Choosing the Right Third-Party Risk Management Certification for Your Industry

In today’s interconnected business environment, managing risks associated with third-party vendors is critical across all industries. Selecting the right Third-Party Risk Management certification tailored to your industry’s needs can empower professionals to effectively identify, assess, and mitigate risks from suppliers, vendors, and partners. This guide will explore the importance of Third-Party Risk Management certifications, industry-specific considerations, the use and benefits of vendor risk management policies, and how SignalX contributes to elevating third-party risk management efforts.

Why Third-Party Risk Management Certification Matters

Third-party risk management certifications validate the skills and knowledge required to oversee a comprehensive risk program. They equip professionals to detect risks early in the vendor lifecycle from onboarding to continuous monitoring and prevent costly incidents such as compliance violations, data breaches, and operational failures. Certifications also demonstrate your commitment to regulatory compliance and build confidence with stakeholders, including customers and regulators.

Advantages of Obtaining a Third-Party Risk Management Certification

- Enhance your expertise in vendor risk identification and mitigation

- Gain structured knowledge on best practices and regulatory requirements

- Improve audit readiness and risk reporting to executives

- Increase career opportunities in finance, healthcare, technology, and other sectors

- Stay current with evolving threats and compliance mandates

Industry-Specific Third-Party Risk Management Certifications

Different industries face varying third-party risks depending on regulatory environments, vendor relationships, and operational dependencies. Selecting a certification aligned with your industry ensures that training addresses your unique challenges.

Popular Third-Party Risk Management Certifications

Certified Third Party Risk Professional (CTPRP): A broad certification suitable for mid-level professionals in highly regulated industries like finance, fintech, and healthcare. It covers program design, due diligence, oversight, and risk controls.

Certified Third Party Risk Assessor (CTPRA): Focuses more on vendor risk assessments and control evaluation, ideal for roles centered on operational risk and compliance.

Certified Third Party Risk Management Professional (C3PRMP): Often offered by specialized institutes, emphasizing comprehensive TPRM program leadership and compliance with frameworks such as OCC and FFIEC.

Other certifications like CRISC, CISSP, and CRCM provide complementary skills but with less focus on third-party risks specifically.

Key Industry Considerations

- Finance and Banking: Strict compliance with regulations such as OCC, EBA, and FFIEC makes certifications aligned with these standards invaluable.

- Healthcare: Certifications that emphasize data privacy, HIPAA compliance, and vendor security assessments are essential.

- Technology and SaaS: Focus on cybersecurity vendor risk, cloud service providers, and data protection.

- Manufacturing and Retail: Supply chain risk management and operational resilience are priority areas.

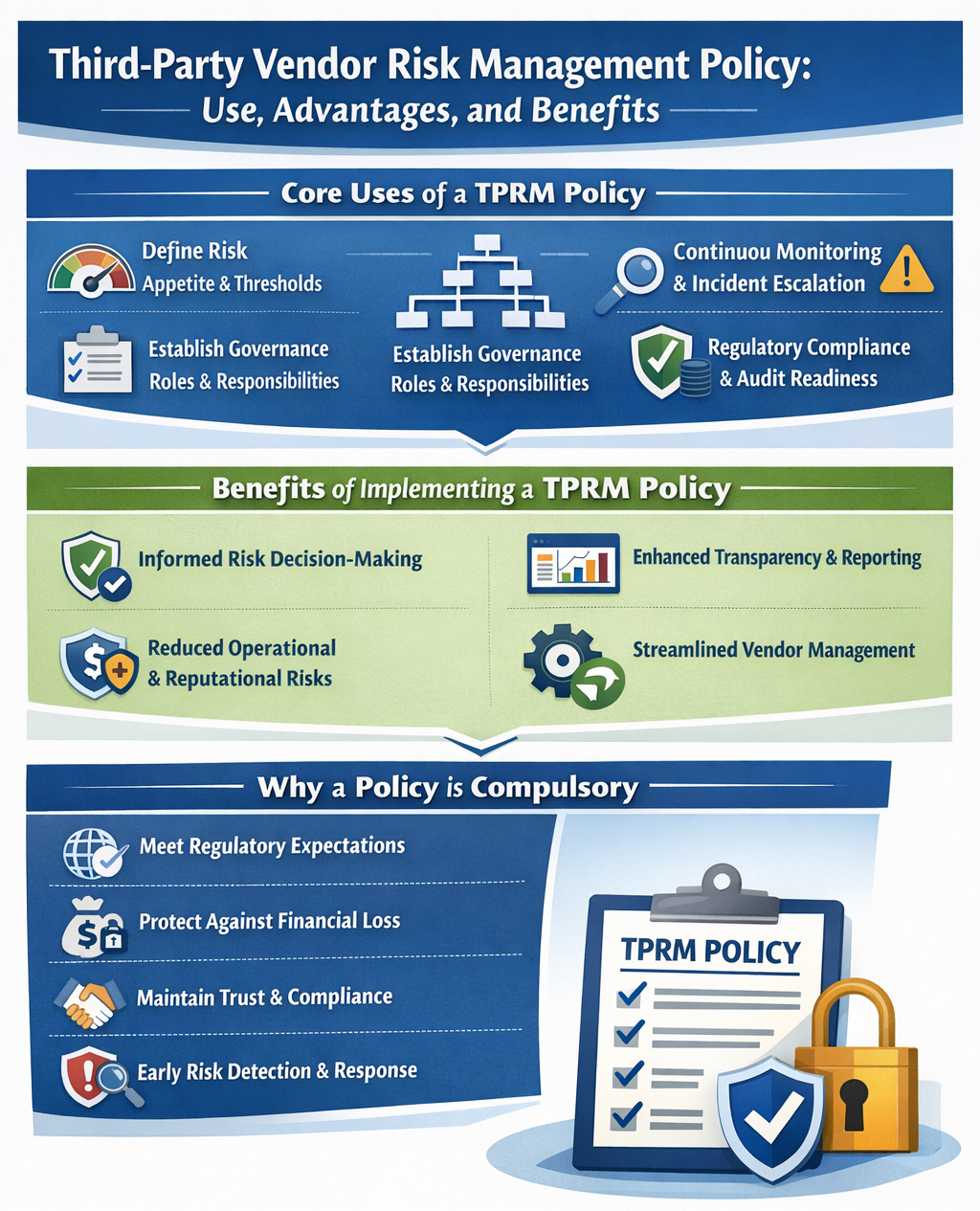

Third-Party Vendor Risk Management Policy: Use, Advantages, and Benefits

An integral part of TPRM is a robust vendor risk management policy supported by practical templates and guidelines. This policy sets the standard for how organizations identify, assess, and monitor third-party risks throughout the vendor lifecycle.

Core Uses of a Third-Party Risk Management Policy

- Define risk appetite and thresholds for third-party relationships

- Establish governance roles and responsibilities

- Guide vendor onboarding, due diligence, and contractual controls

- Enable continuous monitoring and incident escalation procedures

- Ensure regulatory compliance and audit readiness

Benefits of Implementing a TPRM Policy

- Informed and consistent risk decision-making across functions

- Enhanced transparency through standardized risk assessments and dashboards

- Lower operational, legal, and reputational risks with proactive controls

- Streamlined procurement and vendor management processes

- Support scalable and repeatable risk management practices

Why a Policy is Compulsory

- To align third-party risk management with global regulatory expectations

- To protect against financial loss related to vendor failures or breaches

- To maintain trust with customers, partners, and regulatory bodies

- To enable early detection and remediation of risks before escalation

SignalX Contribution in Third-Party Vendor Risk Management

SignalX offers cutting-edge AI-powered solutions designed to transform traditional third-party risk programs. Their platform enhances vendor risk management through automation, comprehensive risk intelligence, and continuous monitoring.

How SignalX Enhances Third-Party Risk Management

Faster Onboarding and Risk Classification: Automates vendor data gathering, risk tier classification, and documentation verification to drastically reduce onboarding time drastically.

AI-Powered Risk Assessment: Instantly analyses vendor documents, certifications, and cybersecurity postures to deliver objective, thorough risk scores.

Continuous Monitoring and Proactive Alerts: Uses multiple data sources, including financial reports, dark web intelligence, and media coverage, to provide early warnings on emerging risks.

Compliance Support: Adapts to evolving regulatory guidelines from bodies like RBI, SEBI, IRDAI, and CERT-In.

Operational Efficiency: Reduces manual effort and errors, enabling teams to focus on strategic decisions.

Builds Stakeholder Trust: Enhanced visibility and risk insights maintain confidence with customers, partners, and regulators.

Ready to Upgrade Your Vendor Risk Management?

See how automated risk insights and continuous monitoring can transform your third-party risk strategy.

Choosing the right Third Party Risk Management certification is a strategic step toward safeguarding your business and advancing your career. Evaluate your industry’s unique needs and select a certification that deepens your expertise in vendor risk oversight. Complement your certification with a solid third-party risk management policy tailored to your organizational goals. Leverage innovative platforms like SignalX to stay ahead with AI-driven risk intelligence and continuous monitoring.

Take the first step today explore Third-Party Risk Management certifications, build a strong risk policy, and integrate AI-powered tools to ensure a resilient and compliant third-party risk management program.

This comprehensive approach not only strengthens your risk management framework but also positions your organisation to thrive in a complex, dynamic vendor ecosystem. Embrace TPRM certifications and modern technology like SignalX to empower your team and protect your business

Frequently Asked Questions About Third-Party Risk Management Certification

Q1: What is Third Party Risk Management certification?

A TPRM certification validates a professional’s knowledge and skills in managing risks related to third-party vendors. It covers vendor risk identification, assessment, mitigation, regulatory compliance, and continuous monitoring.

Q2: Why is Third-Party Risk Management certification important for my industry?

Certification ensures that you understand the unique regulatory requirements, risks, and best practices specific to your industry such as finance, healthcare, or technology. It helps protect your organization from vendor-related risks and demonstrates your commitment to compliance and risk governance.

Q3: What are some popular Third-Party Risk Management certifications?

Key certifications include Certified Third Party Risk Professional (CTPRP), Certified Third Party Risk Assessor (CTPRA), Certified Third Party Risk Management Professional (C3PRMP), and industry-specific ones like CRCM for banking compliance.

Q4: How do I choose the right certification for my role and industry?

Consider your job responsibilities, industry regulations, and experience level. For example, CTPRP suits mid-level risk management professionals across multiple industries, while CRCM is ideal for compliance in banking and finance.

Q5: What are the benefits of implementing a Third Party Risk Management policy?

A well-defined policy standardizes risk assessments, improves governance, enhances compliance, reduces vendor-related incidents, and supports continuous monitoring of third-party risks.

Q6: Is a vendor management policy compulsory?

Yes, many regulatory bodies require organizations to have a Third-Party Risk Management policy to manage risks associated with outsourcing and third-party vendors. It is critical for operational resilience, regulatory compliance, and protecting your company’s reputation.

Q7: How does SignalX contribute to Third Party Risk Management?

SignalX uses AI-driven technology to automate vendor onboarding, provide risk scoring, conduct continuous monitoring, and deliver actionable insights for early risk detection. It helps organisations improve efficiency and maintain compliance with evolving regulations.

Q8: What industries benefit most from Third-Party Risk Management certification?

Sectors like finance, banking, healthcare, IT, manufacturing, and retail benefit greatly, as each faces specific regulatory requirements and operational risks from third-party relationships.

Q9: Can Third-Party Risk Management certification enhance my career?

Yes, certification demonstrates expertise and commitment to effective risk management, making you more competitive for roles related to vendor management, compliance, audit, and enterprise risk.

Q10: How long does it take to earn a Third-Party Risk Management certification?

The duration varies; some programs take a few weeks of study, while others may extend over several months depending on the certification and training format.