Role of Due Diligence in Mergers and Acquisitions :Everything You Need to Know

Mergers and acquisitions (M&A) are high-stakes business transactions that often involve millions, if not billions, of dollars. In these deals, the importance of due diligence cannot be overstated. Due diligence serves as the backbone of any M&A deal, offering a systematic approach to assess risks, verify claims, and uncover potential pitfalls. It plays a crucial role in helping parties make informed decisions and protect their interests.

But what exactly is due diligence, and why is it so critical in the M&A process? In simple terms, due diligence refers to the comprehensive investigation and analysis conducted before finalizing a deal. Its primary purpose is to validate financial, legal, operational, and commercial information presented by the target company. Failure to conduct proper due diligence can lead to disastrous outcomes, ranging from financial losses to reputational damage. With stakes this high, organizations must approach due diligence with precision and care.

In this blog, we will explore the various facets of due diligence in M&A transactions, provide you with a step-by-step guide to conducting thorough due diligence, and highlight how innovative platforms like SignalX play a pivotal role in enhancing the due diligence process.

Understanding Due Diligence: Purpose and Importance

The main objective of due diligence is to assess all aspects of the target company before a deal is finalized. This allows both buyers and sellers to make informed decisions based on a clear understanding of the risks and opportunities at hand. Here are the key purposes of due diligence:

Risk Assessment

One of the primary goals of due diligence is to identify and mitigate risks. Whether it’s financial instability, pending litigation, or regulatory non-compliance, due diligence uncovers red flags that could jeopardize the deal. Identifying these risks allows the parties involved to make informed decisions about whether to proceed with the acquisition, renegotiate the deal, or walk away altogether.

Valuation Accuracy

Due diligence also plays a critical role in accurately valuing the target company. By reviewing financial records, assets, liabilities, and business operations, due diligence helps ensure that the valuation aligns with the true worth of the business. Overvaluing a company can lead to paying more than it is worth, while undervaluing it could mean missing out on a valuable opportunity.

Compliance Verification

In addition to financial and operational assessments, due diligence ensures that the target company complies with all relevant laws, regulations, and industry standards. Legal due diligence focuses on uncovering potential compliance issues that may affect the deal, such as pending lawsuits, intellectual property disputes, or environmental violations.

Types of Due Diligence in M&A

Due diligence is not a one-size-fits-all process. Different aspects of a business must be assessed based on the type of deal and the target company’s industry. Below are the main types of due diligence:

1. Financial Due Diligence

Financial due diligence involves a detailed review of the target company’s financial statements, accounting practices, cash flow, and overall financial health. This type of due diligence helps the buyer understand the financial risks involved in the deal. The process includes analyzing historical financial performance, assessing the accuracy of financial statements, and reviewing any outstanding debts or liabilities.

2. Legal Due Diligence

Legal due diligence focuses on identifying potential legal risks that could affect the deal. This involves reviewing the company’s contracts, intellectual property rights, litigation history, and compliance with local and international laws. The goal is to uncover any ongoing or potential legal issues, such as pending lawsuits, breaches of contract, or regulatory violations, that could impact the acquisition.

3. Operational Due Diligence

Operational due diligence assesses the efficiency and effectiveness of the target company’s operations. This includes evaluating its internal processes, supply chain, human resources, and infrastructure. Understanding the operational aspects of a business allows the buyer to identify potential operational synergies or inefficiencies that could affect the future performance of the combined entity.

4. Commercial Due Diligence

Commercial due diligence examines the target company’s market position, customer base, competitive landscape, and growth potential. This analysis helps the buyer understand how the company fits into the larger market and whether its future prospects align with the buyer’s strategic objectives. It also helps identify any market risks, such as changes in consumer preferences or increased competition.

5. Technological Due Diligence

In today’s digital age, technological due diligence is becoming increasingly important. This involves assessing the target company’s IT infrastructure, software systems, cybersecurity measures, and technological assets. For tech companies or those with significant reliance on technology, this type of due diligence is essential in identifying any potential cybersecurity vulnerabilities, outdated systems, or integration challenges.

6. Environmental, Social, and Governance (ESG) Due Diligence

ESG due diligence is a newer but critical component in M&A transactions, especially as sustainability and corporate responsibility take on greater importance. This involves evaluating the target company’s environmental impact, social responsibility practices, and governance structure. Assessing ESG factors not only ensures compliance with regulations but also helps to identify reputational risks that could arise from poor sustainability practices or governance issues.

The Due Diligence Process: A Step-by-Step Guide

Due Diligence in Mergers and Acquisitions is a systematic process that unfolds over several stages. Below is a step-by-step guide to conducting effective due diligence:

1. Preparation and Planning

The first step in the due diligence process is preparation. This involves assembling a team of experts from various disciplines, such as finance, law, operations, and technology, depending on the complexity of the transaction. The team must define the scope of due diligence, set timelines, and determine the key areas of focus based on the nature of the deal.

2. Information Gathering

Once the scope is defined, the next step is gathering all relevant documents and data from the target company. This may include financial statements, tax returns, contracts, corporate governance documents, intellectual property details, and employee records. The goal is to collect as much information as possible to create a comprehensive picture of the target company’s operations and financial health.

3. Analysis and Evaluation

After gathering the data, the due diligence team conducts a thorough analysis to assess the financial, legal, and operational health of the target company. This involves reviewing key metrics, identifying discrepancies or red flags, and evaluating risks. This stage requires expertise in various fields to accurately assess the data and determine the true value of the company.

4. Reporting and Decision-Making

The findings from the due diligence process are compiled into a report, which is presented to the stakeholders involved in the transaction. The report should highlight key risks, opportunities, and recommendations for proceeding with the deal. Based on the findings, the buyer may decide to move forward with the deal, renegotiate terms, or even walk away.

5. Post-Due Diligence Actions

Once the deal is finalized, post-due diligence actions may include addressing any issues uncovered during the process, integrating the findings into the deal structure, or implementing corrective measures. This could involve restructuring the deal, making changes to the target company’s operations, or mitigating any legal or financial risks.

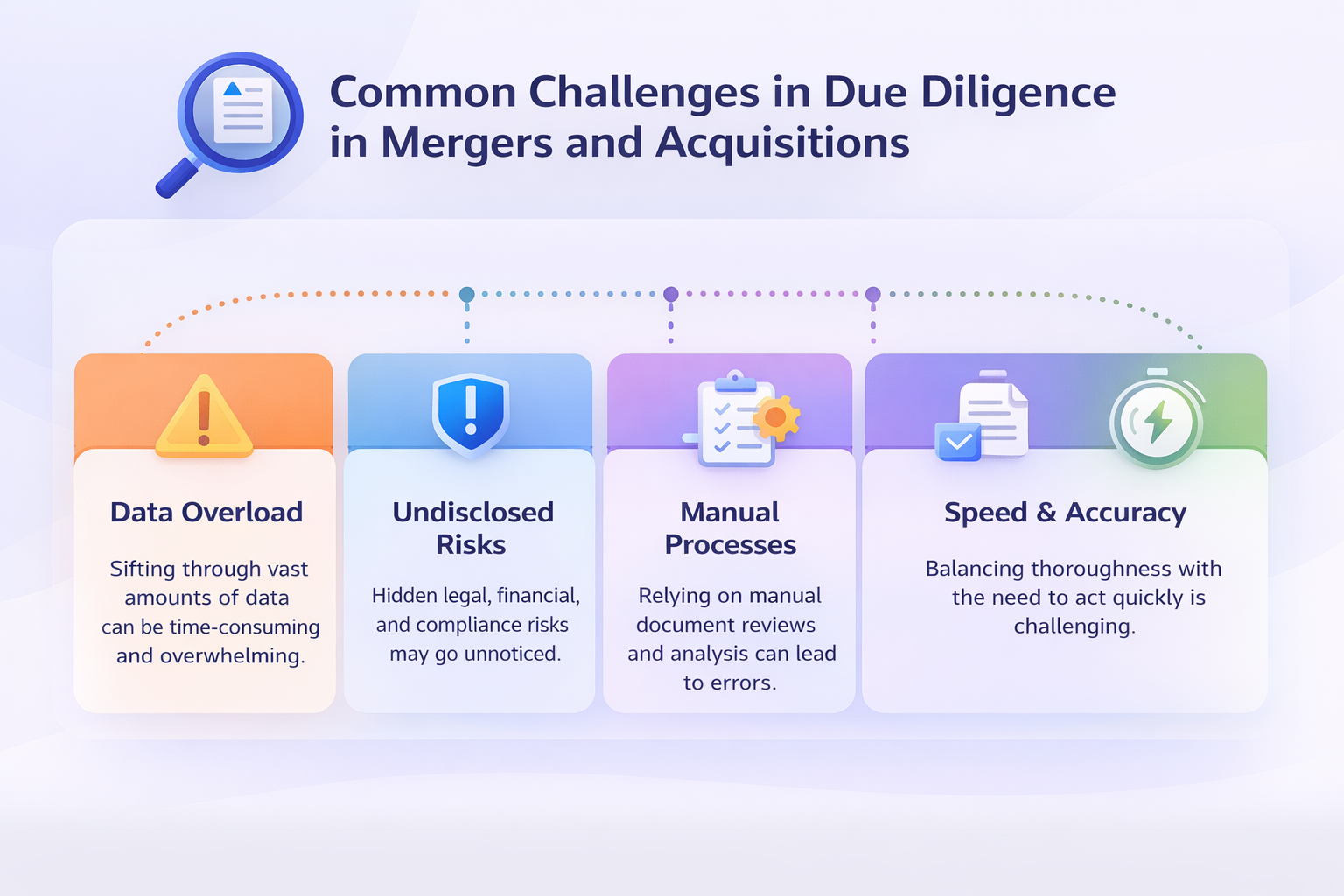

Common Challenges and How to Overcome Them

Despite the importance of due diligence, many companies face challenges throughout the process. Some of the common issues include:

Incomplete or Inaccurate Information

Often, the target company may not provide all the necessary information, or the information provided may be incomplete or inaccurate. To mitigate this risk, it’s essential to request all relevant documents upfront and conduct independent verification through third-party sources, such as auditors, consultants, or legal advisors.

Communication Gaps

Effective communication between stakeholders is crucial to ensure that the due diligence process runs smoothly. Miscommunication can lead to missed opportunities or overlooked risks. Establishing clear lines of communication and maintaining transparency throughout the process can help avoid misunderstandings.

Time Constraints

M&A deals are often time-sensitive, and the due diligence process can take longer than expected. To address this, the due diligence team should prioritize key areas of focus and be prepared to adapt to changing circumstances.

Leveraging Technology in Due Diligence

As the complexity of M&A transactions increases, so does the need for sophisticated tools to streamline the due diligence process. Technology, particularly artificial intelligence (AI) and data analytics, can enhance the efficiency and accuracy of due diligence.

AI and Data Analytics

AI-powered tools can help analyze large volumes of data more quickly and accurately than manual processes. These tools can detect patterns, identify risks, and even predict potential challenges that may arise in the future. AI also enables automated document reviews, speeding up the due diligence process and reducing human error.

Digital Platforms

There are several digital platforms available that help facilitate the due diligence process. These platforms allow teams to securely share and collaborate on documents, track progress, and centralize information. Some tools also offer built-in workflows and analytics to help manage large-scale due diligence projects more effectively.

How SignalX Enhances Due Diligence

SignalX is one such innovative technology that is transforming the way due diligence is conducted in M&A deals. SignalX leverages advanced data science, machine learning, and AI to provide deep insights into a target company’s operational and financial health. Here’s how SignalX takes part in due diligence:

Real-Time Risk Assessment: SignalX uses AI to identify and flag potential risks early in the process. By analysing historical data and cross-referencing multiple data sources, it can uncover hidden risks, such as compliance issues, financial inconsistencies, and regulatory red flags, that may not be apparent from traditional due diligence methods.

Automated Document Analysis: SignalX uses natural language processing (NLP) to automate the review of key documents, such as contracts, financial statements, and regulatory filings. This speeds up the process, reduces human error, and ensures no critical information is missed.

Data Visualization and Insights: SignalX turns

complex data into actionable insights by providing visualizations that highlight key trends, patterns, and risks. These visualizations help stakeholders understand the data more clearly and make more informed decisions.

Integration with Existing Workflows: SignalX integrates seamlessly with existing due diligence workflows, providing real-time updates and alerts on any new findings or developments. This helps due diligence teams stay on top of the process and make timely adjustments as needed.

Continuous Monitoring: SignalX doesn’t just stop at the due diligence phase; it continues to monitor the target company throughout the post-deal integration phase. This ensures that any new risks or opportunities are promptly identified, allowing the acquirer to take corrective action as needed.

to accelerate your due diligence process.

Case Studies: Lessons from Real M&A Deals

Case Study 1: The Yahoo–Alibaba Deal

In the case of Yahoo’s investment in Alibaba, due diligence played a pivotal role in uncovering critical business and financial information. Yahoo conducted extensive due diligence on Alibaba’s operations, financial statements, and market position, which allowed it to negotiate a favourable deal. However, the absence of thorough due diligence on cultural and management differences contributed to challenges post-acquisition.

Case Study 2: The Daimler-Chrysler Merger

The 1998 merger between Daimler-Benz and Chrysler is often cited as a cautionary tale. Despite extensive financial due diligence, the companies overlooked operational and cultural differences, leading to a failed merger. This example highlights the importance of non-financial due diligence, such as understanding corporate culture and operational synergies.

Conclusion: The Imperative of Comprehensive Due Diligence

Due diligence is a critical step in the M&A process that can make or break a deal. By thoroughly evaluating financial, legal, operational, and market-related factors, stakeholders can ensure that their investment is sound and minimize risks. As the M&A landscape evolves, platforms like SignalX are making due diligence smarter, faster, and more comprehensive, enabling businesses to make better-informed decisions.

Whether you’re a buyer or a seller, taking the time to invest in a robust due diligence process is essential for safeguarding your interests and achieving long-term success in your M&A transactions.

Frequently Asked Questions (FAQs)

1. What is due diligence in mergers and acquisitions?

Due diligence in M&A is a structured investigation conducted before finalizing a transaction. It involves examining financial records, legal obligations, operational processes, market positioning, technology, and ESG factors to verify information, uncover risks, and ensure the deal aligns with strategic objectives.

2. Why is due diligence critical to the success of an M&A deal?

Due diligence reduces uncertainty and prevents costly surprises after deal closure. It helps buyers avoid overvaluation, identify hidden liabilities, ensure regulatory compliance, and make informed negotiation decisions, ultimately increasing the likelihood of a successful acquisition.

3. What are the most important types of due diligence in M&A?

The key types include financial, legal, operational, commercial, technological, and ESG due diligence. Each focuses on a different aspect of the target business, ensuring a holistic understanding of risks, opportunities, and long-term sustainability.

4. How does technology improve the due diligence process?

Technology enhances due diligence by automating data collection, accelerating document reviews, and improving accuracy. AI and data analytics help identify patterns, anomalies, and red flags that may be missed in manual reviews, significantly reducing time and effort.

5. What role does SignalX play in M&A due diligence?

SignalX supports M&A due diligence by leveraging AI, machine learning, and data analytics to deliver real-time risk insights. It automates document analysis, highlights financial and compliance risks, visualizes complex data, and continuously monitors post-deal performance, enabling smarter and faster decision-making.

6. What are common challenges faced during due diligence, and how can they be addressed?

Common challenges include incomplete data, time constraints, and communication gaps between stakeholders. These can be addressed through early planning, clear scope definition, use of automated tools like SignalX, and maintaining transparent communication throughout the process.

7. Is due diligence relevant after the deal is completed?

Yes, due diligence extends beyond deal closure. Post-deal monitoring helps organizations track performance, manage newly identified risks, and ensure smooth integration. Platforms like SignalX enable continuous oversight, ensuring long-term value creation from the acquisition.