Top 10 Challenges of Due Diligence in 2025: You should know

Assisting in your firm’s due diligence and compliance processes enables you to continually reduce the risks and challenges of due diligence that could undermine the firm.

Consequently, you’re reducing fraud risk, fines for noncompliance, and reputational damage to your company. And as you are all too aware, the frequency and complexity of these fundamental responsibilities have increased.

An effective due diligence process requires extensive preparation, the right technology, and collaboration between different teams. From financial due diligence to legal and operational assessments, businesses must ensure they have a structured approach to avoid common pitfalls.

In this article, we will explore the 10 most common challenges in the due diligence process and discuss strategies to overcome them.

What is due diligence? Is it mandated by law?

Due diligence is the systematic process of investigating and verifying relevant information about a business, investment, or partnership before finalizing a transaction. It involves assessing financial records, legal compliance, operational capabilities, and potential risks.

While due diligence is not always legally mandated, certain industries and transactions require regulatory compliance checks. For example, publicly traded companies must follow strict due diligence procedures as per securities laws. Similarly, industries like finance, healthcare, and real estate have specific due diligence requirements to prevent fraud and ensure compliance with industry regulations.

For businesses engaged in mergers and acquisitions, due diligence serves as a safeguard against financial and legal pitfalls. By conducting thorough due diligence, companies can protect their investments and make informed decisions that align with their strategic goals.

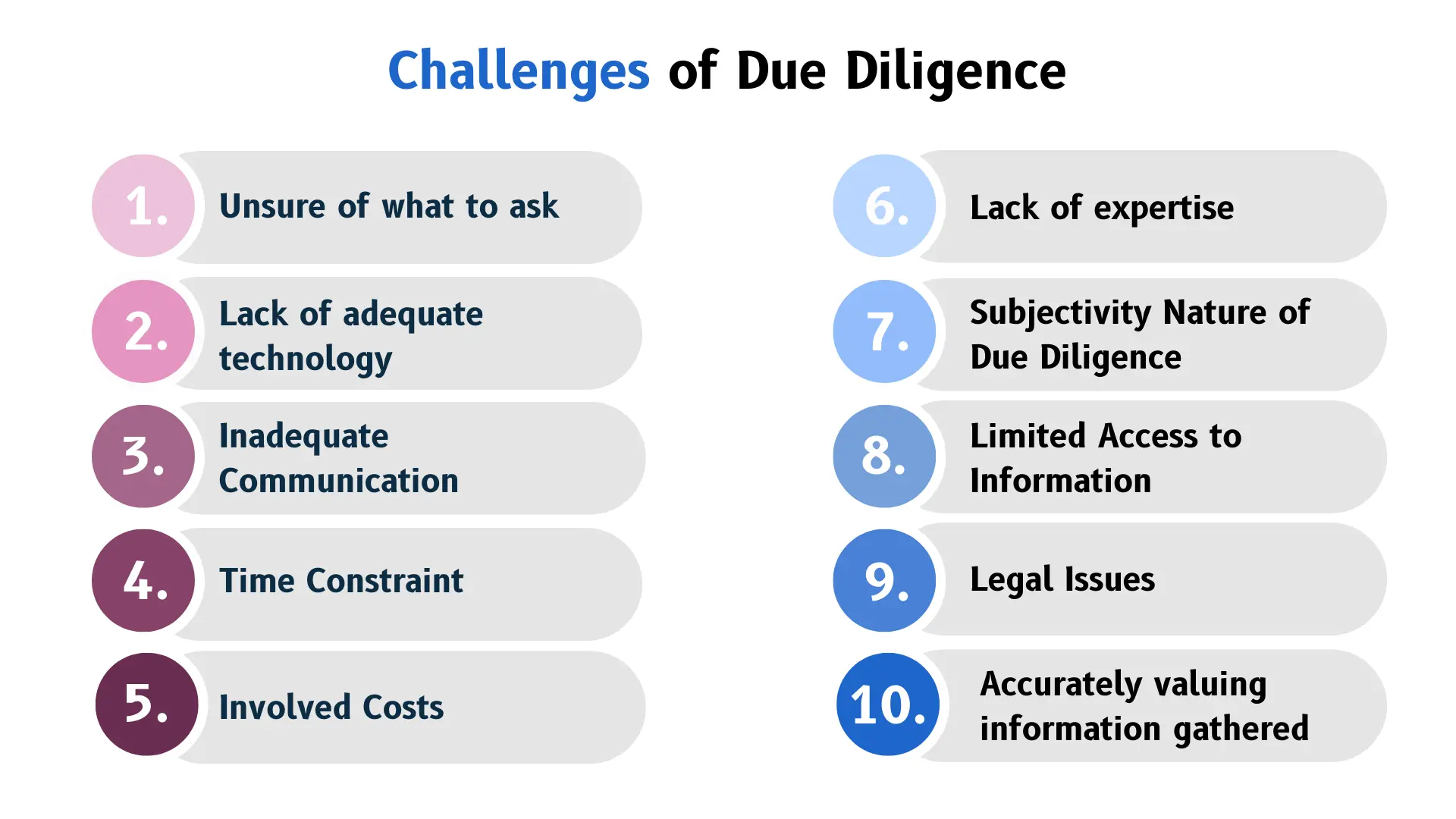

Challenges Of Due Diligence

The following list includes some of the challenges of Due Diligence:

1. Unsure of what to ask

To offer your business the best chance of posing the appropriate questions, it pays to start your due diligence preparations well before the process begins.

Asking the inquiries that go to the heart of the subject is what we mean by “the appropriate questions.”

2. Lack of adequate technology

The use of spreadsheets and email in the due diligence process has grown too commonplace among due diligence teams. The procedure, which is already expensive per hour, is only served by being slowed down.

With the use of sophisticated due diligence solutions like SignalX, teams may exchange information in a more secure and orderly manner without the time-consuming email trails that once characterized due diligence procedures. This will also help the team to overcome the challenges of due diligence.

3. Inadequate Communication

The different due diligence teams (operations, finance, legal, etc.) can function independently without ever communicating with one another.

But this is only one example of a communication flaw that undermines due diligence. Another concern is how to effectively communicate with the other party to the transaction and ensure that the entire process is transparent to everyone.

It is better to accomplish all of this by inviting everyone who needs to be involved into the virtual deal room so they can see how each stage of the due diligence is going and be on the same with the rest of the departments and the seller.

4. Time Constraints

The phrase “anything that drags gets dirty” is used informally in the context of the challenges of due diligence, with the meaning being that the longer due diligence lasts, the more likely it is that relations between the buyer and seller will deteriorate.

Although this is partially true, the objective of due diligence is to offer the entire information rather than whatever information becomes available in a set amount of time.

Managers on both sides of the transaction will need help to stay motivated due to the slow execution of the due diligence process.

5. Involved Costs

It’s important to approach due diligence as an investment rather than a cost in order to avoid the challenges of due diligence. For example, the costs of an extra couple of months of due diligence are negligible compared to the costs associated with choosing the incorrect company to purchase, even though it can seem expensive at times and become even more so when unanticipated expenses pop up.

It is advantageous to view proper due diligence as an investment expense rather than an operating expense because doing so will either result in a successful acquisition or help you mitigate the challenges of due diligence.

Performing due diligence on a large or complex company can be expensive. The process can be difficult for smaller companies/businesses that may lack adequate resources.

6. Lack of expertise

Finding the right personnel to fill the gaps between what your internal due diligence team can and cannot do is one of the major challenges of due diligence.

For instance, an ordinary accountant is unlikely to be able to give the level of analysis needed for a thorough investigation into the target company’s financials.

Of course, your CFO may be able to handle everything, but you’ll need them to be upfront about their skills since a lack of knowledge in any area of due diligence can cost you to face the challenges of due diligence.

7. Subjectivity Nature of Due Diligence

Due diligence involves making judgments and decisions based on incomplete or imperfect information, which can make it somewhat subjective. As a result, it can be difficult to form a clear judgment about the suitability of a business relationship with the company.

8. Limited Access to Information

One of the typical challenges of due diligence is incomplete information, which only sometimes indicates that the seller is being evasive.

It could be a case of improper record keeping or a lack of access to the data that your due diligence team is requesting.

The challenge then becomes making a decision based on your information, assuming you think the information gap is something other than an intentional attempt to prevent your investigation into the company.

9. Legal Issues

Due Diligence sometimes exposes legal issues or potential liabilities facing the company under investigation.

These situations are one of the major challenges of due diligence. The buying side may require assistance from a legal counsel to mitigate the challenge.

10. Using information gathered to make an accurate valuation

The amount of new information that can be discovered during even a brief period of due diligence on a small business is enormous, and almost all of it will be relevant to determining the company’s valuation.

This could be anything from an unrecognized manufacturing plant inefficiency to an impending lawsuit that could be very damaging. Whatever is produced by diligence.

The challenge then becomes determining how to revalue the company based on your findings.

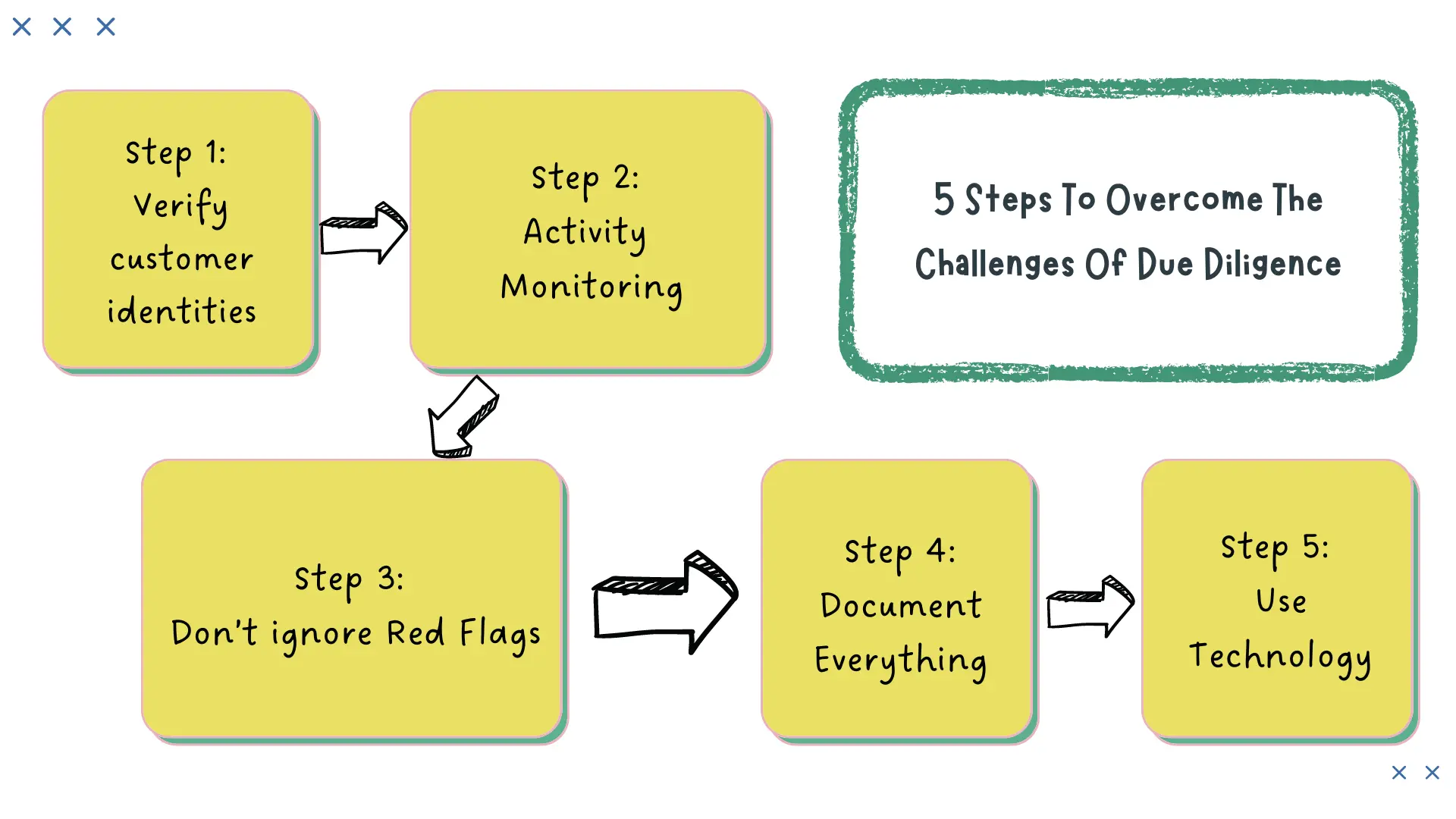

Overcome The Challenges Of Due Diligence

To navigate due diligence successfully, companies must proactively address common obstacles and streamline the process. The following strategies can help mitigate risks and improve efficiency:

- Adopt a structured approach: Utilize due diligence checklists and predefined frameworks.

- Leverage technology: Virtual data rooms and AI-driven analytics can optimize data collection and collaboration.

- Enhance communication: Centralized platforms ensure transparency and coordination among teams.

- Set realistic timelines: Establish clear deadlines and milestones to prevent unnecessary delays.

- Invest in expertise: Engaging financial, legal, and industry specialists enhances accuracy and compliance.

By implementing these best practices, companies can conduct more effective due diligence and minimize potential deal risks.

Different roles of Due Diligence

Due diligence can take several distinct shapes, depending on its goal.

Context-Specific Due Diligence

- Commercial due diligence takes into account a company’s market share, competitive positioning, as well as its potential for growth in the future. This will take into account the business’s supply chain from suppliers to clients, market research, the sales pipeline, and the R&D pipeline. This can also refer to a company’s general operations, including management, HR, and IT.

- A corporation must ensure that all of its legal, regulatory, and compliance ducks are in a row by performing legal due diligence. This covers a wide range of topics, such as ongoing legal disputes, intellectual property rights, and verifying the incorporation of the company.

- Financial due diligence is checking a company’s financial records and statements to ensure there are no errors and that it is in good financial standing.

- A company’s tax exposure, potential tax liabilities, and areas where taxes can be cut going forward are all factors considered during tax due diligence.

Hard vs. Soft Due Diligence

Due diligence can be described as “hard” or “soft,” depending on the approach taken.

- The statistics and data found on financial statements like the balance sheet and income statement are the focus of hard due diligence. This can include fundamental research and the use of financial ratios to gain an understanding of a company’s financial status and generate future projections. However, this type of due diligence can also detect red flags or accounting discrepancies.

Hard due diligence is prone to rosy interpretations by eager salespeople because it is motivated by mathematics and regulations. However, soft due diligence works as a check when numbers are distorted or overemphasized.

- Soft due diligence is a more qualitative method that considers things like the caliber of the management, the employees, and the company’s client base.

There are various factors that influence a company’s performance that figures cannot entirely account for, including leadership, corporate culture, and employee relations. The human factor is frequently overlooked when M&A agreements fail, which is thought to be the case in 70% to 90% of them.

Effective Planning – A Key To Overcoming Challenges of Due Diligence

While there are challenges of due diligence, careful planning and strategizing can aid in addressing the issues. The diligence procedure is divided into two parts: pre-closing diligence and post-closing activities. Pre-diligence must begin with the buyer identifying the appropriate industry experts to undertake the diligence.

Such an expert should be familiar with the people engaged in the firm as well as how the business operates. They must be aware of the target company’s limited access to information. They must insist on the establishment of a dedicated data room to ensure that all available data is made available to the diligence team.

Prior to the start of the diligence, creating a comprehensive information/documents list and sharing it with the target representative will ensure the process is swiftly completed.

During the due diligence process, the expert must discover operational difficulties as well as any instances of fraud in the previous management.

In the case of distressed enterprises, the first few days after acquisition are critical for the acquirer to thoroughly examine the core functions and operations to see whether any gaps or incorrect business practices need to be remedied. As a result, the diligence report must provide suggestions to that effect in their report.

Conclusion

It is crucial to put strategies in place that will boost the likelihood that the transaction will succeed, as distressed M&A is contributing more and more to the growth of M&A overall.

Even though there are challenges of due diligence, one can get past them by hiring the right expert with broad industry knowledge of the target and by developing an effective plan and strategy to guarantee the transaction’s successful completion.

FAQs

Ques: What is a failure in due diligence?

Ans: Failing to exercise due diligence may result in a person losing their employment and, in some circumstances, being sued in civil court for breach of fiduciary duty. Large financial repercussions may result from this. One of the biggest challenges of due diligence is that there are situations in which failing to exercise due diligence is literally illegal.

Ques: What is risk due diligence?

Ans: An organization does due diligence when considering a potential purchase or buyer by doing a thorough risk and opportunity assessment of its business. A substantial amount of data is obtained from all facets of the organization during the due diligence process.

Ques: What are the disadvantages of diligence?

Among the challenges of due diligence, one is that sometimes it can be time-consuming. In addition, buyers may interact with a variety of parties (such as brokers, accountants, and lawyers) during a transaction, each of whom may have incomplete records and different levels of knowledge.

Ques: Why is it called due diligence?

Ans: The phrase “due diligence” combines the words “due,” which is derived from the Latin word debere, which means “to owe,” with “diligent,” which comes from the Latin word diligentia, which means “carefulness or attentiveness.” Since the middle of the fourteenth century, the term “due diligence” has been used in a legal context.

Ques: What are some examples of due diligence?

Ans: The following are additional examples of due diligence:

- Financial statements under review and audit.

- Examining performance predictions for the future.

- Analyzing the market for consumer goods.

- Looking for operational redundancies that can be cut.

- Examining any pending or potential legal disputes.

- Reviewing the antitrust issues.

Ques: What is the difference between an audit and financial due diligence?

Ans: An additional significant distinction between a financial due diligence review and an audit is that, as opposed to an audit, which only reports on the accuracy and fairness of the financial results, a financial due diligence review also looks into the causes of trends in the company’s operational results over a pertinent time period and reports on them in relation to their applicability to the proposed transaction.