Debt Recovery & Insolvency: A Guide to Resolution

Importance of Debt Recovery Tribunals (DRTs)

Insolvency describes a situation when an individual, company, or any other organization is unable to fulfill the financial obligations arising from a transaction. Bankruptcy is different from insolvency as it is a determination of insolvency made by a court of law with resulting legal orders intended to resolve the insolvency, while Insolvency occurs when the debtor is unable to pay off his/her debts as they become due.

Given the COVID-19 pandemic and a nationwide lockdown in force, it is imperative to address the central issues facing by the economy and to present the role of insolvency and bankruptcy law for the recovery of debts of banks and financial institutions and for matters connected therewith or incidental thereto.

The legal and institutional machinery of India while dealing with debt defaults, has not been in line with global standards and several attempts were made to improve the existing condition. However, the modifications had not kept pace with the shift in the Indian economy. The recovery action by creditors, either through the Indian Contract Act, 1872 or through the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (RDDFBI ACT) and the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFESI ACT) has not had desired outcomes. Efficacious insolvency law is necessarily required for the reorganization or liquidation of insolvent entities. The objective behind the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC) was to encourage entrepreneurship and maintain the interests of all stakeholders by blending and amending the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms, and individuals in a time-bound manner and for maximization of value of assets of such persons and matters connected therewith or incidental thereto. The Insolvency and Bankruptcy Code, 2016 (IBC) is the umbrella law for insolvencies and reorganizations in India. This article seeks to clear the ambiguity and the confusion, related to the debt recovery and insolvency regimes.

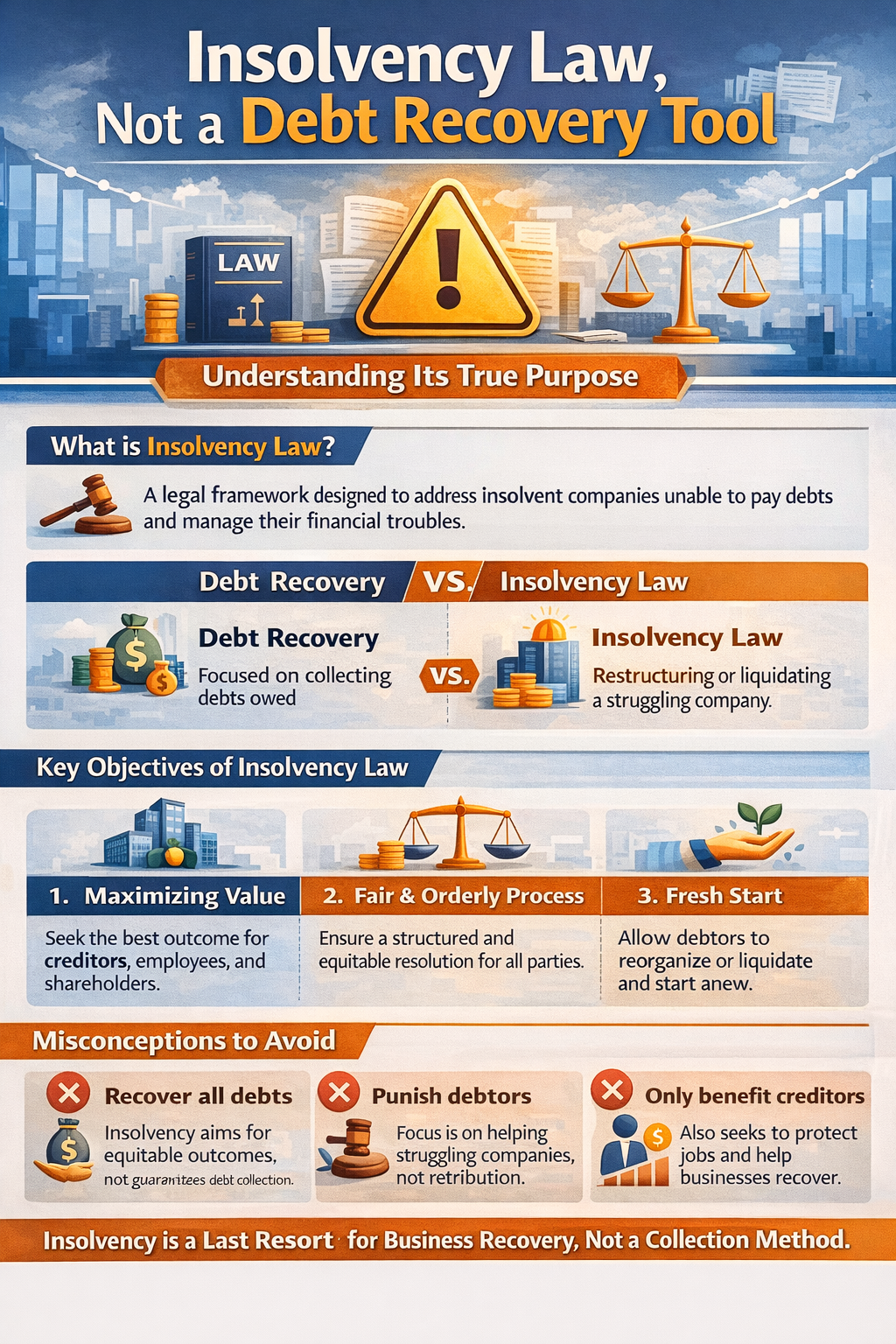

Insolvency law, not a debt recovery tool

It is generally acknowledged that insolvency proceedings are a collective debt collection mechanism through which an insolvent debtor’s assets are pooled together for the benefit of all the creditors, some creditors have over the years been using insolvency proceedings to collect their debts. NCLT has an important role in inhibiting the transformation of insolvency law into debt recovery proceedings. The inability to pay debts is the primary reason why a creditor may choose to invoke insolvency proceedings against a debtor, and for individual debtors, it is the only ground upon which a debtor may be declared bankrupt.

Insolvency proceedings are not meant to coerce or threaten a debtor to pay. The law has been enacted for reorganization and insolvency resolution of the corporate debtor. Its goal is to maximize the value of assets, promote entrepreneurship and the availability of credit, and balance the interests of all stakeholders. It is meant to prevent the inequitable distribution of available assets to one or a few aggressive creditors to the detriment of the debtor and other creditors. Otherwise, assertive and resourceful creditors will extract their pound of flesh and leave the debtor bleeding to death by eliminating any prospects of its revival. Its use for debt collection by individual creditors is a gross misuse of the legislation.

There are many options provided for applicants to use insolvency proceedings as a tool against wilful defaulters. Firstly, insolvency proceedings are cheaper as the fee for filing an insolvency petition under the Code by an operational creditor is just a meager sum of 2,000, irrespective of the value of the debt. For ordinary recovery procedures, the fees are dependent on the value of the debt. Secondly, the debtor can delay actual execution through appeals. This is not common in insolvency proceedings. Finally, the threat of commencement of insolvency forces the debtor to settle with the creditor, as insolvency proceedings negatively impact on the debtor’s business prospects.

The NCLT or “Tribunal” handles corporate civil disputes arising under the Act. NCLAT or “Appellate Tribunal” is an authority that deals with appeals arising out of the decisions of the Tribunal. It is formed for correcting the errors made by the Tribunal. However, Debt Recovery Tribunals (DRTs) facilitate the debt recovery involving banks and other financial institutions with their customers. Appeals against orders passed by DRTs are dealt by Debts Recovery Appellate Tribunal (DRAT). DRTs can take cases from banks for disputed loans above Rs.10 Lakhs. Currently, there are 33 DRTs and 5 DRATs functioning in various parts of the country. Corporate bodies can approach the NCLT for winding up or liquidation of their debtor’s company besides filing a recovery suit under Order 37 of the Civil Procedure Code in the Debt Recovery Tribunals. DRTs are not equipped to deal with complex questions of law and evolving methods and techniques of committing fraud. Insolvency and Bankruptcy Code give powers to DRTs to consider cases of bankruptcy from individuals and unlimited liability partnerships

Insolvency and Bankruptcy Code, 2016 also prevails over the SARFAESI Act, 2002. In the case of Canara Bank v. Sri Chandramoulishvar Spg. Mills (P) Ltd., the NCLAT while referring to Supreme Court’s verdict in the Innoventive case has ruled that when two proceedings are initiated, one under the Insolvency and Bankruptcy Code, 2016 and the other under the SARFAESI Act, 2002, then the proceeding under the I&B code shall prevail. The Court observed in the case of Swiss Ribbons Pvt. Ltd. & Anr. vs. Union of India & Ors., that the Code is not a recovery tool for creditors but is a resolution mechanism used by corporate debtors. The code has a primary focus to ensure the revival and continuation of the company by bifurcating the interests of the company from its management.

The aim of the insolvency law is to maximize return to creditors through a collective debt collection mechanism by pooling together of a debtor’s assets. Creditors make recovery either by a restructuring of the debtor’s business or by its quick liquidation where revival is not feasible. Returns or assets are distributed amongst creditors under insolvency waterfall rules. Insolvency proceedings are meant to avert the problems associated with individual creditors separately rushing to recover their debts and the concomitant waste caused by such actions against an already distressed debtor. High Court of Allahabad, has recently barred parallel proceedings in the National Company Law Tribunal (NCLT) and the Debt Recovery Tribunal (DRT) in the case of State Bank of India vs. M/s LML Limited and others.

From the above analysis, it is evident that although insolvency proceedings are generally believed to be collective and meant to benefit the entire body of creditors, it is undeniable that there is a growing belief that these proceedings can also be used as a debt collection strategy by individual creditors, and despite the risks associated with it, there is every reason for all result-oriented debt collectors to deeply think of insolvency proceedings as the possible weapon against the capable but stubborn defaulters. The judges have the duty to decide whether or not the petition is lawfully before the court, and not to determine the legitimacy of one’s choice of procedure.

About SignalX’s 29A Eligibility Automation Solution.

SignalX’s 29A Eligibility Check Automation solution is custom built to help Insolvency Professionals analyze RA’s, discover connected parties, establish CD/RA independence and analyze CDs. Take a tour of our 29A solution by booking a free live demo today.