What Is Risk and Risk Management: Why It Matters

In today’s fast-paced and unpredictable business world, risk is an inevitable part of operations. From financial uncertainty to operational disruptions, businesses face a variety of challenges that can threaten growth and stability. Understanding risk and risk management is crucial for protecting your business from potential losses and ensuring long-term success.

In this blog, we will break down the key differences between risk and risk management, explain why risk management is vital for businesses, and explore how effective strategies can protect your company from unforeseen challenges.

What is Risk?

Risk refers to the potential for loss or harm that arises from uncertain conditions. Every decision, action, and strategy comes with a degree of risk, whether it’s financial, operational, or reputational. In a business context, risk can manifest in many forms, such as market fluctuations, cybersecurity threats, regulatory changes, or supply chain disruptions. Understanding the various types of risks that your business faces is the first step toward managing them effectively.

Understanding the types of risks your business faces is the first step in effective risk and risk management.

What is Risk Management?

Risk management is the process of identifying, assessing, and prioritising risks, followed by implementing strategies to minimize, monitor, and control the probability or impact of unfortunate events. Unlike risk, which is inherent and unpredictable, risk management is a proactive approach designed to protect an organization from potential harm. By recognizing risks early, businesses can take action to prevent or mitigate their effects.

Risk vs Risk Management:

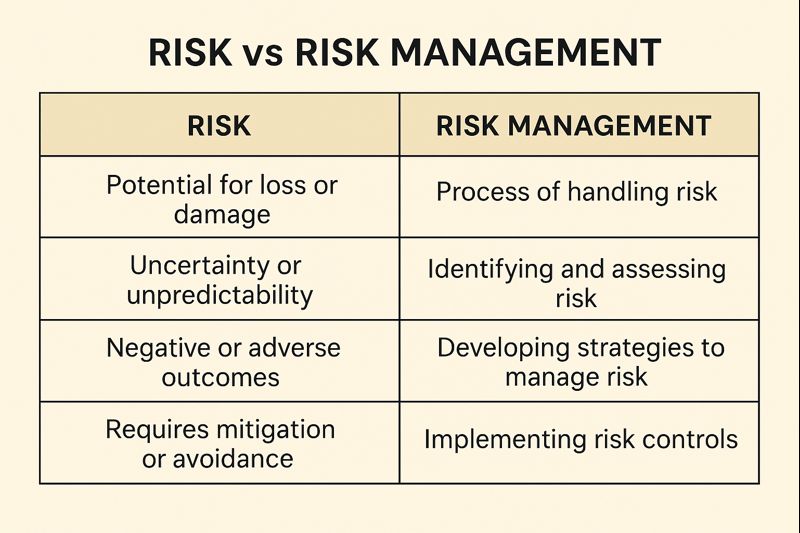

While both risk and risk management are crucial concepts in business, it’s important to understand how they differ:

Risk refers to the possibility of experiencing negative outcomes or consequences due to uncertain events or circumstances. In the context of business, it’s the potential for things to not go as planned, whether due to external factors like market shifts, or internal issues such as operational inefficiencies. Every business faces some level of risk, and understanding its nature is crucial for navigating challenges effectively

Risk Management, on the other hand, is the structured approach to controlling or minimizing those risks. It involves identifying potential risks, assessing their impact, and implementing plans to deal with them.

In simple terms, risk is the threat, while risk management is the solution. The goal of risk management is not to eliminate risk entirely (which is impossible) but to reduce it to a manageable level so that businesses can continue to operate smoothly.

Why Risk Management Matters for Your Business

Running a business always involves uncertainty. Markets shift, customer preferences evolve, technology advances, and unexpected events can disrupt operations at any time. Risk management is the structured approach businesses use to identify potential threats, evaluate their impact, and take proactive steps to reduce or control them. When implemented effectively, risk management becomes a powerful tool that protects the organization and supports long-term growth.

1. Protection Against Financial Loss

One of the primary benefits of risk management is safeguarding a company’s financial health. Every business faces risks that could result in monetary losses, such as declining sales, supply chain disruptions, equipment failure, lawsuits, fraud, or economic instability. Without preparation, these events can lead to serious financial strain or even business closure.

By identifying possible threats in advance, companies can put preventive measures in place. This may include diversifying suppliers, purchasing insurance coverage, maintaining emergency funds, or conducting regular financial audits. Early detection and planning significantly reduce the likelihood of severe financial damage and allow businesses to respond quickly and effectively when challenges arise.

2. Improved Decision-Making

Strong decision-making depends on understanding both opportunities and risks. Risk management provides leaders with a clearer picture of potential outcomes, helping them evaluate the advantages and disadvantages of various strategies.

When risks are assessed systematically, business owners and managers can make decisions based on data rather than assumptions. For example, before launching a new product, expanding into a new market, or investing in new technology, companies can analyze potential obstacles and prepare mitigation strategies. This structured approach reduces uncertainty and increases confidence in strategic decisions, leading to smarter investments and sustainable growth.

3. Business Continuity

Disruptions can happen without warning. Natural disasters, cyberattacks, equipment breakdowns, political instability, or public health crises can interrupt daily operations and impact productivity. Without a plan in place, these disruptions can cause prolonged downtime and loss of revenue.

Risk management includes creating business continuity and contingency plans that outline how the organization will respond during emergencies. This might involve backup systems, alternative suppliers, remote work capabilities, or crisis communication strategies. Having a clear action plan ensures that operations can continue with minimal interruption, protecting both revenue and customer relationships.

4. Enhanced Reputation and Trust

Reputation is one of the most valuable assets a business possesses. Customers, investors, partners, and employees prefer to work with organizations that demonstrate reliability and preparedness. When a company actively manages risk, it shows responsibility, professionalism, and long-term vision.

Organizations that handle challenges effectively build credibility and trust. For example, companies that prioritize data security reassure customers that their personal information is safe. Businesses that respond quickly and transparently to crises maintain public confidence. Over time, this trust strengthens brand loyalty, attracts investment, and improves stakeholder relationships.

5. Compliance with Regulations

Many industries operate under strict legal and regulatory requirements. Failing to comply with these standards can result in fines, legal action, or reputational damage. Risk management helps businesses stay aligned with relevant laws and industry guidelines.

This may include implementing workplace safety protocols, ensuring cybersecurity measures are in place, maintaining accurate financial records, or protecting customer data. By regularly reviewing policies and procedures, companies can identify compliance gaps and address them before they lead to penalties. In this way, risk management not only prevents legal issues but also promotes ethical and responsible business practices.

Get Started with SignalX

How to Implement Effective Risk Management

To successfully manage risks, businesses need a well-defined risk management strategy. Here are some key steps to consider:

1. Risk Identification

Start by identifying potential risks across all areas of your business, including financial, operational, strategic, and external risks. Brainstorm with your team and analyze past challenges to uncover potential vulnerabilities.

2.Risk Assessment and Prioritization

After identifying the various risks, the next step is to evaluate how likely each risk is to occur and the severity of its potential impact on your business. This process allows you to rank risks based on urgency, helping you determine which risks require immediate action and which ones can be monitored or addressed later.

3.Risk Mitigation Strategies

This could include purchasing insurance, diversifying investments, strengthening cybersecurity measures, or creating contingency plans for emergencies.

4.Continuous Monitoring and Review

Continuously monitor identified risks, evaluate the effectiveness of your strategies, and adjust your plans as necessary. New risks may emerge, and old risks may evolve, so staying proactive is key.

Frequently Asked Questions (FAQ)

1. What are some common risks businesses face?

Businesses typically face risks related to financial stability, operational challenges, legal and regulatory compliance, cybersecurity threats, market fluctuations, and reputational damage.

2. How can small businesses manage risk effectively?

Small businesses can manage risks by starting with a simple risk assessment, setting clear priorities, and focusing on affordable mitigation strategies such as insurance or outsourcing specific tasks.

3. Can risk management prevent all risks?

No, it cannot prevent all risks, but it can significantly reduce the likelihood and impact of adverse events, ensuring that businesses are prepared for potential threats.

4. How often should businesses assess their risk management strategies?

It’s recommended that businesses assess their risk management strategies at least annually. However, any significant change—like entering a new market or adopting new technology should prompt an immediate reassessment.

5. Is risk management the same for every industry?

No, the approach to risk management varies across industries due to different operational needs, regulatory requirements, and external factors. What works for one industry may not be applicable in another, so it’s important to tailor your plan accordingly.