Due Diligence Audit – Everything You Need to Know

A due diligence process involves the assessment of the current state of a target company’s assets prior to making an acquisition or investment decision. Due diligence often refers to the in-depth study and research being done before signing an agreement or a transaction with a party.

Due diligence must be conducted before any contracts are signed to ensure you have a full picture of the seller’s company. The assessment can take a week to several months, counting on the scale and complexity of the due diligence audit and how long it takes to obtain and review the information about the business.

What is a Due Diligence Audit?

In general terms, a due diligence audit involves the examination of a business in order to evaluate its standing as a business, and its financial performance – the audit can either be of a legal nature, or for a personal inquiry.

Why is a Due Diligence Audit required?

Due diligence audit is to verify the accuracy and correctness of the information presented in the purchase or sales transaction.

The purpose of a due diligence audit is to help the client make an informed assessment of the company in relation to its ability, potential, history, performance, and reputation.

Most commonly, individuals or firms who are looking to do business with a company request this kind of report in order to help in their decision-making process.

-

Why is a due diligence audit important for buyers?

Due diligence audit is vital as it aids investors in making complex decisions. Due diligence audits are like investments for hedging investments’ risks. A due diligence audit increases the buyer’s assurance that the transactions to be performed are going to be successful.

You cannot be an expert in every field and therefore conducting due diligence via other specialists offers an economy of time, as you don’t have to drown yourself for days or even weeks in complex reports that may not even bring enough clarity. During a due diligence audit, specialists in their field can highlight the foremost important findings as well as the options for dealing with potential risks.

-

Why is a due diligence audit important for sellers?

Performing due diligence is not only important for the buyer, but it may also be important for the seller, as it could reveal that the selling price initially desired was too low.

For a seller, putting yourself in the buyer’s shoes and performing your own due diligence on your firm will help you identify any areas that need improvement before you sell, giving you the chance to increase the price you can demand.

Engaging legal counsel to assist the seller in organizing its pre-transactional due diligence information and remedying any deficiencies or liabilities to the greatest extent possible will make the sale transaction process more manageable for a seller.

It will also reduce the possibility that a buyer will undervalue the business, aid in the negotiation and drafting of the transaction documents and disclosure schedule, and reduce the time and effort required for the due diligence process.

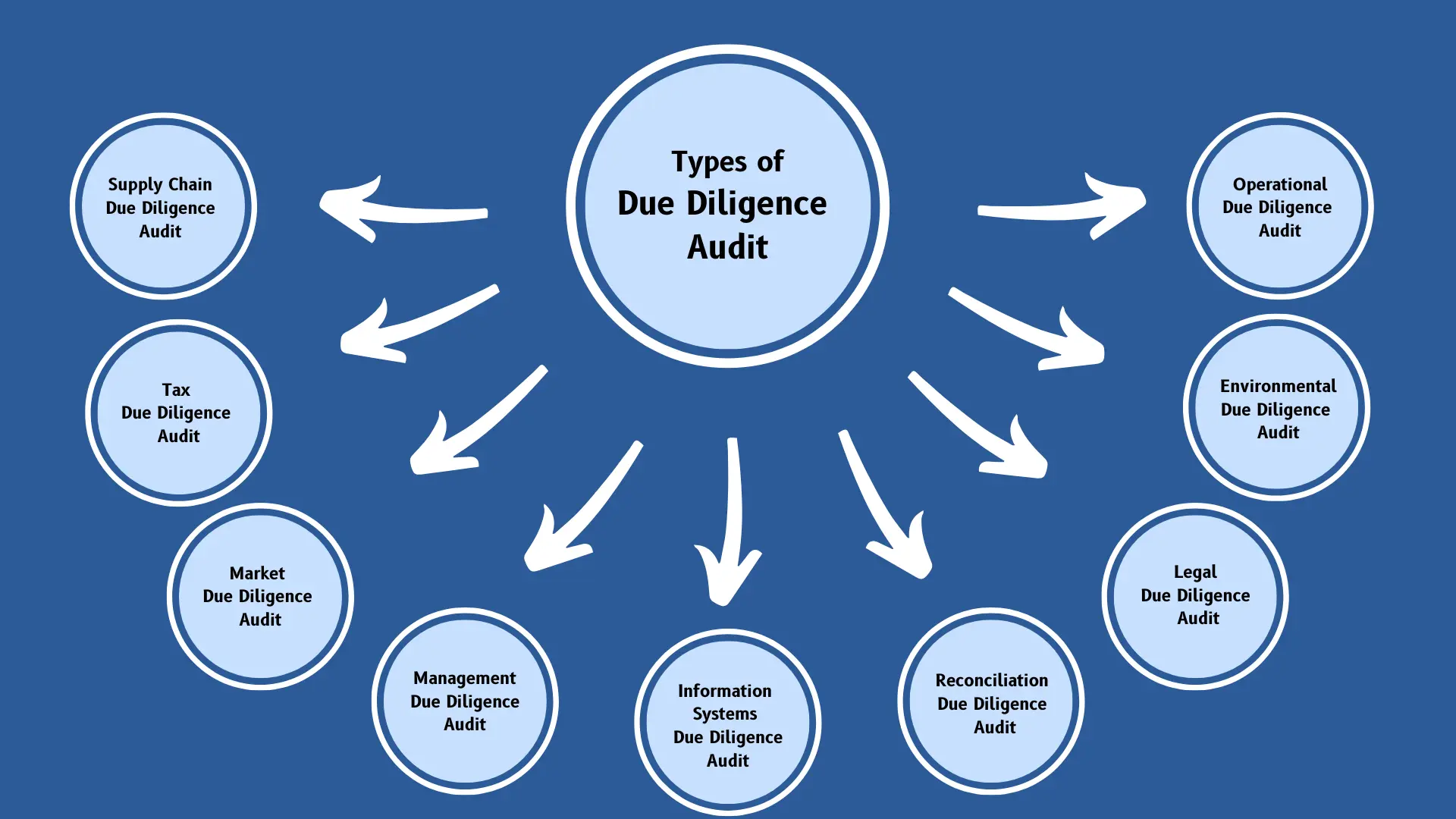

Types of Due Diligence Audit

In addition to financial health, due diligence covers areas such as:

- Supply Chain due diligence audit – As part of supply chain due diligence, a company researches potential suppliers and investigates them to identify risks associated with their operations. Legislative, governance, ethical, and environmental risks are typically included in this category.

- Tax due diligence audit – The goal of tax due diligence is to identify and analyze significant potential tax exposures on the buy side of a transaction. When performing tax due diligence, it is important not only to identify and quantify the potential tax risks but also to ensure that there is an adequate protection mechanism for the buyer. In practice, the most popular form of tax risk mitigation is through tax warranties and indemnities in the deal.

- Market due diligence audit – The market due diligence audit does not rely on the company’s information as with other aspects of diligence. A market due diligence process involves gathering information from industry experts, competitors, customers, and sometimes even from other third parties.

- Management due diligence audit – Management due diligence is the process of appraising a company’s senior management and evaluating each individual’s effectiveness in contributing to the organization’s strategic objectives. It is crucial to assess a company’s management before closing a business deal.

- Information Systems due diligence audit – An IT due diligence, which is an assessment performed on any company with a business that is supported or sometimes enabled by IT/digital capabilities, seeks to uncover performance, liabilities, key risks and opportunities as well as potential investment needs associated with the target company’s IT organization and IT engine.

- Reconciliation due diligence audit – Reconciliation involves comparing transactions and activities with supporting documentation. Moreover, it involves resolving any discrepancies that may have been discovered. The bank reconciliation process, particularly, helps to spot any financial gaps or discrepancies and should be performed internally at least once a month and once per year by an external auditor.

- Legal due diligence audit – Legal due diligence is due diligence concerned with the legal matters of a corporation, deal or agreement, or financial transaction, for creating it optimally safe, secure, privileged, and profitable legally and otherwise.

- Environmental due diligence audit – An environmental due diligence audit evaluates a property’s environmental conditions and risks. In the case of purchases, refinances, or occupants of properties, the process may be initiated at the request of land developers, lenders, attorneys, or private owners.

- Operational due diligence audit – Operational due diligence is the process by which a potential purchaser reviews the operational aspects of a target company during mergers and acquisitions. Most frequently operational due diligence is conducted in the industrial sector.

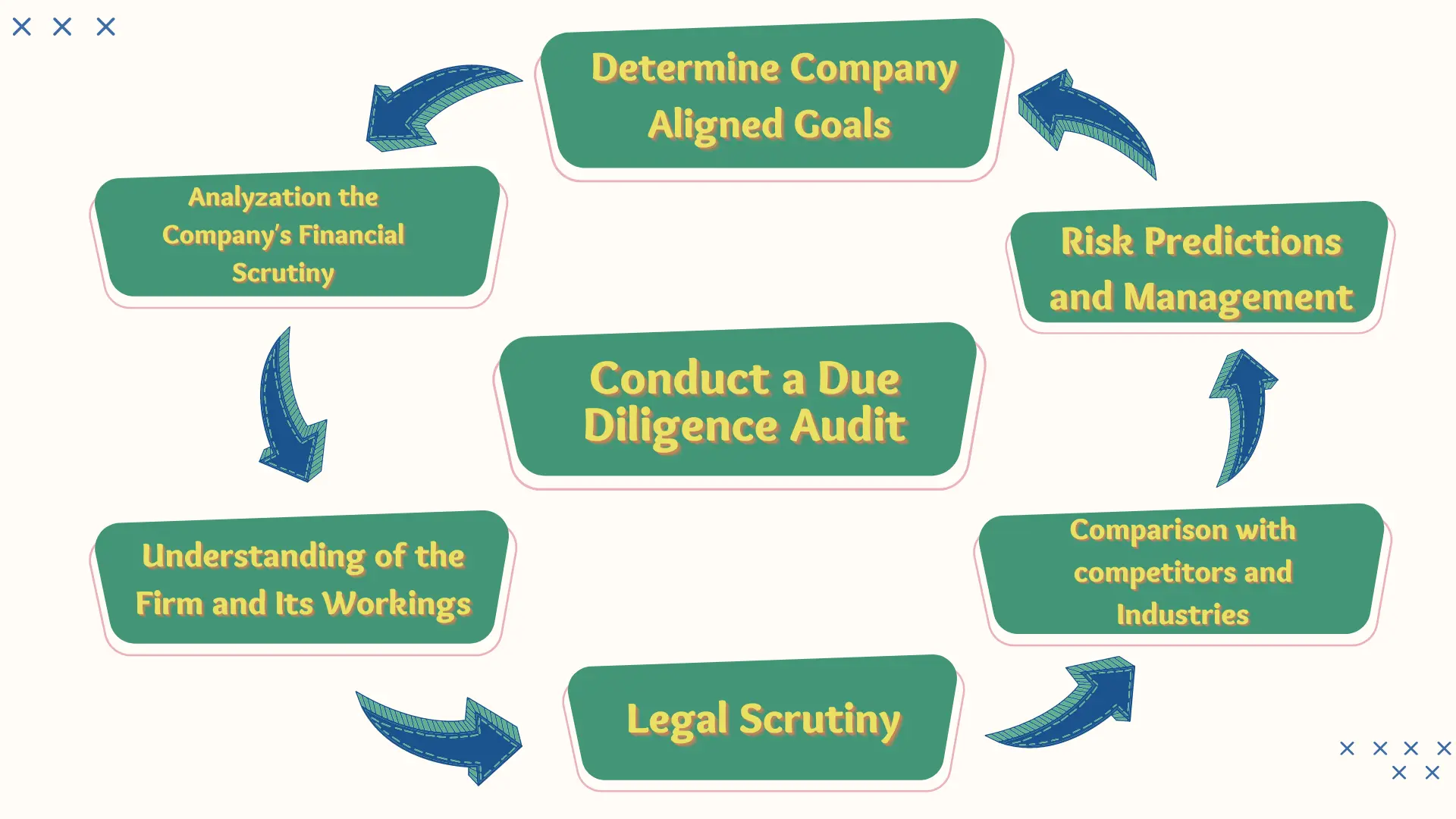

How do you Conduct a Due Diligence Audit?

1. Determining Goals and Whether They Align with the Company:

This is the starting point for all projects. Once you provide goals and expectations and decide on the devices needed for them, the provider determines if they match the company’s aims and projections.

2. Analyzation of the Company’s Financial Scrutiny:

All financial statements of the company are gathered and investigated. You can see for yourself if all information on offer in the company’s Confidential Information Memorandum (CIM) was legit or not. Plus, now you have an idea of their overall financial state.

3. Gaining an Understanding of the Firm and Its Workings:

Operational information is collected and recorded through interviews and conversations with company representatives, so the due diligence audit provider can answer specific queries and look closely at the company’s business practices.

4. Legal Scrutiny:

A thorough examination of the legislative documents of the company is executed, and the details are recorded.

5. Comparison with competing Firms and Industries:

A due diligence audit provider helps compare a company’s data with competitor data, to enable more perspective on its growth and its position in the industry in the past years.

6. Risk Predictions and Management:

Through the due diligence audit provider, you understand all risks the company might be facing in the coming years – both company-specific risks and industry-wide risks- and decide if you’re ready to take them on or not.

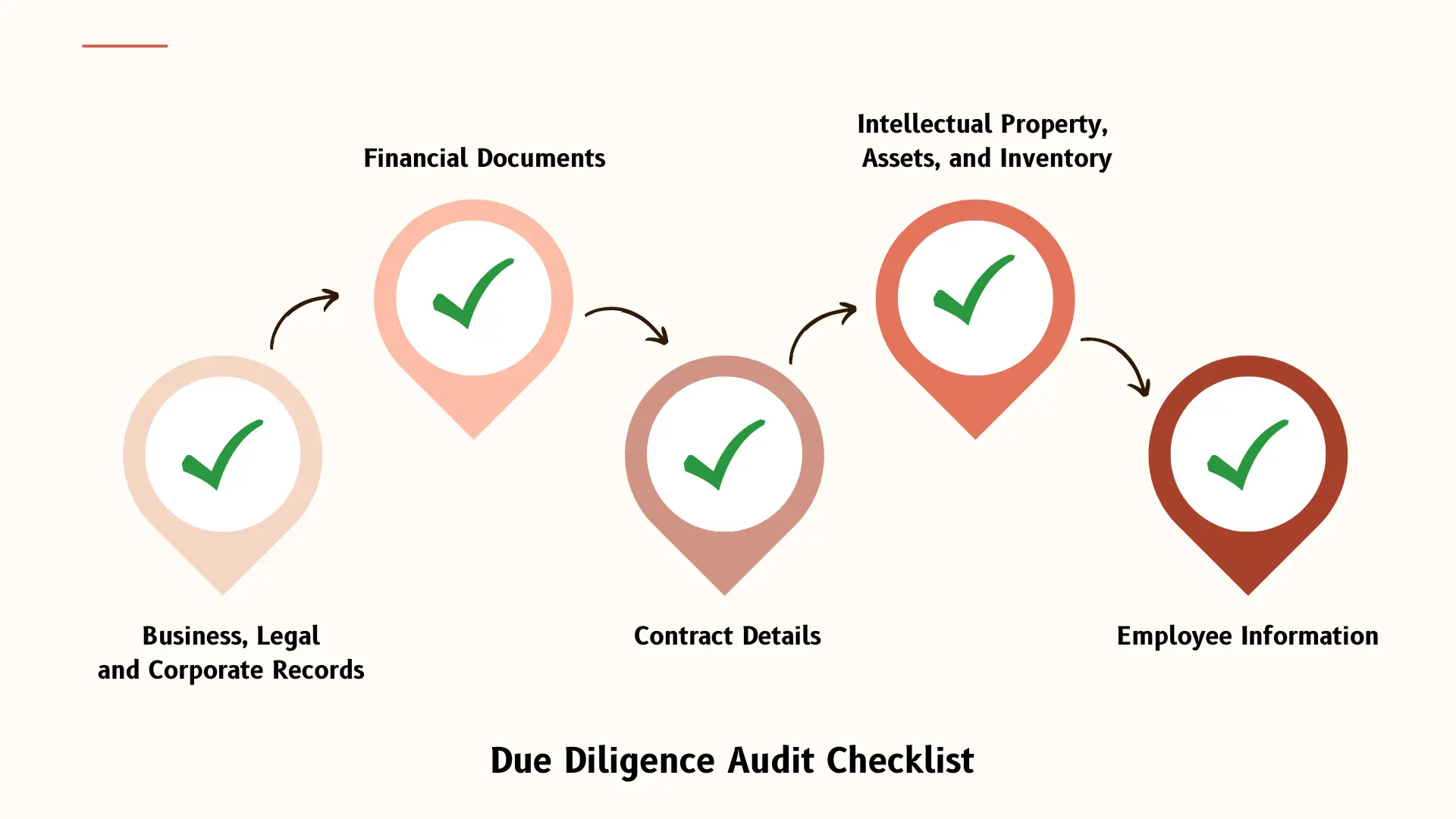

Due Diligence Audit Checklist

Before we jump into the long list of documents you will need to find, a quick explanation is in order:

Each type of transaction will require different documents for the due diligence phase. You will encounter different requests for information when you are trying to secure funding, for example, then you will if you’re preparing to sell your business. Because “due diligence” is such a broad term and may vary based on the parties involved, it’s best to maintain a highly organized system to keep track of almost every important document your business generates.

Here is a small checklist for you to follow:

Corporate Records, Legal, and Business Documentation

- Incorporation documents/Articles of Incorporation

- Litigation records (Current and past legal cases)

- Mergers and acquisitions documents (Purchase or sale agreements)

- Press releases and news coverage

- Board and shareholder meeting minutes

- Property ownership details

- Company bylaws

- Company mission statement

- List of affiliated companies

- Countries of operation

- Shareholder certificates

- Business licenses (Federal, state, local, and other regulatory licenses)

- Organizational structure and charts

- Securities holder information

- Stockholder agreements

- Warranties and guarantees

- Building, zoning, and land permits

- Official registration documents

- Employee licenses and certifications

Financial Documents

- Tax returns (International, federal, state, and local for the last three years)

- Shareholder list with ownership percentages

- Stock options and plans

- Financial statements (Income Statement, Balance Sheet, Cash Flow Statement)

- General ledgers

- Accounts payable/receivable records

- List of outstanding debts and debtors/creditors

- Liabilities and debt collateral details

- Audit reports and tax authority correspondence

- Loan and credit agreements

- Capital structure breakdown

- Financial projections and budget reports

- Key Performance Indicators (KPIs) and financial goals

- Revenue analysis (Gross revenue, revenue per client, revenue by region/service)

- Revenue trend records (at least one year)

- Pricing methodology and margin analysis

- Expense analysis and categorized expenses

- IRS filings and compliance forms

- Retirement plans (401k, pensions, etc.)

- Insurance coverage details (Claims and active policies)

Contractual Agreements

- Client and customer contracts (Including terms, renewal dates, amendments)

- Supplier and vendor agreements

- Partnership contracts

- Settlement agreements

- Leases, mortgages, and credit agreements

- Sales and distribution contracts

- Employee contracts and agreements

- Advertising and marketing contracts

- Outsourcing agreements (IT, HR, etc.)

- Independent contractor and freelance agreements

Intellectual Property, Assets, and Inventory

- Patents and pending patent applications

- Trademarks and copyrights

- Company equipment list

- Technology assets (Software, systems, versions, licenses)

- Domain names and digital assets

- Real estate holdings (Deeds, ownership documents)

- Inventory and stock records

- Research and development assets

Employee Records and HR Compliance

- Employee directory

- Executive team bios and employment history

- Job descriptions and employee work histories

- Employee tax filings

- Employee benefits plans

- Non-compete and NDA agreements

- Workers’ compensation claims and reimbursements

- Stock purchases and sales records

- Stock option plans for employees

- Unemployment claims and settlements

- Severance agreements

- Union contracts (if applicable)

- Pension and retirement plans

- OSHA compliance and violation records

Establishing a Due Diligence Audit Team

Conducting a due diligence audit requires a skilled team to ensure accuracy and compliance. Consider assembling the following professionals:

Key Team Members:

- Accountants – Analyze financial statements and tax compliance

- Financial Advisors – Assess financial risks and investment potential

- Legal Experts – Review contracts, legal liabilities, and compliance issues

- Business Mentors – Provide strategic insights and risk assessments

Role of the Due Diligence Team:

- Review business documentation thoroughly

- Identify financial risks and opportunities

- Highlight potential legal liabilities

- Ensure compliance with industry regulations

- Guide decision-making with expert analysis

Conclusion

A due diligence audit is essential for making informed business decisions, mitigating risks, and ensuring transparency. By following this checklist and involving expert advisors, businesses can navigate mergers, acquisitions, investments, and other strategic moves with confidence.