A Guide to perform MSME search on your vendors

Businesses may want to search their vendors to ascertain their MSME registration status for accurate and timely MSME Returns filing. Whether you’re a business owner, a compliance officer, or a procurement specialist, understanding the MSME registration status of your vendors is crucial for accurate MSME search Returns filing and CARO disclosures.

This blog will walk you through the various methods for performing an MSME Search for your company, including MSME Search by GST Number, MSME Search by PAN Number, and MSME Search by Company Name.

Importance of performing a MSME Search on your vendors –

There are many reasons why businesses may want to perform MSME checks on their vendors and suppliers. Such two cases are –

- During the course of engagement with the customer, the vendor’s MSME posture may change. At the start of the engagement, they may have been an MSME but may have moved out of the criteria due to turnover exceeding the limits. It is necessary to identify the latest posture of the party so that accurate interest provisioning can be performed and benefits can be extended.

- The party may have registered as an MSME post onboarding with the customer. At the time of the vendor registration, the vendor may not have been registered as an MSME, however post onboarding, the party may have registered as an MSME. We have seen many instances where the vendor may not proactively reach out to inform the customer but simply mention the Udyam number on the invoice. Once the party mentions the MSME number on the invoice, the customer is liable to extend the benefits.

Therefore it is essential that the business runs a half-yearly MSME check on its vendor base to ascertain the latest posture of the vendor for accurate MSME Returns compliance and CARO disclosures at the end of the Financial Year.

Often the challenge is the businesses may not have a record of MSME Udyam Numbers of the vendors documented. However, there are solutions for this problem. MSME check can be performed on your vendor base in any of the following ways.

Run MSME Status Check on your list of Vendors.

Upload bulk PAN or GST of your vendors and identify the MSME status along with Udyam Number.

Request a Quote Today

How to Conduct an MSME Search: Multiple Avenues

MSME Search by Udyam Number

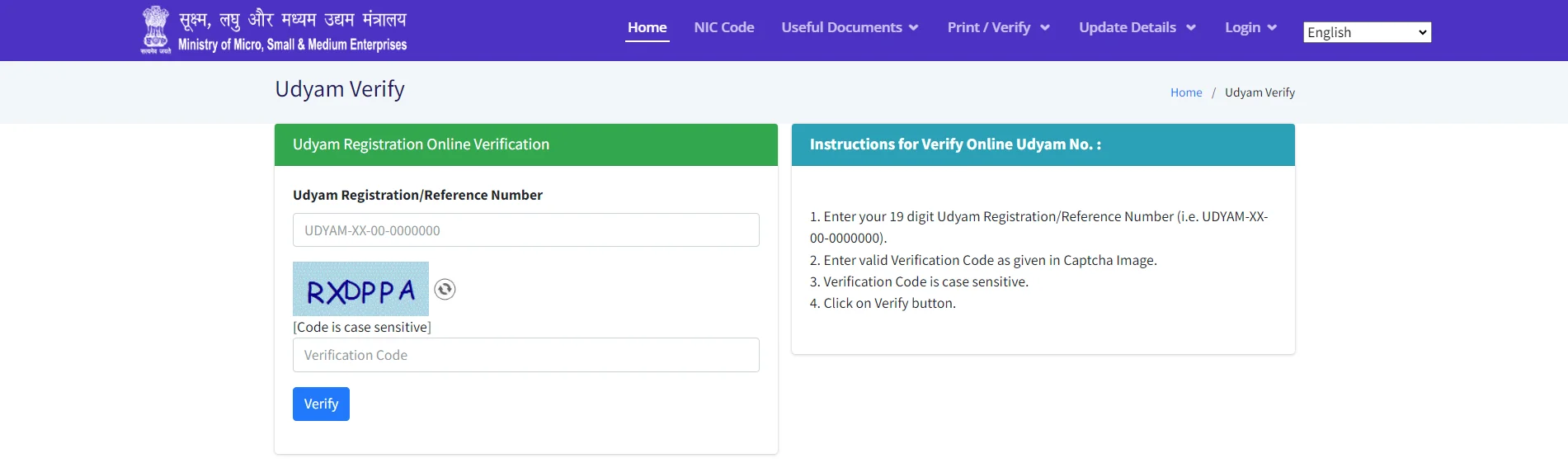

Checking the MSME registration details of a party through their Udyam Number is the simplest. Once you have a UAM number, you can do the following steps to execute an MSME search by Udyam number.

- Visit MSME website and access the search functionality using the following link:

- https://udyamregistration.gov.in/udyam_verify.aspx

- Enter the 19 digit URN of the MSME in the search box and solve the captcha.

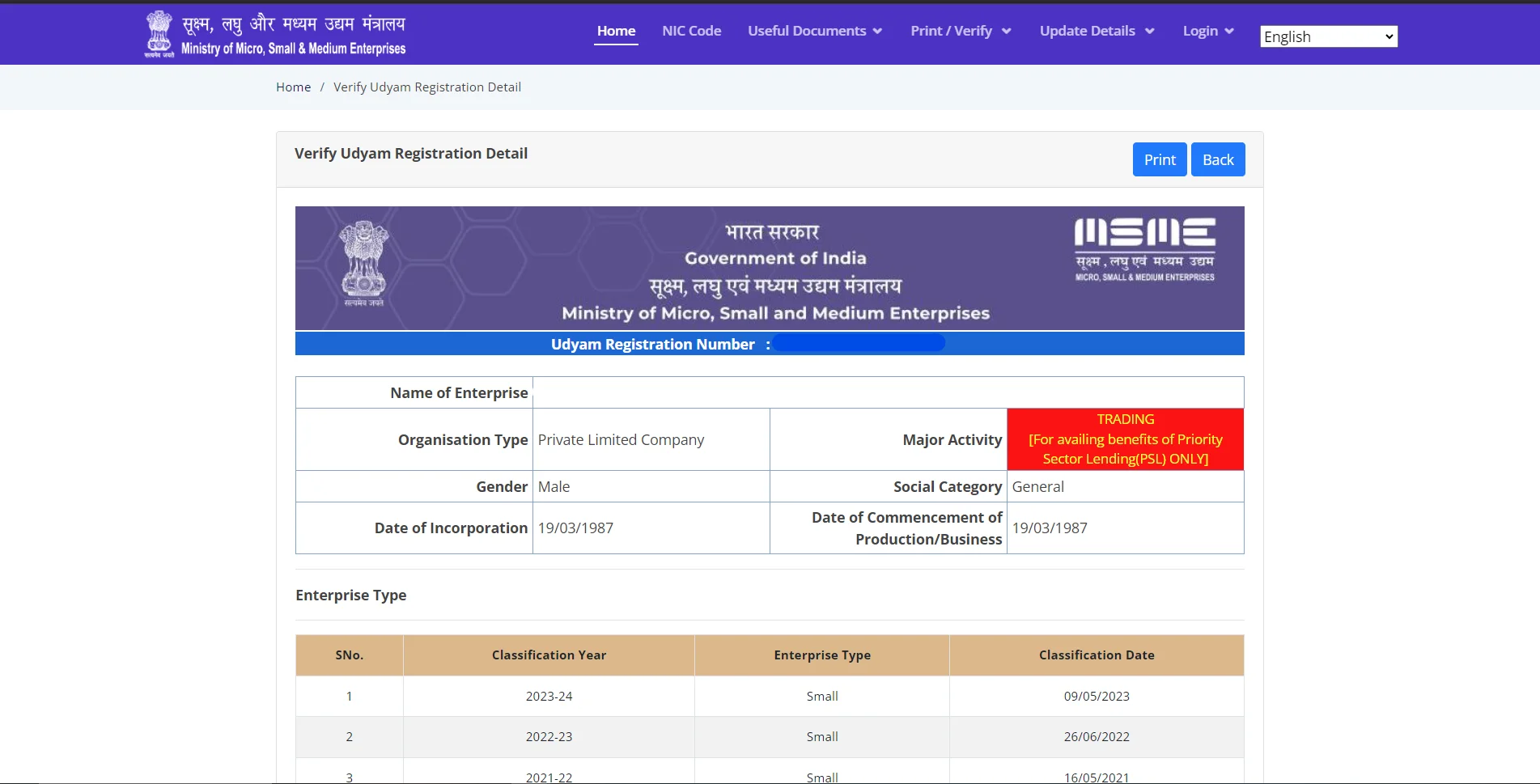

- View the MSME registration status of the target.

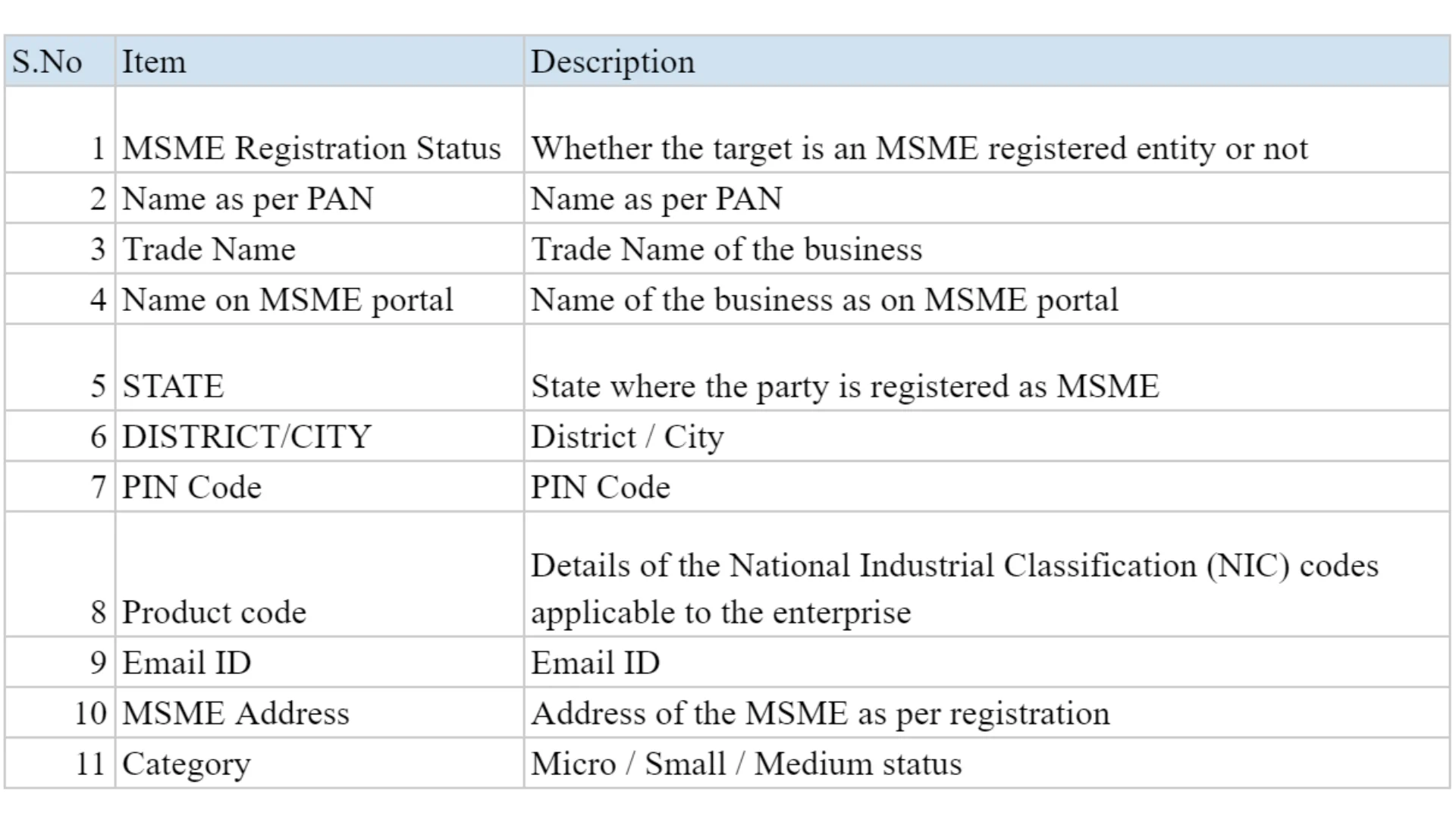

Doing MSME search in bulk through Udyam Number is going to be a laborious exercise. SignalX’s MSME search and verification solution simplified this process. You can provide a list of Udyam numbers in a CSV file and get the following details against each Udyam number.

MSME Search by PAN Number

Many times, businesses do not have the Udyam Numbers of their vendors. Also there may be instances where a party may not be MSME registered but has become MSME registered during the course of the engagement. However there is a way to perform MSME search by PAN number through SignalX’s MSME verification solution.

Provide a list of PANs to SignalX. SignalX will provide the MSME registration status of the MSME against each PAN as to the status of registration as on date. The MSME registration portal provides the registration status when you attempt to register through a PAN number. SignalX’s automated due diligence application queries each of the given PAN number in the MSME registration form to check for existence of MSME registration against the given PAN.

Once a PAN is positively identified as registered as an MSME, then the SignalX database of due diligence reports and business profiles can be used to identify the MSME number of the given entity corresponding to the PAN. As a due diligence and risk assessment tool, SignalX is used by enterprises to screen vast supply chains and trade partners. Over the years, SignalX database covers key business parameters of hundreds of thousands of entities which can be leveraged to identify MSME numbers of businesses already profiled by SignalX.

MSME Search by GST Number

MSME search by GST number is the same process as checking by PAN. Based on the GST number, the PAN number of the entity can be acquired. An entity may have multiple GSTINs but all of them will correspond to a single and unique PAN. Based on GST numbers, PAN is identified by SignalX. The input can be provided in a spreadsheet format and the output can also be sourced in a spreadsheet format.

Once a PAN is positively identified as registered as an MSME, then the SignalX database of due diligence reports and business profiles can be used to identify the MSME number of the given entity corresponding to the PAN.

MSME Search by Product or NIC

The MSME database provides a list of MSMEs offering specific services and products. This database can be accessed in the following ways.

- Visit MSME Website and go to https://udyamregistration.gov.in/searchregistration.aspx

- MSME vendors search can be done with the following three data points. State, District and the description of the product. You had the option to select ‘All’ against the district option.

- Once you submit this information, the portal provides data on a list of NIC codes that are relevant to the product you are looking to source. Against each NIC code, you are also given a list of MSMEs that are offering that product or service in the specified region.

MSME Search by Company Name

If only a vendor name and address is available, SignalX can be used to perform a GSTIN number identification against the business name. SignalX does this exercise by performing a name and address match on the GST records to identify GSTINs that have an exact match.

Once a GSTIN is acquired on the basis of the Company Name from the GST database, the PAN number of the entity can be derived. Once the PAN is derived then MSME search by PAN can be executed as described in the first point.

The inputs provided to SignalX can be the list of Company Names and Addresses to execute an MSME check. SignalX can provide the output in the format of a CSV with MSME registration status against each and MSME numbers against each of the companies positively identified as MSMEs.

Conclusion:

The MSME status of your vendors isn’t just a static data point but a dynamic variable that can significantly impact your compliance and financial planning. Regularly performing an MSME search isn’t merely a box to tick off; it’s a strategic necessity. By leveraging tools like SignalX, you can automate this crucial task, ensuring that you’re always in step with your vendors’ current MSME status.

This proactive approach not only safeguards you against compliance risks but also enables you to extend timely benefits to your vendors, fostering a more transparent and mutually beneficial business relationship.

Frequently Asked Questions

-

How can I verify a vendor’s MSME registration using Udyam number?

If you have a vendor’s Udyam Registration Number (URN), you can directly use the official Udyam portal or a verification tool like SignalX to check their current MSME registration status and view their enterprise classification.

-

What methods can I use to check MSME status using PAN or GST number?

You can provide a vendor’s PAN or GSTIN to the MSME portal or use a vendor verification service. These tools map the PAN/GSTIN to the Udyam database and return whether the entity is registered, along with its Udyam number.

-

Is it possible to verify MSME status of many vendors in bulk?

Yes. You can upload a CSV with multiple PANs, GSTINs, or Udyam numbers and receive batch verification results all showing MSME status and registration numbers where applicable.

-

Why should businesses perform MSME searches on vendors regularly?

Vendor MSME status can change due to increase in turnover or changes in registration. Regular checks ensure correct compliance, accurate Returns filing, and avoid penalties or incorrect interest obligations.

-

What are the new MSME classification thresholds in India?

India’s updated MSME regime defines thresholds for micro, small, and medium enterprises based on investment and turnover. These classifications determine eligibility for benefits and vendor status important to know when verifying.

-

How does SignalX simplify the MSME search process for vendors?

SignalX offers tools to upload vendor lists (PAN/GSTIN/URN), perform bulk MSME searches, and deliver paged results with relevant registration details making validation fast, accurate, and easy.

-

What information is returned when verifying vendors by business name?

When you search by company name, the verification may return matching GSTIN or PAN, the Udyam number, enterprise type (micro/small/medium), registered address, and product or service classifications.

-

What is NIC code based MSME search by product or service?

NIC (National Industrial Classification) codes categorize business activities. You can search MSMEs by selecting state/district and product/service description; the system returns NIC codes and businesses offering those services in that region.

-

How do vendor MSME searches tie into MSME Returns & CARO disclosures?

Companies filing MSME Returns or making CARO disclosures must document their payments to MSME vendors. Having accurate, up-to-date MSME verification helps in correct financial reporting and regulatory compliance.

-

Which businesses typically need to verify vendor MSME status?

Compliance officers, procurement teams, finance departments, and any business that sources from many vendors or participates in government procurement are most likely to require routine MSME status checks.