In the complex yet crucial world of mergers and acquisitions, due diligence serves as a compass, guiding buyers(& sellers) through a sea of obligations, potential liabilities, contracts, and other key elements. It’s the process that ensures buyers truly understand what they’re acquiring, from the financial health of the company to the nature of the seller’s contingent liabilities, and even intellectual property considerations.

However, a poorly executed due diligence in mergers and acquisitions can lead to unwelcome surprises post-transaction, such as previously undisclosed litigations and liabilities or compliance fraud or labor law violations.

Hence, having a robust due diligence process not just a precautionary measure any more, but a strategic tool that enhances decision-making by providing high-quality, relevant information.

The primary objective of due diligence in mergers and acquisitions is to validate and verify the seller’s critical information, including financials, contracts, and compliance standards.

What is Due Diligence in Mergers and Acquisitions?

Due diligence in mergers and acquisitions is the process of investigation, inquiry, and verification of a potential investment to examine aspects like corporate structure, supply chains, litigation, licenses, finance, and employment through a microscopic lens. “

Due diligence” resulted from the U.S. Securities Act, 1993 which shifted responsibility onto securities dealers and brokers to make sure that full disclosure of the information is revealed to all potential investors related to the securities or instruments that they were selling.

During the due diligence process, research is conducted to make sure that all relevant facts and financial information are correct and to verify anything else that was brought up during an M&A deal or investment process before entering into a financial transaction or agreement with another party.

Perform a comprehensive Financial Due Diligence on your targeted party. Download our Financial Due Diligence Checklist to get started today.

Why is it important to conduct due diligence in mergers and acquisitions?

Due diligence in mergers and acquisitions is important to clearly understand the current financial condition of the company along with internal control regulations and operations management.

Due diligence services are essential for any merger or acquisition situation as they provide the buyer with insight into a target firm’s operations and inner workings. Due to the complex nature of mergers and acquisitions, the due diligence process can last several weeks or maybe months.

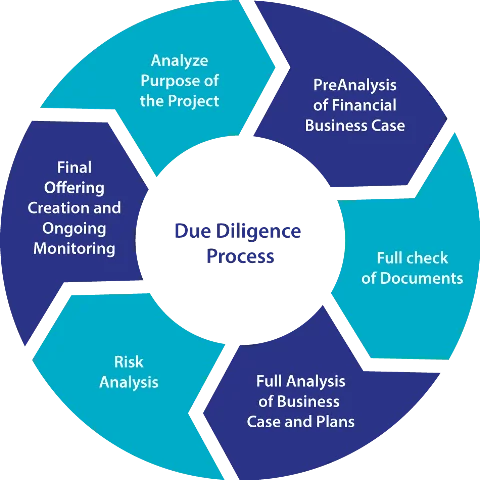

The first step of the process involves collecting information, then quantifying the liabilities, identifying contractual impediments, and finally, verifying the accuracy of business aspects.

The process is time-consuming but is crucial for any M&A transaction, which not only assists the investor in understanding the extensibility of the potential investment but also helps the seller in the true valuation of its business.

Due diligence in mergers and acquisitions is essentially an effective way for buyers to protect themselves from risky business deals. As the process requires a great amount of communication between the two parties, the businesses are also able to form a working relationship.

A structured due diligence process can also help management assess the likelihood of the success of the transaction, and limit surprises during and post transaction period.

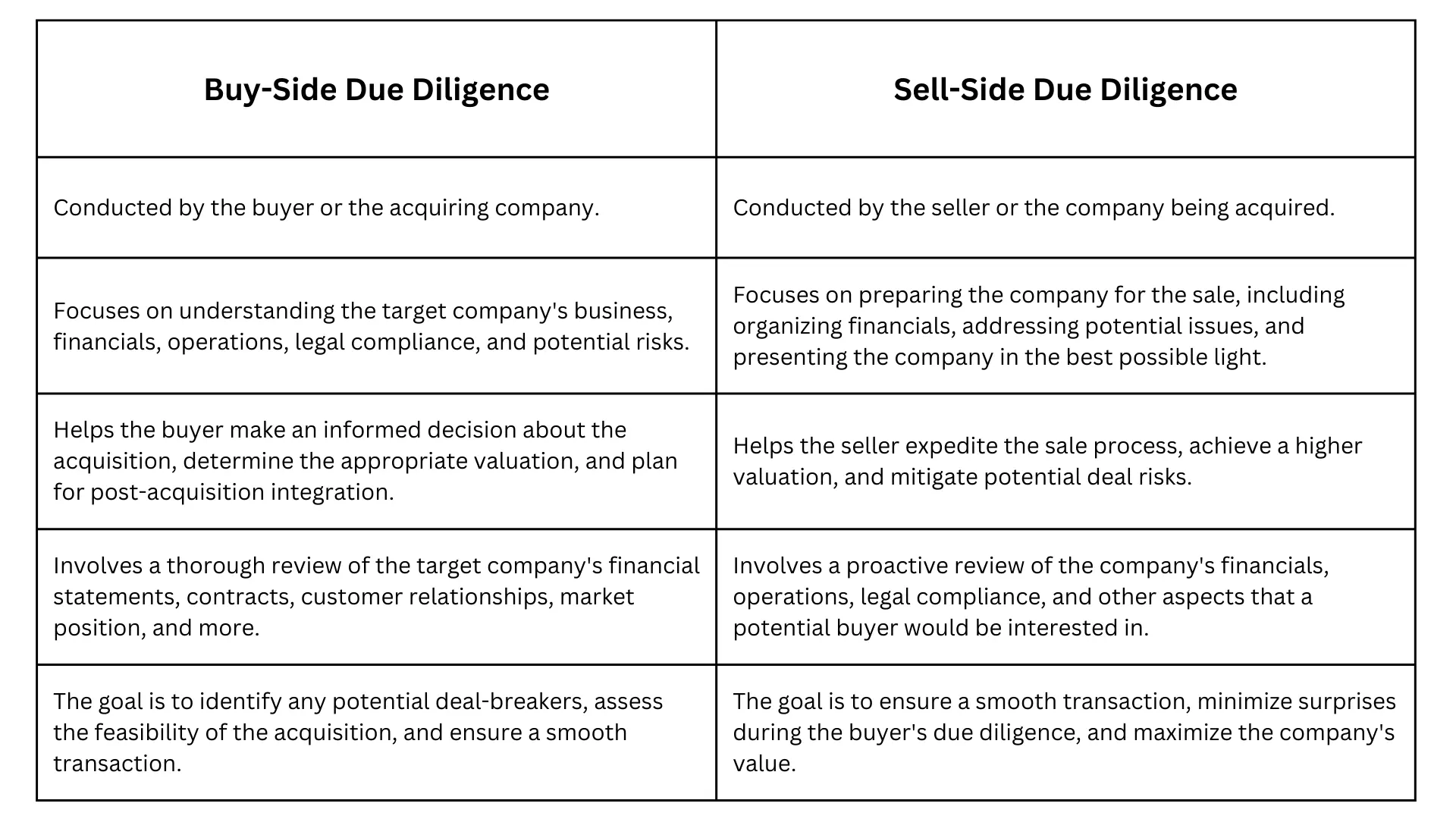

Due Diligence in Mergers and Acquisitions – Buy side vs Sell side

Objective of performing Due Diligence in Mergers and Acquisitions

The objectives are multifaceted and crucial for the success of the deal. Here’s a subjective take on the objectives of performing due diligence in mergers and acquisitions deals.

- One of the primary objectives is to ensure compliance with relevant laws and to uncover any regulatory constraints that might limit the proposed transaction or in a word can be a potential deal-breaker. This involves a thorough legal review to avoid any potential pitfalls down the line.

- A critical aspect of due diligence is evaluating the condition of the physical infrastructure and equipment, along with other tangible and intangible assets. This helps in understanding the true value of the company and any additional investments that might be required post-acquisition.

- Determining the appropriate purchase price and the method of payment is another key objective involved in this process. This requires a comprehensive financial analysis to ensure that the deal is financially viable and beneficial for both parties.

- Verifying important details that could significantly impact the drafting of the acquisition agreement is also crucial. This includes understanding the terms and conditions of existing contracts, obligations, and liabilities.

- As said in the first point, identifying any potential deal-breakers is an essential part of due diligence as it uncovers any hidden liabilities or risks or even future threats that could jeopardize the success of the deal.

- Examining potential antitrust issues is another important objective. This is to ensure that the proposed M&A does not violate any antitrust laws, which could lead to legal complications and penalties.

- Lastly, assessing the legal and financial risks of the transaction is vital. This helps in understanding the potential challenges and risks involved in the deal and devising strategies to mitigate them.

Key Considerations to Put on Your M&A Due Diligence Checklist

- Financial Health Checks:

In an M&A deal, it’s crucial to assess the financial health of the target company. Companies with stressed liquidity carry the risk of becoming insolvent or bankrupt, which could jeopardize the deal. As part of your due diligence, request the target company to provide their last three-year turnover.

This will help you gauge potential insolvency issues. Validate the provided data by examining their balance sheets from the MCA using the registered business name. In M&A transactions where business solvency is a key risk, validating company financials with data available on MCA is essential.

- Litigation Checks:

Highly litigious entities are always a red flag. As a part of due diligence in mergers and acquisitions you must request your counterparty to declare any ongoing litigations that could have a material impact on your engagement. You can validate this data by running your query on the ecourts website of India, and separately on key tribunals. Litigation checks are better done by a legal analyst, and easiest performed on SignalX. Courts and Tribunals are a lengthy list with noisy data.

Automation enables us to cut through the clutter and identify relevant litigations in no time. There have been instances where firms admitted for insolvency proceedings have bid for vendor engagements. Litigation checks surface such critical risks. Firms with dubious litigations or criminal charges against their promoters have to be dealt with caution.

- Tax Compliance Checks:

The GST portal(or by using SignalX’s GST verification tool)makes it possible for you to check how compliant the counterparty is when it comes to filing his monthly GST returns. Companies with poor filing history could impact your ability to claim tax credits on time.

Severe defaults in GST filings will inevitably land the counterparty in trouble and can make him insolvent. This comes with the added headache for you of not being able to claim tax credits for the payments made to the vendor.

- Headcount Checks:

Understanding the operational capacity of the target company is a crucial part of conducting due diligence in mergers and acquisitions. Request the company to declare its current headcount to gauge its operational bandwidth.

Validate this information using LinkedIn by checking the number of employees on the company’s page, or by running a query on the Labor Department’s website using the company’s Corporate Identification Number. This also ensures that the target company has legitimate ongoing operations and is not a shell company.

- Reputation Checks:

A customer reference and a cursory check on any search engine help you identify any reputational risks that may be of concern with the target company. It is also important for the customer reference to be that of a non-related party. You can verify this by checking for related companies from the MCA or on SignalX.

Conclusion

In conclusion, due diligence in mergers and acquisitions is a comprehensive, multi-faceted process that serves as a critical compass guiding the journey of a potential deal. It’s a strategic tool that enhances decision-making, mitigates risks, and ensures a smooth transaction from the end of both parties.

However, performing a robust due diligence process can be complex and time-consuming. With a ton of data to analyze and profiles to screen, it becomes a tiresome work for companies that can last for months.

This is where we come into play. As a comprehensive automated digital due diligence platform, SignalX.ai offers a suite of checks including financials, litigations, ownership structures, business history, tax compliance, market reputation, and much more. It helps you identify red flags early on and fast-track deal cycles.

We are considered as the most comprehensive risk intelligence platform in India. Get in touch with us to make your due diligence process automated and streamlined. Click below to download a Sample Report or schedule a call with us to get started.

Frequently Asked Questions

What is legal due diligence in mergers and acquisitions in India?

Legal due diligence in mergers and acquisitions in India involves performing evaluation and analysis of the target company’s legal matters. It includes examining corporate structure, contracts, litigation, regulatory compliance, intellectual property, and real estate. The goal is to identify legal risks that could impact the transaction and to understand the company’s legal obligations and liabilities.

What are the four phases of M&A?

The four phases of Mergers and Acquisitions (M&A) are:

Pre-acquisition Review: This is the initial phase where the buyer scouts for potential target companies based on strategic fit. Preliminary assessments are made, and non-binding letters of intent may be exchanged.

Due Diligence: Once a target is identified, a detailed investigation is conducted to verify the target company’s financials, operations, legal compliance, and other key factors. This helps in identifying any potential risks or liabilities.

Acquisition Agreement: After due diligence, the terms of the deal are negotiated and formalized in a definitive acquisition agreement. This document outlines the specifics of the transaction, including the purchase price, payment method, and any conditions that must be met.

Post-acquisition Integration: After the deal is closed, the process of integrating the target company begins. This involves merging operations, systems, and cultures. The success of the M&A often depends on how well this phase is managed.

What is the due diligence stage in M&A?

The due diligence stage in Mergers and Acquisitions (M&A) is a critical phase where a thorough investigation of the target company is conducted before the deal is finalized. This process involves a comprehensive review of the company’s financials, operations, legal matters, and other key aspects. The goal is to identify any potential risks, liabilities, or issues that could impact the transaction. It provides the buyer with a clear understanding of what they are acquiring and helps them make an informed decision.