Financial Due Diligence:Everything You Need to Know

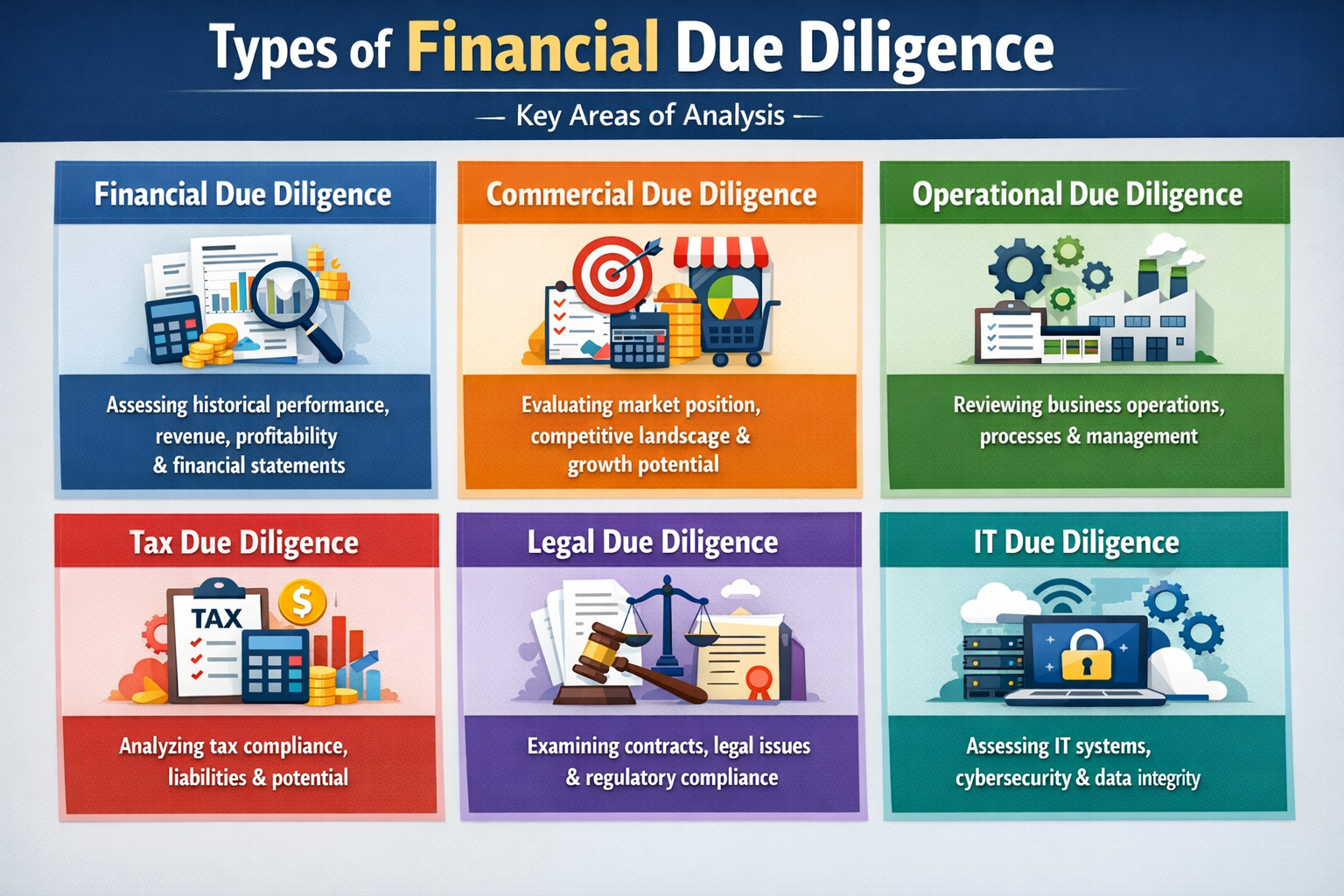

Financial due diligence is a critical step for most businesses, as their growth sees them engage actively in mergers and acquisitions (M&A). No deal goes through without adequate due diligence, and financial due diligence is often the most time-consuming part of the process. Diligence checks include a vast litany of areas, key amongst which are the domains of financial, legal, tax, human resources, and ESG compliance. In this blog, we address the financial aspect of diligence inquiry.

What is Financial Due Diligence (FDD)?

Financial due diligence is an enquiry into the financial affairs of a company. It is a deep analysis of a company’s historical and forecasted trends to confirm the relevance and veracity of these trends.

Scope

The scope of the FDD exercise differs based on the industry, scale of business and size of the company. In general, the following is the focus area of FDD

- Analysis of revenue generation and assessing the quality of earnings, cash flows and margins.

- Sustainability of revenue considering factors such as taxes, interest, depreciation, working capital, financial debts and liabilities, and projected financial numbers.

- Identifying potential liabilities and commitments

- Assessing other crucial variables that may impact the business.

When should I run a Financial Due Diligence?

Ideally, the FDD process begins once the letter of intent outlining the structure of the deal is finalized by the buyer and the seller. Financial Due Diligence has 2 sides to it; one being Buy-side Due Diligence and the other being Sell-side Due Diligence.

Based on the FDD report, a potential buyer can assess whether an acquisition is viable. It also helps the buyer to determine if the price of the acquisition is justifiable and if there are any potential deal-breakers.

How long does it take?

FDD can take anywhere between 2 weeks and 2 months. However, this time frame may vary based on the size of the company that is being acquired and the scope of diligence.

Types of Financial Due Diligence

Buy-side due diligence

This type of FDD is performed by an acquirer or buyer who intends to acquire the target company in question. A buyer can be a private equity firm, venture capitalist, strategic investor, investment bank, family office, sovereign wealth fund, pension funds, insurance company, etc. Buy-side FDD focuses mainly on the financial health of the target company. It involves gathering information about the company’s revenues, expenses, cash flow, balance sheet, debtors and creditors, profitability, growth rate, market share etc.

A buyer interested in acquiring a company or a new business would run Buy-side Financial Due Diligence to gain a thorough understanding of the target’s financial health. The optimal outcome is that the financial position of the target company is established as healthy and stable, with a solid forecast ahead, in the acquirer’s best interests.

Sell-side due diligence (vendor)

Sell-side FDD, on the other hand, is performed by a seller or vendor who is selling a business. This process focuses on areas of interest for potential acquirers or buyers so that there are no hiccups in the transaction.

A Sell-side Financial Due Diligence helps the seller by way of an internal audit, helping uncover issues that otherwise might have gone on unchecked. A sell-side financial DD requires the same work, just conducted from a different perspective. It begs an answer to the question, “What would the buy side want to see in our company from this standpoint?”.

Why is Financial Due Diligence important?

FDD gives you insight into the company’s financial performance and its ability to generate future profits. It provides you with a clear understanding of the company’s strengths and weaknesses.

With this knowledge, you will be able to make better decisions regarding your next steps. You will know how much money you need to invest in order to buy the company. You will also have a clearer idea of what kind of return you should expect from the investment.

In addition, financial due diligence helps in better negotiation and reduces acquisition costs. Getting to know the company better will reduce the probability that you will overpay for it.

What are the benefits of Financial DD?

There are several benefits to performing financial due diligence:

1) Identify potential risks associated with the target company.

2) Determine the viability of the acquisition.

3) Understand the true value of the target company.

4) Identify the issues that should be addressed before a purchase agreement is signed.

5) Ensure that the buyer has enough resources to complete the acquisition.

6) Reduce the cost of acquisition.

7) Minimise legal costs.

8) Avoid post-acquisition pitfalls

How do I conduct Financial Due Diligence?

The financial due diligence process can be broadly divided into the following four stages:

Preparation stage

Before starting the financial due diligence process, it is important to determine if the company is worth investing in. You must first decide whether the company meets your criteria. For example,

- Does the company meet your growth objectives?

- Does it fit well within your industry?

- Is there sufficient market demand for the product/service offered by the company?

Research stage

Once you have decided to proceed with the financial due diligence process and have identified the target company, you will need to carry out some initial research. This involves gathering as much relevant information as possible about the company and may include but not limited to the following:

- Talking to key decision-makers in the target company

- Reviewing public documents such as annual reports, press releases, SEC filings, etc.

- Requesting copies of internal documents like minutes of board meetings, meeting agendas, balance sheets

- Visiting the offices of the company

- Obtaining third-party audits of the company’s financial statements

Verification stage

After completing the research phase, you will need to verify the information you’ve gathered. This means comparing the results obtained through the research with the actual data available on the company.

This process can be further broken down into the following:

- Define the scope of the FDD process

- Identify the information that is required

- Analyse past financial data

- Discuss findings with key people in the organization

- Understand the implications of the findings and discuss them with management

- Prepare the final report

Analysis Stage

After collecting all the required information, you must analyse it thoroughly. This involves performing a broader analysis of the collected data. Some of them include but are not limited to the following:

- Analyses of historical trends of the company’s revenues and expenses

- Comparison of the company’s revenue and expense figures with those of similar companies

- Analysis of cash flow statements and working capital

- Balance sheet analysis to determine if there are any signs of fraud or mismanagement

- Assets, liabilities and long term debt analysis

- Verify the existence of any contracts or agreements between the company and its suppliers/customers

- Perform a market analysis to determine how competitive the industry is

- Identify any weaknesses in the company’s operations

- Target company’s product and service’s analysis

- Audit and analysis of the company’s books and records

- Investigation of the company’s management

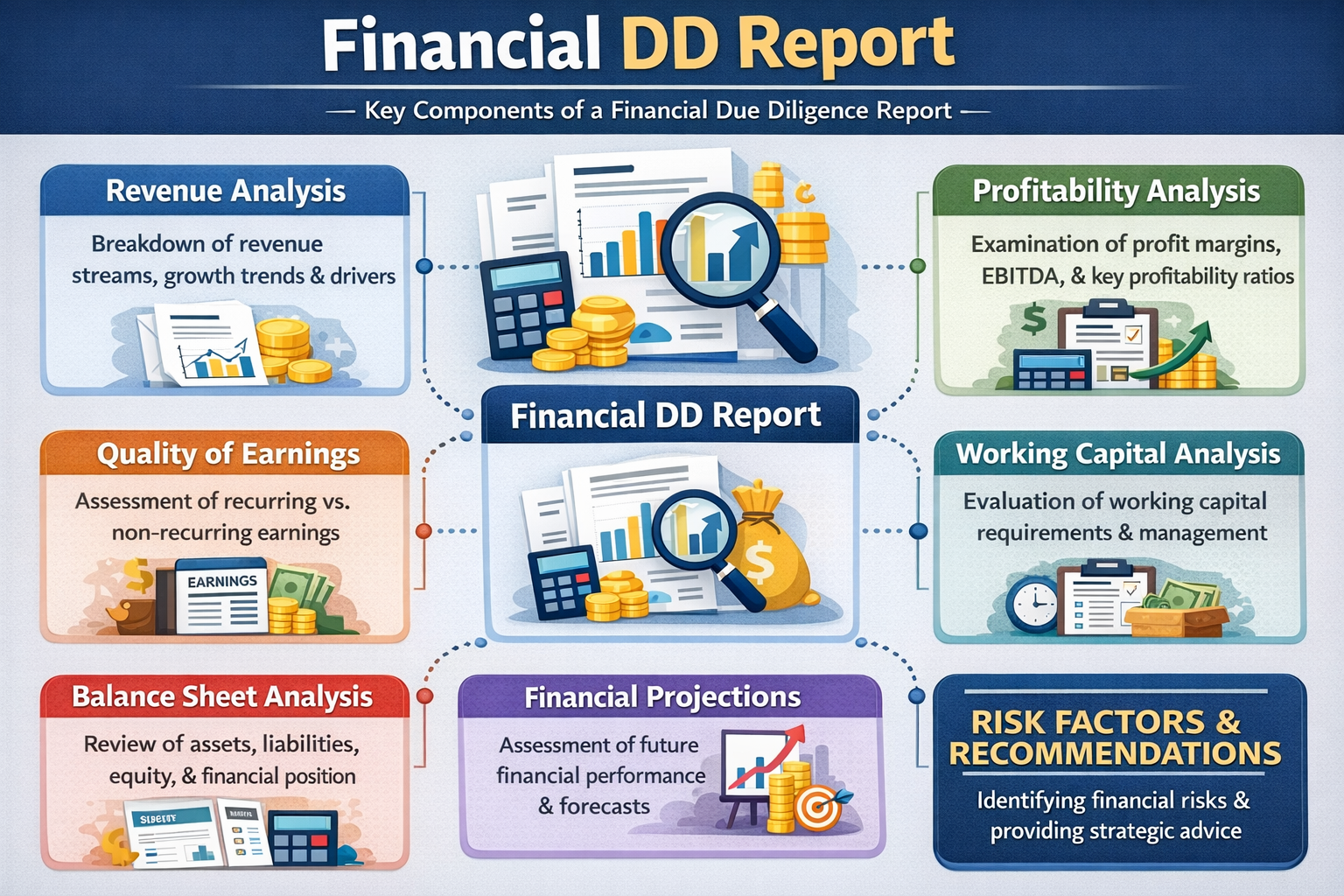

What is a Financial DD Report?

An FDD report is an objective document that summarizes the findings from the FDD process. It should clearly state the issues found during the investigation and provide recommendations to improve the business performance of the targeted company. The report should also contain a summary of the findings and conclusions drawn from the analysis performed.

The difference between Financial Due Diligence and Audit

It’s worth mentioning that FDD is not a financial audit. A financial audit is an assessment of the current financial position of a company based on historical financial statements. In contrast, financial due diligence delves into the reasons for historical and forecasted trends and validates whether these trends are relevant to the purchaser.

Financial due diligence helps the acquirer understand the financial health of the target company. On the contrary, an audit provides assurance regarding the financial statements of the target company.

The Limitations of Financial Due Diligence

FDD has a few limitations. For starters, it is not equivalent to an audit conducted in accordance with generally accepted auditing standards. It does not provide assurance of future performance and cannot replace an independent audit.

In addition, FDD is not suitable for small businesses because they do not have access to enough financial data. Small businesses usually use their own accounting software which makes it difficult for them to gather accurate financial data.

How do I make Financial Due Diligence easier for my firm?

A comprehensive FDD exercise lets the acquirer make an informed decision in regard to the acquisition. Furthermore, it assists the purchaser and vendor in resolving issues and executing a successful transaction.

There are various applications that you can use at different stages of the Financial DD exercise. However, an all-in-one application, like SignalX, can help you analyze all the details of the company’s recent financial history and performance in one place on a single screen. It also provides you with the source documents you require to carry out more detailed, in-depth studies on the target company. Pair this with a well-rounded legal and reputational Due Diligence, and you ought to have all key bases covered, to go ahead with your newest transaction.

Frequently Asked Questions

What is financial due diligence checklist?

A Financial Due Diligence checklist is a comprehensive list of items to be reviewed during a financial due diligence process. It typically includes attributes such as financial statements, tax records, assets and liabilities, revenue streams, business model, market position, and any potential liabilities or risks. The goal is to ensure a thorough understanding of the financial health of the company being acquired or invested in.

What are the key areas of financial due diligence?

Here are some of the key areas of financial due diligence –

- Financial Statements: Review of balance sheets, income statements, and cash flow statements to understand the company’s financial health.

- Assets and Liabilities: Assessment of the company’s assets and liabilities, including any outstanding debts or potential liabilities.

- Revenue and Profitability: Analysis of the company’s revenue streams, profitability, and growth potential.

- Tax Records: Examination of the company’s tax compliance and potential tax liabilities.

- Operational Efficiency: Evaluation of the company’s operational efficiency, cost structure, and profitability margins.

- Market Position: Understanding the company’s market position, competitive landscape, and growth potential.

- Legal and Regulatory Compliance: Checking for any legal issues or regulatory compliance matters that could impact the business.

What is Financial Due Diligence in M&A?

Financial Due Diligence in Mergers and Acquisitions (M&A) is a thorough investigation into the financial health of a company that is being considered for acquisition. It involves analyzing the company’s financial statements, assets, liabilities, revenue streams, tax records, and more.