Regulatory Screening: What It Is, Why It Matters & How to Do It Right in 2026

Regulatory screening is the process of checking individuals, businesses, and transactions against global regulatory, sanctions, and risk databases to prevent financial crime, regulatory breaches, and reputational damage.

In 2026, regulatory screening is no longer just a compliance checkbox. It is a frontline defence against sanctions violations, money laundering, terrorist financing, and rapidly escalating regulatory penalties across jurisdictions.

As enforcement tightens worldwide and regulators expect real-time risk controls, organizations that rely on outdated or manual screening processes face growing exposure. This guide explains what regulatory screening really means today, how it works, where companies go wrong, and how to build a scalable, audit-ready screening program.

What Is Regulatory Screening?

Regulatory screening is the continuous process of identifying regulatory, financial crime, and reputational risks by screening customers, counterparties, vendors, and transactions against authoritative risk data sources.

At its core, regulatory screening answers one critical question: Is this person or entity prohibited, restricted, or high-risk under applicable regulations?

It typically involves checking names and identifiers against sanctions lists, politically exposed person (PEP) databases, watchlists, adverse media sources, and internal blacklists.

In plain English, regulatory screening helps organizations avoid doing business with people they legally or ethically shouldn’t.

It’s often confused with broader compliance activities, but regulatory screening is more targeted. While compliance monitoring tracks ongoing behavior and transactions, regulatory screening focuses on who you are dealing with and whether they pose a regulatory risk at any point in time.

Industries that rely heavily on regulatory screening include banks, fintechs, crypto platforms, healthcare providers, insurers, multinational corporations, and any business operating across borders.

Why Regulatory Screening Is Critical in 2026

Regulatory screening has become mission-critical due to the sheer scale and complexity of modern regulation.

Global enforcement actions have increased sharply, with regulators imposing record-breaking fines for sanctions breaches, AML failures, and inadequate screening controls. Governments are expanding sanctions programs faster than most compliance teams can manually track, particularly in response to geopolitical instability, cybercrime, and terrorism financing.

Penalties are no longer limited to fines. Organizations now face license revocations, forced shutdowns, executive liability, and irreversible reputational damage when screening failures occur.

Cross-border business has also amplified risk. A single transaction can trigger overlapping obligations under U.S., EU, UK, and regional regulations simultaneously. Regulators increasingly expect companies to demonstrate proactive risk detection, not reactive remediation.

In 2026, “we didn’t know” is no longer an acceptable defense.

Types of Regulatory Screening

Modern regulatory screening is not a single activity but a layered framework designed to capture different risk dimensions.

Sanctions Screening

Sanctions screening checks individuals and entities against national and international sanctions lists, including OFAC, the United Nations, the European Union, and the UK’s HM Treasury.

These lists identify individuals, companies, vessels, and countries subject to restrictions or outright prohibitions. Sanctions screening is legally mandatory in many jurisdictions and carries the highest enforcement risk when failures occur.

Politically Exposed Person (PEP) Screening

PEP screening identifies individuals who hold, or are closely associated with, prominent public positions. Because PEPs present elevated corruption and bribery risks, regulators require enhanced due diligence when dealing with them.

Effective PEP screening distinguishes between domestic and foreign PEPs and supports ongoing monitoring, as individuals can become PEPs after onboarding.

Adverse Media Screening

Adverse media screening analyzes negative news, legal actions, and credible allegations related to individuals or organizations. This helps uncover risks that may not yet appear on formal watchlists but still pose reputational or regulatory exposure.

In 2026, adverse media screening increasingly overlaps with ESG and conduct risk management.

Watchlist and Blacklist Screening

This includes law enforcement lists, regulatory enforcement databases, and internal blacklists maintained by organizations. Internal lists are particularly important for preventing repeat exposure to previously identified risks.

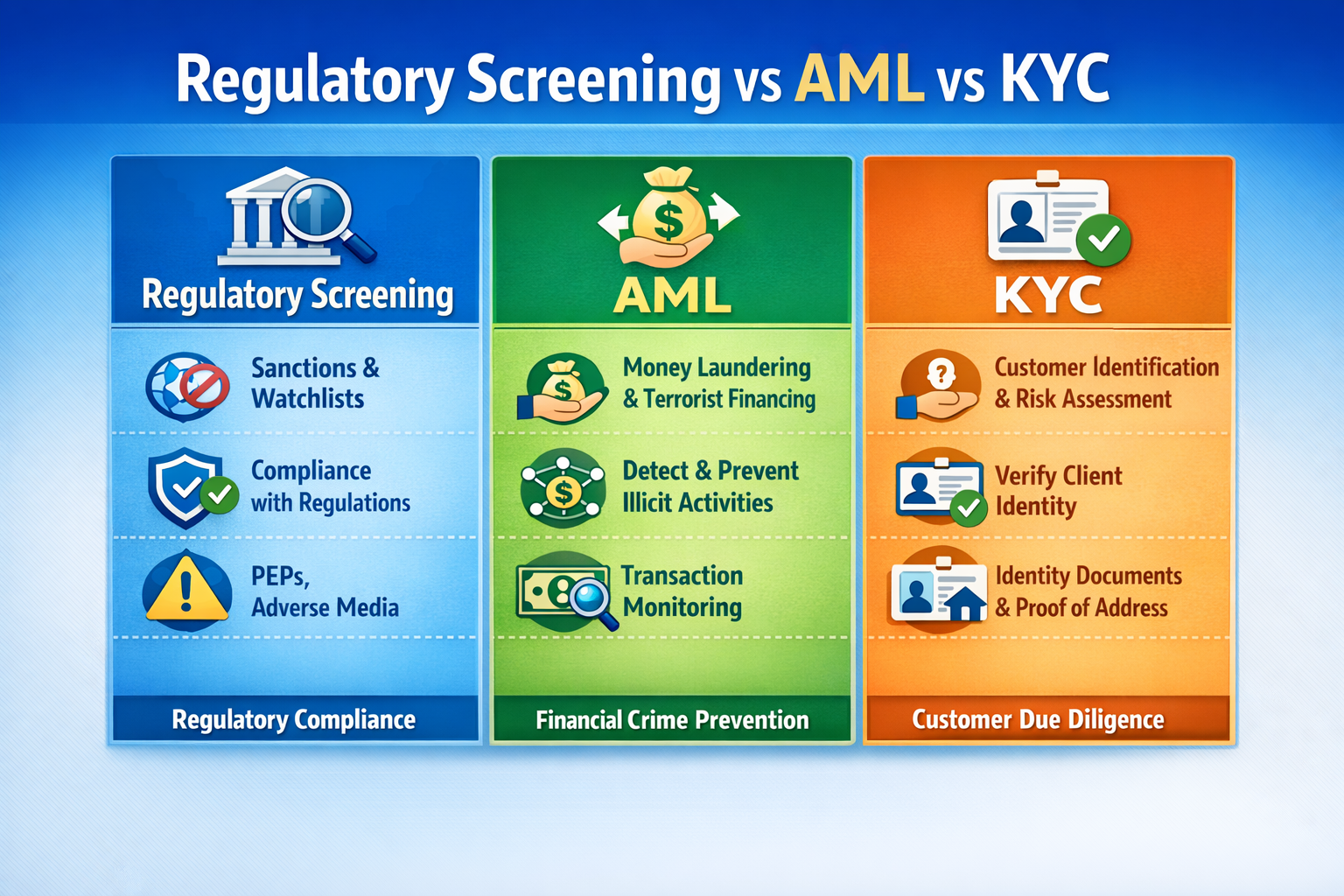

Regulatory Screening vs AML vs KYC

Regulatory screening is often discussed alongside AML and KYC, but they serve distinct roles within a compliance framework.

KYC focuses on verifying customer identity and understanding ownership structures at onboarding. AML covers transaction monitoring, suspicious activity detection, and reporting obligations. Regulatory screening intersects with both by identifying who should not be onboarded or transacted with at all, or who requires enhanced controls.

Together, these processes form a layered defense. Regulatory screening acts as the gatekeeper, AML monitors behavior over time, and KYC ensures identity integrity.

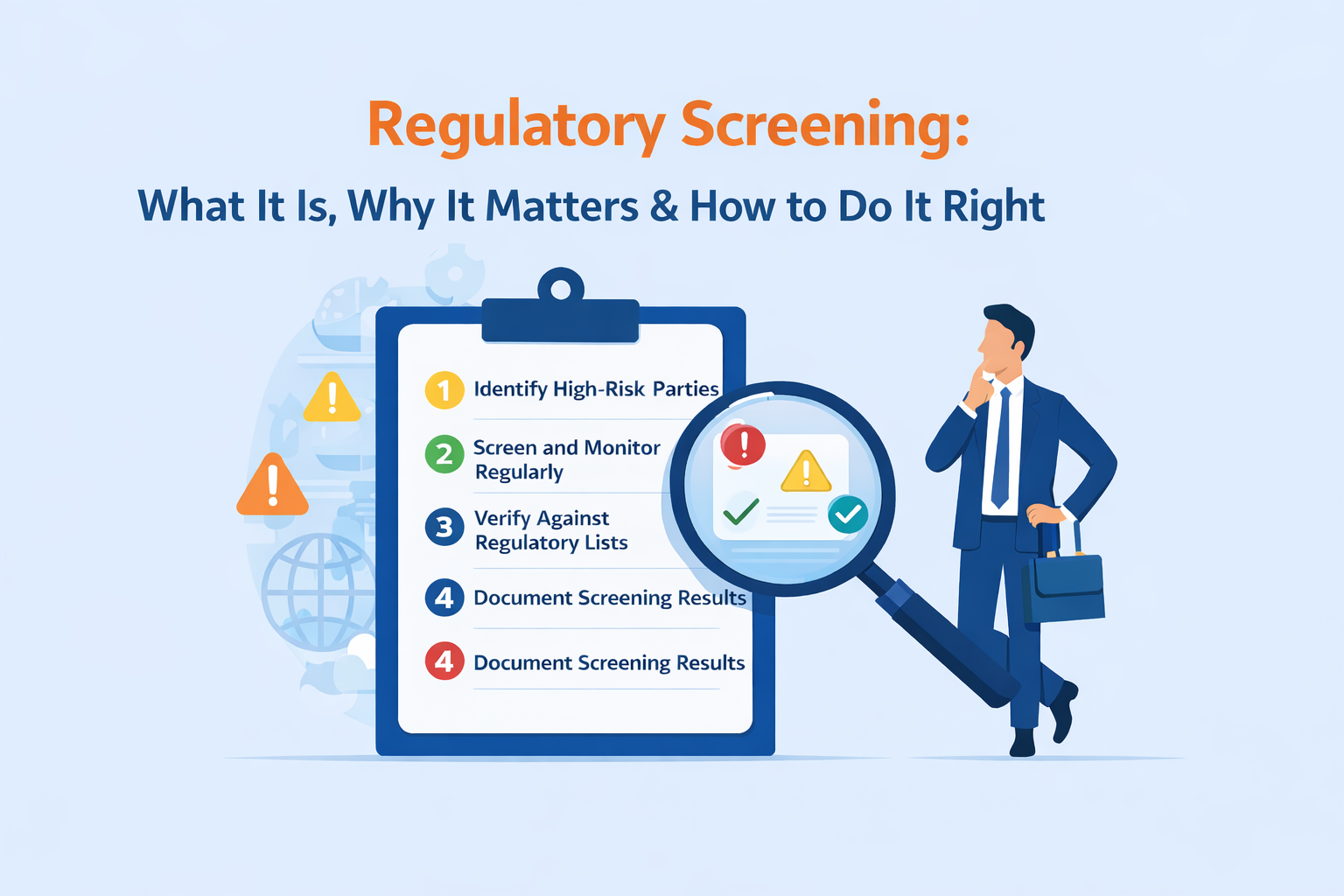

How Regulatory Screening Works Step by Step

A modern regulatory screening process begins with data collection. This includes names, aliases, dates of birth, addresses, ownership details, and identifiers such as passport or registration numbers.

Next comes name matching using advanced algorithms that account for spelling variations, transliteration differences, and incomplete data. Simple exact-match logic is no longer sufficient in global environments.

Once potential matches are identified, risk scoring models evaluate the severity and relevance of the match based on factors such as list source, jurisdiction, and proximity.

Alerts are generated when risk thresholds are met. These alerts are then reviewed by trained compliance analysts who determine whether the match is a true hit, a false positive, or requires escalation.

Finally, ongoing monitoring ensures that changes to sanctions lists, PEP status, or adverse media are detected in real time, not months later.

Manual vs Automated Regulatory Screening

Manual screening methods struggle to meet modern regulatory expectations.

Manual processes are slow, inconsistent, and prone to human error. They often generate excessive false positives, miss subtle matches, and cannot scale with growing customer volumes. Documentation is fragmented, making audits painful and risky.

Automated regulatory screening solves these issues by continuously updating data sources, applying advanced matching logic, and maintaining complete audit trails. Automation reduces compliance costs while increasing accuracy and regulatory confidence.

In 2026, regulators increasingly expect automation. Manual screening alone is widely viewed as inadequate for medium to high-risk organizations.

Key Regulatory Screening Challenges

Despite advances in technology, regulatory screening remains complex.

False positives are a major pain point, overwhelming compliance teams and delaying legitimate business. Data quality issues, such as inconsistent name formats and incomplete records, further complicate screening.

Global name variations and transliteration differences make accurate matching difficult, particularly for non-Latin alphabets. Meanwhile, regulatory requirements change frequently, requiring constant updates across jurisdictions.

Organizations that fail to address these challenges risk both compliance failures and operational inefficiency.

Best Practices for Effective Regulatory Screening

The most effective screening programs follow a risk-based approach, aligning screening depth with customer and transaction risk levels.

Continuous monitoring is essential. One-time screening at onboarding is no longer sufficient in a world where sanctions and PEP status can change overnight.

Data sources should be updated in real time, not periodically. Human-in-the-loop reviews remain critical to resolve complex cases and prevent automation bias.

Finally, clear documentation and audit trails are non-negotiable. Regulators care as much about how decisions were made as the decisions themselves.

How to Choose the Right Regulatory Screening Software

Selecting the right screening software can determine whether a compliance program scales or collapses under regulatory pressure.

Global regulatory coverage is essential, particularly for organizations operating across borders. AI-powered matching capabilities help reduce false positives while capturing true risks.

Configurable risk thresholds allow organizations to tailor screening to their risk appetite and regulatory obligations. API integrations ensure screening fits seamlessly into onboarding, payments, and transaction workflows.

Equally important is transparency. Vendors should clearly explain data sources, update frequency, regulatory coverage, and historical false positive rates.

Regulatory Screening Use Cases by Industry

In banking and financial services, regulatory screening is foundational to AML and sanctions compliance. Fintech and crypto platforms rely on screening to satisfy licensing requirements and prevent platform abuse.

Healthcare organizations use regulatory screening to avoid restricted providers and sanctioned suppliers. Insurers apply screening to policyholders and beneficiaries to manage fraud and sanctions risk.

E-commerce platforms and marketplaces increasingly screen merchants and sellers to prevent cross-border regulatory exposure.

Regulatory Screening Compliance Requirements by Region

In the United States, regulatory screening is driven by OFAC, FinCEN, and sector-specific regulators. The European Union enforces screening under AML directives and sanctions regimes, while the UK maintains its own post-Brexit framework through OFSI.

Asia-Pacific regulations vary widely, with countries like Singapore and Australia imposing strict screening expectations. The Middle East continues to expand sanctions and AML enforcement, particularly in financial hubs.

Organizations operating internationally must align screening practices with the most stringent applicable requirements.

Common Regulatory Screening Mistakes (And How to Avoid Them)

One of the most common mistakes is relying on static lists that quickly become outdated. Another is treating screening as a one-time exercise instead of an ongoing process.

Poor documentation and unclear escalation workflows also undermine compliance efforts. Avoiding these mistakes requires investment in technology, training, and governance.

Building Trust at Scale with SignalX Regulatory Screening

SignalX enables organizations to turn regulatory screening into a real-time, risk-based, and scalable capability.

It continuously screens customers and counterparties against sanctions, PEPs, and adverse media, reducing false positives through intelligent risk scoring. With built-in automation, explainability, and audit-ready reporting, SignalX helps teams stay compliant while cutting manual effort.

The result: lower compliance costs, stronger regulatory confidence, and the ability to scale safely in 2026 and beyond.

The Future of Regulatory Screening

The future of regulatory screening lies in intelligent automation. AI and machine learning will continue to improve match accuracy and reduce false positives.

Real-time compliance will become the norm, with predictive risk scoring identifying potential issues before regulators intervene. RegTech solutions will increasingly converge, unifying screening, AML, KYC, and transaction monitoring into integrated platforms.

Organizations that embrace these trends will gain both compliance resilience and competitive advantage.

Frequently Asked Questions About Regulatory Screening

What is regulatory screening in compliance?

Regulatory screening is the process of checking individuals and entities against applicable sanctions lists, watchlists, and other regulatory databases to identify prohibited or high-risk parties. It helps organizations ensure they do not engage with parties restricted under laws and regulations.

Is regulatory screening required by law?

In many industries, regulatory screening is a legal or regulatory requirement, especially where anti-money laundering (AML), counter-terrorist financing, or sanctions regulations apply. Failure to conduct proper screening can result in serious compliance violations.

When should regulatory screening be performed?

Screening should occur during onboarding to prevent prohibited relationships from forming and continue on an ongoing basis. Continuous screening helps capture changes in risk status, such as newly imposed sanctions or regulatory actions.

What happens if regulatory screening fails?

If regulatory screening is inadequate or missed, organizations may face regulatory fines, enforcement actions, operational limitations, and significant reputational harm. These consequences can also affect customer trust and long-term business viability.

Final Thoughts: Building a Scalable Regulatory Screening Program

Regulatory screening is no longer optional or static. It is a dynamic, high-stakes capability that underpins trust, compliance, and long-term growth.

Organizations that invest in automated, risk-based screening frameworks are better positioned to navigate regulatory complexity, avoid penalties, and scale confidently in 2026 and beyond.

If you’re building or upgrading a regulatory screening program, the right strategy and technology can turn compliance from a cost center into a competitive advantage.