Reverse Due Diligence in M&A Transactions: A PMLA Compliance Requirement for Investment Banking Firms

The intricate terrain of mergers and acquisitions (M&A) carries numerous challenges and risks, with due diligence forming a key protective barrier to ensure the solidity and integrity of business transactions. Amidst the thorny thickets of these operations, conducting reverse due diligence to request details on source of funds from buyers or conducting explicit integrity checks on buyer firms and promoters can be an exceedingly challenging task. This is more challenging when buyer firms are non-domestic.

What does Reverse Due Diligence in an M&A transaction mean?

Reverse due diligence is a process in which a company that is being acquired or is merging with another entity(seller) evaluates the acquiring or merging company(buyer). This process allows the target company to assess the financial health, legal compliance, and other aspects of the acquiring or merging company.

A reverse due diligence is often conducted to identify potential risks and to ensure that the acquisition or merger will be beneficial for the target company. It’s essentially the mirror image of traditional due diligence, where the acquirer evaluates the target company.

The Delicate Balance

Investment banking firms, while operating as a bridge between buyers and sellers, are often entangled in a delicate balancing act. The rigorous pursuit for performing a reverse due diligence may risk upsetting the buyer, leading to a potential breakdown of relationships, or even causing the buyer to take their business elsewhere. The stakes become even higher when one considers the potential legal and reputational damage caused by the buyer’s involvement in illicit activities such as money laundering.

The Regulatory Framework and Recent Developments

The Prevention of Money Laundering Act (PMLA) has been instrumental in deterring and mitigating the illicit flow of funds within the Indian financial ecosystem. Traditionally, the Act has focused on entities such as banks, financial institutions, and intermediaries.

However, recent amendments have widened the net to incorporate professionals such as Chartered Accountants (CAs) who play a key role in facilitating financial transactions, particularly in the sphere of M&A. This change has made conducting due diligence on buyers an explicit requirement.

As per the recent guidelines from the Ministry of Finance, CAs who are involved in sourcing funds for share purchases and transfers between firms have been classified as ‘reporting entities’ under PMLA.

This new classification brings CAs under PMLA’s scrutiny and makes them accountable for compliance with the Act’s provisions. This change significantly raises the stakes for these professionals as they could potentially benefit from tainted money flows if they charge the buyer or the selling firm a fee for the transaction, which exposes them to legal action and penalties under the Act.

Implications for Investment Banking Firms

The recent change in regulation has direct implications for Investment Banking firms engaged in M&A transactions. While maintaining the integrity and ensuring the legitimacy of funds have always been important aspects of the M&A process, the updated PMLA regulations now make them an explicit mandate.

Investment Banking firms often work closely with CAs in executing transactions, sourcing funds, and conducting due diligence. Under the expanded purview of PMLA, they share the responsibility for detecting and reporting any suspicious activities or transactions to the authorities. Any lapses in this regard could lead to legal penalties, reputational damage, and loss of business.

A New Regulatory Landscape

The expanded scope of PMLA signals a new regulatory landscape for IBs and Transaction Advisory firms, where conducting reverse due diligence and compliance are no longer optional but a mandated prerequisite. This has necessitated a shift in how these firms approach the deal process, prompting a reassessment of their due diligence strategies and a reinforcement of their compliance frameworks.

A recent case exemplifies these risk factors in stark relief, where a buyer, upon the closing of a deal, proposed to execute the commercial engagement from a different firm, which was later discovered to have a controlling stake by a Tier 3 Politically Exposed Person (PEP). Such incidents underscore the importance of comprehensive reverse due diligence, a process that must navigate the intricate web of relationships and associations between companies and individuals.

A Comprehensive Due Diligence System Leveraging Public Data

Given the expanded regulatory landscape, it is essential for IB firms to implement a robust and comprehensive reverse due diligence system that can withstand scrutiny from regulatory bodies. One effective strategy involves the utilization of public data such as court records, beneficial ownership information, regulator blacklists, and other similar sources to run discreet checks on buyer firms.

Public data sources provide a wealth of information that can be effectively used for conducting due diligence on buyers. Court records, for instance, can offer invaluable insights into a firm’s litigation history, including both active and disposed cases. These records can reveal patterns of legal issues that might raise red flags for potential buyers.

Beneficial ownership information is another key aspect of a comprehensive reverse due diligence program. Transparency in understanding who really owns and controls the buyer firms is crucial in evaluating potential risks. A buyer firm with hidden or complex ownership structures could potentially be a conduit for illegal activities, such as money laundering or funding terrorism.

Regulator blacklists offer an effective means of identifying entities that have been flagged for regulatory violations. Being involved in a transaction with a blacklisted entity can lead to significant legal and reputational damage, making it a key risk factor to consider during the due diligence process.

Moreover, these public data checks can be performed discreetly, allowing IB firms to conduct rigorous due diligence on buyers without risking the relationship with their clients.

The increased scrutiny and regulatory obligations underline the need for more rigorous due diligence. Fortunately, the proliferation of public data sources, combined with advanced data analysis techniques, allows for a comprehensive and efficient diligence process.

By leveraging these sources, IB firms can uphold their legal obligations under the PMLA, protect their reputation, and maintain the trust of their clients, all while navigating the complexities of M&A transactions. It’s a solution that ensures not just compliance with regulatory mandates, but also provides a roadmap for conducting business in an increasingly interconnected and scrutinized global economy.

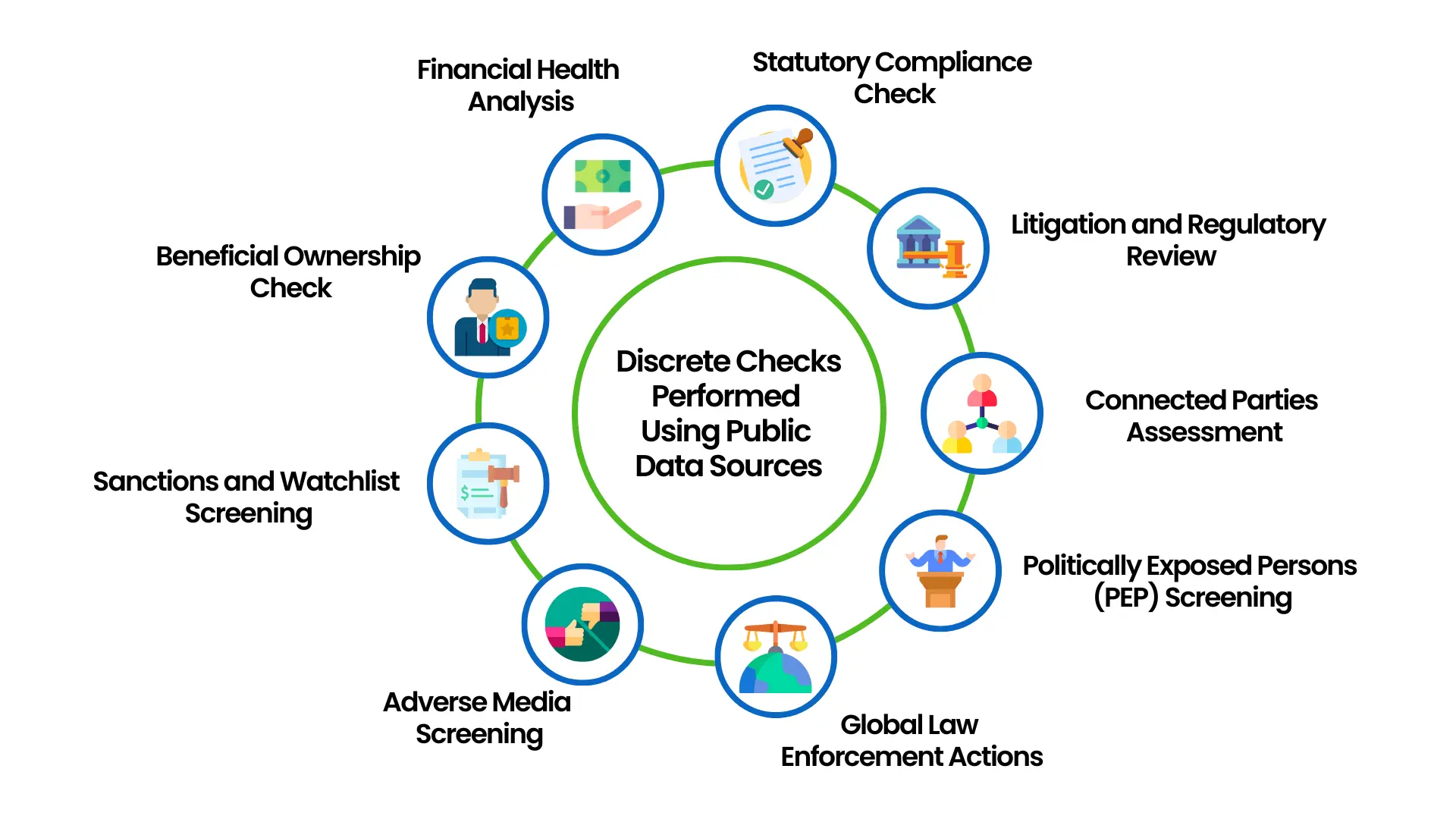

Here are some discrete checks that can be performed using public data sources:

Beneficial Ownership Check: This involves determining who controls the buyer firm and whether these individuals or entities have links to illegal activities or conflicts of interest. Relevant data can be drawn from public corporate registries and stock exchange disclosures.

Financial Health Analysis: By reviewing public financial data, such as historical financial statements and profitability ratios, the financial health of the buyer firm can be evaluated.

Statutory Compliance Check: Checking for compliance with statutory obligations, like the Goods and Services Tax (GST) and Company Law, is possible using public data sources. Non-compliance is a serious concern.

Litigation and Regulatory Review: Court and tribunal records, along with regulatory action data from bodies like SEBI, RBI, can disclose legal disputes or penalties involving the buyer firm or its beneficial owners.

Connected Parties Assessment: Information about parties connected to the buyer firm, including affiliates, suppliers, and shareholders, can be found in public corporate registries and business databases.

Politically Exposed Persons (PEP) Screening: Public electoral rolls, government publications, and international PEP databases can verify if the buyer firm’s directors or beneficial owners are PEPs or closely associated with PEPs.

Global Law Enforcement Actions: Checking global law enforcement databases can indicate if the buyer firm or its beneficial owners have been implicated in international criminal activities.

Adverse Media Screening: Global media sources can provide information about any negative news related to the buyer firm or its beneficial owners, which can flag potential risks.

Sanctions and Watchlist Screening: Screening against sanctions and watchlists imposed by bodies like the UN, EU, or OFAC can reveal any prohibitions or potential ties to illegal activities of the buyer firm or its beneficial owners.

Today, it’s paramount for IB firms to leverage these various sources of public data, both domestic and global, to ensure robust, comprehensive, and discreet reverse due diligence. Not only does this meet regulatory obligations under the PMLA, but it also protects the firm from potential legal and reputational risks, thereby fostering a healthy and transparent M&A environment.

Scope of AI in Due Diligence Automation : The Role of Tools like SignalX

In the face of increased scrutiny and regulatory obligations, it’s crucial for investment banking firms to find more efficient and thorough means of conducting due diligence on their buyers. Emerging technologies, such as artificial intelligence (AI), offer promising solutions to these challenges. AI-based due diligence tools like SignalX are playing an increasingly significant role in enabling firms to implement robust reverse due diligence programs and ensure compliance with regulations like the PMLA.

SignalX and other similar AI tools offer a way to automate the rigorous checks required in reverse due diligence. They can quickly and efficiently process vast amounts of data from various public sources to generate a comprehensive risk profile of a potential buyer. These tools can perform beneficial ownership checks, financial health analyses, statutory compliance checks, litigation and regulatory reviews, connected parties assessments, Politically Exposed Persons (PEP) screenings, global law enforcement actions, adverse media screenings, and sanctions and watchlist screenings.

The automation of these checks significantly reduces the time and effort involved in conducting a due diligence on buyers, allowing firms to focus their resources on making informed decisions based on the insights generated.

Furthermore, by automating these checks, these tools also maintain a level of discretion that helps investment banking firms to balance their legal obligations with the need to maintain positive relationships with clients. They can perform a thorough due diligence on their buyers without causing unnecessary friction with potential buyers, allowing firms to navigate the delicate balance between compliance and client satisfaction.

In conclusion, AI-based tools like SignalX represent the future of due diligence in M&A transactions. By leveraging these technologies, investment banking firms can not only ensure compliance with the PMLA guidelines but also protect their reputations, maintain client trust, and foster a more transparent and secure M&A environment.