to conduct thorough, unbiased checks on potential investment targets. SignalX empowers you to make informed decisions early in the deal lifecycle with credible, data-driven intelligence.

Ready for a Personalized Walkthrough?

200+ Pre-Investment Due Diligence Checks Executed in 48 hours

Backed by some of the most respected compliance and legal teams, SignalX ensures your due diligence goes beyond the surface. In just 48 hours, access AI-curated insights covering everything from litigation history to regulatory red flags, so you walk into every deal confident and informed. Here’s what you can expect in SignalX’s Pre-Deal Due Diligence reports.

-

Financial Health Checks

-

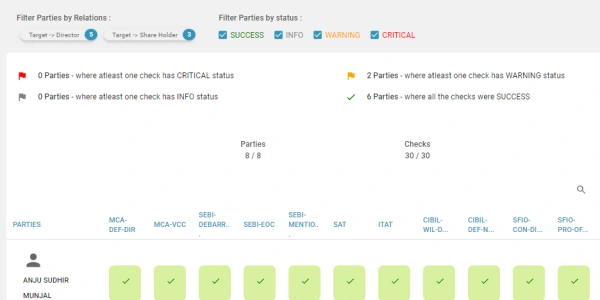

Promoter Background Checks

-

Reputation checks

-

Historic Financial Checks

-

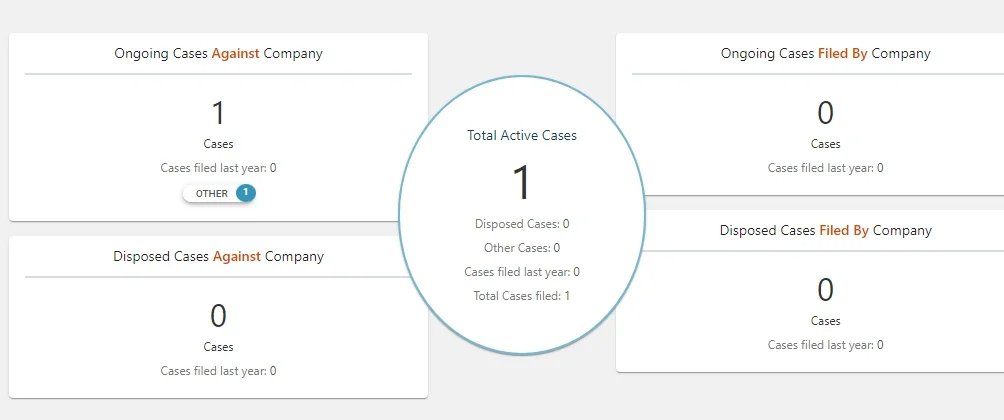

Legal Diligence & Adverse Litigation Checks

-

GST Compliance Checks

-

Regulatory & Economic Default Checks

-

Headcount Checks

-

Customer Sentiment Analysis

-

Adverse Media Checks

-

Financial Quality & Credit Checks

-

AML Sanction Lists & PEP Checks

-

Business Registration & Essential Checks

-

Ultimate Beneficiary Analysis

-

Corporate Governance Checks

Real Stories, Real Results

Kiran Golla

We were referred to use SignalX for 29A eligibility checks and it has been a great decision. The report surpassed our expectations. The format is intuitive and informative, and the platform covers the sources in detail.

Megha Agarwal

SignalX is a fantastic one-stop solution provider. It provided us with all the data required in a short span of time while being cost-effective & providing custom reports.

Santanu Brahma

The platform comes with comprehensive data coverage & analytics, all built into an intuitive interface. Our DD time has reduced to ⅓ of what it would’ve taken otherwise to execute these checks.

Hemanshu Jetley & Samiha Rautela

The detailed connected party study with litigation, finance & media history has been an invaluable addition to our 29A Eligibility checks.

Jagadeesh Kumar

The analysis is extensive & done in record time. SignalX has helped us take automation to the next level.

Manish Jaju

SignalX’s experience with such projects ensured they knew exactly what was required to create a simple yet comprehensive eligibility report, ready for submission to the CoC.

Jigar Bhatt

The team promptly responded, understanding the tight timelines, and delivered the needed analysis in less than 12 hours. CoC members appreciated the detailed checks and due-diligence report presented by RP..

Madhusruthi Neelakantan

We had specific details on each target available at our fingertips. From appeal numbers to court orders - all the data we required was in 1 place. SignalX has helped us cut our Due Diligence cost and time at a very convenient rate.

Built for Investment and Legal Teams Who Can’t Afford Blind Spots

Strategy Teams

Angel investors

Private Equity

Venture capital

Legal Teams

Investment Banking

Financial Institutions

Transaction Advisory

Mergers and Acquisitions

Credit and Lending Teams

Corporate Development

Risk & Compliance Teams

FAQs

Pre-deal due diligence in M&A is the process of verifying a target company’s financial, legal, and compliance health before closing a transaction. It ensures investors don’t inherit hidden risks.

Key documents include audited financial statements, tax filings, compliance records, shareholding structure, litigation history, and details of directors and promoters.

The goals are to uncover potential risks, verify claims made by the target, assess compliance, and determine whether the investment is viable at the proposed valuation.

Traditional diligence can take weeks, but with platforms like SignalX, many checks financial, litigation, compliance can be completed within 48 hours.

Financial due diligence examines financial statements, revenues, debts, and cash flows, while legal due diligence checks compliance, regulatory filings, litigation risks, and ownership disputes.

Investors use background checks, litigation searches, regulatory filings, and adverse media screening to confirm the credibility and integrity of promoters.

Common red flags include undisclosed court cases, inconsistent tax records, overdue debts, frequent director changes, and negative news coverage.

Yes. Reports can be tailored to focus on areas like compliance, financials, or reputation depending on the size, sector, and risk profile of the investment.

Technology platforms like SignalX automate data collection across regulatory bodies, media, and courts reducing human effort and generating reports in less than 48 hours.

Yes. Risk is dynamic new litigations or regulatory issues can arise post-deal. Ongoing monitoring alerts investors to emerging risks and protects long-term value.