What is a Due Diligence Report?

A due diligence report, also referred to as a pre-investment review, is a critical tool in any investment evaluation. It provides a comprehensive analysis of a target company’s financial and operational standing, granting investors valuable insight into the investment opportunity.

To create an accurate due diligence report, expert third-party assessors are often hired to gather crucial information and records from the target business. The report’s purpose is to validate the business’s claims about its financial health and credibility.

When considering investing in a company, an investor may depend on disclosures and statements made publicly, for example, on the company’s website or in investment proposals. However, it’s imperative to verify these statements through a due diligence report to avoid any critical non-compliances that could affect the business’s future operations and the investor’s potential return on investment.

The Objective of Due Diligence Reports

The primary objectives of a due diligence report is to verify the statements made during the investment phase and detect any potential red flags or undisclosed non-compliances. With extensive experience in conducting thousands of pre-investment due diligence reports, SignalX understands the significance of uncovering red flags in the report and its impact on investment decisions. The goal of due diligence is not just to make an investment decision but also to comprehend the associated risks and establish favorable conditions for the investment to proceed. On a high level, the following are the two expectations that an investor has from a well-written due diligence report.

Validate claims made during the deal stage

How true are the claims made about growth, revenue, profitability, intellectual property, etc in the investment solicitation? What are the gaps between what was said and what is?

Identify any red flags or non-compliances

Are there any red flags or non-compliances that were not disclosed previously which may or may not materially affect the deal? What are the conditions that I should impose on the business as pre-investment requirements?

Adverse findings in due diligence reports could derail deals

Having executed thousands of pre-investment due diligence reports at SignalX, we have seen a fair number of red flags identified in deals. Often the investor’s intent of conducting due diligence is not to decide on whether to invest in a business or not, but rather to understand the risks involved better and arrive at conditions under which the investment can be made.

More often than not, the investor has already decided to invest in the transaction, and it is very unlikely that he would change his mind unless something substantial is found during the due diligence process.

Having a comprehensive due diligence report in hand accelarates this decision making process and saves time for both the investor and the target company. As a DD report refelcts back a better persepective of the target business, investors are can get a clear picture of who they are establishing a relationship with.

We have seen hundreds of cases where investors are taken by surprise. A few of the red flags we’ve seen are:

- Undisclosed litigations – Material litigations such as insolvency and bankruptcy applications, fraud, etc on promoters and also sometimes on the business itself that were not disclosed to the investors.

- Shadow promoters – Undisclosed promoters and co-founders in the shareholding structure of the business. Often investors assume that the person pitching the business is a promoter of the business, sometimes this has not been the case.

- Unregistered IPs / IPs registered on Promoters – Intellectual property such as patents and trademarks that are material to the business claimed to be registered but not found and or are registered on the promoters instead of on the business.

Such red flags are seen in deals of all sizes – be it an investment into a start-up or even in M&A transactions. Therefore it is strongly advised for investors to generate due diligence reports or rather pre-investment due diligence reports before proceeding with signing definitive paperwork or wiring the funds.

Streamline Your Corporate Due Diligence Process – Make Smarter, Safer

Business Decisions

Activities to perform before you produce a due diligence report

Preparing a due diligence report would generally require enrolling a professional, executing confidentiality agreements with the business, going through the process of collecting data, and much more, all of this before you even begin the due diligence process. Yes, all of this costs time and money. Therefore it is considered best practice to have a few things in place before you start this process.

1. Understand the purpose of creating the due diligence report

It helps to be very clear on why you’re looking to get a due diligence report prepared. What are your expectations from the investment? What about the business is compelling to you? Discussing the same with your professional can help you validate specific claims or deep-dive into specific areas of the business.

2. Execute pre-deal due diligence checks

Executing a pre-deal due diligence check using publicly available information will help you fast-track the deal and reduce your due diligence expenditures significantly. Today, over 200+ regulators and 7000+ courts make their data available for conducting screenings and checks on investment targets and promoters. All of this information does not require any disclosure or consent from the target business for you to access. Conducting a pre-deal due diligence check using automated tools like SignalX helps you identify red flags early on and minimizes the chances of the deal not going through after an expensive due diligence process.

3. Build a checklist

Having a clear objective of due diligence allows you to build a checklist of documents and data points you would want the business to disclose. Often in deals, the amount of data that is shared by the business can run into tens of thousands of documents. Having a checklist is a necessity before you proceed with collecting data from the business and breaking it down. For example, here is a simple financial due diligence checklist that you can use to collect information from a small business before investing.

4. Set up a data-room / data sharing folder

Having a simple but organized setup to store and manage the data shared by the business is an essential hygiene process in a due diligence exercise. Professionals often forget that they are dealing with confidential information. Managing this data over multiple desktops of analysts can result in copies being made unknowingly and data leaks. Setting up a cloud-based data room can help you organize the due diligence process better, have multiple analysts work on the project, and minimize incidents of data leaks or breaches of confidentiality. Investors have been accused and sued for mishandling confidential data many times.

What should a due diligence report include?

A due diligence report is often extensive and contains an analysis of multiple dimensions of the business – financial due diligence being one of the many. There are primarily 5 parts in a well-executed due diligence report. Each of the following segments requires separate due diligence checklists and may require specialized individuals to execute. Depending on the nature of the deal, the investor may or may not be able to execute diligence at this depth on his own, therefore the necessity to hire professionals.

- Financial due diligence: This is the review of financial statements – provisional and audited, tax filings, expenses and cost structure of the business, revenue flows, receivables, payables, indebtedness, loans from promoters and financial institutions, ownership structure, shareholding, assets, and liabilities.

- Legal due diligence: This is the review of the agreements entered into with employees, vendors, suppliers, trade partners, customers, and distributors. This also involves reviewing documentation on the incorporation of the business, tax registrations, compliance with labor laws, and intellectual property registrations such as patents and trademarks.

- Operational due diligence: This is a review of the operating procedures of the business such as its SOPs, KPIs, code of conduct, policies and procedures, and labor-related complaints. This may also include interviews with customers and department heads. Operational due diligence gives you an understanding of how the business executes its operations on a daily basis.

- Technical due diligence: This is a review of the capabilities of the product/service offered by the business. This is generally done by investors to understand the maturity of the existing technology platform or product such as apps and websites. This often includes interviews with the head of product or technical staff.

- Integrity due diligence on promoters: This is a review of the background of the promoters and key managerial personnel, past and ongoing litigations, noncompliances, political exposure, work experience, educational qualifications, and more.

How much does a due diligence report cost?

As you would have realized, generating a full-fledged due diligence report covering the 5 elements is an extensive process requiring professionals from multiple disciplines. This certainly costs time and money. This is also a reason why increasingly investors prefer a pre-deal due diligence check done discreetly using public data using tools like SignalX before engaging a professional firm to execute the full diligence.

The cost of this exercise depends on the size of the deal and the target business. In large mergers and acquisitions, this cost runs into crores of rupees. For due diligence on a small business that may be under 5-6 years old, a typical law firm would charge you anywhere between 3 – 4 Lakhs INR and may take 15-20 days to complete.

A pre-investment due diligence check using public data on SignalX is inexpensive, automated, and comprehensive, and gets done in 48 hours.

Who prepares due diligence reports?

It is not practical for an investor to put together a team himself to conduct the due diligence exercise and prepare a due diligence report. This team would also be an over-head in seasons when the deal flow is less. Therefore investors tend to outsource this work to due diligence professionals such as the following.

- CA / CFA firms – Most professional Chartered Accountants, CA / CFA firms offer due diligence as a service and include due diligence report preparation.

- Legal Consultants – Corporate Lawyers, and Law Firms offer due diligence services and are well equipped to handle end-to-end due diligence assignments.

- Risk Advisory / Deal Consultants – M&A, Transaction Advisory, and Investment Banking teams also carry due diligence capabilities in-house and offer this as a service. They also offer advisory services to help the investor through the transaction end-to-end, not just due diligence.

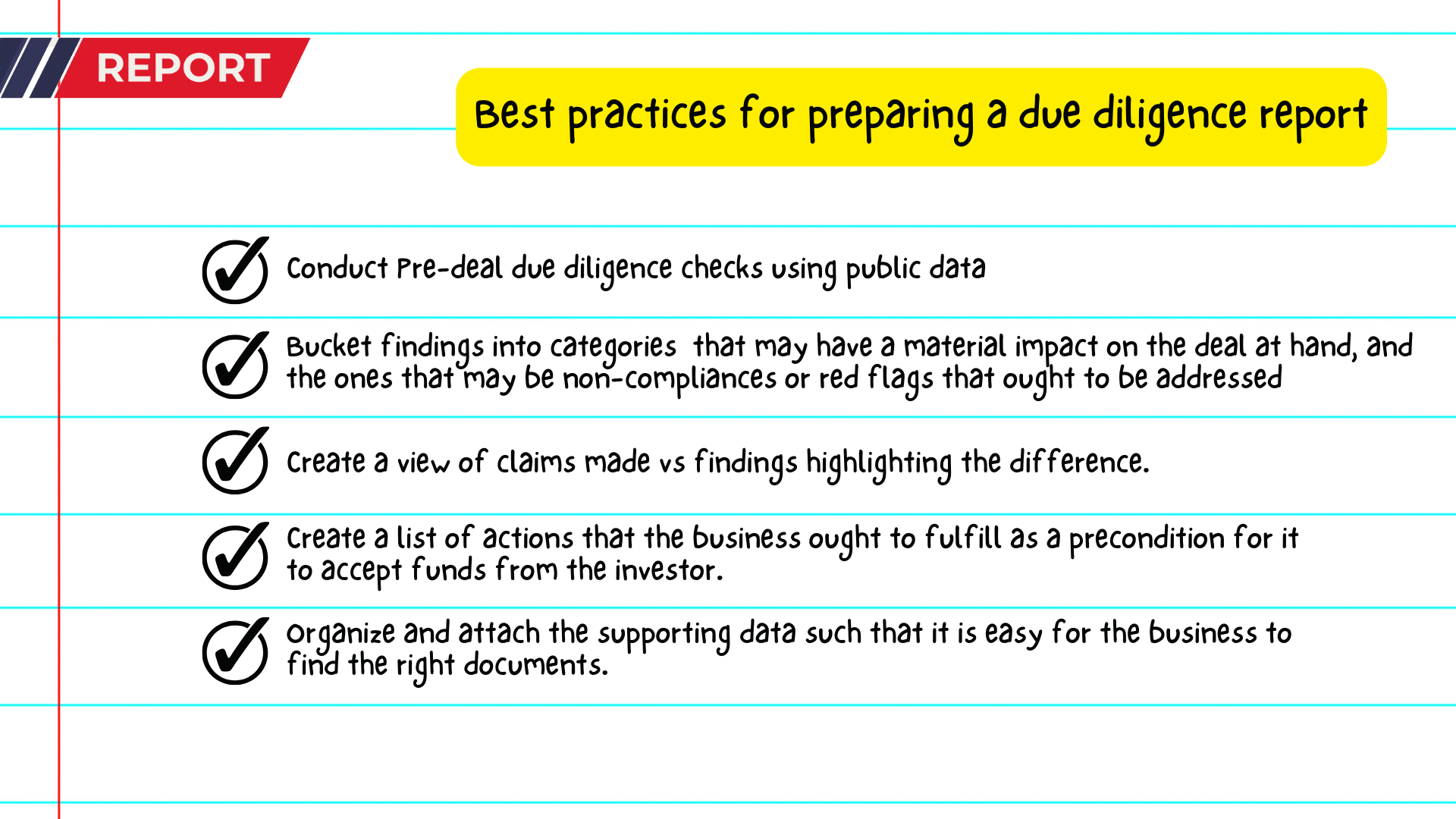

Best practices for preparing a due diligence report

Due diligence reports are required to be actionable, and not merely data dumps. The report must provide sufficient comfort to the investor and make him aware of the red flags and risks that may be material to the transaction.

A well-written due diligence report is not overwhelming for the investor to process but contains specifically actionable to ensure that the transaction is closed quickly. Badly written due diligence reports can appear as data dumps without any clear insights that could aid transactions positively.

The following are some of the best practices to keep in mind when producing due diligence reports.

- Conduct Pre-deal due diligence checks using public data – Pre-investment due diligence checks using public data add significant value to deals by reducing surprises appearing at a later stage and helping investors evaluate the opportunity better. This is inexpensive and automated on platforms like SignalX and is quick to prepare.

Not executing pre-deal checks could result in significant time and money lost during the due diligence exercise due to some material red flags found later on, which would have been identified before beginning the due diligence exercise itself. - Bucket findings into two or more categories namely the ones that may have a material impact on the deal at hand, and the ones that may be non-compliances or red flags that ought to be addressed but may not impact the deal materially.For example, a contract with a vendor or supplier that appears to be assigned intellectual property of the business may be a significant finding. Pending GST filings that may be less than 3 months old may be of minor significance to the overall deal.

- Create a view of claims made vs findings highlighting the difference. For example, if there is a gap in the claimed revenue vs what was found. Or headcount claimed versus actuals found.

- Create a list of actions that the business ought to fulfill as a precondition for it to accept funds from the investor. This can then be included in the deal agreement as closing conditions.

- Organize and attach the supporting data such that it is easy for the business to find the right documents.

A well-drafted due diligence report aids in quick decision-making

A well-drafted due diligence report aids in quick decision-making and moves the deal faster, and thus is an essential part of any transaction. With AI redefining the possibilities in due diligence today, Investors are encouraged to explore technology tools to fast-track diligence and generate insights.

Drafting a due diligence report can be a daunting and expensive task, therefore businesses tend to conduct pre-investment due diligence checks on public data using automated platforms like SignalX that identify high-level red flags with sufficient depth early on in the deal stage itself, to prepare the investor for the transaction and minimize the chances of the deal falling through due to material red-flags being found at a later stage.

Talk to us today on your due diligence requirement. Book a SignalX demo today.

Run comprehensive due diligence checks on your target business and get a

360 degree view of their business profile and risk posture.

Frequently Asked Questions

Q1: What are the three principles of Due Diligence?

Principles of Due Diligence can be different based on the context of application or operation, such as in business acquisitions, investments, or legal matters. However, overall there are three main principles of due diligence, which are :

- Comprehensiveness: This principle involves thoroughly examining all necessary aspects of a decision, transaction, or situation. This could include understanding the financial status, legal obligations, operational procedures, etc. of a company in a business context.

- Verification: This principle involves confirming the information received or discovered. This could be through cross-checking documents, getting third-party confirmations, or using other methods to ensure the information is accurate, complete, and reliable.

- Risk Assessment: This principle involves assessing the potential risks associated with the decision or transaction. This could involve understanding market risks, legal risks, financial risks, etc., and then making an informed decision based on this assessment.

Q2: What is due diligence report in audit?

A due diligence report in an audit is a detailed document that evaluates a business’s assets, liabilities, potential risks, and commercial potential, often prepared for a prospective buyer or investor.

Key components include:

- Company Overview: Summary of the company’s history, products, and market position.

- Financials: Detailed review of the company’s financial statements for any financial risks.

- Operations: Examination of the company’s operational structure and supply chain.

- Legal and Regulatory Compliance: Evaluation of the company’s legal obligations and regulatory compliance.

- Market and Industry Analysis: Analysis of the company’s market share, competition, and industry trends.

- Human Resources: Review of the company’s employee structure and HR policies.

- Environmental and Social Responsibility: Assessment of the company’s environmental and social impacts.

The report helps the buyer or investor understand the business better and identify any potential issues before finalizing a transaction.

Q3: What are the three types of diligence?

Due diligence can be classified into various types based on the context and the purpose for which it is being conducted. Here are three common types:

- Financial Due Diligence: This involves a thorough review of the financial health of a company or investment. It includes analyzing financial statements, tax returns, assets, liabilities, and other financial aspects.

- Legal Due Diligence: This type of due diligence involves reviewing all legal aspects of a company or investment. This can include reviewing contracts, compliance with laws and regulations, intellectual property rights, litigation history, and potential legal risks.

- Operational Due Diligence: It looks at the day-to-day operations of a company. It can include reviewing the company’s business model, operational procedures, technology infrastructure, supply chain, and more.