Section 29A of Insolvency and Bankruptcy Code- Explained

What is Section 29A of IBC?

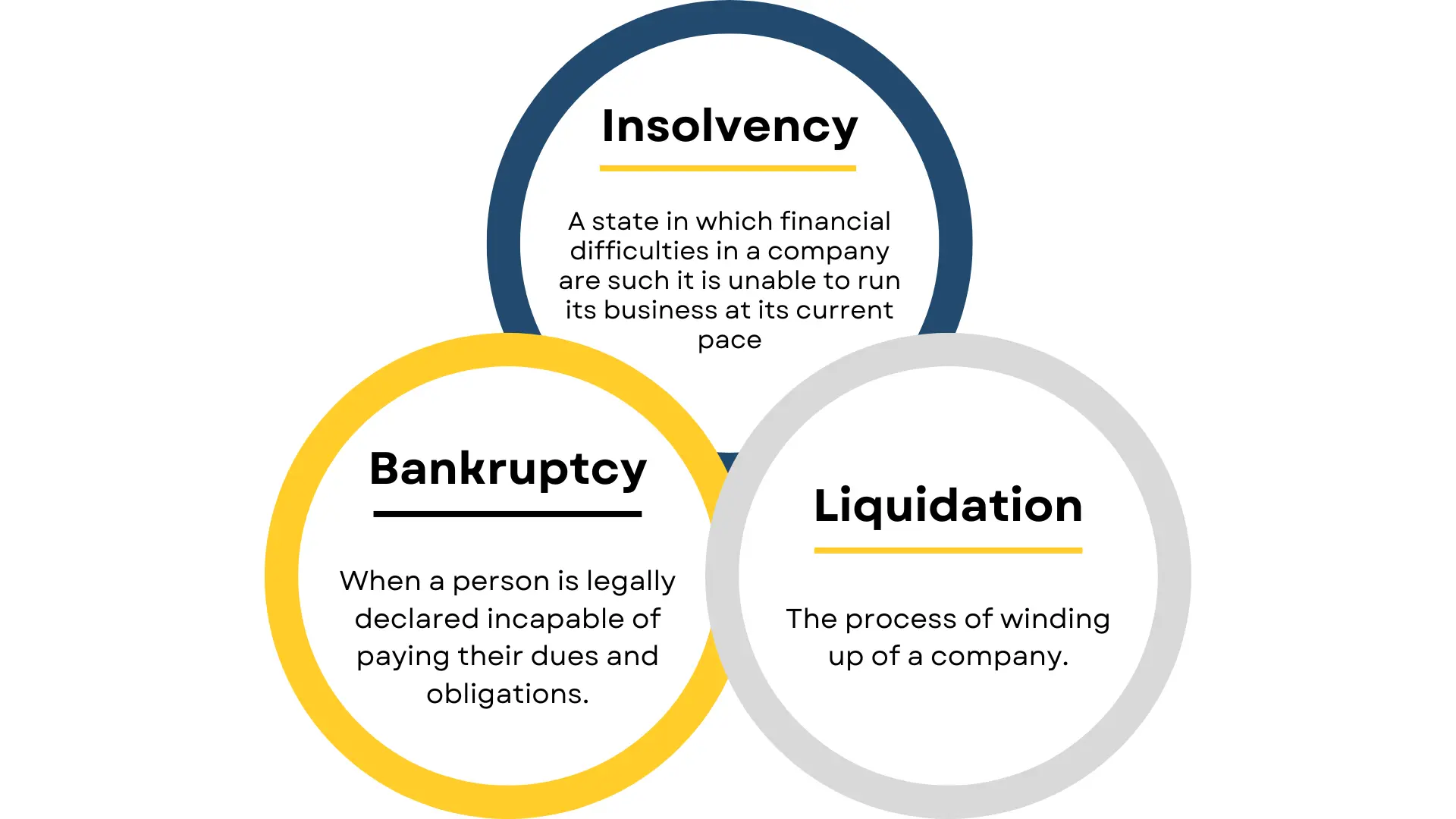

Insolvency laws were at the nascent stage in India when the Parliament enacted legislation named as Insolvency and Bankruptcy Code, 2016. It aimed to protect the interest of a person/company in insolvency/bankruptcy and for improving the ease of doing business in India.

Most of the matters on IBC are dealt with by the National Company Law Tribunal (NCLT) though SC is vested with an extraordinary constitutional jurisdiction under Article 142 of the Constitution of India to grant justice in any cause or matter pending before it. This jurisdiction is not available to other Tribunals or the High courts. However, the Supreme Court of India has been called multiple times to discuss the issues arising out of matters resolved under the IBC.

Section 29A is the most controversial section of IBC. It was amended multiple times to remove the errors. Section 29A talks about the conditions in which a person becomes ineligible to become a resolution applicant. This section has been discussed many times in the courts of law to interpret the section precisely and remove the irregularity and errors present in it.

Why Section 29A is important and what is its purpose?

The Indian Parliament enacted the landmark Insolvency and Bankruptcy Code, 2016 (Code) on May 28, 2016. One of the primary objectives of the Insolvency and Bankruptcy Code, 2016 (the “Code”) is to facilitate the adoption of a resolution plan for the corporate debtor.

The Code was introduced amid an alarming rise in nonperforming loans (NPLs) in the Indian banking industry and to address a highly fragmented and delay-prone legal regime relating to insolvency and stressed debt resolution. Since its introduction, the Code has undergone two rounds of amendments with the Government of India introducing ordinances followed by legislative amendments in November 2017 and June 2018, in light of the judicial pronouncements and industry experience.

Significantly, Section 29A was incorporated in the Code in November 2017, to curb the attempts by the recalcitrant promoters of insolvent companies to regain control of the company leaving creditors with a massive haircut.

Today, most litigation initiated under the IBC relates to Section 29A. The Section provides extensive disqualification criteria for resolution applicants enlisting those who shall not be eligible to submit a resolution plan under the IBC. The resolution plan is to serve as a benefit to not only the creditors but also to the already stressed corporate debtor.

The intention behind inserting Section 29A is to restrict those persons from submitting a resolution plan who could have an adverse effect on the entire corporate insolvency resolution process. This would also aid in adhering to the timelines outlined under IBC which were otherwise being hampered due to the exploitation of the loopholes in the bidding process.

It has been seen in recent times that the Adjudicating Authority in its few decisions has permitted the promoters to submit their resolution plan after the company has been declared insolvent.

Although, such decisions were highly praised by many scholars as they safeguarded the revival of the defaulting entity, however, authors certainly believe that this will subsequently dilute the intent and purpose of section 29A and will ultimately defeat the objective of this code.

Section 29A states that-

“A person shall not be eligible to submit a resolution plan, if such person, or any other person acting jointly or in concert with a such person—

Here the expression ‘acting jointly or in concert’ signifies two or more persons acting together as a group. In the case of ARCELOR MITTAL INDIA (P.) LTD. V SATISH KUMAR GUPTA, the Supreme Court laid down that, The expression “acting jointly” in the opening sentence of Section 29A cannot be confused with “joint venture agreements”. It does not mean that certain persons have got together and are acting “jointly” in the sense of acting together.

(a) Is an Undischarged Insolvent

An Undischarged Insolvent is a person/company that hasn’t gone through the Insolvency resolution proceedings. In layman’s terms, it means, a person/ company who has filed the petition of bankruptcy at the court of law and is still going through the insolvency proceedings is known as an undischarged Insolvent.

(b) Is a Wilful Defaulter

in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 (10 of 1949);

As per the Master Circular issued by RBI (under the Banking Regulation Act, 1949), A Willful Defaulter is a borrower – when he does not meet his obligations even when he can do so, not utilizes the funds for a specific purpose they have been availed for, siphons the funds neither for the purpose, they were availed for nor have it in another form of assets, dispose of the property or assets which were given for securing the loan without the knowledge of the lender, misrepresentation, and falsification of reports, and fraudulent transactions.

(c) An account of a corporate debtor

under the management or control of such person or of whom such person is a promoter, classified as a non-performing asset in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 (10 of 1949) [or the guidelines of a financial sector regulator issued under any other law for the time being in force,] and at least a period of one year has elapsed from the date of such classification till the date of commencement of the corporate insolvency resolution process of the corporate debtor:

This simply means that when an insolvent entity is unable to settle overdue amounts including interest and charges relating to the account before the submission of the resolution plan for one or more years, whose accounts are classified as Non-Performing Assets is ineligible to be a resolution applicant. In the judgment of Arcelor Mittal India Private Limited vs. Satish Kumar Gupta & Ors. the apex court interpreted this clause and analyzed the definition of “control” and observed that the expression ‘control’ in Section 29A(c), denotes only positive control.

Justice Nariman further quoted that:

“Section 29A(c) is a see-through provision, great care must be taken to ensure that persons who are in charge of the corporate debtor do not come back in some other form to regain control of the company without first paying off its debts.”

Thus, it’s clear that if any person wishes to submit a resolution plan acting jointly or in concert with other persons, classified as NPA(person or other persons happens to either manage or control or be promoters of the corporate debtor) and whose debts have been not paid off for a period of at least one year before the commencement of CIRP, becomes ineligible to submit a resolution plan.”

Provided that the person shall be eligible to submit a resolution plan if such person makes payment of all overdue amounts with interest thereon and charges relating to non-performing asset accounts before submission of resolution:

Provided further that nothing in this clause shall apply to a resolution applicant where a such applicant is a financial entity and is not a related party to the corporate debtor.

(d) Has been convicted for any offense punishable with imprisonment –

(i) for two years or more under any Act specified under the Twelfth Schedule; or

(ii) for seven years or more under any law for the time being in force:

Provided that this clause shall not apply to a person after the expiry of a period of two years from the date of his release from imprisonment:

Provided further that this clause shall not apply in relation to a connected person referred to in clause(iii) of Explanation I];

Any person who has been convicted for an offense is punishable with imprisonment for two years or more prescribed under the 12th Schedule to the IBC. A total of 25 laws are mentioned in the above-mentioned schedule consisting of Money laundering, Foreign Exchange, Pollution control norms, tax, Anti-corruption, and Securities market regulations.

Or for seven years or more under any law for the time being in force. This disqualification would be applicable to both Indian Laws and Foreign Laws. The disqualification will not apply to a person in a case where it has already been two years or more from his release from imprisonment.

Furthermore, the ineligibility is not applicable to “connected persons”, this definition has a broad spectrum including the holding company, subsidiary company, associate company or any related party of the proposed acquirer, its promoters, the acquirer’s board as well as the proposed management of the corporate debtor or its promoters. However, this condition would not be valid on a resolution applicant who is a financial entity and is not a related party of the corporate debtor.

(e) Is disqualified to act as a director under the Companies Act, 2013 (18 of 2013):

Under section 164(1) of the Companies Act, 2013, a director is disqualified if he turns out to be of unsound mind, Insolvent, His/her case is pending before the court on insolvency or unsoundness of mind, he/ she has been sentenced for 6 months of imprisonment for an offense involving moral turpitude, an order has been passed by the court/tribunal declaring him disqualified, he didn’t pay his calls on shares, he/she has been convicted of offenses dealing with related party transactions(under section 188 of Companies Act, 2013), he/ she is prohibited from acquiring Director Identification Number.

(f) is prohibited by the Securities and Exchange Board of India from trading in securities or accessing the securities markets;

Under Sections 3 and 4 of Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Markets) Regulations, 2003, every person is prohibited to buy, sell or deal in securities in a fraudulent manner, to defraud on the issue of securities, listed or proposed to be listed on a recognized stock exchange, dealing in securities fraudulently or by an unfair trade practice, etc. ( Mentioned in Section 3 and 4 of the Act).

(g) Has been a promoter or in the management or control of a corporate debtor

in which a preferential transaction, undervalued transaction, extortionate credit transaction, or fraudulent transaction has taken place and in respect of which an order has been made by the Adjudicating Authority under this Code:

Provided that this clause shall not apply if a preferential transaction, undervalued transaction, extortionate credit transaction, or fraudulent transaction has taken place prior to the acquisition of the corporate debtor by the resolution applicant pursuant to a resolution plan approved under this Code or pursuant to a scheme or plan approved by a financial sector regulator or a court, and such resolution applicant has not otherwise contributed to the preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction;

This ineligibility takes effect when the promoter(or in the management or control) of a corporate debtor is involved in Preferential transactions/Undervalued transactions/ Extortionate credit transactions/ Fraudulent transactions.

This sub-clause talks about a person who has positive control over a corporate debtor, only he/she can make the dynamic decisions stated in sub-clause (g), such as entering into preferential, undervalued, or fraudulent transactions. Therefore it’s clear that the expression ‘management or control’, works on the principle of ‘Noscitur a sociis‘. In simple words, it’s a rule used by courts in interpreting legislation by interpreting ambiguous words and understanding them with the words with which it is associated in the context.

(h) Has executed a guarantee in favor of a creditor

in respect of a corporate debtor against which an application for insolvency resolution made by such creditor has been admitted under this Code 5 and such guarantee has been invoked by the creditor and remains unpaid in full or part;

This ineligibility occurs when a person takes a guarantee for a corporate debtor who is Insolvent. This clause was discussed in the case of RBL BANK LTD. VS. MBL INFRASTRUCTURES LTD and it was held that- in the cases where a creditor has not invoked the guarantee or made a demand, the guarantee should not be prohibited. It means that no default in payment of dues has been made and therefore cannot be covered under sub-clause (h) of the Code.

Therefore this sub-clause has to be understood in the context of the objectives of the Code and Ordinance in general and not in their regular meaning or in the context of enforceability of the guarantee as a legal and binding contract.

(i) [Is] subject to any disability, corresponding to clauses (a) to (h), under any law in a jurisdiction outside India; or

In common parlance- any ineligibility arising from the above-mentioned clause in (i) will be effective under any law in India or outside the borders of India.

(j) Has a connected person not eligible under clauses (a) to (i)

As mentioned above, the term “connected persons” has a very broad ambit including the holding company, subsidiary company, associate company, or any related party of the proposed acquirer, its promoters, the acquirer’s board as well as the proposed management of the corporate debtor or its promoters. However, this condition would not be valid on a resolution applicant who is a financial entity and is not a related party of the corporate debtor. This explanation has been done by the apex court in the judgment made in Arcelor Mittal India Private Limited vs. Satish Kumar Gupta & Ors.

The affair has certainly not ceased and the question that is still in the heads is what’s going to be next? The Code is still at the initial stage and will need more interpretation before it gradually settles down. Lets just hope for better laws to be made and implemented for the development of the country.

Need for Section 29A

Section 29A was introduced in order to curtail a bar on the eligibility of the resolution applicant. Section 29A is a restrictive provision, that specifically lists down the persons who are not eligible to be resolution applicants. Section 29A in its entirety not only restricts promoters but also the people related/connected with the promoters.

However, the first version of sec. 29A was a little too rigid, and hence washed-out way too many categories from being resolution applicants.

Thus, to solve the problem a streamlined version of section 29A was introduced vide Notification dated 6th January 2020. Section 29A is now also relevant to the sale during liquidation, as well as sales outside the liquidation process, and participation in a scheme of arrangement during liquidation processes.

Nevertheless, Section 29A has excessively enlarged the scope of disqualification to the extent of drastically reducing the prospective resolution applicants based on what could be labeled as generalized criteria for disqualification wherein it does not differentiate between a genuine applicant and one with antecedents.

A similar view was expressed by the National Company Law Tribunal (“NCLT”) in the matter of RBL Bank Ltd v. MBL Infrastructure Ltd wherein it was expressed that it cannot be the intention of the legislature to disqualify the promoters as a class but to rather exclude those class of persons who may affect the credibility of the resolution process given their antecedents.

Upon commencement of the resolution process under the Code, the Board of Directors of the company stands immediately suspended and its powers and rights are vested in and exercised by the Insolvency Professional. Also, while the directors are entitled to attend the meetings of the Creditors Committee, such directors have no voting rights and neither are their recommendations binding on either the resolution professional or any member of the Creditors Committee.

However, recently the NCLT, Mumbai Bench, in a matter of Wig Associates Private Limited gave a ruling that completely disregarded the wordings of Section 29A by allowing the resolution plan offered by an applicant who was related to the director(s) the company of Wig Associates which had applied to Section 10 of IBC, triggering CIR Process against itself in August 2017.

It appeared, at that time that Bank of Baroda, being the sole financial creditor, and Wig Associates reached a one-time settlement with Mr. Mahindra Wig for the settlement of outstanding amounts.

To comply with the provisions of IBC, Mahindra Wig offered a resolution plan which was approved by the Bank of Baroda, which was later submitted following an Expression of Interest (EOI) floated in April 2018, after the IBC Amendment Act, 2018/Ordinance was passed.

Need to encourage restructuring rather than liquidation

The Insolvency and Bankruptcy Board of India (IBBI) has amended the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016, and the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016.

Under the amendments introduced to the liquidation process regulations, ineligible persons are now barred from being part of any compromise or arrangement at the stage of liquidation.

Furthermore, a secured creditor who chooses to sell secured assets independently also cannot sell the same to a person who is ineligible under the IBC. This has been introduced to specifically overrule the decisions passed by some NCLTs, whereby it was held that no bar operated on the sale of secured assets to the ex-promoters of the Corporate Debtor if such sale is carried out by a secured creditor under Section 52 of the IBC.

Since many believe that genuine promoters will become ineligible and there will be no competition between acquirers/ bidders and promoters and due to which creditors will not receive adequate consideration.

Owing to the uproar created by the Ordinance, the government is considering revisiting blanket restrictions provided under the ordinance and is expected to announce certain relaxations to the ‘harsh’ eligibility requirements for the bidders (i.e. the resolution applicants).

After the moratorium period commences, the RPs take charge of the debtor company with the sole objective of protecting its assets and fundamental operations. It is a one-man show that runs the affairs of the debtor company. The amendment has been introduced to fill in the gaps in the insolvency law in India.

It clarifies the position of the promoters and management of the corporate debtor in the process of insolvency and liquidation. It removes the contradiction between IBC and the Act.

29A Eligibility Automation Solution – SignalX

SignalX’s 29A Eligibility Check Automation solution is custom-built to help Insolvency Professionals analyze RA’s, discover connected parties, establish CD/RA independence and analyze CDs.

SignalX uses advanced Machine Learning technologies to automate comprehensive due diligence on any given target. You can run automated Section 29A checks on any given target and their related parties on SignalX.ai

Take a Tour of Our Section 29A Solution

Book a free live demo and see how SignalX automates Section 29A investigations with speed, accuracy, and compliance.

FAQs

1. What is Section 29A of the Insolvency and Bankruptcy Code (IBC)?

Section 29A is a provision that lists the types of people and entities who are not allowed to propose a resolution plan in insolvency proceedings. It was introduced to ensure that those responsible for mismanagement or defaults cannot take control of distressed companies again.

2. Who is disqualified under Section 29A?

A person may be disqualified if they are a wilful defaulter, have been convicted of certain offences, are disqualified as a director under the Companies Act, or are linked to companies with overdue non-performing assets.

3. Can promoters participate in resolution under Section 29A?

Promoters can sometimes participate if they first settle their dues or meet specific legal conditions. Courts have also clarified situations where promoters may regain eligibility.

4. What does the term “connected persons” mean under Section 29A?

Connected persons include promoters, directors, relatives, or business entities with significant control or influence. This ensures that indirect connections do not allow ineligible applicants to bypass restrictions.

5. Are there any exceptions to Section 29A restrictions?

Yes, certain exceptions apply. For example, regulated financial institutions are often exempt, and in some cases, amendments or court rulings have provided relief to specific applicants.

6. Have there been recent changes to Section 29A?

Yes, amendments and judicial interpretations continue to refine the scope of Section 29A. These updates have provided more clarity on terms like “control” and “management” and have outlined limited relaxations in eligibility.

7. How can I check if a resolution applicant is eligible under Section 29A?

Eligibility involves checking multiple criteria such as wilful default status, disqualification records, and NPA history. To simplify this process, SignalX offers detailed due diligence reports that help financial institutions and legal teams quickly confirm Section 29A compliance.

8. What does Section 29A(c) say about non-performing assets (NPAs)?

This clause disqualifies applicants who were promoters or in control of companies with loan accounts that remained non-performing for more than a year before insolvency proceedings began. SignalX’s financial analysis tools can highlight these NPA linkages, reducing risk during the resolution process.

9. Does being a wilful defaulter always make someone ineligible under Section 29A?

Yes, being identified as a wilful defaulter generally leads to automatic disqualification, although courts may review the circumstances and due process involved in the classification.

10. How have Indian courts interpreted Section 29A?

Courts have played a key role in shaping the application of Section 29A. They have clarified the meaning of terms like “control” and “management,” and in some cases, allowed promoters to reapply once dues are cleared.