Nowadays, everyone is aware of the harm that a politically-exposed business partner or client can cause to an organization. To ensure your organization fully complies with the latest financial PEP regulations, the respective organization or company must be aware of who or what a Politically Exposed Person (PEP) could potentially be.

The criteria for defining who is a political person is broad, international definitions vary and the Financial Action Task Force (FATF) is frequently issuing updated recommendations.

Who is a Politically Exposed Person?

There is no single, universally agreed-upon definition of PEPs. In basic terms, a Politically Exposed Person is someone who, through their prominent position or influence, is more susceptible to being involved in bribery or corruption.

A politically exposed person is someone who is authorized to perform prominent public functions in a country and includes governors of the state, members of Parliament, military officers, senior government and judicial executives, and heads of local bodies such as municipal corporations, among others.

Due to their position, they can commit money laundering offenses and other related corrupt activities like terrorist financing. You could also qualify as a politically exposed person if you are a family member or a close relative of such an individual.

PEP monitoring is used to help ensure that these individuals are not abusing their power to embezzle or otherwise steal and misuse funds. Their immediate family members may also be monitored.

The History of Politically Exposed Persons

The term PEP or Politically Exposed Person was introduced in the 1990s when the Nigerian dictator Sani Abacha misappropriated billions of dollars from the Nigerian Central Bank for many years and transferred all the funds to his accounts in the UK and Switzerland.

After Abacha was overthrown, the succeeding government tried to recover the money and had difficulties doing so, which led to the introduction of the concept of a “Politically Exposed Person”. Many cases were registered against persons indulged in money laundering and classified as PEPs.

- In October 2007 – Vladimir Kuznetsov, a former Russian diplomat has sentenced to four years and three months imprisonment and ordered to pay a US$73,000 fine for money laundering. Kuznetsov chaired a United Nations budget committee when he misappropriated the money, he also helped a fellow UN staff member to take over US$300,000 in bribes from companies seeking UN contracts.

- In May 2008 – Jim Hayes (Alaska mayor) and his wife were sentenced to 66 and 36 months respectively. They were convicted of illegally diverting government funds awarded to the Love Social Services Center (LSSC), a charity created to aid disadvantaged residents of Fairbanks. The couple was also convicted of money laundering for trying to conceal the diversion of funds, and for filing false tax returns.

- In March 2012– A regionally-operating British bank i.e., Royal Bank of Scotland, was fined £8.75 million (US$10.9 million) for failing to properly handle customers classified as politically exposed persons and breaches of money-laundering rules after three years of “serious” and “systemic” problems in handling the affairs of customers vulnerable to corruption because of their political links.

- In November 2015 – Barclays Bank was fined £72 million ($108 million) for failing to minimize the risk that it may be used to facilitate financial crime. The clients involved were politically exposed persons (PEPs) and should, therefore, have been subject to enhanced levels of due diligence and monitoring by Barclays.

- In June 2016 – The UK division of India’s Canara Bank was fined 896,100 pounds ($1.2 million) in the UK for anti-money laundering breaches. Britain’s markets regulator blocked the bank from accepting new deposits for around five months for systemic anti-money laundering (AML) failures.

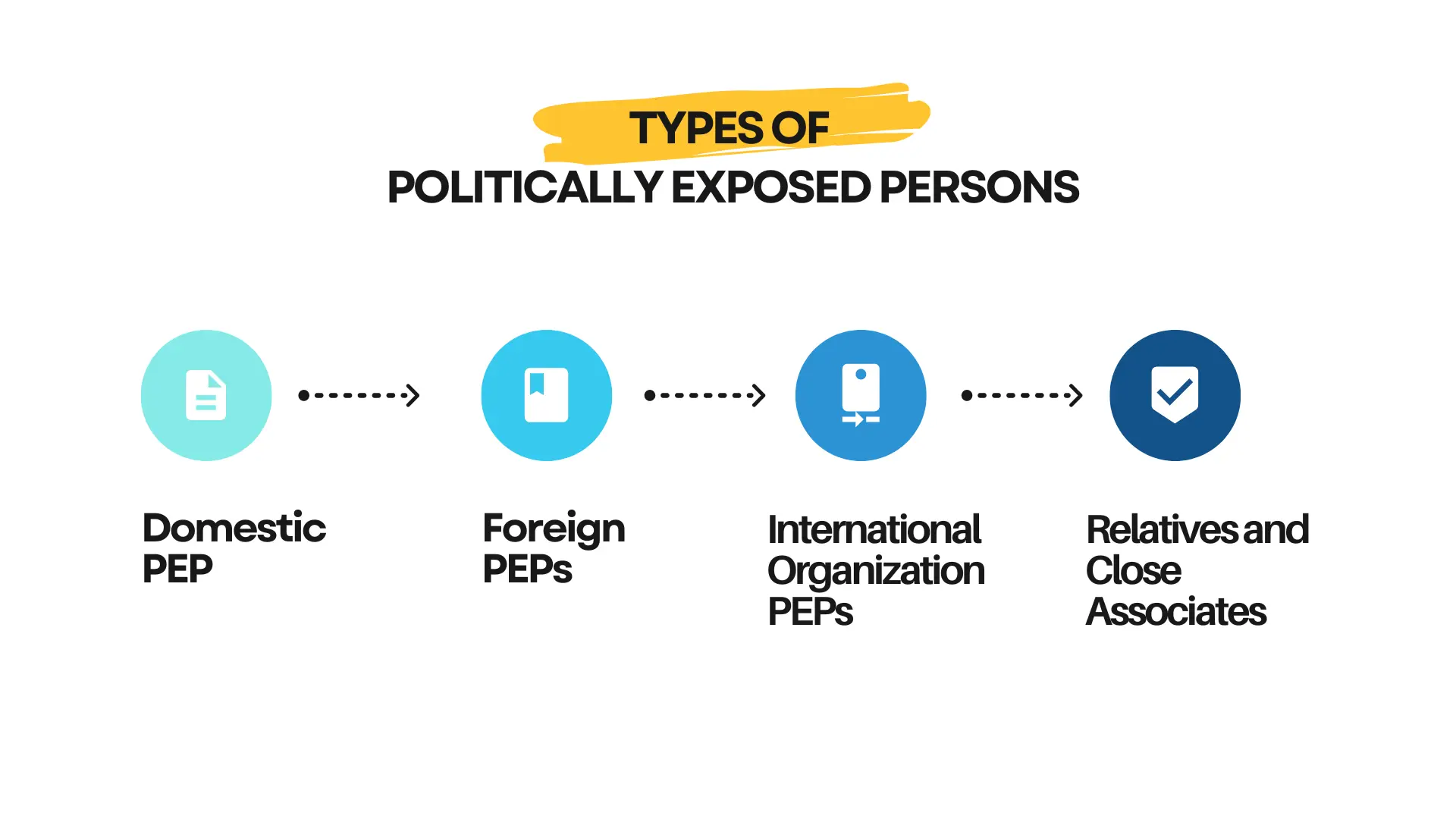

Types of Politically Exposed Persons (PEPs)

1. Domestic PEPs

A person who has a prominent public position or has a role in a government body. Such as –

- Legislative and Bodies: Members of Parliament.

- Executive Bodies: Cabinet and assistant ministers.

- Judiciary Bodies: People working within supreme courts, constitutional courts, or high-level judicial bodies.

- Central Financial Institutions: Court of Auditors and members on the boards of central banks.

- Armed Forces: High-ranking officers in the armed officers can be classified as PEPs.

- State-Owned Enterprises: Senior executives, former and present members of the board of directors.

2. Foreign PEPs

Someone who holds a prominent public position or a role in some other country is considered a foreign PEP.

- Diplomatic Roles: Ambassadors or those who take charge of affairs would be considered PEPs.

- International Sports Committees: Members of these committees may be influenced to vote on the location of major sporting events/contracts for building venues, etc., so have recently been included by FATF under their definition of a PEP.

3. International organization PEPs

A person who has a high position in an international organization, such as the United Nations (UN), the World Trade Organisation (WTO), or the North Atlantic Treaty Organization (NATO).

4. Known ‘Close Associates’ who are Considered Politically Exposed Persons

- Immediate Family Members who are Considered PEPs – Parents and children of PEPs, Spouse or partner, Siblings, Uncles, and aunts. Even slightly indirect family members (such as in-laws) will be considered politically exposed persons.

- Persons having a close business relationship or joint beneficial ownership of legal entities or legal arrangements with a politically exposed person.

- Anyone who has the sole beneficial ownership of a legal entity that is known to have been set up for the benefit de facto of the PEP.

Why is it important to run due diligence on a politically exposed person?

-

Why Due Diligence is Necessary for PEPs

Politically exposed person regulations are enacted to prevent individuals in positions of power from abusing the confidence of the public and financial institutions to benefit personally. Requiring institutions to perform necessary due diligence on potential PEPs is a preventive measure to avoid any possible fraud in the future.

-

The Risk of Financial Crimes

Businesses are becoming increasingly exposed to the risk of financial crimes such as fraud, money laundering, and terrorist financing. With the increased scrutiny from local and international financial regulatory authorities, it has become important for financial institutions to protect themselves from all kinds of fraud and financial crimes.

-

Classification and Screening of PEPs

All such individuals who fall under the politically exposed person’s definition must be classified according to their level of risk and hence be screened. Financial institutions have to implement PEP screening and AML measures to reduce their risks and liabilities.

-

Regulatory Framework by FATF

The Financial Action Task Force (FATF) has introduced a regulatory framework for combating the risk associated with businesses and financial systems for illicit activities. Every country must implement strict anti-money laundering (AML) compliance processes, with penalties.

-

Compliance Process and Ongoing Customer Due Diligence (CDD)

As per anti-money laundering regulations, financial institutions should take all rational steps to ensure that they do not knowingly or unconsciously help in hiding or passing the proceeds of corruption by political figures, their families, and associates. Part of the compliance process is ongoing Customer Due Diligence (CDD), which means a business must conduct ongoing screening processes for monitoring business transactions and entities.

-

RBI’s Circular on AML/KYC

The Reserve Bank of India (RBI), in its circular, dated 1 July 2008, on AML/KYC instructed banks and financial institutions regulated by RBI to carry out effective AML/KYC measures.

“Banks should verify the identity of the person and seek information about the sources of funds before accepting a Politically Exposed Person as a customer.”

-

Sanctions Checks

Sanctions Checks are necessary to assess the risk of individuals, companies, and countries. The sanction checks include PEP screening, Adverse Media & Watch list Screening.

-

The Changing Nature of PEPs

In India, so many elections are held at different levels. With new people getting elected, the database of PEP needs to be modified continuously and there is a need for an entity that will carry out this activity. The changing nature of a politically exposed person’s business and political interests can make manual periodic reviews a challenging prospect for many firms.

-

The Need for Real-Time Automated Solutions

An annual review of a PEP’s status may be unachievable for some firms or prove inadequate for high-risk politically exposed persons. However, the risk can be managed more effectively with a real-time automated solution that can regularly scan for material changes to a politically exposed person’s account or file.

Due Diligence obligations on a politically exposed person

While there is no global definition of a politically exposed person, most countries have based their definition on the Financial Action Task Force on Money Laundering (FATF) standard. There is no specific mention of exercising enhanced due diligence to determine whether the customer is a PEP or to establish the source of wealth and source funds.

The EU Third Money Laundering Directive and FATF Recommendation 6 require companies and businesses to perform the following additional due diligence measures:

- Exercise appropriate risk management systems (eg implementing appropriate internal policies, procedures, and controls) to determine whether the customer or beneficial owner concerning the customer (if any) is a politically exposed person.

- Take reasonable measures to establish the source of wealth and source of funds.

- Conduct enhanced ongoing monitoring of the business relationship (e.g. monitor customers’ accounts and scrutinize transactions to ensure that they are consistent with its knowledge of the customer, their business and risk profile, and where appropriate, the source of funds).

To comply with AML regulations and to trace and tackle PEPs, businesses need to have a proper procedure in place.

Any business entity should know when to check for a PEP and why to check for it. PEP records should be integrated into the system of every business so that the onboarding customer is screened against it and to nullify the associated risks and criminal activities.

FATF Recommendations for Politically Exposed Persons

There are confirmed risks associated with politically exposed persons that justify stringent measures to be taken to put a halt to financial crimes such as money laundering, terrorist financing, and others. Businesses are required to take preventive measures before establishing a relationship with such persons.

Businesses are required to perform a proper PEP list screening whenever a new customer is on board to check the criminal history and associated risks. FATF requires countries to ensure that financial institutions implement measures to prevent money laundering through financial institutes by PEPs and to detect potential misuse whenever it occurs.

1. AML/CFT POLICIES AND COORDINATION

Assessing risks and applying a risk-based approach –

Countries should identify, assess, and understand the money laundering and terrorist financing risks for the country, and should take action, including designating an authority or mechanism to coordinate actions to assess risks and apply resources, aimed at ensuring the risks are mitigated effectively.

Based on that assessment, countries should apply a risk-based approach (RBA) to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified.

This approach should be an essential foundation for the efficient allocation of resources across the anti-money laundering and countering the financing of terrorism (AML/CFT) regime and the implementation of risk-based measures throughout the FATF Recommendations.

Where countries identify higher risks, they should ensure that their AML/CFT regime adequately addresses such risks. Where countries identify lower risks, they may decide to allow simplified measures for some of the FATF Recommendations under certain conditions.

Countries should require financial institutions and designated non-financial businesses and professions (DNFBPs) to identify, assess, and take effective action to mitigate their money laundering and terrorist financing risks.

National cooperation and coordination –

Countries should have national AML/CFT policies, informed by the risks identified, which should be regularly reviewed and should designate an authority or have the coordination or other mechanism that is responsible for such policies.

Countries should ensure that policy-makers, the financial intelligence unit (FIU), law enforcement authorities, supervisors, and other relevant competent authorities, at the policymaking and operational levels, have effective mechanisms in place which will enable them to cooperate

They are also directed to coordinate and exchange information domestically with each other concerning the development and implementation of policies and activities to combat money laundering, terrorist financing, and the financing proliferation of weapons of mass destruction.

This should include cooperation and coordination between relevant authorities to ensure the compatibility of AML/CFT requirements with Data Protection and Privacy rules and other similar provisions (e.g. data security/localization).

2. MONEY LAUNDERING AND CONFISCATION

Money laundering offense –

Countries should criminalize money laundering based on the Vienna Convention and the Palermo Convention. Countries should apply the crime of money laundering to all serious offenses, including the widest range of predicate offenses.

Confiscation and provisional measures –

Countries should adopt measures similar to those outlined in the Vienna Convention, the Palermo Convention, and the Terrorist Financing Convention, including legislative measures, to enable their competent authorities to freeze or seize and confiscate the following, without prejudicing the rights of bona fide third parties:

- property laundered,

- proceeds from, or instrumentalities used in or intended for use in money laundering or predicate offenses,

- property that is the proceeds of, or used in, or intended or allocated for use in, the financing of terrorism, terrorist acts, or terrorist organizations,

- property of corresponding value.

Such measures should include the authority to

- identify, trace, and evaluate the property that is subject to confiscation;

- carry out provisional measures, such as freezing and seizing, to prevent any dealing, transfer, or disposal of such property;

- take steps that will prevent or void actions that prejudice the country’s ability to freeze or seize or recover property that is subject to confiscation;

- take any appropriate investigative measures.

Countries should consider adopting measures that allow such proceeds or instrumentalities to be confiscated without requiring a criminal conviction (non-conviction-based confiscation), or which require an offender to demonstrate the lawful origin of the property alleged to be liable to confiscation, to the extent that such a requirement is consistent with the principles of their domestic law.

3. TERRORIST FINANCING AND FINANCING OF PROLIFERATION

Terrorist financing offense

Countries should criminalize terrorist financing based on the Terrorist Financing Convention and should criminalize not only the financing of terrorist acts but also the financing of terrorist organizations and individual terrorists even in the absence of a link to a specific terrorist act or acts. Countries should ensure that such offenses are designated as money laundering predicate offenses.

Targeted financial sanctions related to terrorism and terrorist financing

Countries should implement targeted financial sanctions regimes to comply with United Nations Security Council resolutions relating to the prevention and suppression of terrorism and terrorist financing.

The resolutions require countries to freeze without delay the funds or other assets of and to ensure that no funds or other assets are made available, directly or indirectly, to or for the benefit of, any person or entity either (i) designated by, or under the authority of, the United Nations Security Council under Chapter VII of the Charter of the United Nations, including under resolution 1267 (1999) and its successor resolutions; or (ii) designated by that country according to resolution 1373 (2001).

Targeted financial sanctions related to proliferation

Countries should implement targeted financial sanctions to comply with United Nations Security Council resolutions relating to the prevention, suppression, and disruption of the proliferation of weapons of mass destruction and its financing.

These resolutions require countries to freeze without delay the funds or other assets of and to ensure that no funds and other assets are made available, directly or indirectly, to or for the benefit of, any person or entity designated by, or under the authority of, the United Nations Security Council under Chapter VII of the Charter of the United Nations.

Non-profit organisations

Countries should review the adequacy of laws and regulations that relate to non-profit organizations which the country has identified as being vulnerable to terrorist financing abuse.

Countries should apply focused and proportionate measures, in line with the risk-based approach, to such non-profit organizations to protect them from terrorist financing abuse, including

- by terrorist organizations posing as legitimate entities;

- by exploiting legitimate entities as conduits for terrorist financing, including to escape asset-freezing measures;

- by concealing or obscuring the clandestine diversion of funds intended for legitimate purposes to terrorist organizations.

4. PREVENTIVE MEASURES

Financial institution secrecy laws

Countries should ensure that financial institution secrecy laws do not inhibit the implementation of the FATF Recommendations.

SignalX for PEP screening and AML solutions

SignalX enables you to put in place a strong Customer/Vendor Identification Program to protect your business from unforeseen financial, compliance, and reputational risks. Talk to us today for a free consultation and a free customer/vendor due diligence checklist.

Frequently Asked Questions

Who is a politically exposed person in India?

In India, a politically exposed person (PEP) is defined as an individual who is or has been entrusted with a prominent public function. This includes:

- Heads of state or government

- Senior politicians, such as ministers, members of parliament, and members of legislative assemblies

- Senior government or judicial officials, such as judges or magistrates

- Senior executives of state-owned enterprises

- Ambassadors, high-ranking military officers, or senior officials of political parties.

Why is PEP high-risk?

A person exposed to politics is considered high-risk because he or she has access to public funds and decision-making powers, making them more likely to commit fraud, corruption, or other financial crimes. It is possible for PEPs to abuse their power or facilitate illegal activities such as bribery, embezzlement, or stealing from the government. It is important to identify PEPs to mitigate the risks associated with them and to prevent the illicit use of the financial system.

What are the different types of PEPs?

There are three main types of PEPs: domestic, foreign, and international organizations PEPs. Domestic PEPs are individuals who hold prominent positions within a specific country, such as politicians or high-ranking military officers.

Foreign PEPs are individuals who hold prominent positions in another country, such as ambassadors or members of international sports committees. International organizations PEPs are individuals who hold high positions in organizations such as the United Nations or NATO.

How was the concept of PEPs introduced?

The concept of PEPs was introduced in the 1990s after the Nigerian dictator Sani Abacha misappropriated billions of dollars from the Nigerian Central Bank and transferred the funds to his accounts in the UK and Switzerland.

The succeeding government had difficulty recovering the money, leading to the introduction of the concept of a “Politically Exposed Person” to help prevent similar cases of money laundering.