What is Supply Under GST? Become a responsible taxpayer

Are you looking forward to starting a business or buying something domestically or internationally? If yes then you must be aware of what is the supply under GST and what are the relevant provisions.

Prior to GST, supplies were not included in indirect taxation. The phase during which indirect taxes were levied differed according to tax laws. The ‘excise duty’ was levied on manufactured goods when they were removed from the factory. For services rendered, a ‘Service Tax’ was imposed based on some rules known as the ‘point of taxation rules. A VAT would be levied on the value of goods sold or services provided. The current system combines all taxes into a single tax period.

All of this went through a makeover when on April 12, 2017, the Central Goods and Services Tax Act of 2017 was notified. State GST legislation has also been enacted along similar lines.

The government worked tirelessly to implement indirect tax reform beginning July 1, 2017. Since then, the concept of Supply under GST has been an important topic of discussion. This article tries to resolve all such queries around supply under GST.

Let’s delve deeper to learn and discover more about the related concepts. First, let us know what the system was before GST.

Good & Services Tax: What Does Supply Under GST Mean?

The forthcoming GST regime simplified a lot of loopholes in the existing indirect tax regime. The policy centralized everything under one head, however, it contains several sub-sections to justify each type of supply. The term “Goods and Services Tax” is defined in the constitution as any tax on the supply of goods, services, or both, with the exception of taxes on the supply of alcoholic beverages for human consumption.

In the Act, the word “supply” has an expansive definition. The following six criteria, which can be used to classify a transaction as a supply, can be adopted to understand the meaning and scope of supply under GST:

- Provision of products or services. GST is not applied to the supply of anything besides goods or services.

- A supply should be made in exchange for payment.

- The supply must be made in the course or furtherance of business.

- The supplier must be taxable.

- The supply must be taxable.

- Supply must occur within the taxable bracket.

Taxable Supply Under GST Know-How: How Is Supply Under GST Charged?

Knowing your tax is like knowing an end-term syllabus. It is absolutely imperative to note the process of GST computation on your supply of goods and services. In order to charge GST, a supply must be considered as a part of the taxable slab. Tax liability arises at the “time of supply of goods and services.” To determine GST’s applicability to the supply, it is crucial to determine whether a payment matches the tax slab.

As per Section 2(108) of the Central Goods and Services Tax and otherwise, CGST Act 2017, a taxable supply under GST includes both goods and services subject to taxation under this Act. The term ‘Supply’ is a taxable event under GST.

GST applies to any transaction that involves the ‘Supply’ of either Goods or Services. Section 7 of the CGST Act of 2017 has been amended to add a new provision under the concept of supplies of goods and services under GST. Previously, it only applied to goods. Activities involving providing products or services by any person other than an individual to its participants or constituents, or vice versa, in exchange for cash, payment, and other valuable consideration.

Zero-Rated Supply Under GST: Know It All

One must be aware of zero-rated supply under GST to thoroughly understand the applicability of the taxes. Section 16 of the IGST Act defines the concept of “zero-rated supplies under GST” as follows:

- Export of services or goods or both.

- You can sell goods and services to a developer or unit of a Special Economic Zone (SEZ).

The government’s intention with a zero rating was to consider untaxing the input and output for zero-rated supplies. The goal was to make Indian products and services competitive globally. Furthermore, such a supply of goods and services under GST was implemented to ensure that taxation did not act as an obstruction. The export prices of goods and services did not increase with higher taxes.

GST Council In The GST Regime: Role & Purpose

The GST Council was established by the Government of India (GoI) to amend, control, and harmonize the country’s goods and services tax. To simplify the taxation procedure for the taxpayers, the Council replaced every existing multiple taxes process and introduced new taxation methods.

In order to assist the relevant departments and prevent fraud, the Council must also keep an eye on all taxation procedures. In this article, we examine the GST Council and gain an understanding of one of the crucial councils responsible for governing all facets of GST in India.

The GST Council has the authority to decide on a variety of tax-related issues, including the rate of tax that will apply under the GST model, tax deduction policies, the deadline for submitting GST forms, and special exemptions for certain States in India. The job of the GST Council is to make sure that goods and services are taxed at the same rate throughout India.

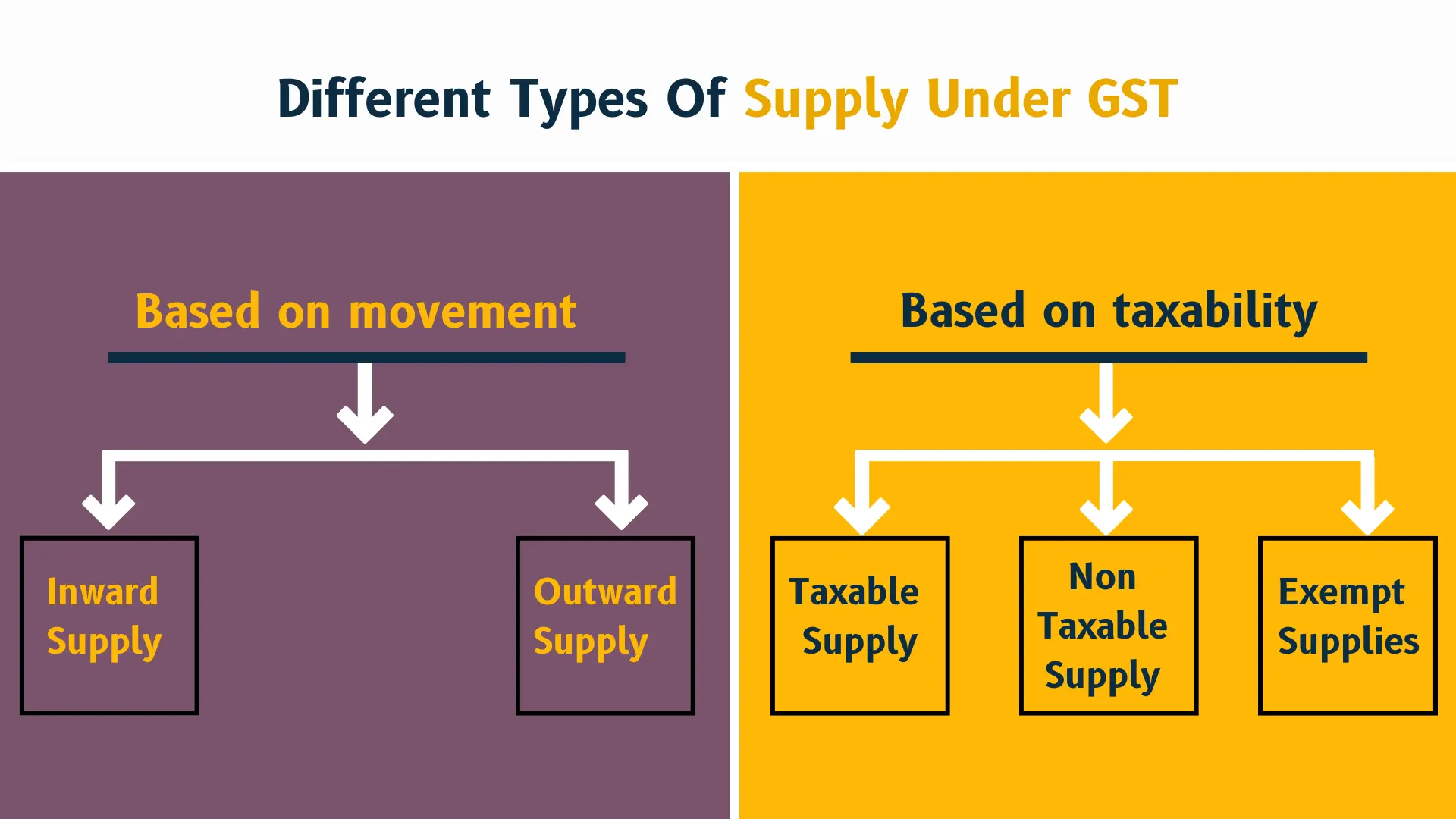

Understand The Different Types Of Supply Under GST

GST divides the supply of goods and services into multiple categories: taxable, non-taxable, composite, and many more. These are further subdivided into various types based on the characteristics of the supply made.

Free GST Number Verification

Based on movement, a supply under GST is divided as:

Inward Supply:

An “inward supply under GST” is the receipt of goods or services from another person, whether purchased, acquired, or otherwise, with or without consideration. Your company receives supplies from other companies (purchases and expenses) and is also included in inward supply under GST.

Outward Supply:

Outward supplies are any supplies made by one’s company. Outward Supply under GST and their reporting are essential for both the supplier and the receiver when filing GST Returns.

Based on taxability, a supply under GST is divided as:

Taxable supply: A GST Tax Guide

“A GST supply includes both goods and services and is not subject to tax under the CGST Act.” Section 2(108) of the CGST Act of 2017.

A taxable “Supply under GST” refers to a supply of goods or services that is subject to tax under the Central Goods and Services Tax Act of 2017. Section 15 of the CGST Act states that the containing value is the value of the taxable Supplies under GST.

The basis for valuation for the supply of goods and/or services underneath the GST Regime is “Transaction Value.” First, we must ascertain the transaction value in order to levy the GST tax. The cost actually paid or due for the supply of products and/or services is the “Transaction Value.” The following two conditions apply to this:

- Supplier and recipient are not related.

- Price is the only factor taken into account when making the supply.

Non-Taxable Supply Under GST:

“A non-taxable Supplies under GST is a supply of goods or services or both that is not subject to tax under the CGST Act or the IGST Act.” Section 2(78) of the CGST Act of 2017.

Exempt Supplies: Know The GST Exemptions

Exempt supplies are another type of nontaxable prominent supply under GST. Even if they are subject to supplies under GST, the supply of excluded goods or services is not subject to it. However, the registered tax inspector cannot claim ITC on input data used to manufacture such supplies.

Even if they are subject to supplies under GST, the supply of excluded goods or services is not subject to it. However, the registered tax inspector cannot claim ITC on input data used to manufacture such supplies.

Until 2019, there was no provision in the GST regime for determining the taxability of accessible supplies. As a result, clarification was required to avoid ambiguity, double taxation at the output and input stages, and litigation.

This article examines the most recent circular authorized by the Central Board of Indirect Taxes and Customs (CBIC) in 2019 that clarifies the taxability of free supplies under the GST regime. It is imperative to know the taxable supplies under GST as well.

Why Does GST Registration Matter?

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services via the GST registration procedure. It has primarily replaced numerous indirect taxes that previously existed in the country. Each point of sale imposes a destination-based tax.

The following are the advantages of GST registration for supplies under GST:

- Recognized as a legal supplier of services and products

- Legally permitted to collect taxes from purchasers, and credit taxes are paid on goods and services provided to recipients.

- Accounting for taxes paid on input goods or services can be used to pay GST due on goods and services supplied by the company. You become eligible to benefit from various GST laws if you keep proper bookkeeping of the taxes paid earlier.

- GST Laws have fewer and simpler compliance requirements.

- Procedures for refunding tax money and registering taxpayers are standard, and the format of tax returns is standardized.

The Concept Of Inter-State, Intra-State, And Composite Supply Under The GST Regime?

It is important to understand the concept of Inter-state, Intra-state, and composite supply under the GST regime. These are explained below:

- Inter-State Supply Under GST

Inter-state supply meaning can be easily understood in the following way. It occurs when the Supplier and the location of the supply are in multiple states. The transaction is presumed to be inter-state when goods or services are dispatched or imported, or even when products or services are provided to or by an SEZ unit.

- Intra-State Supply Under GST

In contrast to the aforementioned concept, when the supplier’s place and the place of availability, i.e., the buyer’s location, are both located in the same state, intra-state supply occurs. An intra-state supply meaning is conceptually different from that of an inter-state. In intra-state transactions, a vendor must obtain both CGST and SGST first from the customer.

- Composite Supply Under GST

A composite supply under GST, as defined by GST, is one made by a taxable person to a recipient that consists of two or more taxable goods and services of goods or services, or both, or any combination thereof, that are naturally bundled and supplied in combination with each other in the normal course of business, one being a primary supply.

Let us understand with the example what composite supply under GST is all about. Let us consider the case of a wrapped gift box of chocolates. Chocolates are the primary product, with boxes, gift pouches, message cards, and gift-wrapping services provided by the salesperson serving as supporting structures. Since these are composite Supplies under GST, the GST rate will be the same as for chocolates.

Provisions For More Than One Goods/Services Involved:

There are numerous instances where more than one principal item is involved in the process. How to fix that? According to Schedule II of the GST law, any supply under GST will be categorized as either whole goods or entirely services, depending on the principal item or service supplied under GST. This also applies to situations where the supply includes goods and services. While goods and services could be supplied separately, they can also be supplied as a bundle or set using the following methods:

- In essence, composite Supply under GST occurs when the goods and services provided together are a natural bundle (where it makes more sense just to provide them rather than sell them separately).

- Mixed Supply under GST occurs when the products and services supplied together are not naturally grouped (they are not interdependent and can be sold separately).

A mixed supply consists of two or more goods or services that are independent of one another and are not required to be sold together. The first requirement for mixed supply is not to be a composite supply. In such cases, the two higher tax rates are applied to the entire supply.

For example, purchasing a Christmas package that includes cakes, aerated drinks, chocolate bars, Santa caps, and other freebies. Each of these items can be sold individually and are not interdependent. This is a diverse supply.

GST is significant because it will help various government projects such as ‘Make in India.’ The implementation of GST is expected to broaden the tax base and improve tax compliance. It would increase government revenue even more.

Frequently Asked Questions

How to determine the place of supply under the GST system?

In international transactions, the location of the service receiver should be the location of the supplier. Whenever the service receiver’s location cannot be determined, the supplier’s location will serve as the provider’s location.

Is GST applicable on free supply?

Free transfers between unrelated parties are not considered “supply,” and as a result, they are not taxed; nevertheless, free transfers between relatives are considered “supplies,” and as a result, they are subject to GST.

Who can issue bills of Supplies under GST?

Bills of Supply under GST may be issued instead of Tax Invoices by GST Registered Businesses. Companies dealing with Exempted Goods as well as composition vendors can use it.

Who gives GST?

There is a prospect that the GST will be a dual tax, assessing and collecting state and federal taxes on intrastate sales. Additionally, the Center must tax and collect IGST on the delivery of goods and services across state lines.

Which activities are included in supply in GST?

Provision of products or services for consideration provided or promised to be provided during the course or advancement of a business. In addition to sales, transfers, barter, exchange, licenses, rentals, leases, and disposals, there are also leases and rentals. In the course of or for the advancement of business, the importation of services for payment is also included in GST.