What Is Customer Due Diligence (CDD)?

Customer Due Diligence (CDD) refers to the structured approach organizations use to understand who their customers are, how they operate, and what level of risk they introduce to the business. Rather than being a one-time compliance task, CDD is an ongoing process that evolves as customer behavior, regulations, and risk environments change.

For businesses operating in regulated industries particularly financial services, fintech, payments, crypto, insurance, and professional services CDD is a regulatory expectation and a risk management necessity. It ensures that companies do not unknowingly facilitate illegal activities or expose themselves to regulatory penalties.

CDD plays a foundational role in Anti-Money Laundering (AML) and counter-financial crime frameworks. Without a clear understanding of customers, even the most advanced transaction monitoring or fraud detection systems lose effectiveness. In essence, CDD answers a fundamental question: Who are you doing business with, and should you trust them?

Why Customer Due Diligence Matters

Customer due diligence matters because risk does not exist in isolation it enters organizations through relationships. Customers, partners, and counterparties can all introduce financial, legal, and reputational threats.

One of the most important benefits of CDD is its ability to prevent financial crime before it occurs. By assessing customer identity, intent, and risk exposure, organizations can detect warning signs early rather than reacting after damage has been done.

CDD also protects organizations from regulatory consequences. Global regulators increasingly expect businesses to demonstrate not only compliance on paper, but also meaningful, risk-based decision-making. Weak due diligence controls can lead to fines, license revocations, enforcement actions, and public scrutiny.

Beyond compliance, CDD supports healthier customer relationships. When risk is properly assessed upfront and monitored over time, businesses can reduce friction, minimize disruptions, and build transparency into their operations. Effective CDD creates confidence for regulators, stakeholders, and customers alike.

Customer Due Diligence vs KYC vs AML

Although often used interchangeably, Customer Due Diligence, Know Your Customer (KYC), and Anti-Money Laundering (AML) represent different layers of the same compliance ecosystem.

KYC is the identity-focused component. It involves collecting and verifying basic customer information such as name, address, date of birth, or business registration details. KYC answers the question: Is this customer who they claim to be?

CDD expands beyond identity verification. It incorporates KYC data but also includes customer risk assessment, behavioral analysis, ownership evaluation, and ongoing oversight. CDD answers a broader question: What level of risk does this customer pose over time?

AML is the overarching framework that governs how organizations prevent money laundering and related crimes. It includes policies, controls, reporting obligations, and enforcement mechanisms. CDD operates within AML programs as a core preventive control.

In practice, KYC is a step within CDD, and CDD is a pillar supporting AML compliance.

Types of Customer Due Diligence

Not all customers present the same level of risk, which is why CDD is applied in different forms depending on the situation.

Simplified Due Diligence (SDD) is used for customers considered low risk. These may include public institutions, regulated entities, or customers operating in low-risk jurisdictions. SDD involves limited verification and lighter monitoring, allowing organizations to allocate resources efficiently.

Standard Customer Due Diligence (CDD) applies to the majority of customers. It includes identity verification, basic risk scoring, screening checks, and routine monitoring throughout the relationship.

Enhanced Due Diligence (EDD) is reserved for customers who present elevated risk. This could include politically exposed persons, customers from high-risk regions, complex ownership structures, or unusual transaction patterns. EDD requires deeper investigation, more frequent reviews, and additional data to fully understand risk exposure.

Using the appropriate level of due diligence ensures compliance while avoiding unnecessary operational burden.

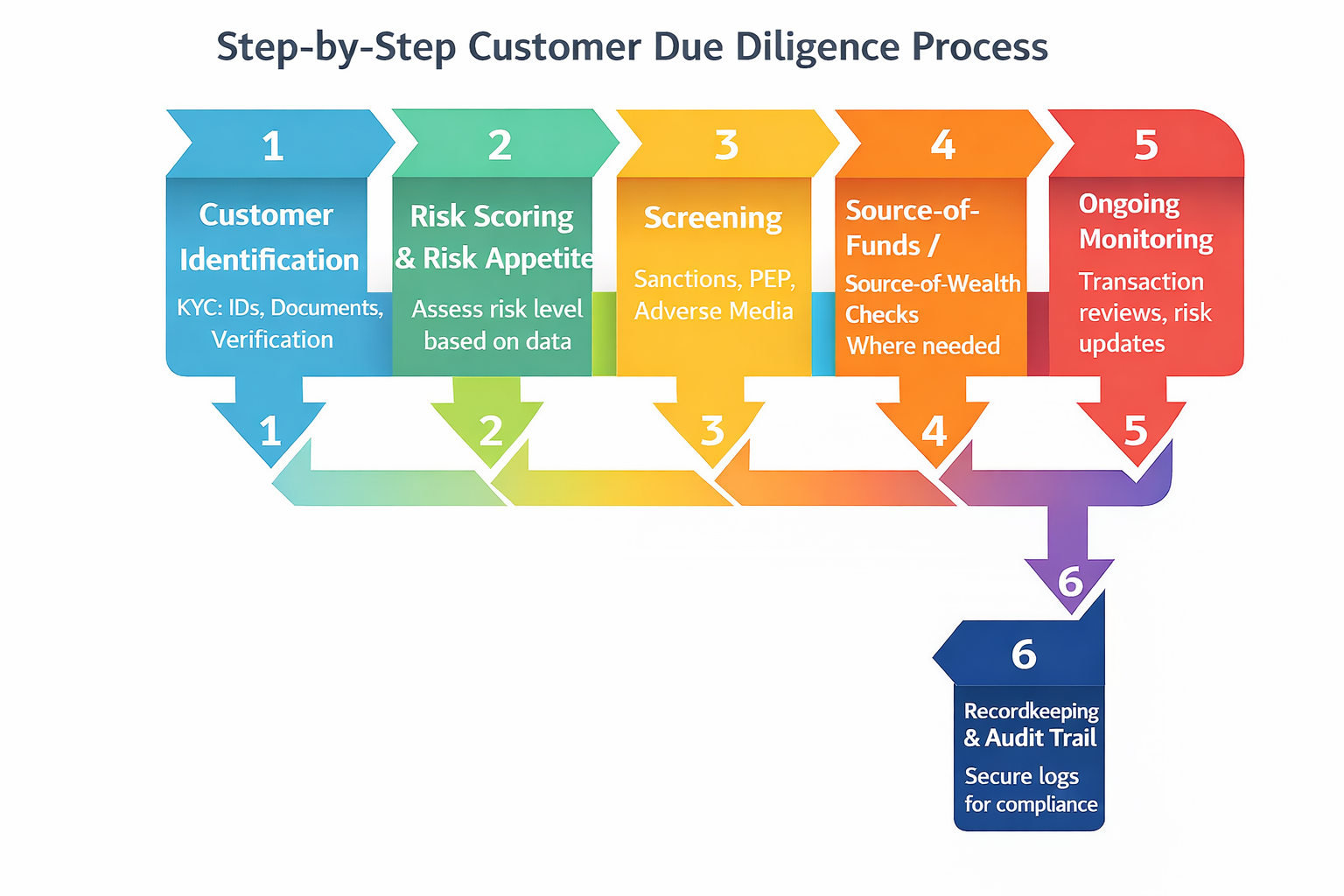

Step-by-Step Customer Due Diligence Process

A well-designed CDD process follows a structured yet flexible sequence of activities.

The first step is customer identification and verification, where individuals or businesses provide information that is validated against trusted sources. This ensures the customer exists and is legitimate.

Next comes risk assessment and customer profiling. Organizations evaluate factors such as geographic exposure, industry risk, ownership complexity, transaction expectations, and delivery channels. These elements are combined to assign a risk rating.

Screening checks follow, including sanctions lists, politically exposed persons databases, and adverse media sources. These checks help identify potential links to criminal activity, corruption, or regulatory restrictions.

For higher-risk relationships, source of funds and source of wealth analysis is conducted. This step helps determine how customers generate their money and whether it aligns with their profile and activity.

CDD does not stop at onboarding. Ongoing monitoring tracks customer behavior, transactions, and risk signals over time. Significant changes trigger reviews or escalations.

Finally, documentation and recordkeeping ensure that decisions are transparent, defensible, and auditable. Regulators expect organizations to demonstrate not only outcomes, but also how those outcomes were reached.

Challenges in Traditional Customer Due Diligence

Despite its importance, traditional CDD processes face several limitations.

Manual workflows often slow down onboarding, creating frustration for customers and internal teams. Reviewing documents, conducting checks, and approving decisions can become bottlenecks, especially during periods of growth.

Another challenge is alert overload. Legacy screening tools frequently generate large volumes of false positives, forcing compliance teams to spend time clearing low-risk alerts rather than focusing on genuine threats.

Fragmented data is also a major obstacle. Customer information stored across disconnected systems makes it difficult to maintain a single, accurate view of risk or to conduct continuous monitoring effectively.

These challenges increase costs while reducing the overall effectiveness of CDD efforts.

How Technology Is Transforming Customer Due Diligence

Technology is fundamentally changing how organizations manage customer due diligence.

Automation has reduced reliance on manual reviews by streamlining identity verification, screening, and risk scoring. This results in faster onboarding without compromising control.

Advanced analytics and artificial intelligence enable continuous risk monitoring, allowing organizations to detect changes in behavior, ownership, or exposure as they happen rather than waiting for scheduled reviews.

Modern CDD platforms also centralize data, standardize workflows, and generate audit-ready reporting. This improves collaboration across compliance, risk, and operations teams while increasing regulatory confidence.

Technology-driven CDD shifts compliance from a reactive obligation to a proactive risk strategy.

Customer Due Diligence Landscape

SignalX approaches customer due diligence as an ongoing risk intelligence function rather than a static compliance requirement. Its focus is on identifying evolving risk signals and contextual insights that change over time.

Unlike traditional KYC or AML providers that concentrate heavily on onboarding or transaction alerts, SignalX emphasises continuous due diligence across the customer lifecycle.

Compared to governance, risk, and compliance (GRC) or vendor risk platforms, SignalX is purpose-built for customer and third-party risk assessment. It delivers deeper visibility into reputational, behavioral, and financial risk indicators.

When evaluating CDD solutions, organizations should consider flexibility, depth of insights, monitoring capabilities, and how easily the solution integrates into existing systems and workflows.

Best Practices for Implementing Customer Due Diligence

Effective CDD begins with a risk-based mindset. Organizations should tailor due diligence requirements to customer risk rather than applying uniform controls.

Alignment between CDD processes and regulatory expectations is critical. Policies should be clear, practical, and consistently applied across teams and regions.

Integrating CDD into broader compliance and operational workflows improves efficiency and accountability. When risk insights are shared across functions, organizations can respond faster and make better decisions.

Regular training and governance oversight also ensure that CDD remains effective as risks and regulations evolve.

Common Customer Due Diligence Mistakes to Avoid

One frequent mistake is assuming that compliance ends after onboarding. Customer risk is dynamic, and failing to monitor changes can leave organizations exposed.

Another issue is over-reliance on checklists. Treating CDD as a box-ticking exercise undermines its purpose and weakens risk detection.

Inadequate documentation is also a major risk. Even strong controls can appear ineffective if decisions are not properly recorded and justified during audits or examinations.

Avoiding these mistakes requires a combination of strong governance, technology, and risk awareness.

Customer Due Diligence Checklist

Before onboarding a customer, organizations should clarify identity, ownership structure, purpose of the relationship, and expected activity.

Documentation typically includes identification records, business registrations, beneficial ownership information, and supporting financial data. Monitoring and review schedules should be defined based on risk level, ensuring timely reassessments and escalation when necessary. A clear checklist improves consistency while supporting regulatory .

Frequently Asked Questions About Customer Due Diligence

What is customer due diligence in simple terms?

It is the process of understanding who your customers are, assessing their risk, and monitoring them to prevent misuse of your services.

When is enhanced due diligence required?

EDD is required when customers present higher-than-normal risk due to factors such as political exposure, geography, or complex structures.

How often should customer due diligence be updated?

Updates depend on risk level but should occur regularly and whenever material changes are detected.

Can customer due diligence be automated?

Yes. Many CDD tasks can be automated, improving speed, accuracy, and consistency while reducing manual effort.

Conclusion

Customer Due Diligence is no longer just a regulatory requirement it is a strategic capability. By understanding customers deeply and monitoring risk continuously, organizations can protect themselves from financial crime while building trust and resilience.

As risk landscapes become more complex, the future of CDD lies in intelligent, technology-driven, and risk-based approaches that adapt in real time rather than relying on static checks. Businesses that embrace this evolution will be better positioned to meet regulatory expectations and sustain long-term growth.