Related Party – Definition and Concept

The term Related Party is given under Section 5(24) of the Insolvency and Bankruptcy Code. The Code describes it as a commutative relationship between the related party and the corporate debtor. Earlier, there was no definition regarding Related Party in the Code but this was brought by the Insolvency and bankruptcy code (Amendment) Ordinance, 2018. So, at that time the definition of Related party given under the Companies Act, 2013 was followed.

The legislation regarding Related Party is given under the Insolvency and Bankruptcy Code, Companies Act, SEBI LODR regulations, Indian Accounting Standards (IND AS 24).

Related Party according to Insolvency and Bankruptcy Code, 2016:

As per the Code, the related party to the corporate debtor is:

- a director or partner of the corporate debtor or a relative of a director or partner of the corporate debtor;

- key managerial personnel of the corporate debtor or a relative of a key managerial personnel of the corporate debtor;

- A limited liability partnership or partnership firm in which a director, partner, or manager of the corporate debtor or his relative is a partner;

- a private company in which a director, partner, or manager of the corporate debtor is a director and holds, along with his relatives, more than two per cent. of its share capital;

- a public company in which a director, partner, or manager of the corporate debtor is a director and holds, along with relatives, more than two percent. of its paid-up share capital;

- any body corporate whose board of directors, managing director or manager, in the ordinary course of business, acts on the advice, directions or instructions of a director, partner or manager of the corporate debtor;

- any limited liability partnership or a partnership firm whose partners or employees, in the ordinary course of business, act on the advice, directions, or instructions of a director, partner, or manager of the corporate debtor;

- any person on whose advice, directions or instructions, a director, partner or manager of the corporate debtor is accustomed to act;

- a body corporate which is a holding, subsidiary or associate company of the corporate debtor, or a subsidiary of a holding company to which the corporate debtor is a subsidiary;

- any person who controls more than twenty percent. of voting rights in the corporate debtor on account of ownership or a voting agreement;

- any person in whom the corporate debtor controls more than twenty percent. of voting rights on account of ownership or a voting agreement;

- any person who can control the composition of the board of directors or corresponding governing body of the corporate debtor;

- any person who is associated with the corporate debtor on account of—

i) participation in policy-making processes of the corporate debtor; or

(ii) having more than two directors in common between the corporate debtor and such person; or

(iii) interchange of managerial personnel between the corporate debtor and such person; or

(iv) provision of essential technical information to, or from, the corporate debtor.

Related Party according to Companies Act, 2013:

Companies Act, 2013 also defines Related Party under Section 2(76). It means a party related to a company in any other way other than the companies own transaction. So, as per the act following are Related Parties:

Difference between Section 2(76) of Companies Act and 5(24) of IBC:

Although, both the sections are similar to each other. There are only minor differences like:

- The definition under Section 5(24) of IBC is broader in scope than Section 2(76) of the Companies Act, 2013. However, Section 3(37) that talks about the application of definition given under Section 2 (76) of the Companies Act, 2013 apply when there is a definition of a term given under the code. If looked at from a wider perspective then Code only talks about the Related Parties in relation to Corporate Debtors or individuals but ignores the related parties in reaction to Body Corporate or a Company.

- Section 2(76)(iv) of the Companies Act, 2013 and section 5(24)(d) of the IBC talks about the same thing but the only difference lies in the perspective. The latter is inferred from the perspective of a corporate debtor. But section 2(76) is a general definition of a Related party.

Related Party according to Indian Accounting Standards (IAS) 24:

The Indian Accounting Standards has defined Related Party with respect to a person and an entity. It states that a related party is a person or an entity that is related to an entity preparing its financial statements (i.e. Reporting Entity).

A person is said to be related to a Reporting Entity if:

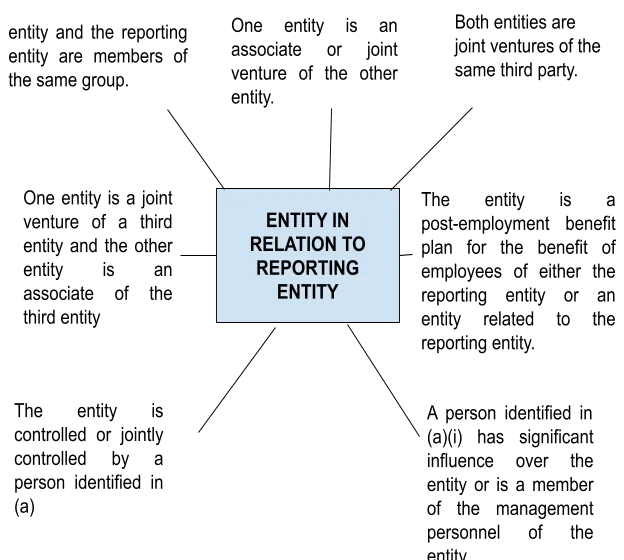

An Entity is related to a Reporting Entity if:

SEBI LODR REGULATIONS:

Under SEBI LODI Regulation, the term Related Parties include:

- Such an entity is a related party under section 2(76) of the Companies Act, 2013.

- Such an entity is a related party under the applicable accounting standards.

Why Disclosure of Related Party Essential under the purview of Section 29A of the IBC, 2016?

Section 29A of the IBC talks about due diligence. A Resolution Professional has to look upon the eligibility criteria of each applicant in the Resolution Process. Section 29A of the IBC specifically states that the Related Party is ineligible to participate in the Resolution Process. The aim behind the insertion of ineligibility criteria is to restrict such entities or persons who could have an adverse impact on the insolvency resolution process. Well, disclosure of related parties is essential for Section 29 of the IBC because the very aim of the code is to protect the interests of creditors.

The participation of Related parties in the resolution process will affect the other creditors’ interest as the related party would try to gain over other creditors hence, profiteering the corporate debtor. That’s the reason also that they are not granted voting rights in the Resolution Process as no participation means no voting rights. So it is important for the interest of the Committee of Creditors and to create an impartial surrounding that related parties do not participate in such a resolution process.

To carry out due diligence in the Resolution process Signal X is the best platform as it provides deep-dive analysis on financials, litigations, compliance, peers, and due diligence.

Litigation Checks:

There are cases where NCLT has given decisions on the participation of Related parties in the Resolution Process. In the case of Ruchi Soya Industries Ltd, Adani Wilmar was declared as the highest bidder by the Committee of Creditors. Meanwhile Patanjali Ayurveda the second-highest bidder raised a claim against Adani Wilmar regarding his ineligibility to contest in the Resolution Process. The basis of such contention was that the wife of the Managing Director of the Adani Wilmar was the daughter of the Promoter.

Also, in Essar Steel Case, Arcelor Mittal, and Numetal, the bidders were held ineligible in the context of the Related Party clause. The reason behind it was that Rewant Ruia, the son of Essar Steel promoter was the beneficiary in Numetal and Arcelor Mittal was the owner of 29.05% stakes in the defaulter Uttam Galva. However, the Supreme Court has that if the applicant clears off all its dues then they can become eligible as a resolution applicant under section 29A.

In Pankaj Yadav v. SBI, the Adjudicating Authority taking into consideration the facts and circumstances of the case observed that meticulous planning was made by the Director of the ‘Corporate Debtor’ to execute ‘Assignment Deed’ with the sole intention to bring down the voting power to the ‘State Bank of India’ which cannot be regarded as a natural business decision. The Adjudicating Authority also observed that a ‘related party’ cannot suddenly become a ‘non-related party’ because he just washes off his hands and hands over the paper to another party who had no valid reasons for taking up the assignment of a debt.

Regulatory Checks:

Various regulatory bodies keep a check on the related parties. SEBI, CIBIL, MCA, NCLAT, NCLT, ITAT, CESTAT are the regulatory bodies that play an important role in its regulation.

Recently, The Securities and exchange board of India proposed certain changes with regards to norms regulating related parties and to prevent its misuse, also to safeguard the interest of shareholders. Further, the penal has also recommended widening the ambit of definition of the related party and related party transactions as well as the changing threshold for determining RPTs and approvals.

A group of 9 members of an expert panel headed by Mr. Ramesh Srinivasan, the managing director & CEO of the Kotak Mahendra Capital, has made these recommendations. The current definition states that any person or entity or promoter’s group of a listed company and have at least 20 percent of shares, shall be considered as a related party. However, the panel has recommended a change in the current definition, widening the scope to any party or entity that is directly or indirectly exercising control, irrespective of their share in the company.

Additionally, the recommendation made to include the parties that have the power to influence the company. The panel further states that as per the working group, members of a promoter group may come under the definition of related party keeping in mind that the promoters may have control over the promoter group and may influence the decision making on the group.

About SignalX’s 29A Eligibility Automation Solution.

SignalX’s 29A Eligibility Check Automation solution is custom built to help Insolvency Professionals analyze RA’s, discover related parties, establish CD/RA independence and analyze CDs. Take a tour of our 29A solution by booking a free live demo today.